By Jacob Wolinsky. Originally published at ValueWalk.

S&P Global Ratings has today published its “ESG Overview: Global Sovereigns.” The report discusses environmental, social, and governance (ESG) credit factors that inform our analysis of 135 sovereign governments we rate globally.

Q4 2020 hedge fund letters, conferences and more

ESG credit factors are important to S&P Global Ratings’ analysis of sovereign creditworthiness. They are embedded in several of our rating factors. Changes in ESG credit factors therefore influence–positively and negatively–our sovereign ratings and outlooks (see “How Environmental, Social, And Governance Factors Help Shape The Ratings On Governments, Insurers, And Financial Institutions,” published Oct. 23, 2018, on RatingsDirect). ESG can affect a broad range of rating factors we examine to determine our sovereign ratings, as described in “The Role Of Environmental, Social, And Governance Credit Factors In Our Ratings Analysis,” published Sept 12, 2019.

Analysis Of Sovereign Governments: Analytical Approach

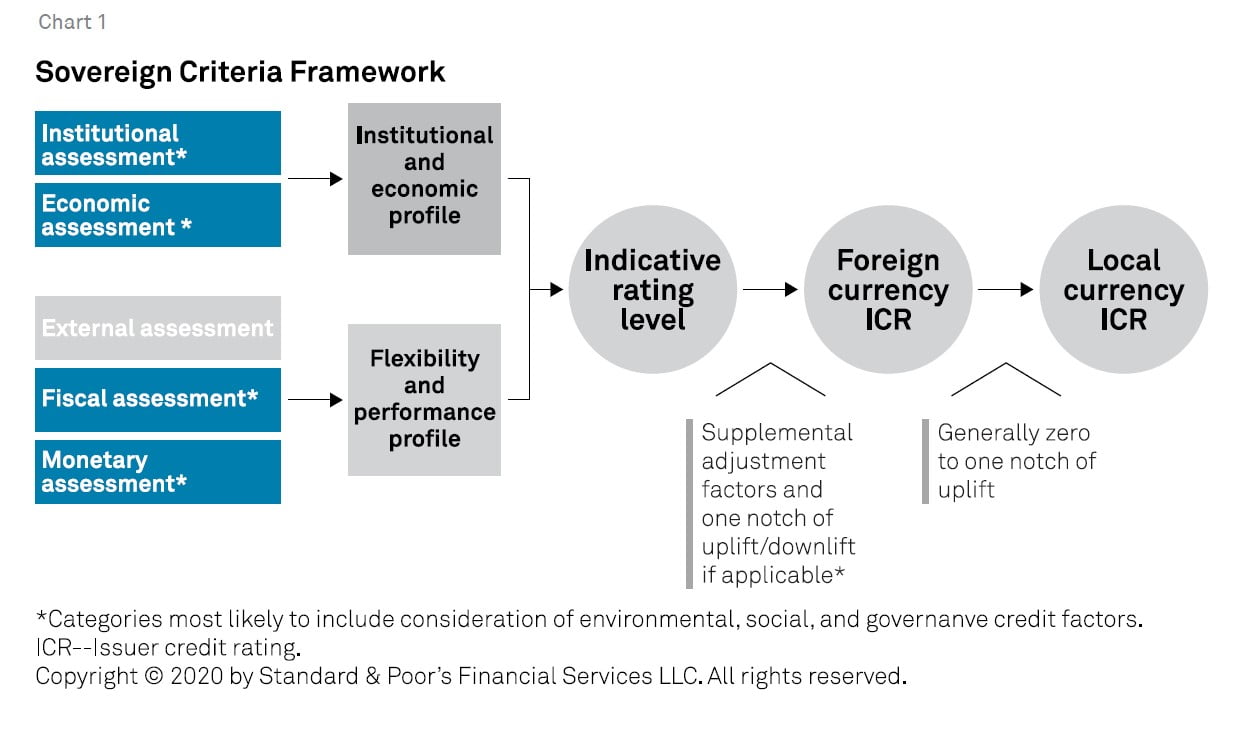

ESG risks and opportunities can affect a government’s capacity to meet its financial commitments in many ways. We incorporate these considerations into our ratings methodology and analytics. This enables analysts to factor in short-, medium-, and long-term impacts–both qualitative and quantitative–during multiple steps of their credit analysis. Comparatively favorable ESG credentials do not necessarily indicate strong creditworthiness (see “The Role Of Environmental, Social, And Governance Credit Factors In Our Ratings Analysis,” published on Sept. 12, 2019).

Environmental risks we consider include greenhouse gas (GHG) emissions, such as carbon dioxide; pollution and waste; water and land usage; and natural conditions (the physical climate, extreme and changing weather conditions). Social risks include those from human capital management; safety management; and consumer-related effects of customer service and consumer behavior affected by environmental, health, human rights, privacy, or community considerations. For sovereigns, such societal and socioeconomic exposures arise directly because they affect a country’s population. Governance risks include, among other things, the quality and timeliness of policymaking, the rule of law, control of corruption, freedom of the press, accountability, and transparency.

Governance Is A Key Pillar Of Sovereign Creditworthiness

In our sovereign analysis, we consider governance credit factors mainly in the context of our institutional assessment, one of the five key sovereign rating factors (see “Sovereign Rating Methodology,” published Dec. 18, 2017).

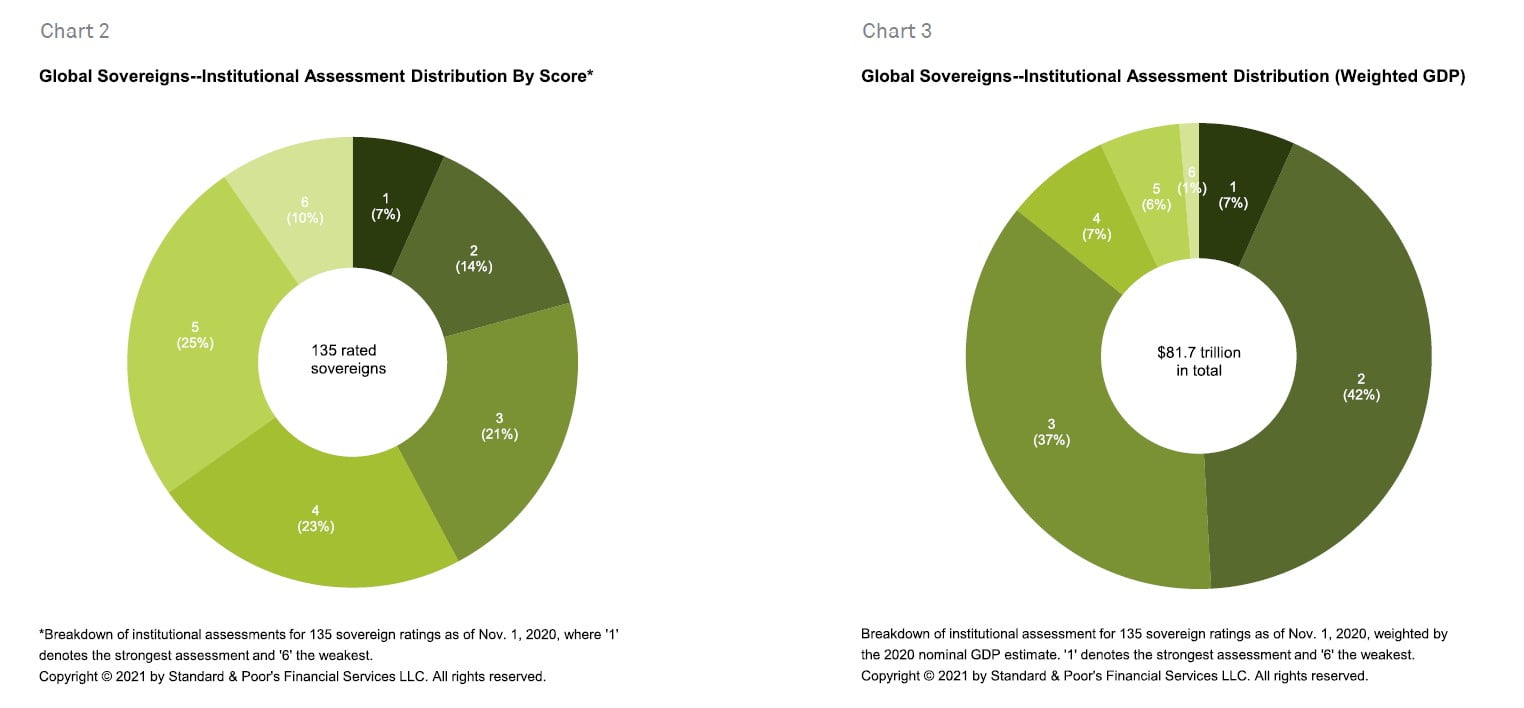

The GDP-weighted distribution of our institutional assessments, taken as a proxy for governance, shows governance to be a relative strength (a score of ‘1’ or ‘2’) for about one-half of sovereign governments, and a clear weakness for 7% (or one-third for the unweighted distribution) with institutional assessments of ‘5’ or ‘6’. The institutional assessment includes our analysis of how a government’s institutions and policymaking affect its credit fundamentals by delivering sustainable public finances, promoting balanced economic growth, and responding to economic or political shocks. Most of these factors align closely with governance concepts.

In addition to counting as an individual rating factor in our methodology, a very low institutional assessment serves as a cap on sovereign ratings, given the importance of this factor, regardless of the indicative rating that emerges from combining all our individual rating assessments. While institutional assessments are widely dispersed across our 1-6 scale (with ‘1’ being the strongest assessment and ‘6’ the weakest), advanced economies tend to, on average, have stronger governance. Therefore, the GDP-weighted share of countries with strong institutional assessments of ‘1’ or ‘2’, at 49%, far exceeds the GDP-weighted share of countries with assessments at ‘5’ or ‘6’ (7%).

Alongside the governance credit factors included in the institutional assessment, our monetary assessment also reflects our opinion on monetary policy credibility, including the independence of the central bank, its policymaking tools and effectiveness, track record on price stability, and role as a lender of last resort.

Social Factors Are Becoming Even More Important

Social factors also inform our institutional assessment, mainly because they relate to the cohesiveness of civil society in the broadest sense. Our analysis of social cohesion looks at social mobility, social inclusion, the prevalence of civic organizations, degree of social order, and the capacity of political institutions to respond to societal priorities. Socioeconomic indicators, including demographics, play an important role and can cause or signal varying degrees of stress on government finances. High and sustained net emigration or unemployment, and unaddressed age-related spending imbalances, are often linked to poor social outcomes for a country’s inhabitants and put government finances under stress.

The COVID-19 pandemic, for example, has revealed varying degrees of resilience and responsiveness to health and safety risks. By and large, sovereigns with stronger governance credit factors, including from robust monetary policy, have been better able to withstand the credit impact from measures to contain the pandemic.

Environmental Risks Are Tangible And Increasingly From The Energy Transition

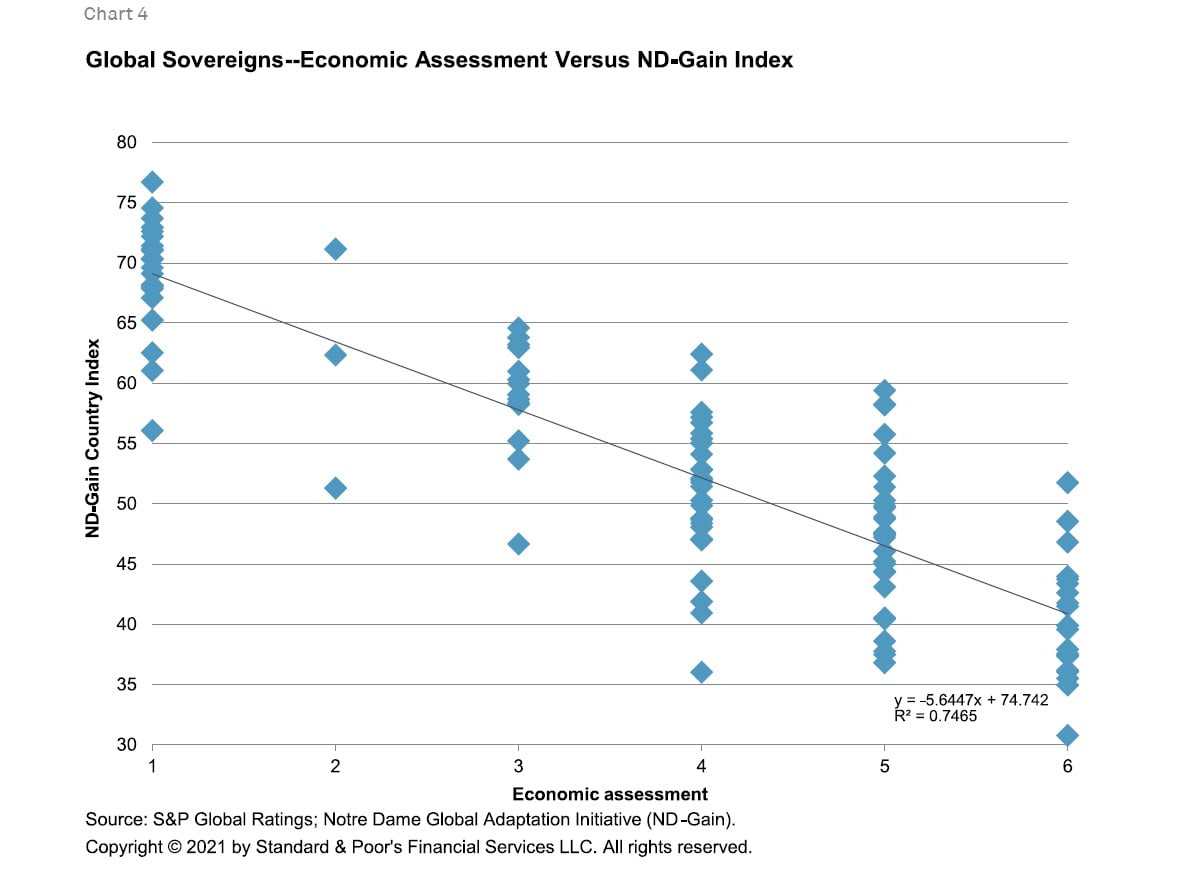

Environmental credit factors are the most complex to capture and, due to climate change and efforts to contain it, the most rapidly evolving. Physical risks pose a limited direct threat to our ratings on sovereign governments with advanced economies, since advanced economies with exposure to natural catastrophes also tend to have solid adaptation strategies, resilience records, and infrastructure. Our ratings on many emerging-market sovereigns, on the other hand, already reflect potential risks arising from future natural disasters. This can be seen in the overall good alignment of our economic assessment with the Notre Dame Global Adaptation Initiative (ND-Gain) index.

Our economic assessment also includes a potential adjustment for volatility in economic output, often caused by constant exposure to natural disasters or adverse weather conditions. When natural disasters hit, this may also affect our fiscal assessment (through the impact on tax revenue and spending pressures) and our external assessment (through a sudden loss of exports) as damage costs rise.

Read the full report here by S&P Global Market Intelligence.

The post An ESG Overview Of Global Sovereign Governments appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.