By Jacob Wolinsky. Originally published at ValueWalk.

Below is a short note on recent moves in Bitcoin and crypto-assets from Wave Financial’s Senior Trader Justin Chuh, with this week’s analysis focusing on where the US stimulus cheques are going.

Q4 2020 hedge fund letters, conferences and more

US Retail Investors Spending Their Stimulus Cheques On Bitcoin

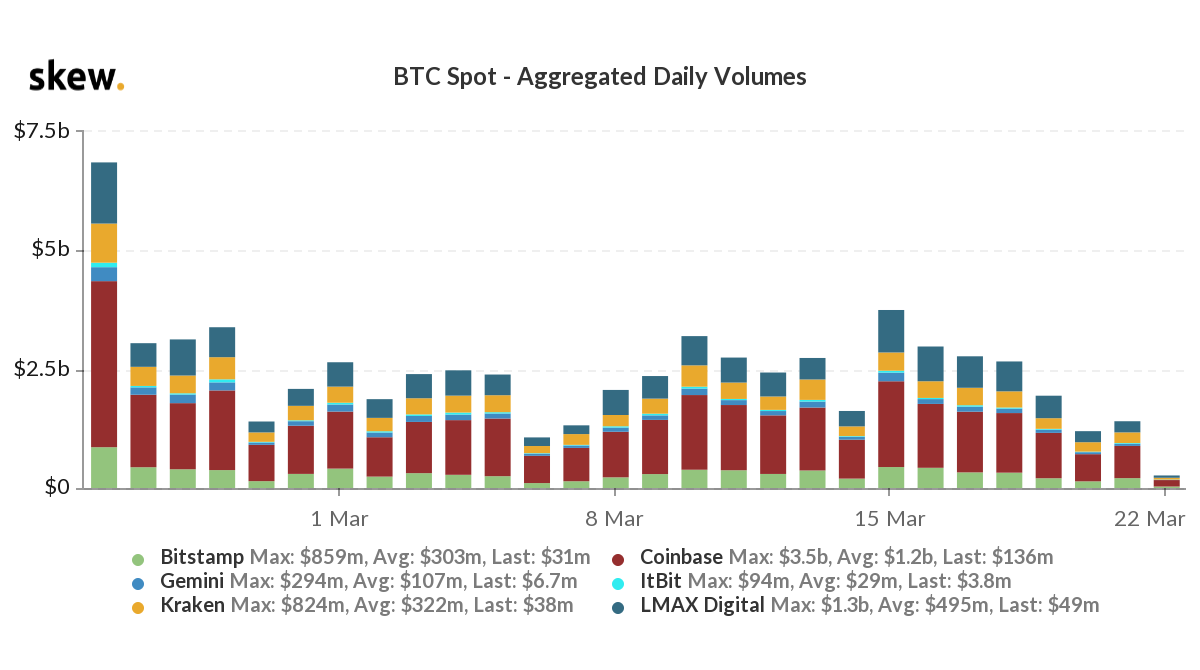

Are US retail investors really spending their coronavirus stimulus cheques on bitcoin? Bitcoin fiat exchange volume has fallen and is lower year-over-year. Obviously, it’s harder to have higher exchange volume when comparing price levels, but in aggregate there are more market participants with even more dry powder behind them now. A main question among bitcoin entrants is how much upside from this level, and the main issue for them is unit size.

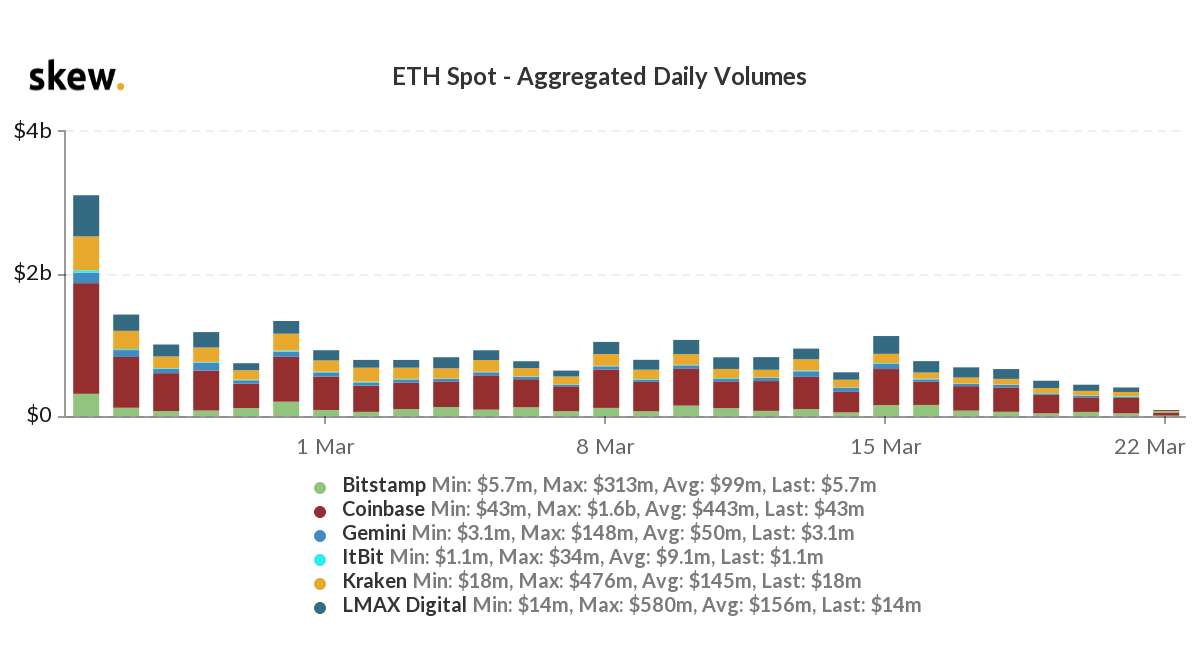

It’s a similar story for ether, currently seeing the weakest volume in all of Q1 2021. Investors seem jealous that it can’t break new highs, while bitcoin can, which moved through $60k last weekend and touched again on 3/18/21, but failed to hold again. Ethereum network users are continuously upset over gas fees, but currently, there is no better alternative. However, for a cryptocurrency that is only worth 3 cents of BTC, ether has surprisingly relatively high notional volume, averaging $500m a day compared to $1.3b a day for bitcoin, at Coinbase.

NFTs live and breathe on Ethereum, and so do the most popular DEXes, and thus access to alt coins. Retail investors want to explore these, whether expensive jpeg/gif, meme coins, or not, if directed towards crypto investments, their stimulus cheques will likely be spent on “the next bitcoin.” Many of these new entrants are upset they missed some of the earlier rides, and are shooting for the moon with their diamond hands. Also, the institutions providing repetitive reinvestments and interest bearing accounts are expanding their offerings, another avenue for money to be steered away from bitcoin and ether.

Cryptos Are Heading Higher In The Near Term

So, while the money printing machines continue to go ‘brrrrrrr’, this doesn’t automatically mean bitcoin and all other cryptos are heading higher in the near-term.

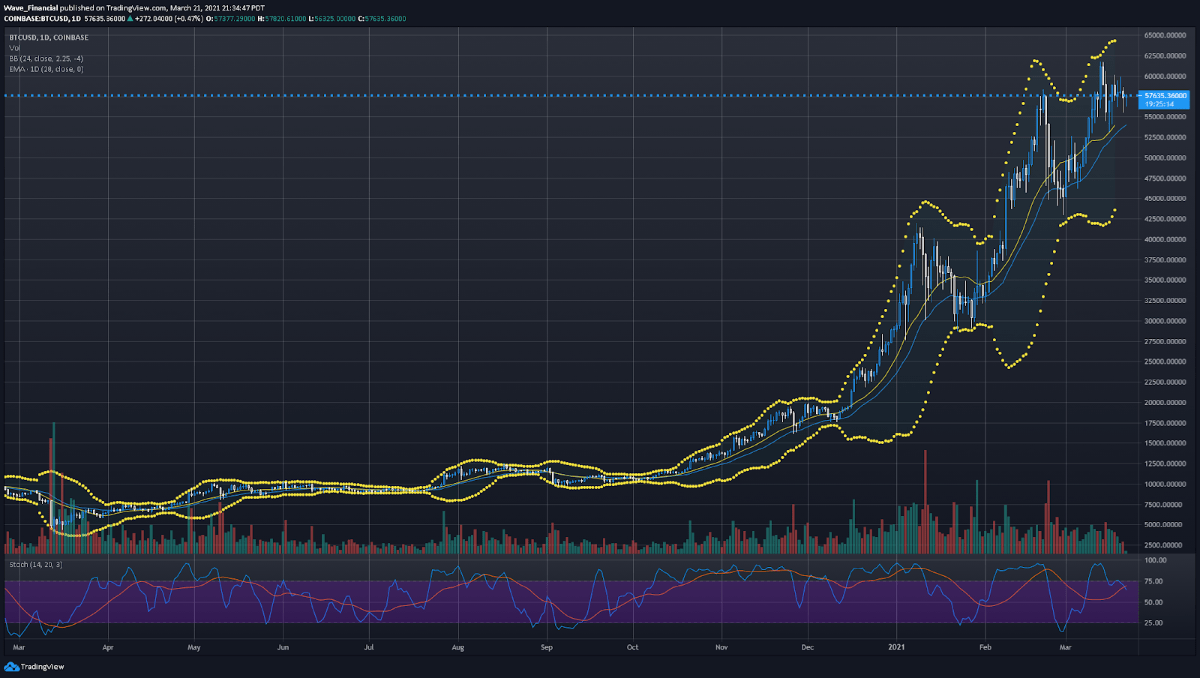

BTC continues on it’s downleg from new highs of $61,700 and unable to stay above it’s previous all time high of $58.4k. We could see the market drift lower and with weak buying activity around the $54k down to $52.5k range, and stronger support between $48k down to $45k.

ETH continues to hold its value in the between $1,700 and $1,800. We could see the resistance at the $1,300 to $1,500 range earlier in 2021 turn into support, as it may be cheap enough for gas and on-chain items.

About Justin Chuh, Senior Trader at Wave Financial

Prior to joining Wave Financial Justin Chuh was at proprietary trading technology business HC Tech where he was a FX trader for 7 years. Justin is a CFA Charterholder, member of CFA Society Los Angeles and graduated from Arizona with a BS in Business Economics and Management. Justin is be responsible for trading Bitcoin and other digital assets that make up Wave’s assets under management, ensuring that their trading strategies cover fund inflows and redemptions.

About Wave Financial LLC

Wave Financial LLC (Wave) is a Los Angeles and London based investment management company that provides institutional and private wealth digital asset solutions. Led by a team of highly experienced financial services professionals, Wave provides investable funds via their diverse investment strategies applied to digital assets and tokenized real assets. Wave also offers managed accounts for HNWIs and family offices seeking tailored digital asset exposure, bespoke treasury management services, and early-stage venture capital and strategic consultation to the digital asset ecosystem.

Wave is regulated as a California Registered Investment Advisor (CRD#: 305726).

T: https://twitter.com/wave_financial

L: https://www.linkedin.com/company/wave-financial/

The post The Stimulus Cheque Conundrum – Are They Going Into Bitcoin? appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.