By Jacob Wolinsky. Originally published at ValueWalk.

Last year was a year I’m sure we’ll all remember for the rest of our lives, given the amount of pain and turmoil it has caused almost every citizen of our world. But if you only looked at our figures below, you may think that think that 2020 was a fortunate year.

In a certain way, there may be some good that ultimately comes from the pain, since it’s usually turmoil that creates progress in society – people and companies (which are really just collections of people organized around a common goal) rarely change or improve their daily habits if they are fat and comfortable. Change comes when you’re hungry (whether it’s literally feeding your family, or worried about the survivability of your business) and the status quo is no longer an option, that we are spurred to seek out better alternatives.

So while 2020 has brought about a great deal of pain for many, perhaps when we look back at this period in 10 years time, we may appreciate the silver lining. In the US, people who have lost jobs or incomes due to Covid are going back to (online) schools at greater rates, using this period to set themselves up for better job opportunities afterwards. Businesses whose processes were once analog / paper-based are forced to adopt digital tools, which over time will make their operations more efficient and ultimately result in higher profits (and thus resilience against future shocks like Covid).

In fact, many of these trends were already in place, but it took a large external “wake-up call” to kick it into high gear. 2020 was really a year of acceleration, more than anything else – one such instance being US ecommerce penetration, which accelerated by at least 3 years. Southeast Asian ecommerce penetration, which is a relatively new consumer habit, was pulled forward even more. As mentioned in our previous letters, this acceleration in ecommerce and internet adoption tremendously benefitted our portfolio, and rapidly increased the underlying value of our investments by a similar amount.

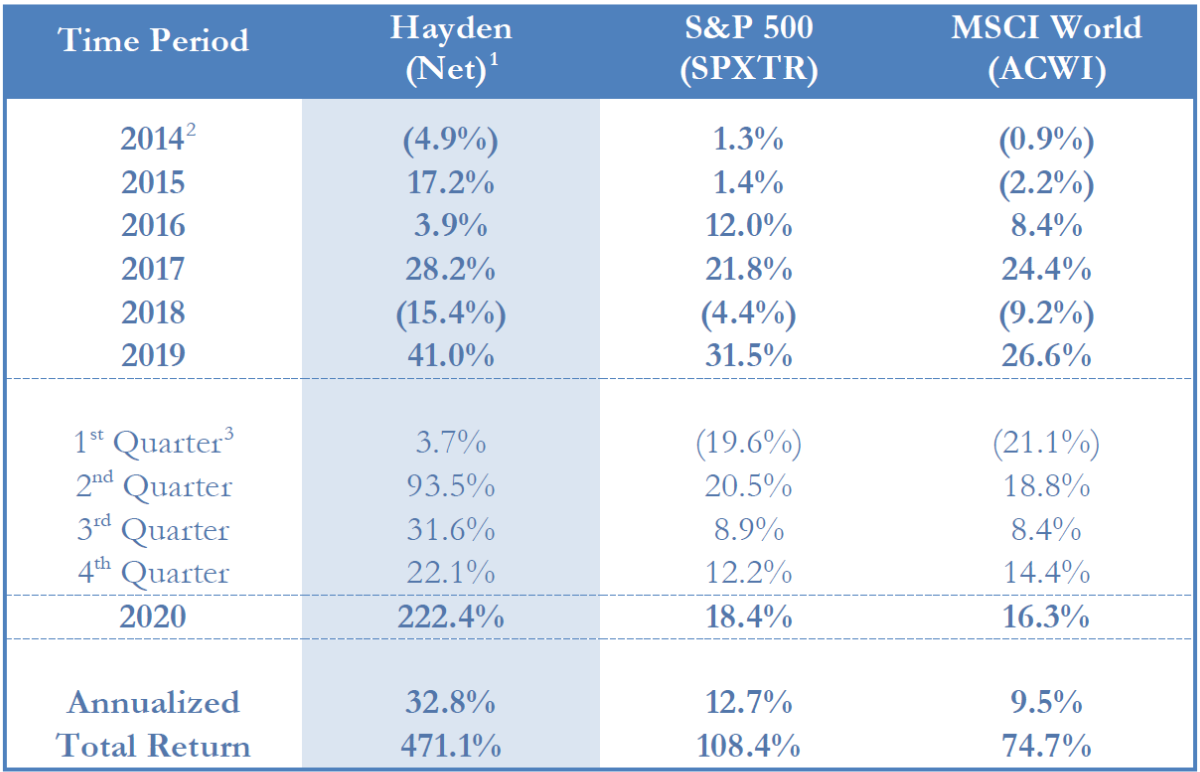

During the last quarter of 2020, our portfolio appreciated by +22.1%. Comparatively, the S&P 500 returned +12.2% and the MSCI World returned +14.4%. This brings our full year 2020 return to +222.4% vs. +18.4% for the S&P 500 and +16.3% for the MSCI World. Since inception, we have returned +471.1% for our partners (net of fees), or a +32.8% annualized return…

The post Hayden Capital Up 222% In 2020 (Full Q4 Letter) appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.