By Jacob Wolinsky. Originally published at ValueWalk.

- Vaccine distribution between ‘Western’ allies and Chinese allies continues to decouple

Q4 2020 hedge fund letters, conferences and more

- The inadequate distribution of vaccines will act as a ‘governor’ for economies to reach economic potential as tourism should be limited

- Chinese household debt has bulged from 20% in 2009 to just under 60% in 2020

- Microlending has served as a band-aid for consumption, however, half of that borrowing is used to pay mortgages

- The anticipated slowdown in China, coupled with strong growth in the west, could trigger defaults on newly issued bonds

- We believe the CNY is overvalued and therefore some commodities (soybeans and crude oil) could be vulnerable

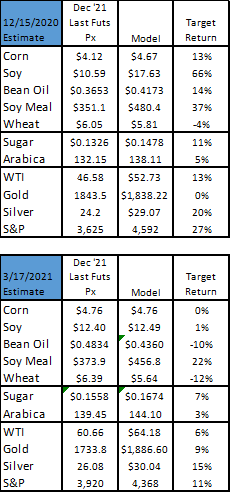

Western vs. Chinese Vaccinations

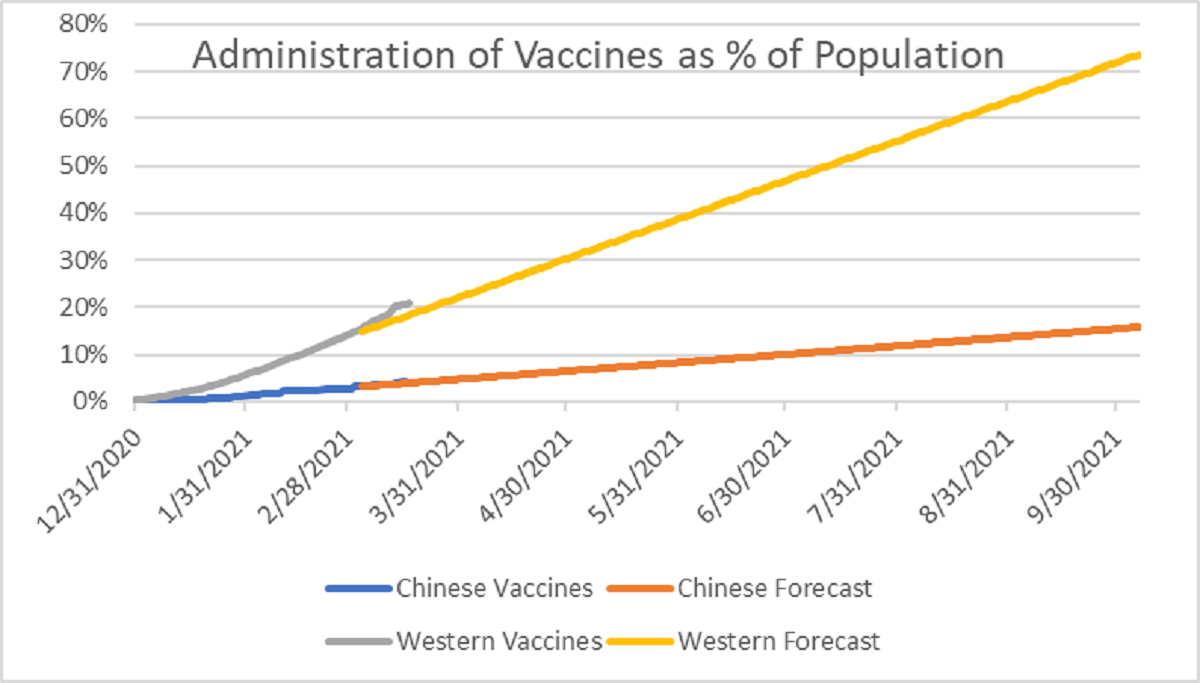

A couple of weeks ago we highlighted the incipient trend of higher ‘Western’ vs. Chinese vaccinations. As stated in that note, we have monitored the trends and we have more confidence in our assertion: Western nations should reach +70% immunity by August 2021 while China and its vaccine purchasers will only reach 15% by the same time. Assuming six months of immunity, there will be an insufficient number of Chinese vaccinations to allow those economies and tourism (8-11% of GDP) to resume. Below is a chart of vaccinations as a percent of population and our forecast:

Source: Bloomberg, Ourworldindata.org, CP Capital

Notice that our trend in Western vaccinations may be too flat. This could imply a faster and earlier economic recovery for Western nations.

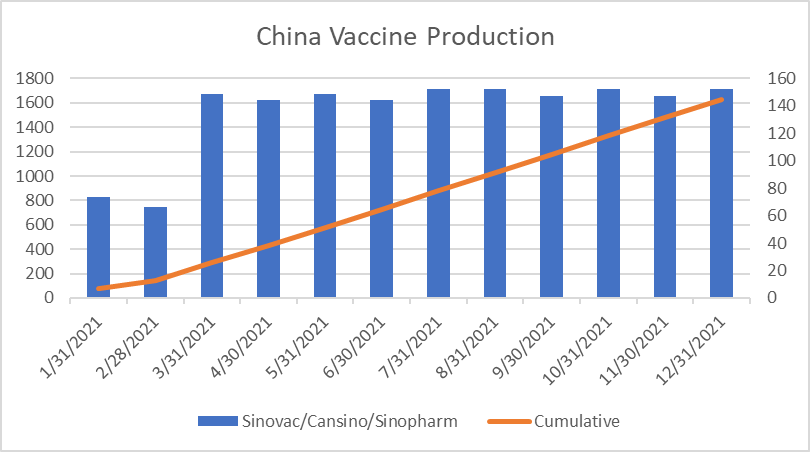

It should be noted that Chinese vaccine production is not the bottleneck. It appears that distribution is the main hurdle as vaccine production should reach 1.6b by year end.

Source: Reuters, SCMP

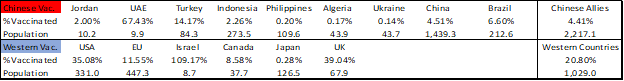

Below are the latest vaccinations for countries that have agreed to buy Western or Chinese vaccines (Israel is allowing foreign nationals to get vaccinated):

Source: Bloomberg, WorldBank, Ourworldindata.org

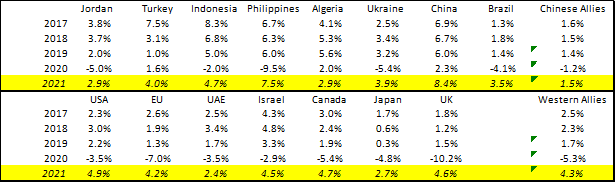

Below is GDP by country and analysts’ forecasts for 2021:

Source: Bloomberg

Notice that analysts expect GDP in EM countries to rebound to pre-2020 levels, particularly from strong Chinese growth.

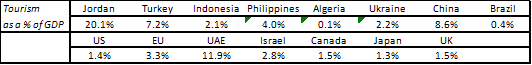

However, looking at tourism as a percentage of GDP, we see:

Source: WorldBank, cgtn.com

According to CGTN (https://news.cgtn.com/news/2020-03-11/China-s-total-tourism-revenue-in-2019-reached-6-63-trillion-yuan-OLDZXQvVXG/index.html), Chinese tourism revenue topped 6.63 trillion yuan (roughly 1 trillion USD) in 2019. In 2020, domestic travel was down 25% YoY according to domestic airline passenger data. While we saw a strong recovery from April-Sept, since then we have seen another slowdown. Furthermore, tomtom.com mobility indicators already point to decreases YoY in congestion. Therefore, we believe it is unlikely that travel/tourism in China will return to pre-crisis levels. As a result of sluggish vaccinations and mobility, we should see tourism’s contribution to GDP up marginally YoY if that. Accordingly, we disagree with analysts’ estimate for Chinese GDP of +8.4%. We see something closer to 4-6% on slower tourism alone.

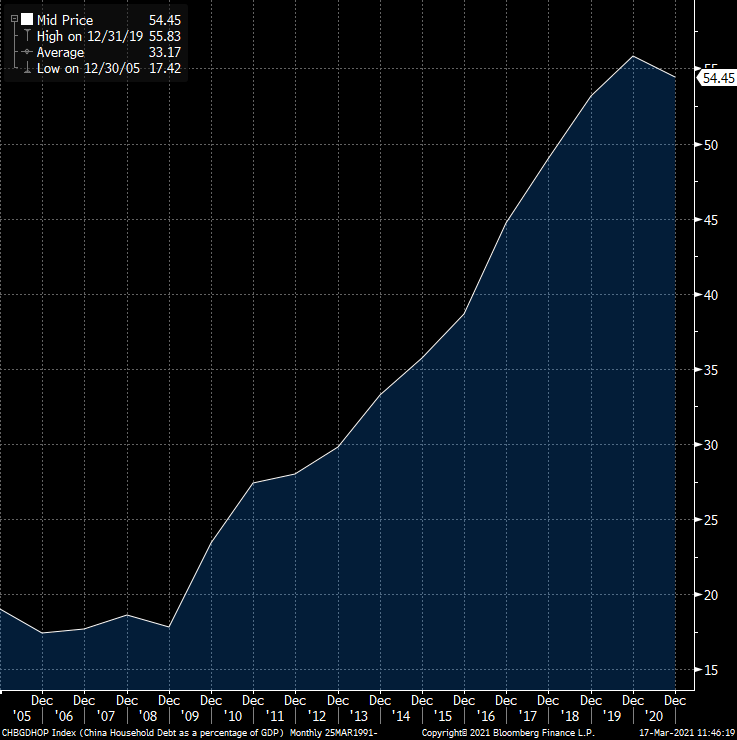

Chinese Household Debt Swells To 55% In 2020

Looking closer at the Chinese economy, we see that household debt has swelled from 20% in 2009, to 35% in 2015 to 55% in 2020:

Source: Bloomberg Economics

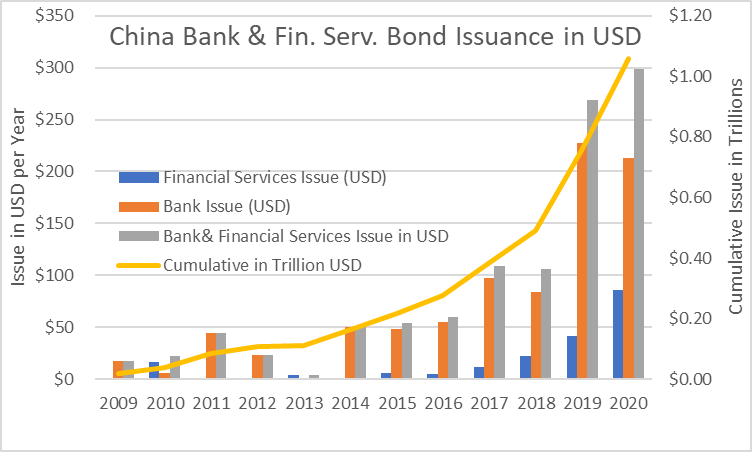

Looking closer at bond issuance of banks/financial service companies, we see that these companies have issued over 1.1trilion USD in debt in the last 10 years:

Source: Bloomberg

You may have noticed the headlines around Ant Group or Tencent over the past couple of months. These companies serve as intermediaries between borrowers and lenders and receive fees for doing so. I.e., Ant Group and Tencent have an incentive to find borrowers. So, we have new credit issued to lend to borrowers for consumption. However, in the last year, the borrowing could be going to something far more dubious: mortgage payments. According to the 12/31/2020 SCMP article, “China’s new microlending curbs do not address underlying issue of household debt and borrowing, analysts say”, nearly half of newly issued debt was used to pay mortgages. If true, this suggests that homeowners are already struggling with payments.

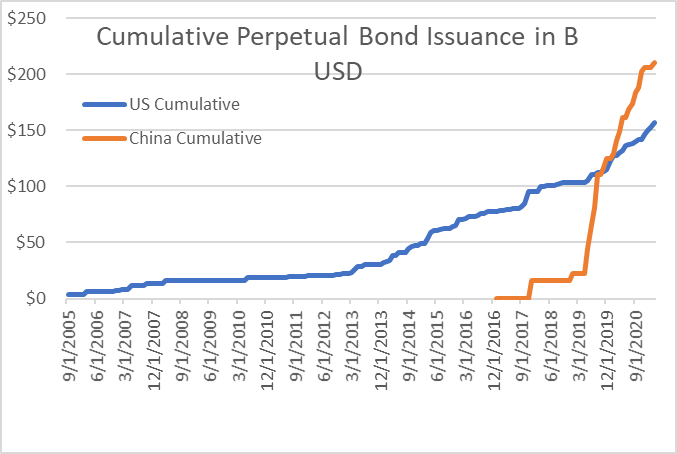

On top of this, we have seen an explosion in Chinese perpetual bond issuance. Perpetual bonds are similar to interest only mortgages where the borrower only pays a coupon payment, but the bonds are callable. From our research, we see that perpetual bonds are not that uncommon. However, when we compare the notional amounts issued in the US and China we see that Chinese borrowers (mainly the BoC and Ag. Bank of China) have accelerated perpetual bond issuance:

Source: Bloomberg, CP Capital

Notice that Chinese banks have issued over 200b USD in perpetual bonds in three years where US corporates have issued 150b USD in 15 years.

Putting everything together, we see rapid expansion of debt and a gloomy outlook that Chinese households will be able to service their debt. Furthermore, an increase in yields could exacerbate and accelerate problems for the Chinese borrowers.

The result for us, is a weaker yuan. Most likely these loans sour and the PBoC will remove them from banks’ balance sheets by increasing M2, thus devaluing the currency. Alternatively, the Chinese government could look to accelerate exports by devaluing.

In either scenario, our CNY model output for 2021 has gone from 6.4 to 6.97.

In this scenario, we see lower commodities prices as China could afford to de-stock and slow imports.

Soybeans

Should the Chinese economy slow, we see soybean demand down to 95 million metric tonnes (MMT) vs. the USDA’s last estimate at 100MMT. This, coupled with a more-than-adequate pipeline, could result in an extra 1.5MMT of beans back on the world market by drawing down the pipeline. In this scenario we see downside to US bean exports, something that we are seeing in lower vessel line-ups.

Crude Oil

Similar to soybeans, China has re-stocked crude oil with an estimated increase of 5mm bbls YoY and an increase of 15mm bbls over 2019. In the slower economy scenario, we see Chinese crude oil demand down 1.3mm bpd. Longer term this would affect the US crude oil balance sheet but at this time we have not made any changes. However, as we get more confident in a Chinese slowdown/weaker yuan, we could make further adjustments to our US SnD resulting in far lower prices ($35-40USD/BBL) in the second half of 2021.

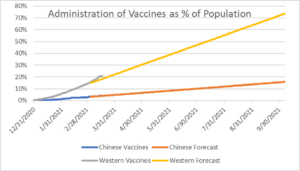

Below are select price model targets from our Dec 2020 Outlook and current targets:

Article by Greg Presseau

The post Slow Vaccine Distribution, Bulging Debt And Potential Commodities Destocking appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.