By Pierre Raymond. Originally published at ValueWalk.

The Broad Market Index was up 1.94% last week and 34% of stocks out-performed the index.

Q4 2020 hedge fund letters, conferences and more

The Largest Gap Between Share Prices And Corporate Growth

Currently, we have the largest gap between share prices and corporate growth than we have ever seen. We have been lulled into a dangerous complacency with now 12 years of round after round of massive money-printing by global central banks. This has the effect of increasing the value of assets and decreasing volatility. The central bankers have blown an enormous asset-price bubble.

We know this gap will close but the recent extended share prices suggest that people expect the corporate growth downtrend to reverse very soon and very strongly. The fourth-quarter numbers that we will see in coming weeks will provide a hint but it will not be until the second quarter of this year before we can measure the growth trend independently of the impact of the virus.

The Gross Margin Chart below is the performance of stocks versus long treasury bonds (in blue) and the average corporate gross profit margin (in red).

Notice how reliable the gross margin is in predicting the direction of stocks. Also notice that, relative to bonds, the broad market index has been in a downtrend since 2018. The recent strong rally has lifted shares to a premium price in that downtrend. That makes stocks very vulnerable to a growth disappointment.

Optimism About A Strong Recovery In Growth

There is huge optimism about the imminence of an unusually strong recover in growth reflected in these in premium share prices.

However, as of the third-quarter financial statements more that 50% of companies are recording a gross margin decline and the average gross margin is down. The bottom end of the currently wide volatility range between stocks and bonds is a 30% drop relative to bonds.

It’s still very early in this year’s 2021 annual update with the recent SEC filing update only started and with a little over 3% complete. The volume of SEC filings will increase in coming weeks but for now a couple of housing companies reported weaker sales growth. That could be important because it is persistent strength in big ticket consumer goods like housing that ultra-low interest rates are designed to ignite to sustain and extend the economy. Keep an eye on sales growth in housing as it is already negative and falling which is not a good sign.

Shift to active management now and maintain a portfolio of companies with high and rising profitability.

With share prices at all-time highs and corporate growth broadly falling, it has never been more important to make active decisions with your investments.

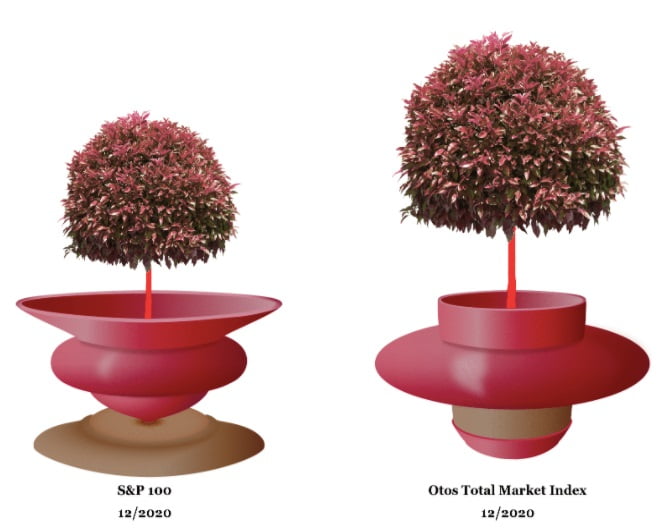

Otos AI Supports Investment Portfolio Construction

Otos personal AI Supports Investment Portfolio Construction. Otos accommodates the broad range of investing strategies, styles, risk preferences, time horizons and goals.

Otos performs ongoing investment monitoring at the component and portfolio level which ensures that the desired attributes, preferences, and performance are sustained through time.

Our retirement portfolio strategy for people in their 40’s has a risk rotation element that reduces exposure when shares are extended and increases exposure when shares are depressed. This simple market risk element is coupled with a premium growth attribute within a socially responsible (ESG) population.

Using these active strategy elements, we have generated a substantial premium return with lower volatility. You also get control and confidence which will be very welcome as we navigate the most uncertain investing environment ever.

Get active now! Otos is welcoming new founding clients and offering an equity interest in the fintech Otos Inc.

The post Sell, Sell, Sell? Market Set To Drop 30% appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.