By Sabine Ghali. Originally published at ValueWalk.

The Deadly Impact Of The New South Wales Wildfire And The Future Of Sustainable Finance by Sei Young Kim (Michelle)

Q4 2020 hedge fund letters, conferences and more

Introduction

The catastrophic 2019-20 wildfire in New South Wales resulted in a massive loss of human and animal life. The overall damage and loss caused by the bushfire were disastrous. Due to the bushfire in New South Wales, 5.4 million hectares of land were burned; 2,439 homes were destroyed1; three billion animals were killed; and almost 33 people lost their lives2.

Unfortunately, physical damage and loss are not the only challenges New South Wales has been going through. It also has been facing several financial hardships, including the long-term credit risks of the state government. The area is especially at high risk of credit downgrade given that its primary industries are farming and forestry, which are the industries that require a stable source of water. The summer and winter crop production in New South Wales has decreased significantly, and the water scarcity has increased due to the recent drought and wildfire. More wildfires and droughts are expected to happen in the region, given that the area has a high temperature, low humidity, and strong winds. Due to the increasing climate risk observed in the region, investors have been concerned with the increased default risk, and some rating agencies mentioned that the triple-A rating of New South Wales debt could be downgraded. Thus, it is crucial for New South Wales to plan out and implement nature-based solutions and various policies, including green bonds, tax incentives, and environmental regulations, to mitigate the downgrade credit risk resulting from the threat of drought and fire in the area3.

As of 2021, the credit rating of New South Wales debt is ‘AA+,’ which is one notch lower than triple-A. This is mainly due to the state government’s increased borrowing to revive the economy during the pandemic4. However, although its credit rating is primarily due to the impact of the Covid-19 pandemic, according to the NSW Treasurer, two of the main drivers that decreased the revenue base of New South Wales are drought and bushfire5. Currently, to recover the significant loss from the wildfire, New South Wales is taking few initiatives, including issuing additional green bonds6, supporting business decisions that could help the transition to net-zero emissions7, and building more wildlife drinking stations2. However, given that southeastern states in Australia, which includes New South Wales, are still expected to have a high risk of bushfire even in 20218, its continuous effort and commitment to prevent the environmental risks and to think strategically and creatively on how to incorporate sustainable finance would be essential.

Challenges and Solutions

Economic Loss and Biodiversity Loss

The wildfire in New South Wales has affected the state government’s credit risk and damaged Australia’s economy as a whole. Various sectors of the economy have been negatively affected by the wildfire. And all the monetary policies, including the interest rate, have been adjusted to encourage spending and increase consumer confidence. Most importantly, New South Wales’s yield curve was inverted as of 2020, indicating that the area might face an economic recession3. Moreover, millions of animals died, and half a billion animals have been affected across the area. Animals like koalas are relatively safe in terms of extinction danger since they live across the country. However, animals that have to live in a particular environment in New South Wales could disappear if their habitats get burned down by the fire9. The loss of animals in the area would affect the ecosystem’s food chain and eventually affect how we live. To prevent the biodiversity loss issue, New South Wales could benchmark the ongoing investment fund in Uganda called EADB Biodiversity Investment Fund (BIF). BIF is a fund that helps construct a biodiversity-friendly investment in Uganda10. New South Wales can create its own version of BIF to help protect the animals living in the area.

Water Stress

In addition to economic and biodiversity loss, due to the low levels of soil moisture, New South Wales’s biggest risk has been water stress. Moreover, it is expected to invest in additional infrastructures to support the firefighting efforts11. Due to the increased water-related stress and recovery costs, people living in New South Wales might not be able to find drinkable water anymore, and the businesses related to agriculture and fishing might fail. The key takeaway is that even though the area has a reasonable backup plan to recover all the losses from natural disasters, it is more important to prevent the destructive climate catastrophes ahead. Effective policies that could support environmental conservation would be essential. To that end, environmental regulations that could restrict certain activities that might result in higher carbon dioxide emissions; education on raising the climate risks awareness; and corporations’ active ESG integrations would help prevent these natural disasters from happening beforehand.

Green Bonds

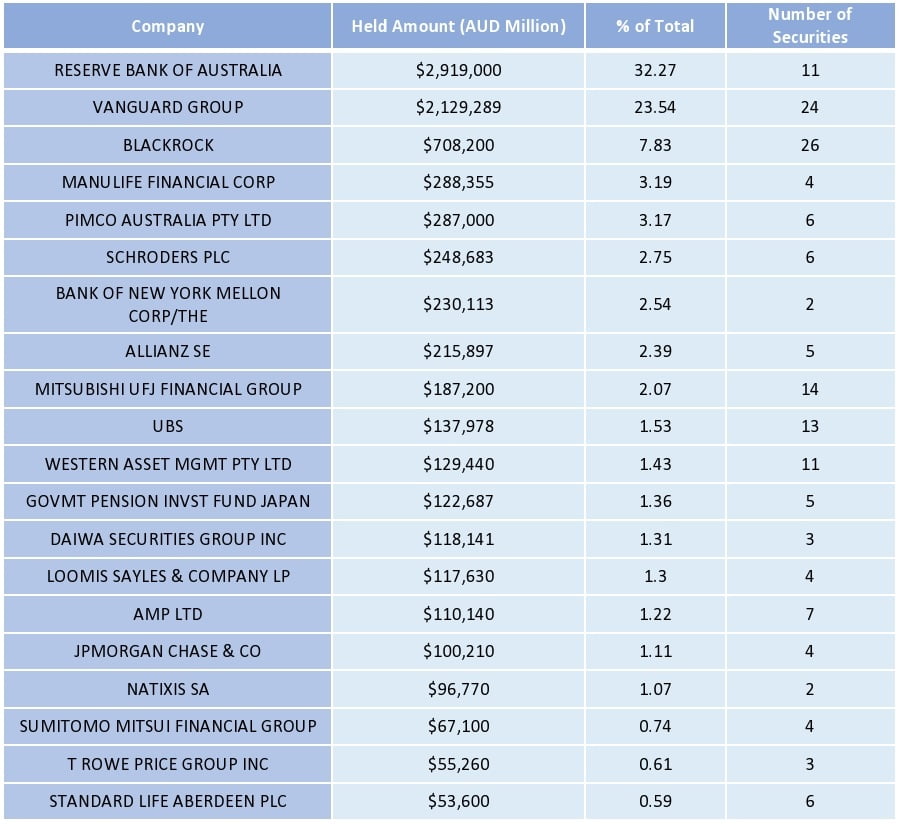

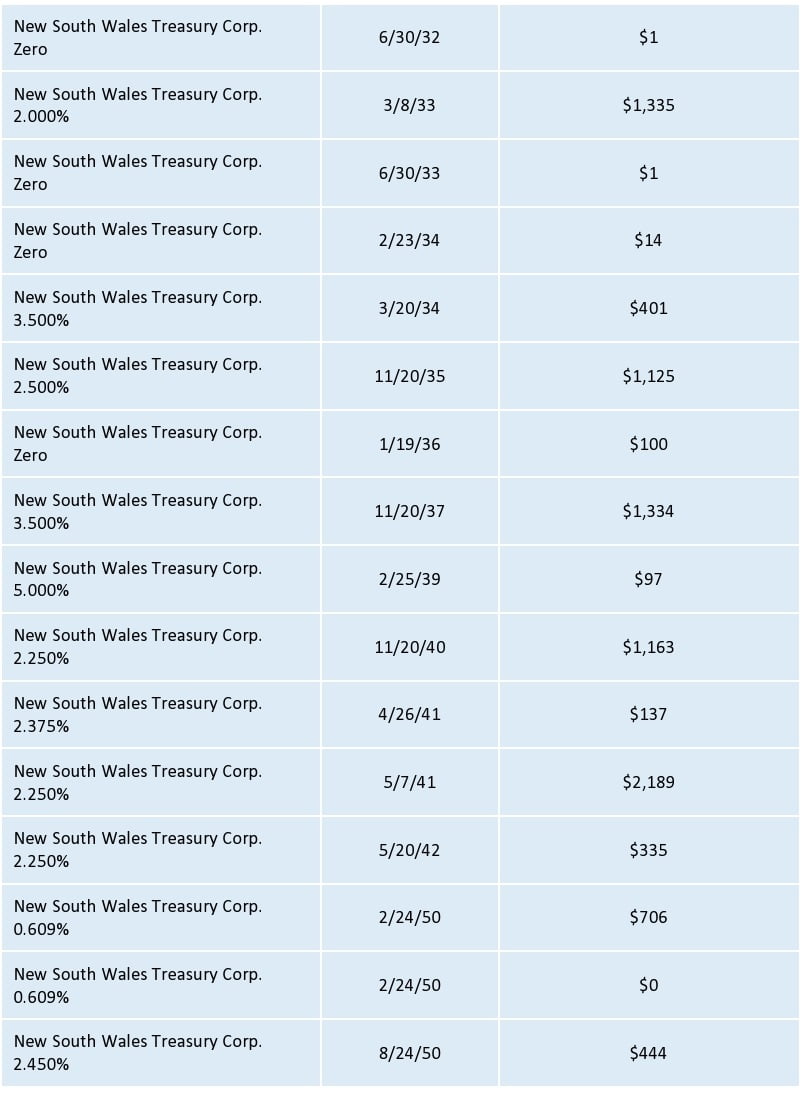

A green bond is an investment product where its proceeds are mainly used for projects that could benefit the climate and overall environment12. Green bonds could be an effective solution for New South Wales to prevent and mitigate the credit downgrade risk caused by the decline in natural capital. However, apparently, as of early 2020, only 4% of New South Wales debt was green bond3. Thus, the area has been encouraged to expand its Sustainability Bond Program. Also, by issuing additional green bonds, current investors (See Table 1 at the end of the report) would feel less risky for their investment in New South Wales debt even though they invested in vulnerable industries such as timber and agriculture. Investors would know the climate risk in the area is being mitigated with the proceeds of green bonds. Also, an increase in demand for green bonds is needed to promote the green bond issuance. Tax incentives can be one of the main benefits for investors that could increase the demand for green bonds. Besides, New South Wales can incorporate interest subsidies or grant programs as well. For instance, China offers interest subsidies where the local government pays 40% of the green bonds’ interest rate, and the payment is made to the investors. Similarly, in Japan, the Ministry of Environment provides grant subsidies to cover the green bonds issuance cost13. Although many corporations and organizations are interested in making positive environmental change, green bonds would be more attractive for investors if New South Wales can incorporate more investors-friendly policies.

Australian RMBS

From the perspective of investors, diversification could be another solution that could mitigate climate risks. About three million California homes are expected to face a decrease in home values due to the wildfire. Decreased home values could eventually lead to an increase in mortgage default risk14. However, surprisingly, according to S&P Global, even though lots of houses were burned down in New South Wales, the overall rating of the Australian residential mortgage-backed securities (RMBS) did not affect by the bushfire given that the burned-down area only covers less than 6% across the Australian RMBS. Australian RMBS was able to keep its rating because it was geographically well-diversified15. Thus, diversified portfolios would be critical instead of limiting to a specific sector or industry for investors. Diversification would allow investors to manage risk effectively.

Current Credit Rating of New South Wales

Many rating agencies expected New South Wales to face an increased risk of credit downgrade due to the wildfire. On December 7, 2020, its long-term credit rating got downgraded by one notch from ‘AAA’ to ‘AA+.’ However, interestingly, the main driver of its credit downgrade is the impact of COVID-19. Due to the pandemic and business lockdowns, New South Wales increased and expected to increase its government debt, and thus, S&P Global decided to lower its credit rating4. It is the first time for the area to lose their ‘AAA’ rating since 200316. However, NSW Treasurer Dominic Perrottet also mentioned that all the challenges New South Wales had to face, including drought, bushfires, and Covid-19, have negatively affected its revenue base and worsened the situation5.

Climate Initiatives

Since the bushfire happened, there have been few initiatives taken by New South Wales to recover from the bushfire loss and to prevent future climate risks. In terms of biodiversity, most of the injured or sick koalas have returned to the wild after getting appropriate treatment at the Port Macquarie Koala Hospital located in the Mid North Coast of New South Wales. A crowdfunding campaign of almost 7.9 billion helped the hospital to continue its program of helping animals. Moreover, Australia built about 140 wildlife drinking stations in New South Wales and across other states2. The NSW government has taken other initiatives, such as increasing the numbers of volunteer wildlife rehabilitators; opening an emergency feral animal control program; and developing seed banking17.

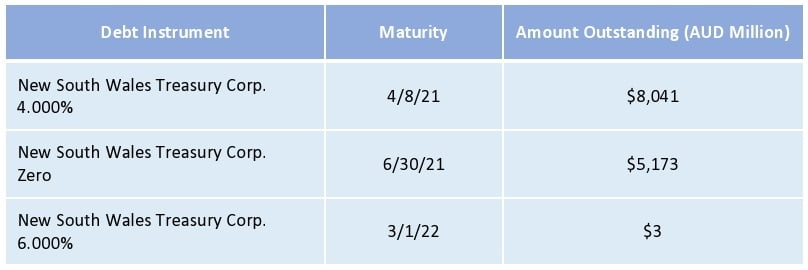

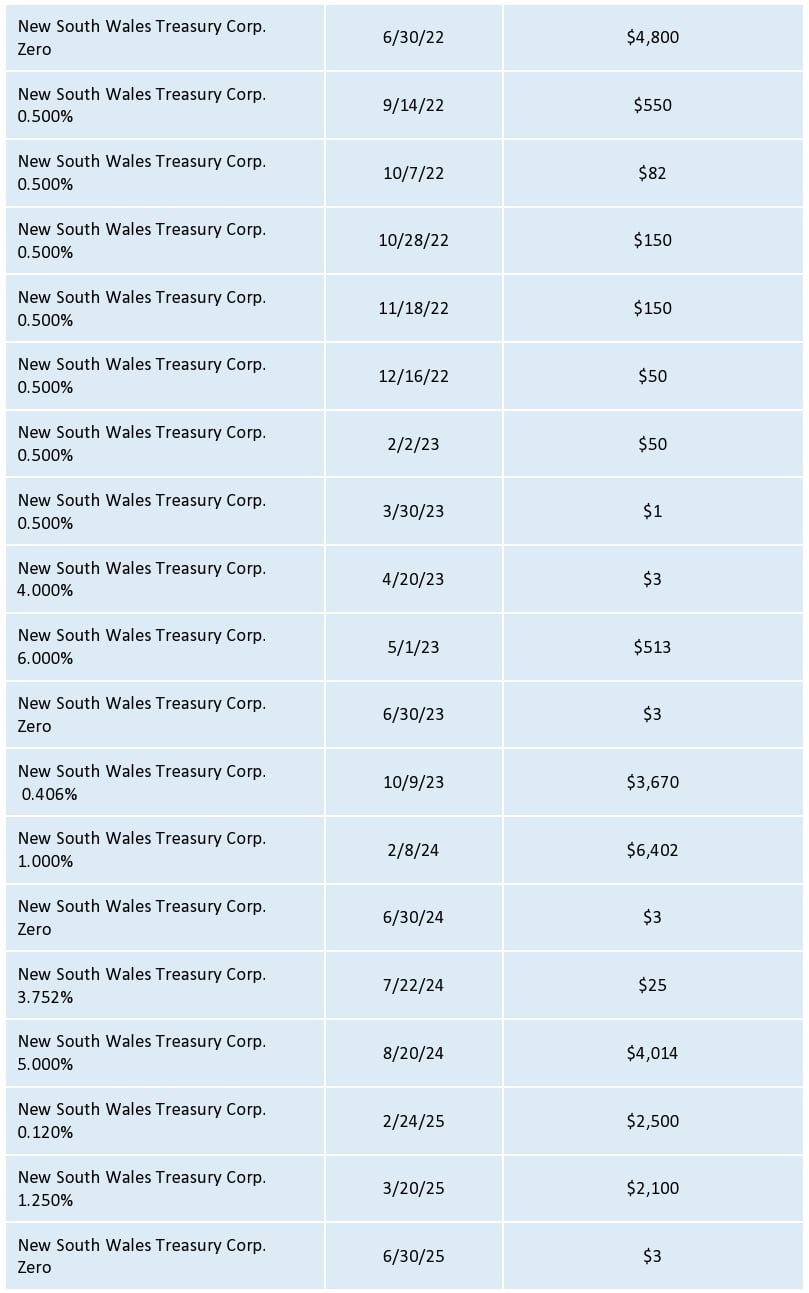

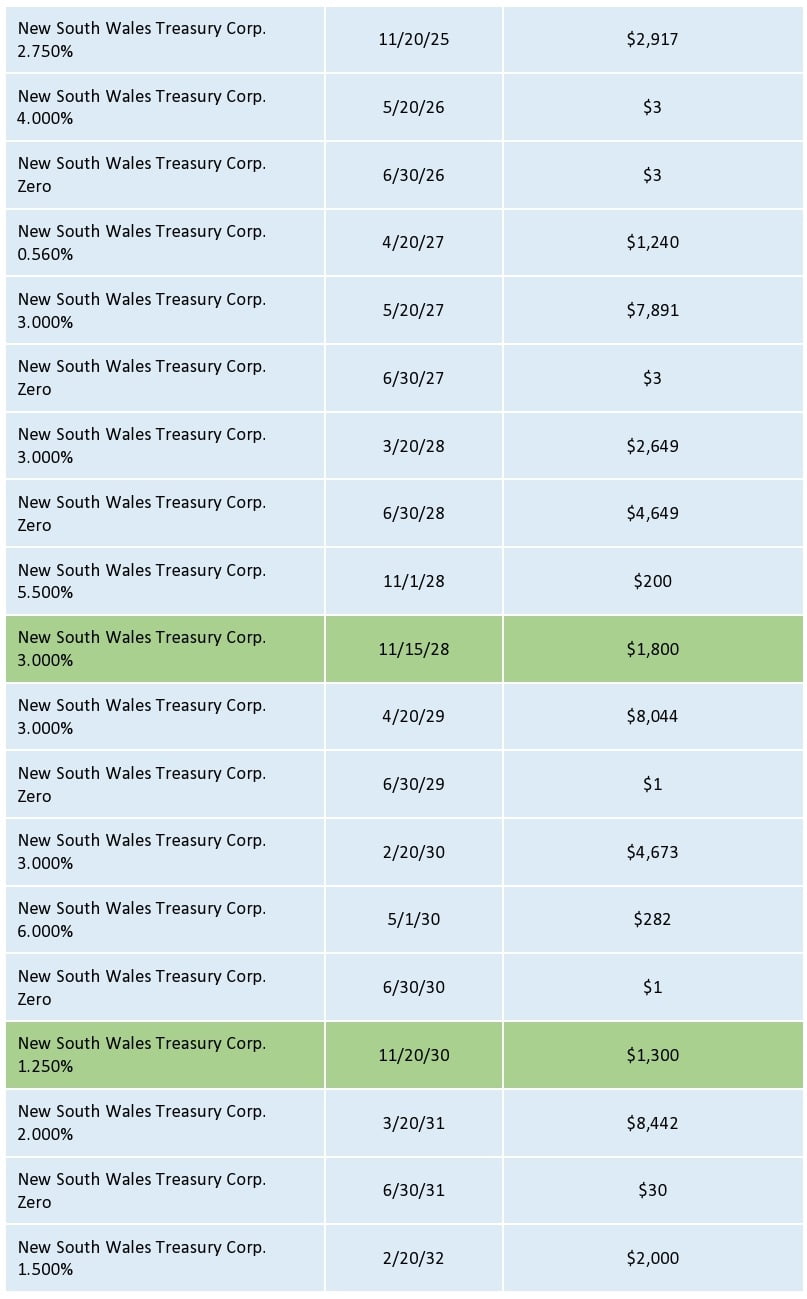

Moreover, in terms of sustainable finance, TCorp, the central financing division for New South Wales, has issued a new additional $1.3 billion green bond with a maturity date of November 2030 on October 21, 20206 (See Table 2 at the end of the report). Australia has also published a sustainable finance roadmap that talks about different recommendations to mitigate the climate risks that Australia’s finance system is facing. All the recommendations, including collaborations and discussions with financial regulators for guidance on sustainable benchmarks; supporting business decisions that could help net-zero emissions transition; and other climate risk mitigation efforts, are expected to be implemented by 20307.

Although Australia, specifically New South Wales, is working hard to recover from the bushfire and is putting more effort and taking initiatives to prevent the environment and mitigate the climate risks, it is too early to lessen these efforts. Still, in 2021, the dry, hot, and windy climate is increasing the bushfire risk across Australia’s southeastern states, including the New South Wales region8. Thus, its continuous effort and commitment to prevent climate risk and to think strategically about the role of sustainable finance would be essential.

Conclusion

Climate risk and natural catastrophes would affect the most vulnerable industries such as timber, agriculture, and forestry and would also affect the economy as a whole and the everyday lives of people. Specifically, regions like New South Wales, where drought and wildfire are likely to happen due to high temperature and low humidity, would have a much higher risk of natural disasters. Especially these days, where lots of economic and social activities are banned due to the covid-19 pandemic, it would be much harder for regions like New South Wales to recover from economic loss, specifically from its downgraded credit rating. Although it is taking various initiatives to combat different climate challenges, given the increase in bushfire risk in the area and increased government debt, New South Wales would have to continue its efforts to prevent climate risk and incorporate sustainable finance.

Even though the article mainly focused on talking about the loss in New South Wales, it is worth mentioning that preventing natural catastrophes and climate risk is an important topic every human being has to be seriously concerned about. The overall loss is much more complicated, and it is happening even in unexpected places in the world. Fortunately, these days, more companies acknowledge the importance of ESG and try to integrate ESG investing in their investment practice for long-term profitability. It is hard to find one financial institution not mentioning ESG or sustainability in their websites, and many companies state sustainable finance as one of their core values or missions. More stakeholders and corporate leaders pay attention to how their business and investment decisions affect environmental sustainability and social and governance factors. Of course, there are few challenges regarding ESG investing, such as a lack of strong ESG metrics and transparency of ESG reporting. However, as more companies and organizations attempt to effectively and accurately measure ESG metrics and their impact, lack of standardization of ESG measurement would not be an issue, and corporates would be able to actively integrate ESG factors in their investment process.

Physical injuries and loss caused by the wildfire that could be merely seen and heard from the news are just one part of the disastrous loss. Especially living in the Anthropocene era, where every human activity directly influences the climate and the environment, I cannot emphasize the importance of environment conservation and the role of sustainable finance enough.

Appendix

Table 1: Top Twenty Institutional Investors Owning New South Wales Treasury Corporation Debt, 29 January 202118

Table 2: New South Wales Debt Instruments, 29 January 202118

Note: Green bonds are highlighted in green.

Works Cited

- “Australia Fires: New South Wales Blazes All ‘Contained’.” BBC News, 13 Feb. 2020, www.bbc.com/news/world-australia-51484814.

- Reid, Sarah. “How Australia’s Tourism Industry Is Recovering a Year After the Devastating Bushfires.” Travel + Leisure, 13 Jan. 2021, www.travelandleisure.com/travel-tips/travel-trends/australia-tourism-recovery-bushfires.

- Thoumi, Gabriel. “From Drought to Fires to Downgrade Risk.” Planet Tracker, Mar. 2020, file:///Users/michellesykim/Downloads/From-Drought-to-Fires.pdf.

- Foo, Martin, et al. “Credit FAQ: Why We Downgraded The Australian States Of New South Wales And Victoria.” S&P Global, 7 Dec. 2020, www.spglobal.com/ratings/en/research/articles/201207-credit-faq-why-we-downgraded-the-australian-states-of-new-south-wales-and-victoria-11767010.

- Smith, Alexandra, and Tom Rabe. “NSW Credit Rating Downgraded for First Time.” The Sydney Morning Herald, 7 Dec. 2020, www.smh.com.au/politics/nsw/nsw-credit-rating-downgraded-for-first-time-20201207-p56lcu.html.

- Patron, Oksana. “TCorp’s $1.3b November 2030 Green Bond Achieves Strong Result.” Money Management, 20 Oct. 2020, www.moneymanagement.com.au/news/financial-planning/tcorp%E2%80%99s-13b-november-2030-green-bond-achieves-strong-result.

- “The Australian Sustainable Finance Roadmap Recommendations – Summary.” Australian Sustainable Finance Initiative, www.sustainablefinance.org.au/roadmap.

- “Bushfire Danger Elevated as Heatwave Conditions Continue to Sweep Parts of Australia: The Weather Channel – Articles from The Weather Channel.” The Weather Channel, weather.com/en-IN/india/news/news/2021-01-25-bushfire-danger-elevated-due-to-heatwave.

- Yeung, Jessie. “What You Need to Know about Australia’s Deadly Wildfires.” CNN, 14 Jan. 2020, www.cnn.com/2020/01/01/australia/australia-fires-explainer-intl-hnk-scli/index.html.

- Thoumi, Gabriel. “JHU Nature-Based Solutions Slides.”

- “Water Stress a Threat to NSW’s Credit Rating.” Water Source, 3 Feb. 2020, watersource.awa.asn.au/business/assets-and-operations/water-stress-a-threat-to-nsws-credit-rating/.

- “Explaining Green Bonds.” Climate Bonds Initiative, 19 Feb. 2019, www.climatebonds.net/market/explaining-green-bonds.

- “Creating Green Bond Markets – Insights, Innovations, and Tools from Emerging Markets.” World Bank, Oct. 2018, openknowledge.worldbank.org/bitstream/handle/10986/30940/131405-WP-SBN-Creating-Green-Bond-Markets-Report-2018-PUBLIC.pdf?sequence=1&isAllowed=y.

- “US Wildfires Could Spark Financial Crisis, Advisory Panel Finds.” The Guardian, 10 Sept. 2020, www.theguardian.com/world/2020/sep/10/us-wildfires-financial-crisis-markets-cftc-report.

- Kitson, Erin. “How Will Bushfires Affect Australian RMBS?” S&P Global, 12 Jan. 2020, www.spglobal.com/_assets/documents/ratings/ratingsdirect_creditfaqhowwillbushfiresaffectaustralianrmbs__43419628_jan-12-2020.pdf.

- Cranston, Matthew, et al. “Victoria, NSW Lose AAA Credit Rating: S&P.” Australian Financial Review, 7 Dec. 2020, www.afr.com/policy/economy/victoria-loses-aaa-credit-rating-s-and-p-20201207-p56l9b.

- “Recovering from the 2019-20 Fires.” NSW Environment, Energy and Science, 4 Feb. 2020, www.environment.nsw.gov.au/topics/parks-reserves-and-protected-areas/fire/park-recovery-and-rehabilitation/recovering-from-2019-20-fires#:~:text=The%20NSW%20Government%20is%20providing,our%20parks%20will%20be%20ongoing.

- Bloomberg L.P.

The post The Deadly Impact of the New South Wales Wildfire and the Future of Sustainable Finance appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.