By Jacob Wolinsky. Originally published at ValueWalk.

Whintey Tilson’s email to investors discussing his ‘Short Squeeze Bubble Basket‘ is down 25% in four days; Ray Dirks Research’s $hortBuster Club report; how he lost money speculating; Recommended reading; Buffett’s annual letters from 1957 to the present.

Q4 2020 hedge fund letters, conferences and more

Whitney’s Short Squeeze Bubble Basket’ Is Down 25%

1) It looks like my “spidey sense” allowed me to nail yet another ridiculous bubble almost to the hour…

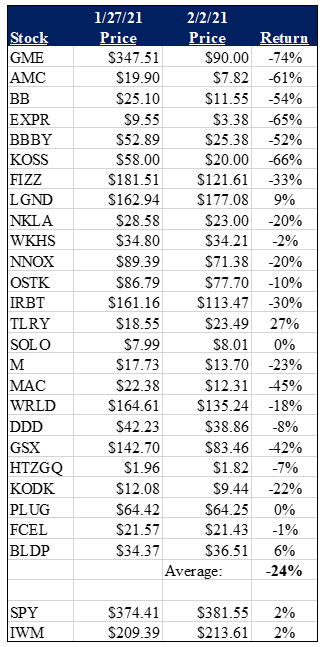

Only four trading days after I called the top, my 25-stock “Short Squeeze Bubble Basket” has crashed by 24% (through yesterday’s close), with GameStop (GME), of course, leading the way, down 74%! (Mark my words, it will soon go down by another 74%!)

Here’s the full performance from my spreadsheet:

I have a few thoughts…

I originally had only the most absurd eight bubble stocks – the first seven plus GSX Techedu (GSX) – on this list. While they would have performed far worse (they’re down an average of 56% versus down “only” 11% for the remaining 17), I chose to publish a larger list because I wanted to warn my readers about as many terrible stocks as possible – and every one of these stocks is a total dog.

Collectively, these 25 stocks lost $35 billion in market value over the past four trading days. This breaks my heart because, while I can’t prove it, I’m certain that professional investors accounted for very little of this loss (in fact, I’m sure they profited from it). Instead, as I warned again and again, it was naïve individual investors – the people who can least afford it – who got incinerated.

Ray Dirks Research’s $hortBuster Club Report

2) The Redditors squeezing the shorts – and the breathless media covering it – think they’re so original, but this has happened many times in the past… and it always ends in tears for those engineering the short squeeze. Here’s an e-mail I received from one of my readers:

Below is the cover the of the November 1993 issue of Ray Dirks Research’s $hortBuster Club report. Beginning in 1991, Ray and his minions at The OTC Review published the short portfolio of the Feshbach brothers, the best-known short sellers of that era, and targeted their positions. They even set up a $hortBuster mutual fund!

It worked for a while, as the Feshbachs went from making 60% in 1990 and being on the cover of Time magazine, to losing 60% in 1991, the year the Value Line 5 (lowest rated) stocks outperformed the Value Line 1s for the first and only time as low-priced, high-short-interest stocks soared.

Almost nobody remembers that now, but it was a big deal at the time. The current running of the shorts is no different and will just create some incredible opportunities on the short side when the short squeeze inevitably wanes.

P.S. – Ray Dirks has an interesting history. He was the analyst who called exposed the accounting fraud at Equity Funding Corporation of America, but he was then sued by the SEC for insider selling, arguing that he turned over the information to his clients for their profits rather than to the SEC for its enforcement. The case went all the way to the Supreme Court out of which came the Dirks Test, requiring those finding fraud on the market to inform the SEC. That rule seems long forgotten as the SEC enforcement division pays little to no attention to whistle blowers. I personally asked the head of the Enforcement Division when George H.W. Bush was President what opinion he had of short seller tips, and he said the staff ignores them. I doubt things have changed much.

How I Lost Money Speculating

3) If you’ve lost a lot of money in the past week as the short squeeze stocks collapsed, you’re actually lucky. Here’s why…

At the very start of my investment career in the late 1990s – at the tail end of a long bull market (sound familiar?) – I, too, was speculating madly.

But I was fortunate. Before I got in over my head, I lost money on the first stock I bought – a pump-and-dump scheme called StreamLogic – which awakened me to the error of my ways. So I called my college buddy Bill Ackman, who was then running his first fund, Gotham Partners, and I’ll never forget what he told me:

Go read Warren Buffett’s annual letters – and you can stop there. You don’t need to read anything else.

So I did – and his simple concept of patiently searching for the rare dollar bill that can be purchased for 50 cents resonated with me – and it changed my life…

Recommended Reading; Buffett’s Annual Letters From 1957 To The Present

4) 25 years later, I still think Bill’s advice is excellent – though I wouldn’t stop at Buffett’s letters. For further reading, here’s what I recommend.

5) To read Buffett’s letters, I’d start with those going back to 1977, which are posted on Berkshire Hathaway‘s (BRK-B) website here, or here’s a nice compilation of them, organized by topic: The Essays of Warren Buffett: Lessons for Corporate America.

Then, read the letters from 1969 to 1976, which I’ve posted here.

Finally, I long ago compiled the Buffett Partnership letters from 1957 to 1970, but never posted them publicly… until now.

It’s astounding to see the greatest investment mind of all time at work in its early days.

Enjoy!

Best regards,

Whitney

The post Ray Dirks Research’s $hortBuster Club Report appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.