By Monica Kingsley. Originally published at ValueWalk.

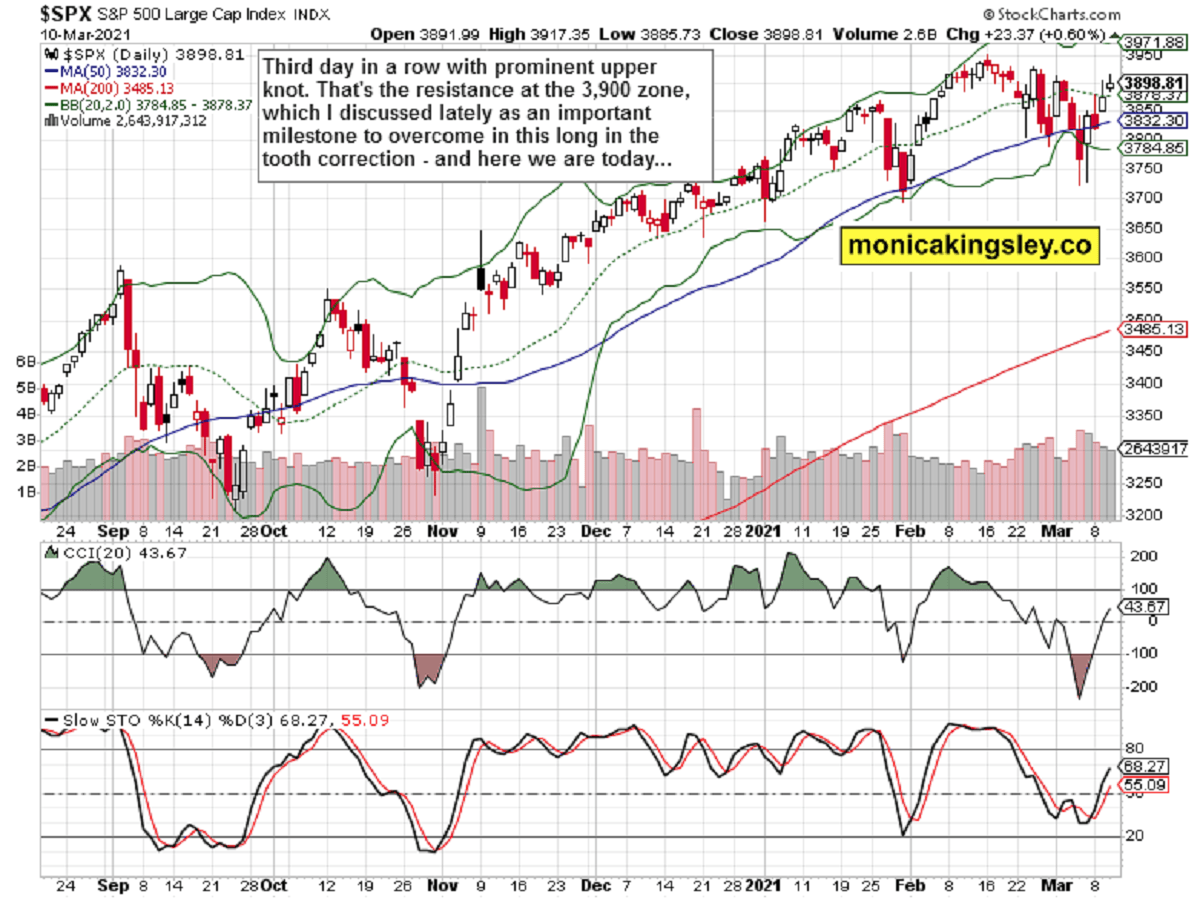

The daily banging on the 3,900 threshold shows in yesterday‘s upper knot, and this milestone has very good chances of being conquered today. More important than the exact timing though, are the internals marking the setup – we‘ve indeed progressed very far into this correction. While not historically among the longest ones, it‘s still getting long in the tooth – just as I was writing throughout the week.

Q4 2020 hedge fund letters, conferences and more

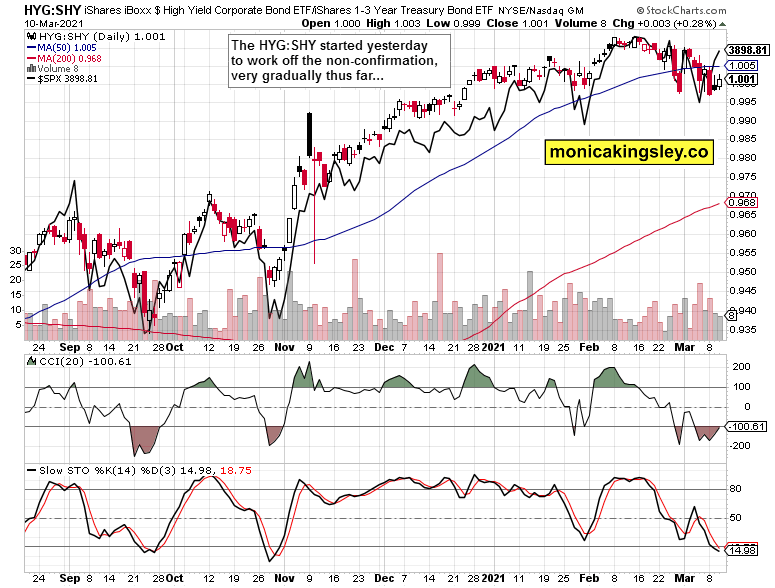

And it is getting stale, even if I look at the star non-cofirnation, the high yield corporate bonds. Relatively modest daily upswing, outshined by investment grade corporate bonds. Yes, the credit markets are calming down, and the tiny daily long-term Treasuries upswing doesn‘t reflect that fully just yet. Besides giving breathing room to defensives such as utilities and consumer staples, it‘s also very conducive to the precious metals sector.

Copper, oil or agrifoods aren‘t flashing warning signs either – this is a healthy consolidation of steep prior gains as the dollar is getting again under pressure on retreating yields. Just as stocks are undergoing the larger rotation in favor of high beta value plays (financials and manufacturing ones are doing great, airlines jumped), the leaders out of the corona deflationary crash are leading no longer (technology). The picture of the unfolding reflationary recovery is a healthy one as rates are rising on account of improving economic environment, and inflation doesn‘t really bite yet.

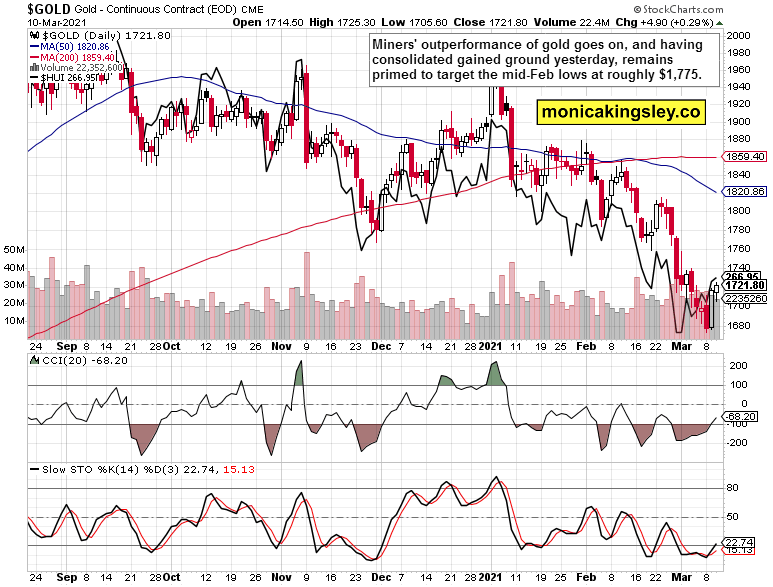

Ideal environment for the stock market to do well (hello my profitable open position), and for commodities to do really well. While the Fed is prepping the markets for (temporary, they say) higher inflation readings, gold didn‘t react too bullishly to yesterday‘s mildly positive CPI data – just wait for PPI data which would reflect the surging commodity prices more adequately. At the moment, evaluating the strength and internals of precious metals rebound, is the way to go as we might very well have seen the gold bottom, with the timid $1,670 zone test being all the bears could muster. Time and my dutiful reporting will tell.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 Outlook and Its Internals

Volume isn‘t sharply contracting, and coupled with the price action, the rebound above 3,900 has good chance of succeeding. The path most ahead to entertain your imagination as well, looks as a little congested series of daily candles followed by a longer white one. We‘re in a stock bull market after all, and still not in danger of a significant (10%+) correction as I have been writing throughout 2021.

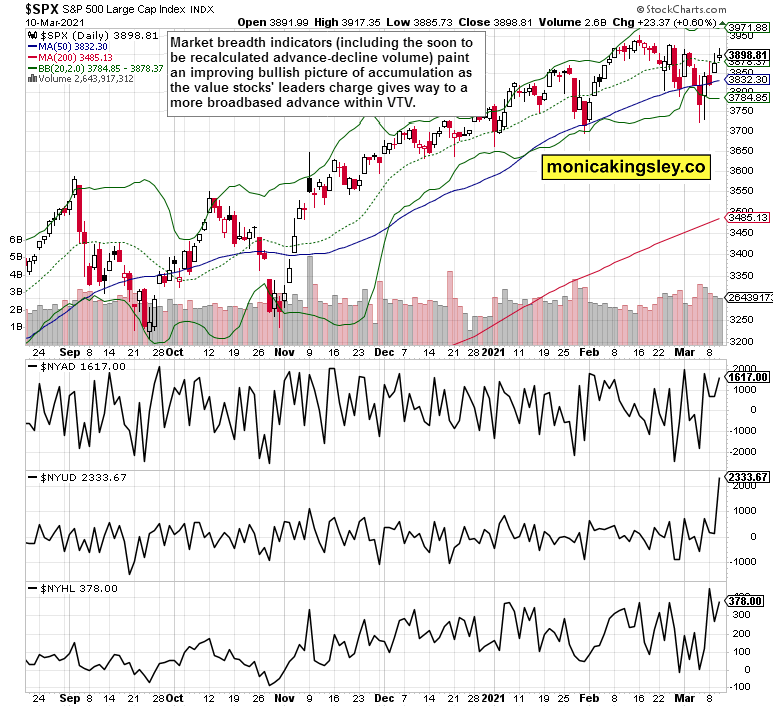

Market breadth indicators have turned the corner really, underscoring accumulation within a returning bull market advance – just as the bullish percent index shows. A brief sideways to higher consolidation of this week‘s advance would only help to solidify it before the next run higher.

Credit Markets

High yield corporate bonds to short-dated Treasuries (HYG:SHY) ratio‘s degree of non-confirmation has decreased, at least if you take direction into view. Finally, high yield corporate bonds are turning higher, and once they catch breath even more, the all time highs already in sight would be conquered as smoothly as the 3,900 zone I delineated earlier.

Gold Sector Examined: Bulls Can’t Take A Rest

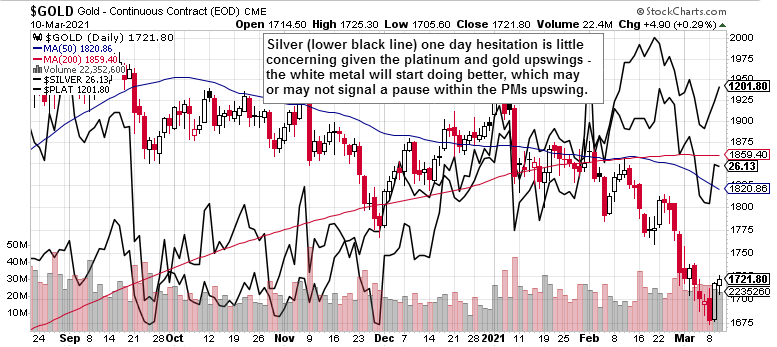

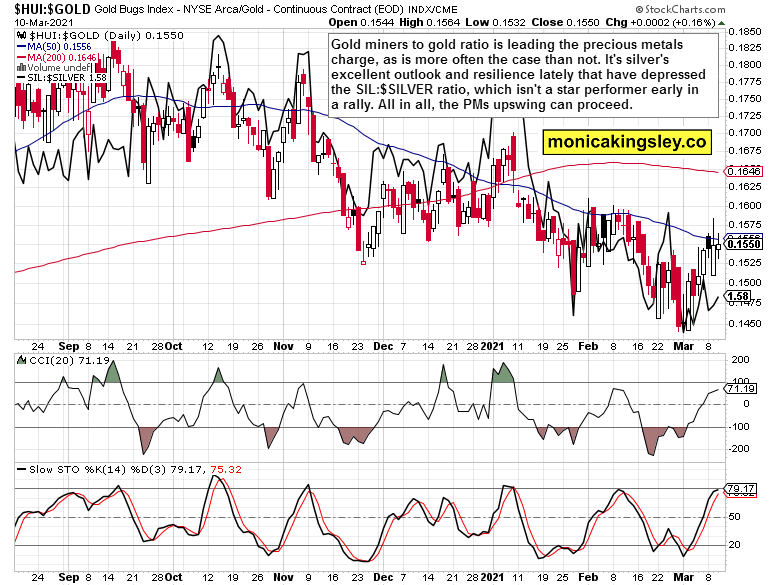

Very mild upswing in both the gold miners and gold – along the lines of a daily consolidation with bullish undertones. This early in the precious metals upswing, miners are in the pool position, and their relative and gradually increasing strength has been visible since the early Mar days. So far so good here.

Silver, Platinum and the Rest

Silver isn‘t yet outshining the rest of the crowd, and that‘s good, for it often tends to do so in the later stages of the precious metals sector advance. Within the coming precious metals advance, I continue to view silver outperformance as expected. Part monetary metal, part commodity, it‘s uniquely position to benefit. Its yesterday‘s setback is nothing to be concerned about as the gold, gold miners and platinum rebound keeps doing largely well.

Comparing the gold miners to gold ($HUI:$GOLD) ratio to the silver miners to silver (SIL:$SILVER) ratio is returning a bullish snapshot of the current advance too. The beaten down gold sector is leading the charge, and the silver one will play catch-up in time.

Summary

Having reached the 3,900 zone, the S&P 500 is likely to consolidate the gains next. Due to the improving key markets (corporate bonds and tech), I am not looking for any this week‘s potential setback to turn the tide in this aging correction really.

The gold upswing is proceeding, helped by the weakening dollar and ever so slightly retreating Treasury yields. After clearing the volume profile defined support at $1,720 and stretching a little below, the gold bulls next objective is the roughly $1,775 figure marking the Feb lows. Should that one be conquered, the odds of having seen gold bottom this Monday, would have dramatically increased.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

The post Stocks Bulls Can Take a Rest – But Gold Ones Can’t appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.