By Monica Kingsley. Originally published at ValueWalk.

Stocks reversed yesterday, and the close below 3,900 indicates short-term weakness instead of muddling through in a tight range. Especially the sectoral reaction to still retreating yields, is worrying. Yesterday‘s session means a reality check for prior reasonable expectations:

Q4 2020 hedge fund letters, conferences and more

(…) The index is likely to advance, but the engine is going to be tech this time – not value stocks. I view this as a deceptive, fake strength in the bull market leadership passing over to value inevitably next. That‘s why I expect the S&P 500 advance to unfold still, a bit rockier than it could have been otherwise.

Tech Underperformance

Tech faltered yesterday, and neither the other sectors were convincing. Rotation within stocks didn‘t work yesterday or the day before, and that‘s short-term concerning for the stock market bull health – as in, the path ahead would be truly rockier, and accompanied by brief, sharp selloffs such as the one bringing S&P 500 futures to 3,865 moments ago. The bull market isn‘t though over by a long shot – all we‘re going through is a recalibration of the rising inflation – I still stand by my year end call for $SPX at 4200.

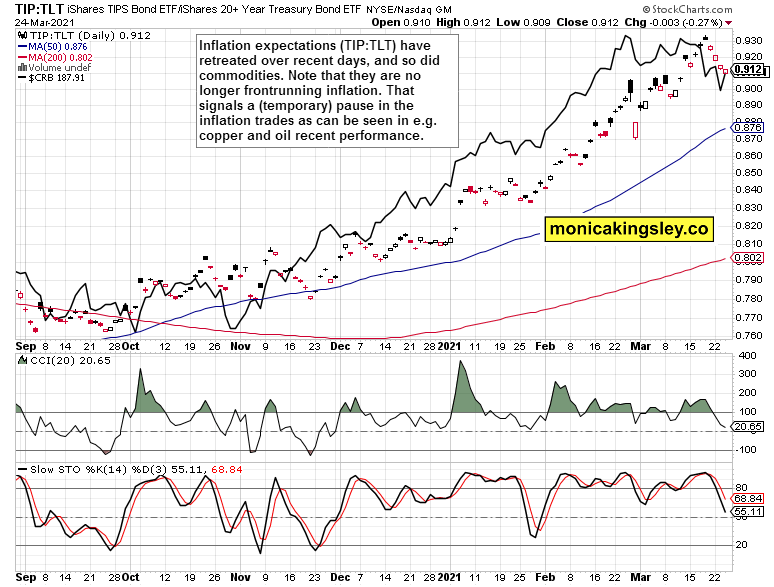

It‘s commodities that are under the greatest pressure now, and the copper and oil signals doesn‘t bode well for the immediate future. These are likely starting consolidation of post-Nov 2020 sharp gains – they are no longer frontrunning inflation expectations. This has also consequences for silver, which is more vulnerable here than the yellow metal now.

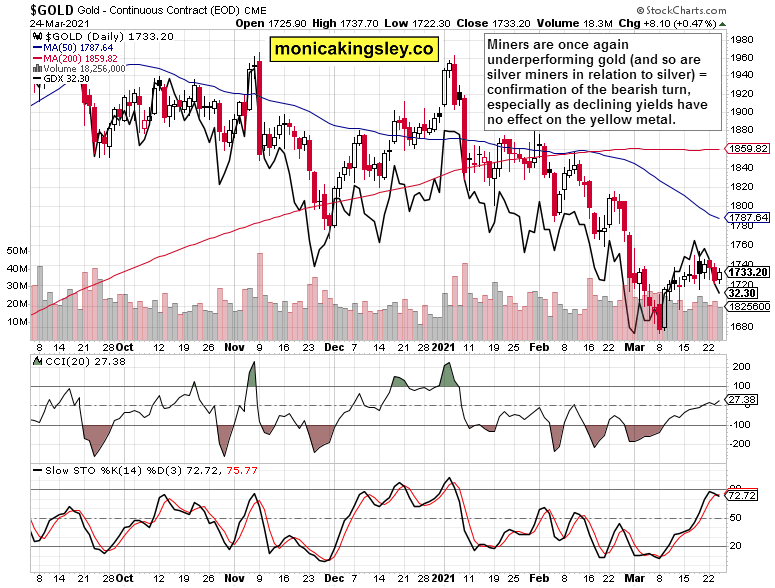

Gold is again a few bucks above its volume profile $1,720 support zone, and miners aren‘t painting a bullish picture. Resilient when faced with the commodities selloff, but weak when it comes to retreating nominal yields. The king of metals looks mixed, but the risks to the downside seem greater than those of catching a solid bid.

That doesn‘t mean a steep selloff in a short amount of time just ahead – rather continuation of choppy trading with bursts of selling here and there.

What could change my mind? Decoupling from rising TLT yields returning – in the form of gold convincingly rising when yields move down.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

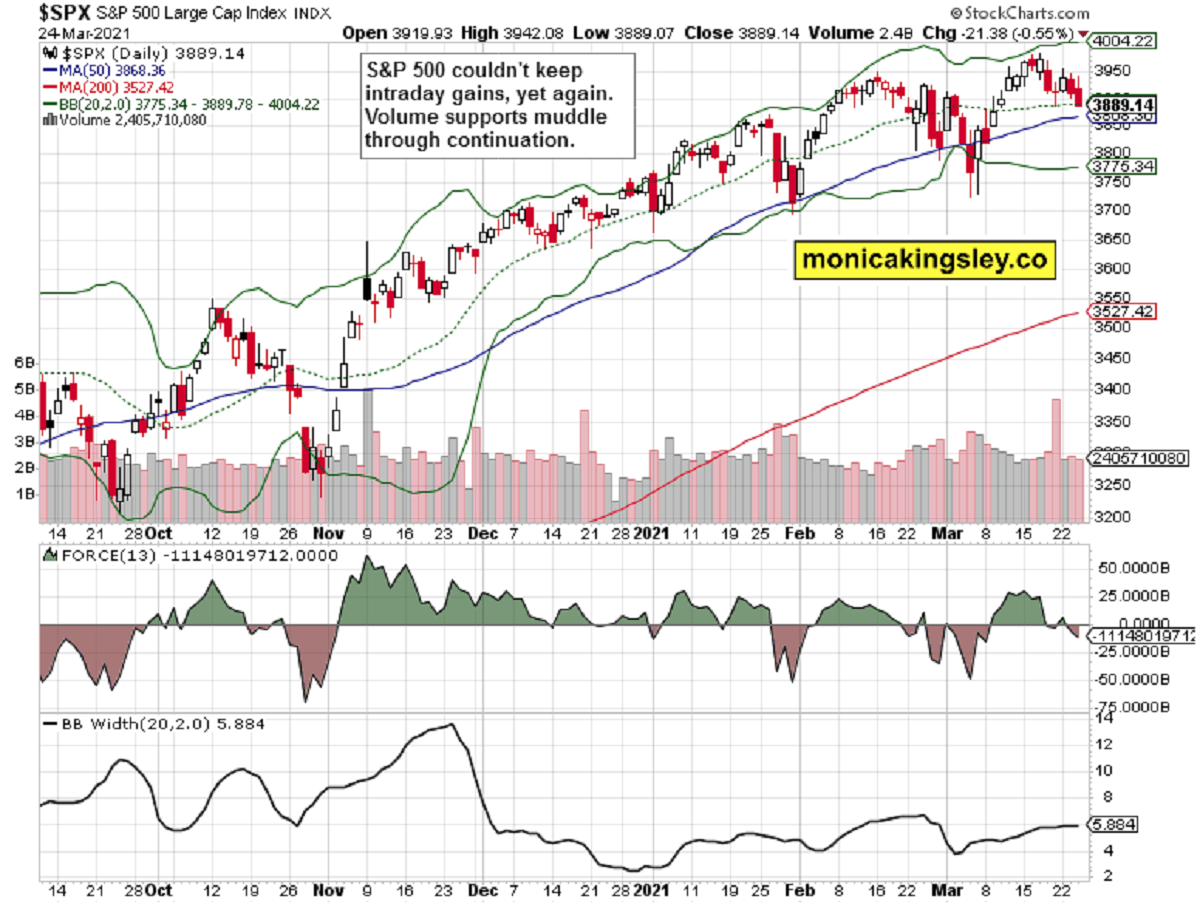

S&P 500 Outlook

While yesterday‘s volume isn‘t consistent with a true reversal, it still says we‘re not done with the downside, which however shouldn‘t reach all too far. Force index on the other hand, looks as starting its decline, so the short-term picture is mixed. Whether the 50-day moving average test would lead to a rebound, is an open question – but I think it will.

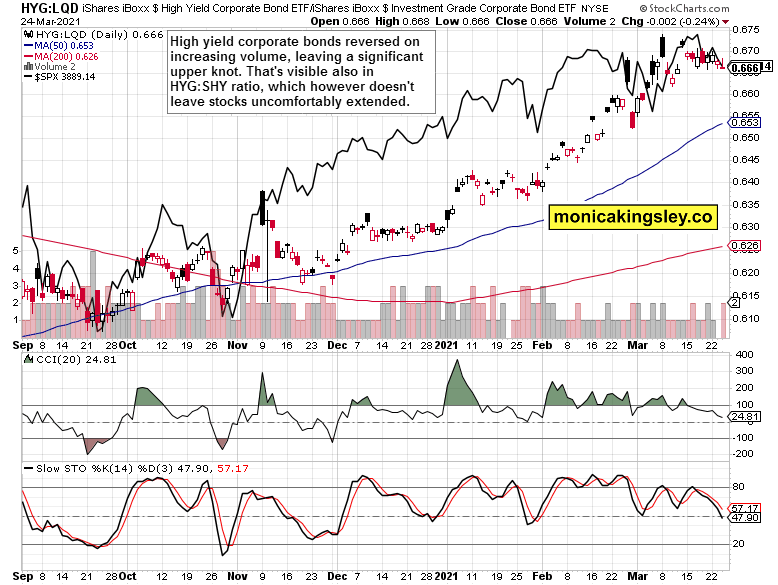

Credit Markets

The high yield corporate bonds to short-dated Treasuries (HYG:SHY) ratio gave up all of yesterday‘s gains, but isn‘t leaving stocks as extended here. Much depends upon whether squaring the risk-on bets would continue, or not. Both stocks and the ratio appear consolidating here, and not rolling over to the downside.

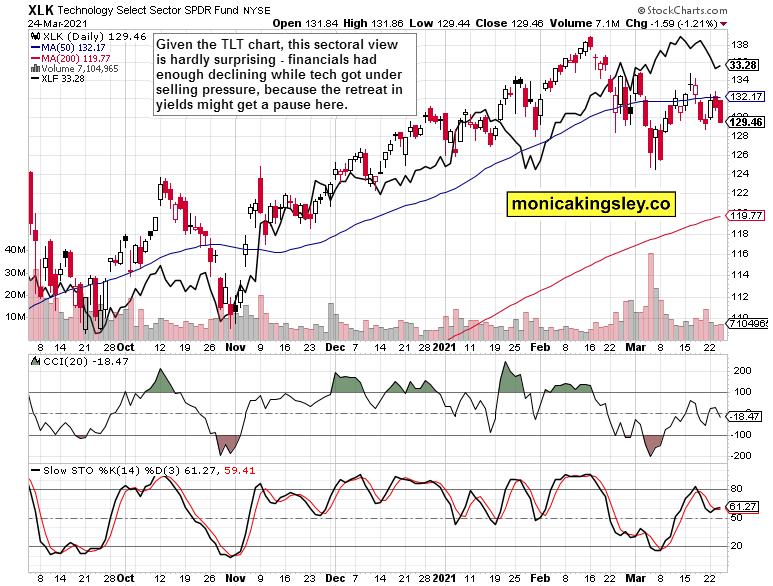

Technology and Financials

Technology (XLK ETF) showing weakness while financials (XLF ETF) aren‘t yet ready to run – that‘s a fair description of the moment. What‘s most concerning, is the tech underperformance on still rising long-term Treasuries.

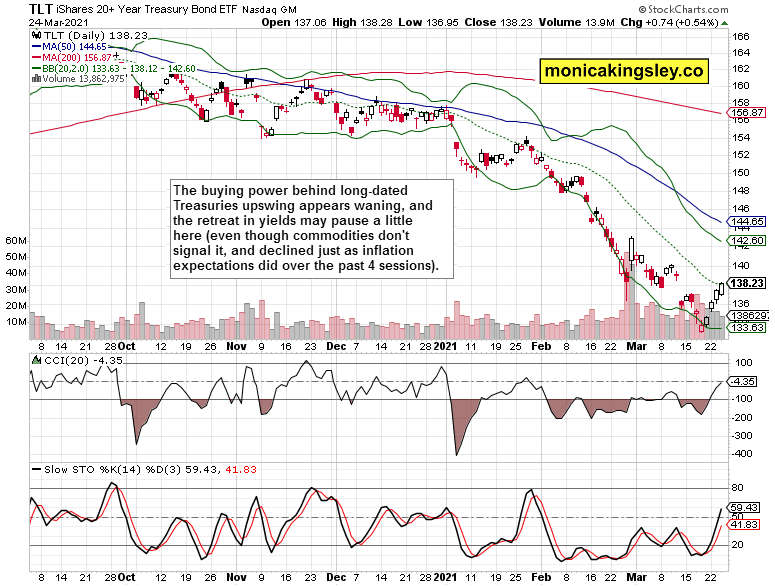

Treasuries and Inflation Expectations

Volume behind the TLT upswing is drying up, and S&P 500 sectors are sensing another turn to the downside. Utilities aren‘t getting anywhere while $NYFANG is as weak as could reasonably be, which doesn‘t bode well for stocks.

Commodities showed daily resilience as inflation trades meekly turned around – but make no mistake, inflation expectations runup appear getting questioned on a short-term basis, and the more volatile commodities feel that.

Gold and Miners

The precious metals sector remains under pressure, and the renewed and visible miners underperformance highlights that. Yesterday‘s gold upswing happened on lower volume than the preceding downswing, adding to the woes. Silver though remains more vulnerable to the downside than gold, and miners aren‘t painting a bullish picture at all.

Summary

With the tech underperformance returning to the fore, the S&P 500 is short-term exposed, but the momentarily elevated put/call ratio looks as marking not too much downside left as prices approach the 50-day moving average. Once value stocks turn upwards, the stock bull market would be running again.

Until gold and silver miners show outperformance again, both metals remain vulnerable to short-term downside – silver more so than gold, which could catch a bid as a safe haven play. But should gold strength return on declining yields, that would be another missing ingredient in the precious metals bull market.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

The post Risk-Off Is Back Again appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.