By Pierre Raymond. Originally published at ValueWalk.

The Broad Market Index was down 0.77% last week and 44% of stocks out-performed the index. Last Friday, Walmart Inc (NYSE:WMT) reported their 2020 annual SEC filing and completed our update for the 4th quarter providing insight on possible market directions.

Q4 2020 hedge fund letters, conferences and more

As for the broad market, the average sales growth rate fell short of last quarter (but slightly, 5.25% vs 5.3% last period). The average gross profit margin has also stopped falling but with fixed costs rising (SG&A expense for most companies), the average operating profit margin (EBITDA) is still lower and down for the 6th consecutive quarter.

Profit Margins Are Key

This falling profit margin trend is the biggest threat to the upcoming recovery. Over the 30-year history of premium growth from US companies, the biggest driver of that premium was the advancing gross profit margins through lower costs of goods sold which was mostly fuelled by lower cost of labor (offshoring) and persistently lower commodity prices (extraction industries moved to poor countries).

Made In USA

For thirty years, American companies generated growth-in-cash at a faster rate than growth-in-sales through exploitation of globalization. It is likely that will reverse in coming years and act as a drag on the cash flow recovery of US companies as profit margins remains under persistent pressure due to higher labor costs (shift back to American made products) and higher commodity prices (lower consumption of greenhouse products will only be driven by higher prices).

This creates a high and increasing risk of a steep drop in stock prices in the coming months. The recent rise in long term bond yields, from the low of 1.2% last July to 2.4% now, has occurred while the major stock indexes have advanced 26% to a new high relative to bonds.

Cyclicals Are Recovering

The higher frequency of improvement in both sales-growth and the gross profit margin indicates that the worst of the corporate growth decline is in the past. The shape of the improvement suggests that it is a consumer-cyclicals lead industrial recovery that we have seen many times in the corporate data record.

Interest Rates Are ‘Really’ Low

Short term interest rates have now dropped to such an unusually low level that we must further reduce cash positions. The long treasury bond portfolio value has declined 18% since the mid-pandemic low in July last year when the 30-year bond yield was 1.3%.

Even more bizarre is the recent drop of short-term interest rates. The 3-month treasure bill (the zero-risk asset) now yields the lowest ever and the nearest to zero we have ever seen at 0.036%. That has forced investors into higher risk assets as the yield has fallen on a broad range of lower risk alternatives.

So, What To Do?

Buy premium growth companies; choose rising sales growth companies with improving profit margins (these are acceleration attributes). Currently, shares of stable and reliable companies are more commonly trading at a discount price since the market has rotated to the higher risk stocks in recent months. This is an important opportunity to defend the portfolio from the higher risk of a sharp drop in share prices and still reduce cash.

While the market behavior shifts to more risk taking, the shares of these stable premium growth companies have become depressed. Focus on stocks of dividend paying companies that are recently accelerating cash. Add these to your portfolio now to protect against a sharp market decline.

You can be confident that we will navigate successfully through this major shift in US Growth. The 1st step is to improve the growth characteristics of your portfolio of companies. Walmart is a great example of a resilient consumer-cyclical company that is retooling, recovering and striving for profitability.

Walmart Stores $131.740 Buy This Rich Company Getting Better

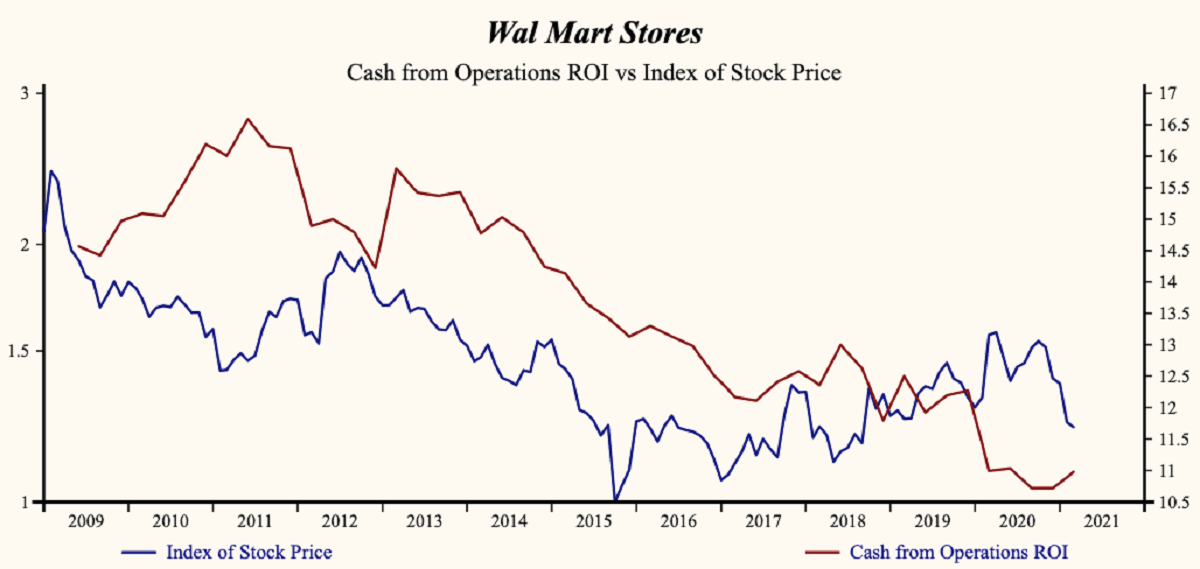

Wal Mart Stores (NYSE:WMT) has been a profitable company with persistently high cash return on total capital of 14.2% on average over the past 20 years. Over the long term the shares of Walmart Stores have advanced by 22% relative to the broad market index.

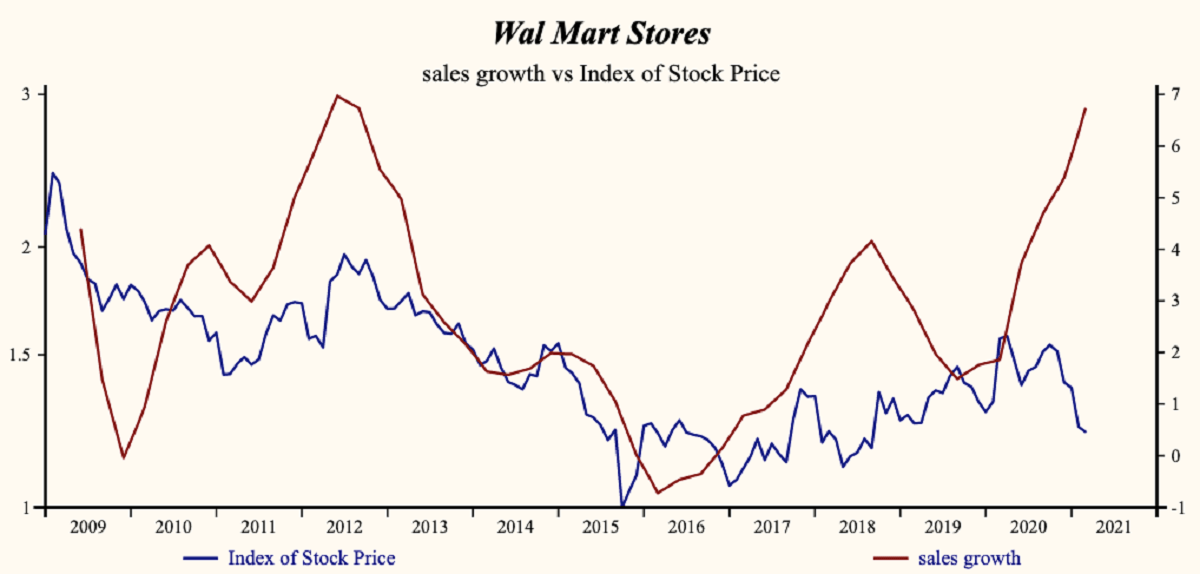

Currently, sales growth is 6.7% which is high in the record of the company but higher than last quarter. Receivable turnover continues to fall reflecting a strong quality of sales.

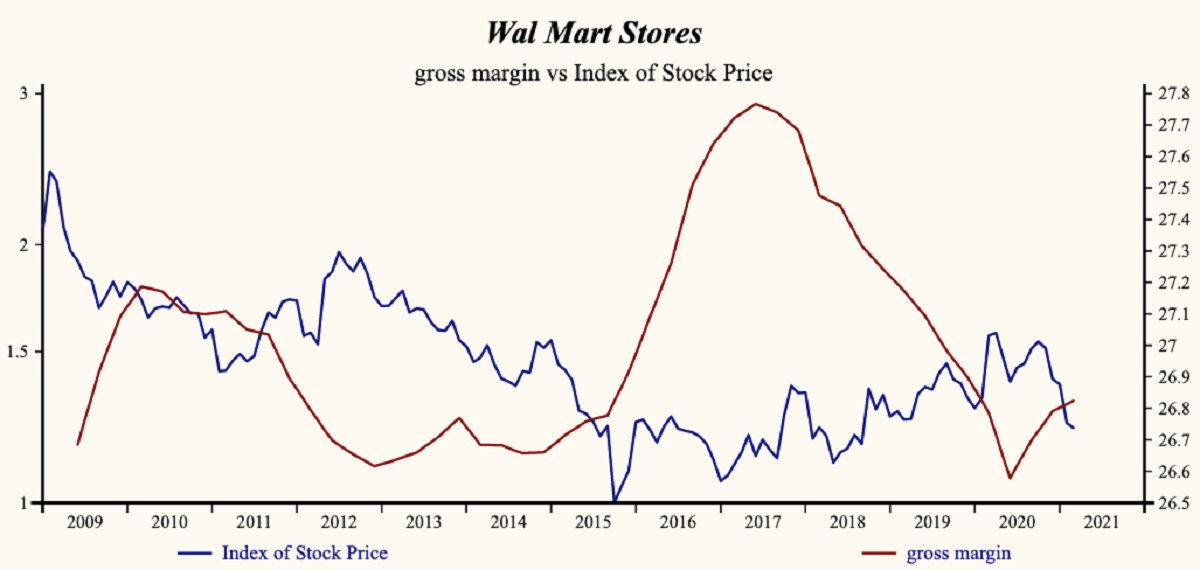

The company is recording a high and rising gross profit margin. Inventory turnover continues to fall indicating that products are not sitting on the shelf. Sales, General & Administrative (SG&A) expenses have been steady since early 2019. That implies that the company has further capability to accelerate EBITD relative to sales with lower costs.

The recent gross margin improvements have reversed cash from operations (ROI) from its recorded low which continues to support free cash flow.

Dividend Growth Remains Steady

The current indicated annual dividend produces a yield of 1.7%. Five-year average dividend growth is 2.1%. Current trailing operating cash-flow coverage of the dividend is 4.3 times.

The shares are trading at lower-end of the volatility range in a 26-month rising relative share price trend. The current depressed share price provides a good opportunity to buy the shares of this evidently accelerating company.

The current depressed share price provides a good opportunity to buy the shares of this evidently accelerating company.

Investors do not wait. Act now!

The post Walmart: Stable & Reliable Company appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.