By Jacob Wolinsky. Originally published at ValueWalk.

ADW Capital Partners commentary for the fourth quarter ended December 2020, discussing their new position in CDON AB.

Q4 2020 hedge fund letters, conferences and more

Dear Partners,

Please find attached our results for the 4th quarter of 2020 and our 40th quarter since inception.

At the risk of sounding like a broken record, we want to reiterate a critical point discussed in all quarterly letters. ADW Capital Partners, L.P. (the “Fund”) operates a concentrated, tax-sensitive and long-term strategy designed to minimize correlation to the broader indices with a focus on avoiding permanent capital loss. Inevitably, this approach will result in periods of underperformance. By the same token, our efforts to maintain a lower correlation strategy driven by company-specific outcomes may produce significant outperformance in periods of market weakness, as we saw in 2011. We are not traders, return chasers or month-to-month stock jockeys. We are investors who look for opportunities to return multiples on the Fund’s capital in a tax-efficient manner over an extended period of time. While this strategy may yield lumpy results, we believe it limits idea dilution and protects the Fund’s returns from Uncle Sam and Wall Street.

Our Decennial:

As we embark on ADW Capital’s second decade, I want to take a moment and reflect on the first ten years. In our very first letter, we said that our strategy is modeled after the original Buffett Partnership, LTD, where Buffett created a small fortune both for himself and for his initial investors by managing a small/micro-cap focused fund. Our focus has largely followed this path: to own a concentrated portfolio of owner-operated companies where management profits alongside shareholders, not at the expense of shareholders.

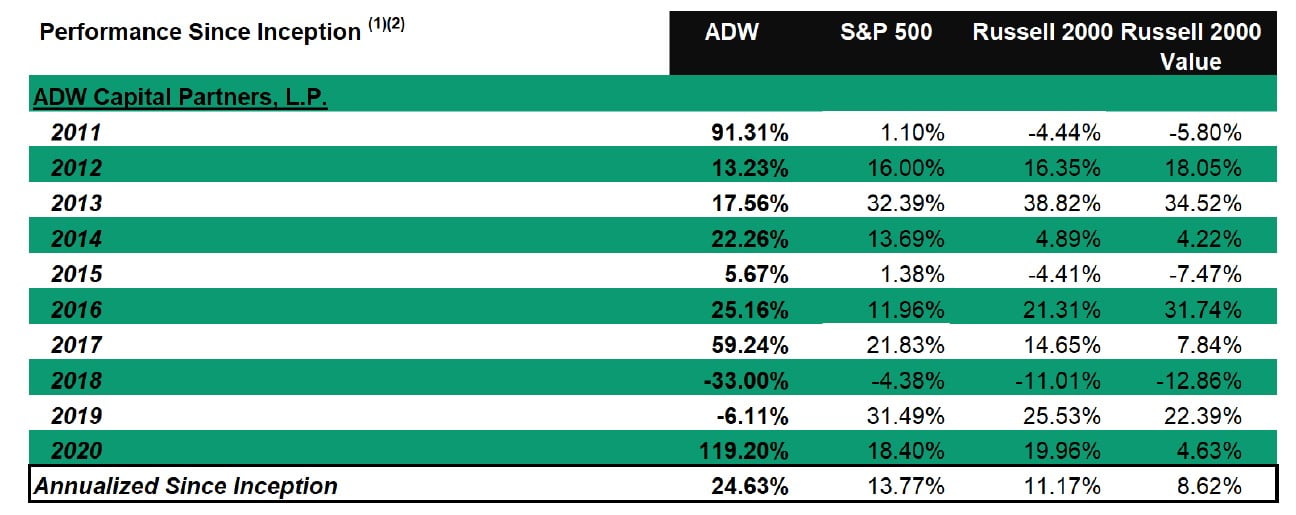

An investment of $100 at the inception of the partnership is worth $904.15 net of fees through Q4 2020. This represents a compounded annual return of 24.63%. While we are pleased with this result, we are no less determined to keep delivering over the next decade and beyond.

Although 2020 was a banner year for the partnership, the lessons of 2018 and 2019 remain front of mind. We are mindful of assigning too much “platform value” to businesses as they execute on growth plans. We are attentive to rebalancing the portfolio as positions rise to ensure adequate liquidity. Perhaps most importantly, we frequently ask ourselves if we are overstaying our welcome in any of our names as they appreciate. I view managing this partnership as some mix of art and science, and I strive to improve each year at both. I do know one thing for sure, though: navigating 2018 and 2019 has made me a better investor.

I see a bright path ahead for the small and midcap companies we favor. Investor exuberance for large growth stocks has left many high-quality smaller names languishing in the dust. Even with equity markets at all-time highs, our names still appear mispriced to me on both an absolute and relative basis. I am confident that our hard work in underwriting these businesses will continue to be rewarded as our management teams execute on their plans. That being said, by narrowing our focus to such a small group of names, we are well positioned to act fast if there is a change in the story – better positioned, I would argue, than managers with a less concentrated approach.

New Position: CDON AB (CDON)

Historically, our most successful investments have been in situations where other investors cannot seem to shed their past perceptions of a company, creating the kinds of major mispricing opportunities that we saw in PAR or RCI Hospitality. Recently, we discovered such an opportunity with CDON AB (CDON). CDON is a classic ADW style investment: an under-the-radar spin-off with zero research coverage, high insider ownership, a business inflection point, and multiple avenues for value creation with de minimis risk of permanent capital loss.

CDON AB (CDON) operates as an e-commerce marketplace for the Nordics. Today, the company offers a broad range of products through both third party (3P) sales (with over 1,500 Nordic merchant partners) and through its legacy first-party (1P) media merchandise.

CDON.se was launched in 1999 and began its life as an online CD retailer in the Nordics (hence its name, “CD-On”). Over time, CDON became the go-to online destination for electronics, CDs and DVDs – creating a strong brand in the Nordics with nearly 2 million shoppers (10% of the Nordic shopping age population) and achieving cognitive reference as the leader in legacy media, with good prices, selection and convenience (also known as Bezos’ “three things that never change”). The business grew very quickly early in its life but later faced major challenges as legacy media merchandise purchasing shifted to iTunes, Netflix, etc. As a result, CDON had to reinvent itself or risk obsolescence!

Fast forward to 2013, after pressure from a group of activist investors, CDON was prompted to open its platform to third party (3P) merchants and leverage its brand and site traffic to create one of the first e-commerce marketplace businesses in the Nordics. The strategy worked marvelously. 3P sales grew from 0% to nearly 80% of consolidated Gross Merchandise Volume (GMV) and nearly 100% of total Gross Profit. Today, CDON is the largest marketplace in the Nordics, offering over 8 million products to over 2.3 million customers across Sweden, Norway, Denmark, and Finland.

Why Do We Like Marketplace Businesses?

It has traditionally been a brilliant business to create a network of buyers and sellers, and to charge a fee for that service. For local newspapers and print magazines (pre-internet) classified advertising was a high-margin cash cow. Another good example is auctions, which take a share of each item sold at the sale, plus listing fees. These business are also incredibly durable, as they create natural incentives for parties to come together and transact on a platform, creating significant value for all participants, and erecting natural barriers to entry for incuments that are very difficult for new entrants to overcome. Sotheby’s (BID), one of the largest auction houses in the world, traces its history back to 1744! Marketplaces are an inherently attractive business model as they have negative working capital, can leverage fixed costs to scale and generate significant margins.

The rise of the internet allowed the marketplace business model to be almost infinitely expanded—at near-zero marginal costs—to almost any specialized product category imaginable. There are worldwide general merchandise marketplaces like eBay (EBAY) or Amazon Marketplace (AMZN). There are regional versions of these, like Mercadolibre (MELI), Allegro, Ozon or CDON. There are also more specialized marketplaces, like Etsy and many others.

Once a marketplace/network reaches critical mass, it becomes incredibly difficult for a competitor to breach its moat. Merchants want to sell to the biggest pool of buyers and buyers want to limit search times by shopping where they are most likely to find the products they are seeking. As a result, the largest marketplaces tend to get even larger, taking potential customers away from prospective competitors.

E-commerce In The Nordics

Looking at e-commerce globally, approximately 50% of total global GMV is transacted on a marketplace (Amazon, MercadoLibre, eBay, etc). We believe the reason marketplaces command 50% share in global e-commerce GMV is simple: marketplaces (when run well) generally win on the four dimensions of retail: price, selection, convenience, and service. For buyers, marketplaces represent a trustworthy platform where they can find everything they need from a broad range of brands/merchants along with reviews and discounts. For merchants, it is a way to reduce the costs of acquiring new customers and tap into a pool of active shoppers cost efficiently. One absolutely key concept which favors the marketplace model over the individual direct-to-consumer merchant model is the fact that a marketplace enjoys higher customer lifetime values (LTV), allowing it to outbid individual merchants on customer acquisition costs (CAC) in today’s world of performance marketing. This ability to pay more for customers at attractive unit economics allows marketplaces to aggregate consumer demand, ultimately presenting individual merchants with the proposition of “if you can’t beat ‘em, join ‘em” when deciding whether to sell on a marketplace.

Looking at e-commerce in the Nordics, we believe CDON will benefit from two important trends over the next decade. Firstly, we estimate that e-commerce has 9% share of retail spend in the Nordics. This is low compared to roughly 15% share in the U.S, 30% in the UK, and 40% in China. We estimate the total e-commerce pie to grow ~15% per annum over the next few years as offline retail spend continues to shift online. Secondly, marketplace share as a percentage of total e-commerce GMV in the Nordics is only 2%, vs. 50% globally! As mentioned above, the online marketplace business model, consumer experience and natural economic advantage is vastly superior vis-à-vis the direct-to-consumer model. CDON already has 10% share of the shopping age population and we estimate that the trend of marketplaces continuing to take share in the e-commerce ecosystem, coupled with the shift of overall retail spend, will lead to a “twin-turbo effect” for CDon which should yield compounded growth rates in excess of 50%+ for the foreseeable future.

How Large Is The Opportunity?

Pre-spinoff, CDON was buried inside a mismanaged and undercapitalized holding company that failed to reinvest back into its “crown-jewel” asset. Despite being starved of capital, the new management team, led by Kristoffer Valiharju (handpicked by the activists) has made terrific progress by swapping the legacy tech stack, replacing nearly the entire C-suite and more than tripling the size of the marketplace (3P) business since he was appointed as CEO in 2018.

As an independent company, CDON now has the opportunity and laser focus to go “all-in” on the marketplace model. Looking at GMV per user across marketplaces in Europe, we believe that as CDON expands its product depth and continues adding new categories, the company can more than 10x its share of wallet with the Nordic consumer.

Looking out 5 years, we believe CDON can achieve ~15 billion SEK in GMV (up from 2 billion SEK) through wallet share gains and modest shopper growth. Today, total retail spend in the Nordics is roughly 750 billion SEK. With e-commerce penetration growing to 15% through 2025, we are assuming CDON can eventually command 10% share of total e-ccomerce spend. 15 billion SEK in GMV would imply no shopper growth and would imply that CDON will achieve GMV/ per shopper levels in line with Allegro, the leading Polish marketplace.

While 15 billion SEK of GMV would imply 50% compounded annual growth, we believe this would yield revenue growth rates in excess of 75% per annum. Through the introduction of new merchant services (Advertising, Payments Logistics, Loyalty, etc.), we believe CDON can earn ~15% of its GMV in revenue by 2026, up from ~10% today and generate EBIT margins of ~50%.

From today’s share price of ~800 SEK, we believe we can compound our capital in excess of 40% through 2026, with ~200% immediate upside at a peer group multiple (Ozon, Allegro). We are excited to partner with Kristoffer Valiharju and the Rite Ventures team!

Conclusion

As of February 1, our headcount has increased by 50%, with Alex Maloney joining ADW as President. In this capacity, he will look after the business side of our partnership, including both engaging with our current partners and spearheading our efforts to bring new partners aboard. I look forward to having you get to know Alex in the coming months. Even with this addition, we remain a small team and, as always, invite you to reach out to any of us with any questions you may have.

I want to conclude with a word to our partners. I have long held that I stand to learn a lot more from my partners than they do from me. You are a uniquely successful, engaging group whose perspective and counsel have been invaluable to me along the way. I am grateful for your trust and excited to keep making money for us all in the years to come. Adam D. Wyden

“Our job is to find a few intelligent things to do, not keep up with every damn thing in the world” – Charlie Munger

The post ADW Capital Partners Up 119% In 2020; Long CDON AB [2020 Letter] appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.