By Jacob Wolinsky. Originally published at ValueWalk.

Muddy Waters is short XL Fleet Corp (NYSE:XL) because it strikes us as middle of the fairway SPAC garbage. We conclude that the real green technology at XL is duping investors into throwing money at this company through a collection of exaggerations, half-truths, and mistruths. XL’s previous equity raise (Series D) appears to have been at a valuation of approximately $73 million, which is a far cry from its SPAC valuation.

Q4 2020 hedge fund letters, conferences and more

Former salespeople stated that they were pressured to inflate their sales pipelines materially in order to mislead XL Fleet Corp’s board and investors. These former salespeople and other employees also told us that XL misleads its customers about performance and savings; and, that due to these exaggerations, customer reorder rates are in reality quite low. (One former employee ballparked the reorder rate at only 10%.) We also understand that roughly half of the customers XL touts in its investor presentation are inactive.

We give very little credence to the narrative that XL will be a serious player in full vehicle electrification. It appears to have little valuable proprietary technology. In fact, some former employees laughed out loud when we asked them whether XL can compete in EVs.

Although XL is capable of announcing a “strategic partnership” that “includes the opportunity to explore” installing charging stations at the arena where its SPAC promoter’s team plays, we doubt that its EV technology will allow it to do much more than pump out highly promotional press releases. We see little reality to the Blue Sky story with which this stock has been promoted.

Exaggerated Backlog and Customer Results

- XL Fleet Corp’s management systematically inflates the company’s backlog.

- XL’s claimed customer base appears grossly overstated.

- We understand from former employees that at least 18 of 33 customers XL featured were inactive.

- Numerous XL customers reportedly have not reordered due to poor performance and regulatory issues.

- XL uses the City of Seattle as a case study, but in reality, Seattle appears to have had much worse results than claimed.

XL Fleet Corp Management Systematically Inflates The Company’s Backlog

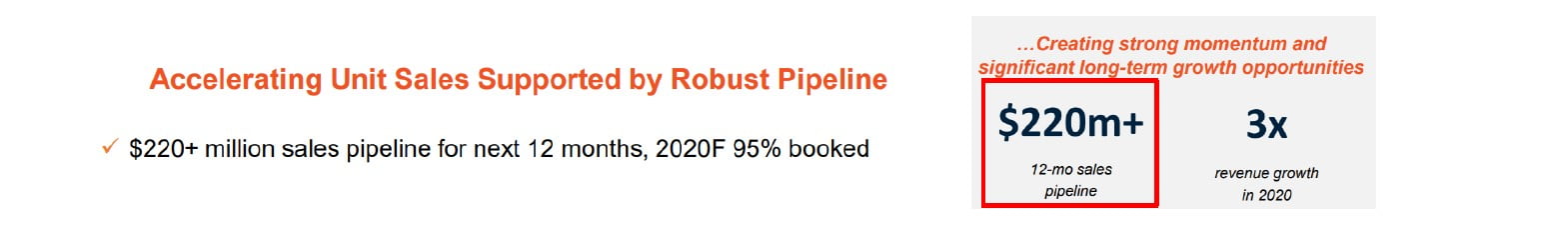

XL claims a backlog of $220+ million. This number is key to XL Fleet Corp’s sales projections, appearing twice in XL’s SPAC slide deck. However, our conversations with former employees suggest XL’s “pipeline” is a fiction created under pressure from senior managers. We understand that the rot emanates from XL management, who further embellished their employees’ already exaggerated pipeline entries.

“If you even talk to a guy, whether he expressed interest or not, you always created an opportunity for 5-10 vehicles [in Salesforce]. OEM? 50 – 100 vehicles… The numbers always looked good to the [XL] board, and they looked good to people like you… Me and the other salespeople always talked… I was always skeptical of that—if it’s not legitimate, why the hell are we putting it in?” – XL Former Employee B

“Once a quarter before board meetings, I would find that a bunch of my deals with larger [potential sales] numbers behind them would have been exaggerated substantially in their probability to close: from 25% up to 75%. For that brief week when the board was in town, my deals were at 75%, and I would have nothing to do with that. That was [manager name redacted]. A minimum of four times a year he would exaggerate my pipeline substantially to report to the board.” – Former XL Employee A

XL’s Claimed Customer Base Appears Grossly Overstated

Below is XL Fleet Corp’s stated customer list, which includes 33 logos.1 Former employees told us that many of these had not ordered vehicles for a long time. In a March 2, 2021 appearance on CNBC with Jim Cramer, XL CEO Tod Hynes deflected a question about whether its customers include some of the names below.

We Understand From Former Employees That At Least 18 Of 33 Customers XL Featured Were Inactive

The list shrinks by over half after removing reportedly inactive customers:2

Poor Retention Resulting from XL’s Exaggerations

Numerous Xl Customers Reportedly Have Not Reordered Due To Poor Performance And Regulatory Issues

We believe that XL Fleet Corp’s high customer attrition rate stems from XL’s lack of engineering edge, its misleading efficiency claims, and its substantial issues with regulatory approval.3

“Almost no one reorders… it’s maybe 10%. To get your order in the first place, it’s a months and months wait, you’re angry, and then the thing doesn’t work as promised. ‘6% improvement for $15,000? We’re not going to buy any more of these things.’” – Former XL Employee A

“PGE had 13 to 15 trucks. He [fleet manager] was promised 50% savings and he got less than 10%… We created a report saying it’s their fault they’re idling too much and driving above the speed limit… He got in hot water because he didn’t receive the savings promised.”

“SDGE had ordered 35 vehicles with the intent of putting them in service when XL regained CARB approval, but that never happened. That was $525,000 in lost annual revenue.”

“It wasn’t saving them enough money on the small stuff [fleet vehicles] to warrant it anymore… Pepsi wasn’t going to buy anymore.”

CalVans is a massive order that XL Fleet Corp lost: $2.5 million per year… indefinitely. XL could not fulfill the order in 2019 or 2020 because they didn’t have CARB approval. That’s an example of a customer that didn’t care about the technology. All they want is to put a kit on there. They could actually unplug it… they don’t care because someone else is paying [incentives] for the hybrid. [XL] couldn’t do the order”

The Majority Of Touted Customers Are Reportedly Inactive:

“They wanted to see how their vehicles were performing, and what data we had compared to data we had. They wanted real time access to the XL Link, and we weren’t able to give it to them. The company wouldn’t allow it, because I think the data would not show in a favorable light what the vehicles were doing.”

“When they sold off distribution, distributors weren’t interested. Distributors didn’t want to spend money upfront to outfit them… they will probably replace them with the latest and greatest ICE van.”

“Ten-vehicle pilot program. They haven’t bought any more.”

“Just a pilot, two or three trucks; they haven’t repeated the order and it’s been three to four years.”

“It was a pilot, three trucks. They will never order again.”

“They did a pilot… it’s bullshit. The fleet manager wasn’t interest in speaking [to XL]. I don’t know if he even knows where their one vehicle is. Not a repeat order.”

“They had two plug-in hybrid vehicles. The way they drove their trucks to their job sites sometimes 70 miles away, there was zero benefit from the hybrids. The utilities are really good at looking at their telematics and what they spend and save on fuel. It was hard to justify the capital investment to purchase any additional vehicles.”

Continue reading the article on Muddy Waters

The post XL Fleet Corp: More SPAC Trash – Muddy Waters appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.