By Refinitiv. Originally published at ValueWalk.

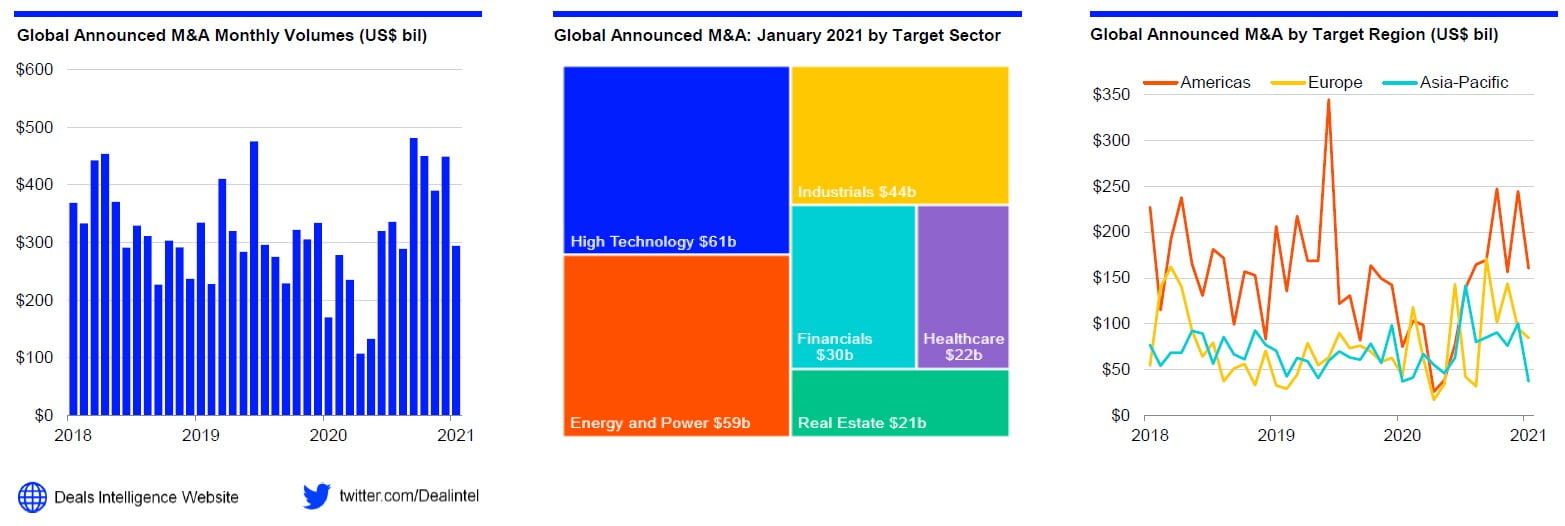

“M&A deals totalling US$294.6 billion were announced globally during the month of January 2021, down 34% from the previous month but marking an increase of 73% from January 2020 and the fifth highest January total since our records began in the 1970s.”

Q4 2020 hedge fund letters, conferences and more

Highlights:

- European M&A increases 95% YTD for best annual start since 2017; Deals involving a target in the Americas more than doubles YTD; Asia Pacific M&A flat compared to the opening month of 2020.

- Highest January total for tech M&A since our records began. Tech sector leads for six consecutive months, since August 2020.

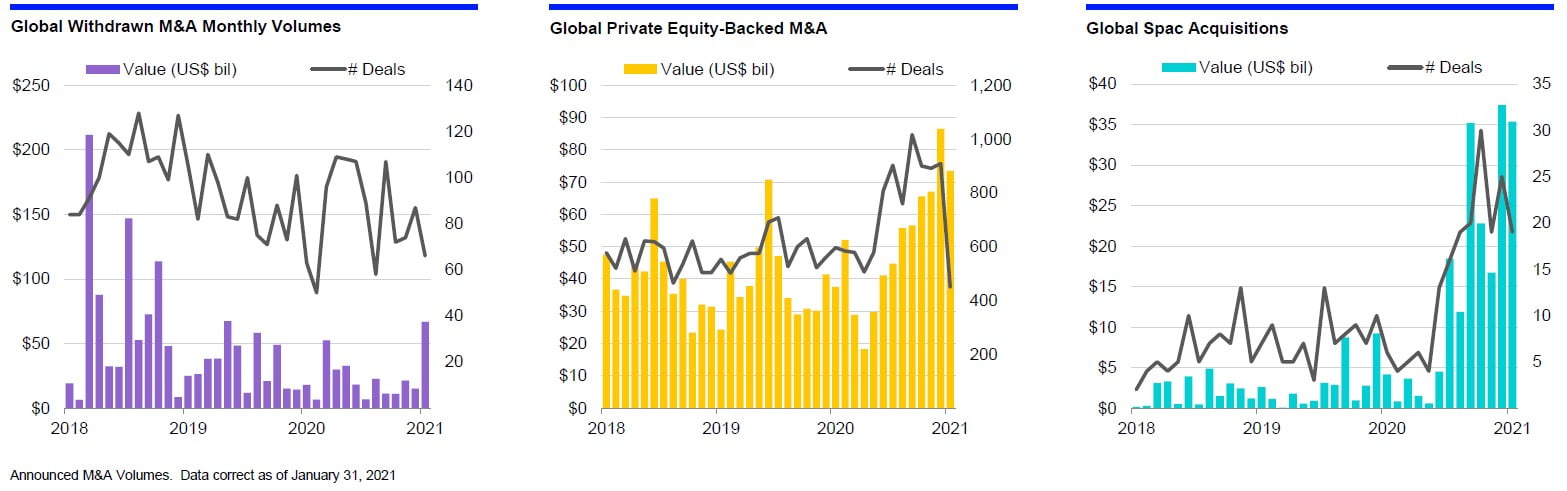

- Withdrawn M&A at 20-month high by value.

- Private equity-backed M&A records sixth highest monthly total of all-time.

- Spac acquisitions exceed $35 billion and mark second highest monthly total of all-time.

January 2021: M&A increases 67% YTD; Tech leads for 6 th consecutive month

Global M&A: Fifth Highest January Total On Record

Deals totalling US$294.6 billion were announced globally during the month of January 2021, down 34% from the previous month but marking an increase of 73% from January 2020 and the fifth highest January total since our records began in the 1970s.

Cross border M&A transactions reached US$119.7 billion during January 2021, the highest January total since 2006, while domestic deals increased 77% from January 2020 to US$174.8 billion.

Sectors: Tech Deals Dominate in January 2021

Deals in the technology sector totalled US$61.5 billion during January 2021, 150% more than the value recorded during January 2020 and the highest January total since our records began. Technology deals account for 21% of global M&A by value during January 2021, more than any other sector. Tech has been the leading sector for six consecutive months, since August 2020.

Regions: Highest January M&A Total in Europe for 4 years

US$84.8 billion worth of deals were announced in Europe during January 2021, up 95% from January 2020 and the best annual start since 2017. Deals involving a target in the Americas more than doubled in value from last year to US$160.4 billion during January 2021. Meanwhile merger activity in Asia Pacific reached US$37.5 billion during January 2021, flat compared to the opening month of 2020.

January 2021: Withdrawn M&A at 20 month high; Sixth highest monthly total on record for PE backed M&A; Second highest monthly Spac M&A total

Withdrawn Deals: 20 Month High by Value

Deals worth US$66.7 billion were withdrawn globally during January 2021, the highest monthly total since May 2019 and the highest January total since 2007.

While the value of withdrawn deals increased, the number of deals recorded in January fell to 66 from 87 during the previous month.

Private Equity: Sixth Highest Monthly Total of All Time

Private equity backed M&A totalled US$73.5 billion during the month of January 2021, 15% less than the value recorded during December 2020, but almost double the value recorded during the same month last year. The value of private equity backed deals recorded during January 2021 is the sixth highest monthly total since our records began in the 1970s.

Spac M&A: Second Highest Monthly Total of All Time

Nineteen spac acquisitions with a combined value of US$35.4 billion were announced during January 2021. The value of acquisitions by special purpose acquisition companies recorded during January 2021 is the second highest monthly total on record after an all time high of US$37.4 billion was recorded in December 2020.

Sources:

Data – “Refinitiv Deals Intelligence”

Commentary – “Lucille Jones, Deals Intelligence Analyst, Refinitiv”

The post Global M&A: Fifth Highest January Total Since 1970s appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.