By Jacob Wolinsky. Originally published at ValueWalk.

Over the course of 2020, financial insecurity concerns rose to an all-time high. With millions of Americans unemployed or experiencing reduced hours or salaries, more households than ever were living paycheck to paycheck.

Q4 2020 hedge fund letters, conferences and more

In fact, only 39% of American households could afford an emergency expense up to $1,000, and only 23% of Americans could afford this amount outright. Of the aforementioned 39%, 38% would borrow this amount; 18% would use a credit card; 12% would secure the money from family or friends; and 8% would use a personal loan.

Discover Personal Loans set out to understand how Americans are currently preparing to become more financially secure by understanding how they define money security, how they’re preparing to become more savvy with their income, and to uncover any tips that are helping them feel safe during these unprecedented times. They polled just over 1,000 individuals, and here’s what they learned.

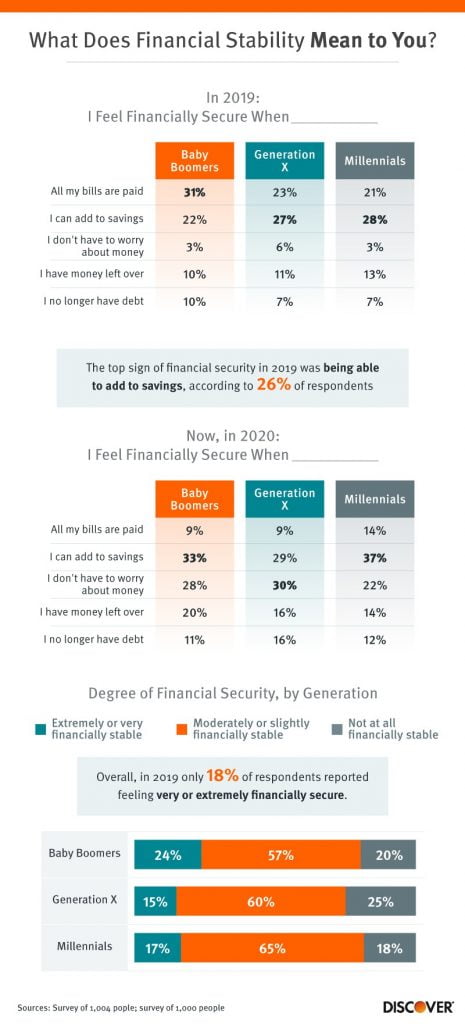

Financial Security in 2019 = Expenses Paid and Savings Growing

When surveyed in 2019, Americans across multiple generations (baby boomers, Gen X, and millennials) believed financial security equates to being able to pay your bills on time while also growing your savings account. What’s interesting is that baby boomers rated paying bills higher than building savings, while both Gen X and millennials believed having a healthy savings account to be more important.

Financial Security in 2020 Is All About Savings and Reduced Money Anxiety

In 2020, the definition of financial security shifted for all generations. Now, the primary focus was on savings and less stress regarding finances. With the pandemic playing a large role in shaking financial foundations, many placed a heavier emphasis on savings than on paying bills. Financial security became more about having money put away in case of an emergency, like job loss or needing to pay hefty medical bills.

Considering so many Americans faced unprecedented hardship throughout 2020 and are still struggling to find work and recover from this economic upheaval, it’s unsurprising that not having to worry about money was the second-most popular answer to defining financial security. In fact, Gen Xers, who are nearing retirement age, are the only generation to rank not wanting to worry about money higher than savings.

Reflecting on Financial Security

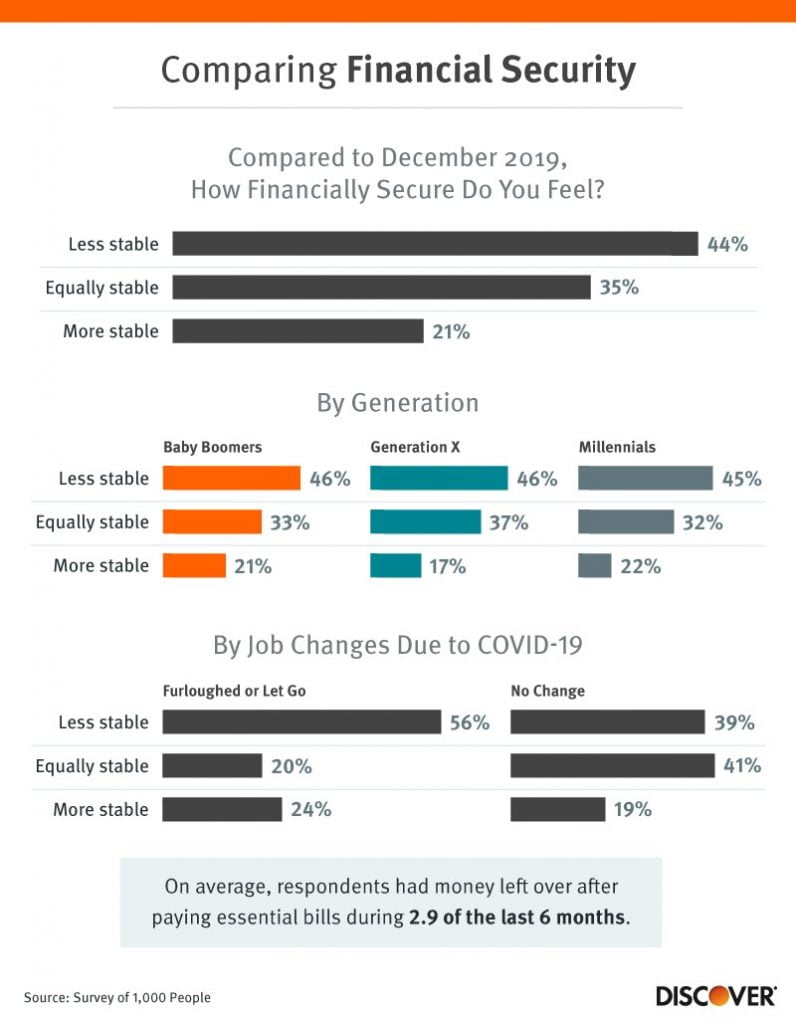

When individuals were asked how financially secure they felt in 2020 compared to 2019, nearly half (44%) answered less stable. On top of that, 56% of individuals who were furloughed or let go this year felt less stable financially. Of those who experienced no job change or loss, 39% still felt less stable overall.

This could indicate that even those who were not financially impacted by the coronavirus pandemic in 2020 might be feeling less certain about their job security, and as a result, feel less financially stable.

Relationship With Debt

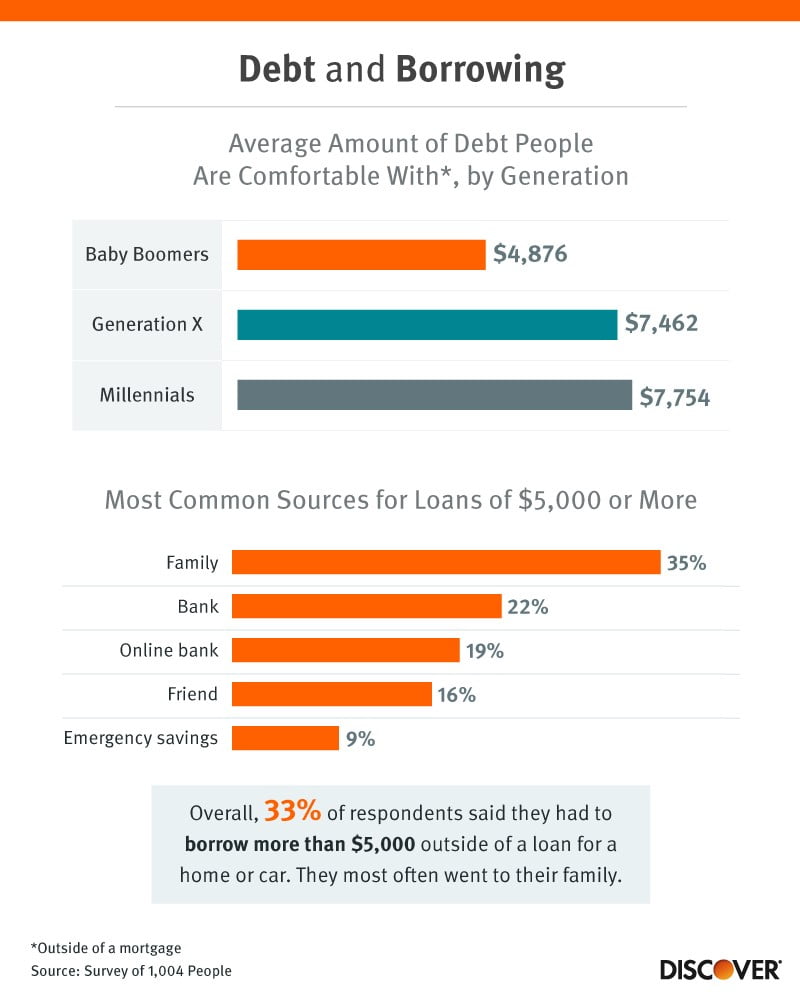

Next, Discover Personal Loans looked at the way different generations viewed debt to understand how much debt individuals are generally comfortable with carrying. Baby boomers were the least comfortable with debt, with an average comfort level of $4,876. Gen X and millennials clocked in pretty closely ($7,462 and $7,754, respectively), which could be due to higher costs of living when these generations came of age and increases in student loan amounts.

Common Ways of Securing Loans

What is really interesting is how most individuals secure money for a loan. While you might think a private loan or credit card is the most popular method, 35% of participants revealed that they would go to family for a loan of $5,000 or more. Brick-and-mortar banks, online banks, friends, and savings accounts all followed.

In fact, 33% of participants admitted to having to borrow more than $5,000 from family to pay for a mortgage or car loan.

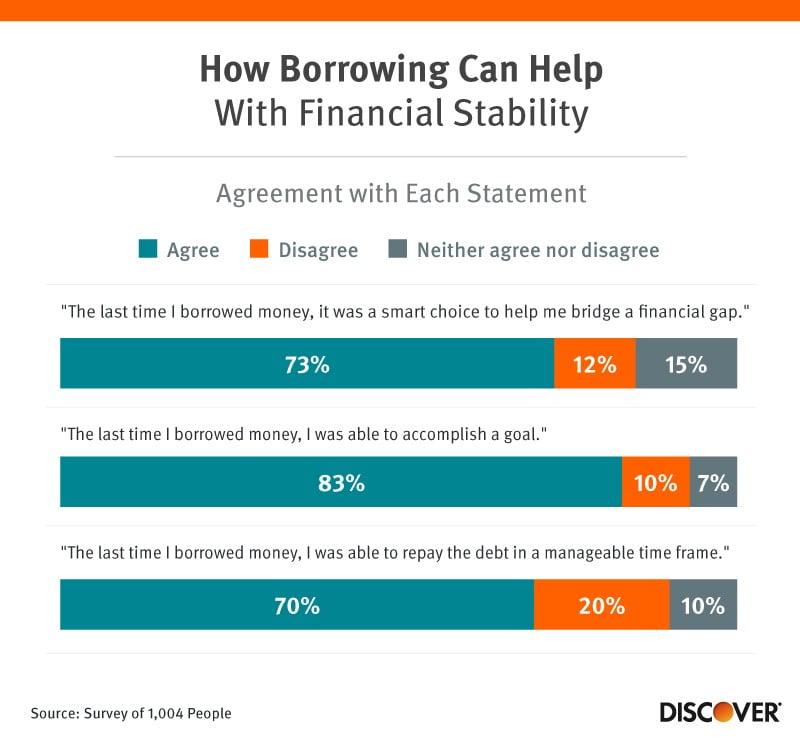

Turning to Loans to Make Ends Meet

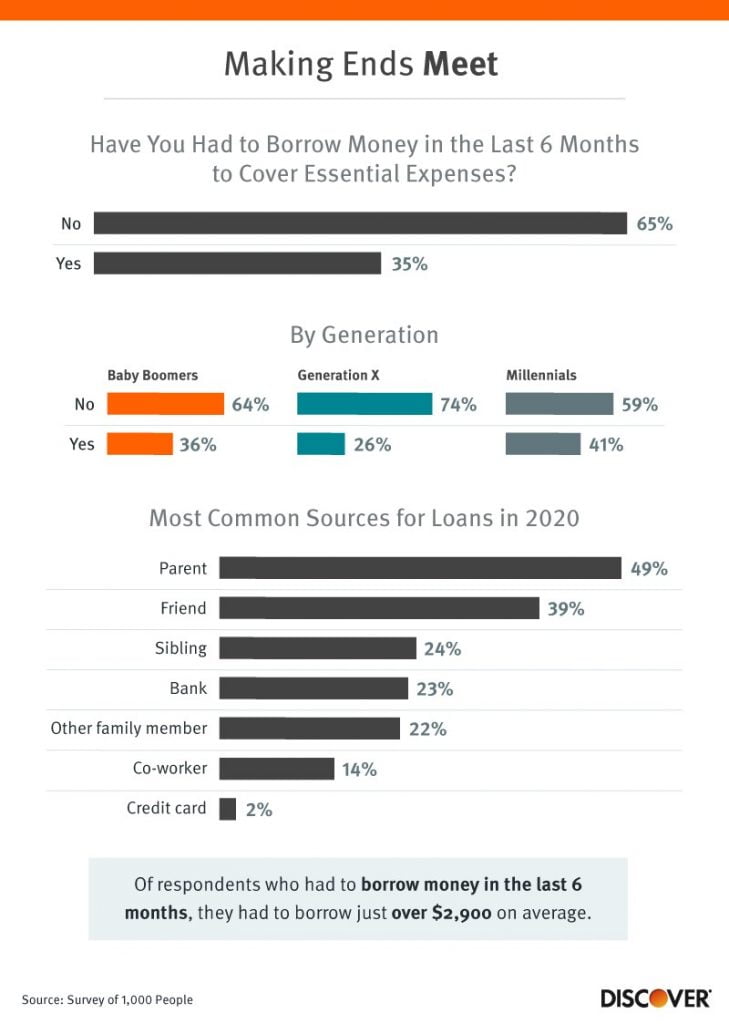

Next, Discover Personal Loans looked at whether individuals needed to secure a loan from family, friends, or a bank in the last six months. It turns out, 65% of individuals did not need to take out a loan, with Generation X in the lead for not needing to borrow money. Millennials were the most likely to take out a loan during this time period, with 41% needing to secure additional funds to make ends meet.

Most individuals turned to a parent (49%), friend (39%), or sibling (24%) to help with financial troubles. Only 23% turned to a bank, and around 2% resorted to using credit cards. The average amount borrowed across participants over the last six months was $2,900.

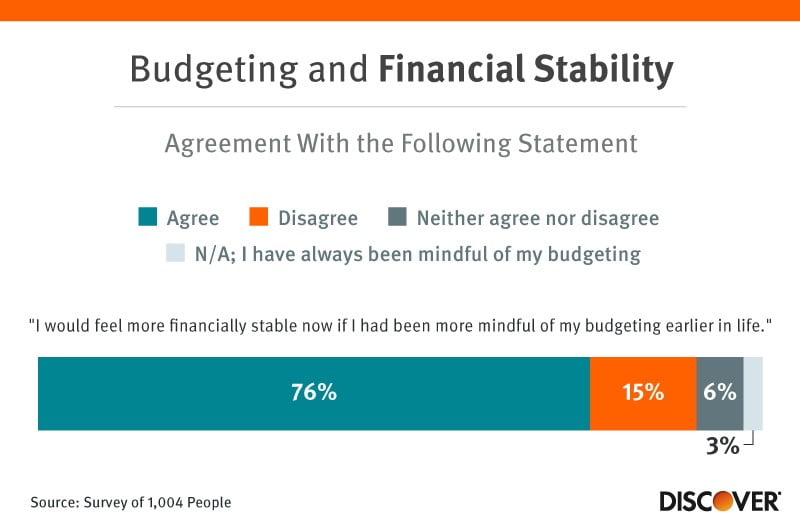

How Budgeting Beliefs Relate to Financial Security

Budgets are common solutions to helping many take control of their finances. When asked, 76% believed they would feel more financially stable if they had started budgeting earlier in life. Only 3% admitted to budgeting throughout their entire adult life.

In fact, 75% of those surveyed who did not feel financially stable at all believed budgeting earlier in life would have put them in a better spot in 2020 and left them with more savings and financial preparedness.

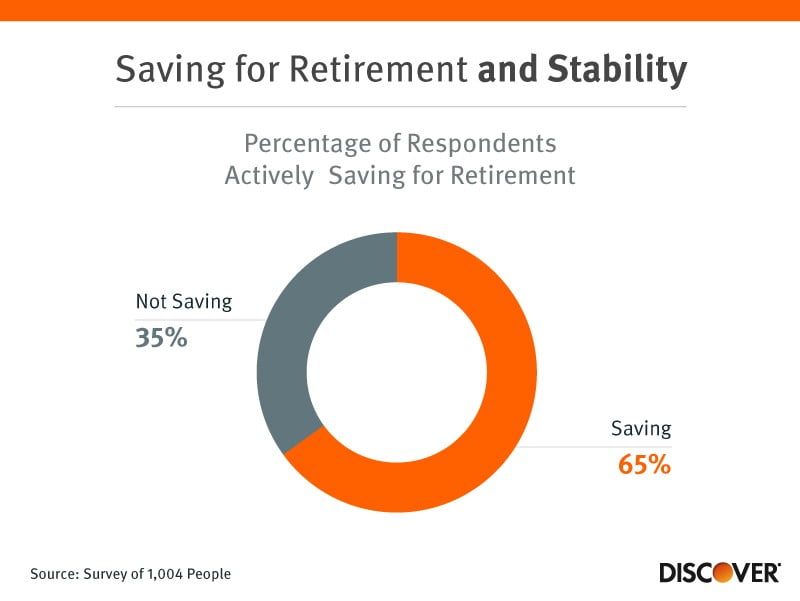

Retirement Savings Have Been Put on Hold for 1/3 of Americans

The idea of retirement can bring about mixed feelings – those who are financially prepared often look forward to this part of their life, while those who are not tend to dread the topic. When asked, 65% of participants surveyed were actively saving for retirement, while 35% were not saving a penny toward retirement.

Often, saving for retirement becomes more of a priority as you grow older, but saving young can help you earn tens or even hundreds of thousands more, thanks to compound interest. However, it seems a lack of financial security has left many living paycheck to paycheck with no extra room for retirement savings in their budget.

Final Thoughts

This past year has shown a transformation in the way we view financial security. More Americans are realizing the importance of saving, reducing money anxiety, and budgeting to stay on track financially now and in the future.

The post What Was Financial Security In 2020 All About? appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.