By Korbinian Koller. Originally published at ValueWalk.

When the situation changes, you have to be willing to change with the situation. It is this required flexibility that distinguishes the professional from the amateur, not only in trading. While the bigger picture is the same, we have seen many unusual pattern formations over the last two months. Intraday trading behavior similarly is atypical for Silver and points towards manipulation. Luckily, changes like this also provide opportunities. Silver’s situation changed, you change.

Q4 2020 hedge fund letters, conferences and more

This week’s price action changed the probability for the short term towards the highest likelihood of continued sideways movement within the established range of the last eight months. Consequently, opportunities have been opening up in the related mining sector. Meaning now is the time to prep this additional field of leverage and sift through one’s choices on how to strike once Silver has found its bottom.

Weekly Chart of Silver Spot Price compared to Mining Companies:

Silver Spot Price compared to Mining Companies, weekly chart as of March 24th, 2021.

The main work in trading is to be prepared. “Make a plan, and trade that plan.” Comparing fundamentals and charts, we found the above candidates to be prime for additional holdings to your spot price trading and physical holdings.

The weekly comparison chart shows the strong relationship of mining company valuation towards the actual Silver spot trading price. It also illustrates a beta component meaning the miners move from a percentage perspective proportionally more than the spot price. Depending on your risk appetite, you can pick what suits your aggressiveness of investment style best. This requires adjustment of risk through position size. Miners offer a stock market exposure with leverage and an instrument where you wouldn’t mind owning a part of the company you are holding stocks in. This in an environment where thinking from a wealth preservation perspective is vital.

Silver in US-Dollar, Daily Chart, Silver’s situation changed, you change:

Silver in US-Dollar, daily chart as of March 24th, 2021.

The daily chart above shows why we find the short to mid-term picture to be changed. A significant tight trading range (yellow box) broke to the downside. The bears were able to get the upper hand and not only over this range but price also broke through a significant supply zone based on maximum volume transactions at the US$26.11 price zone. This results in a successful second leg of a downtrend within the broad sideways range fulfilling the bear flag marked in red lines.

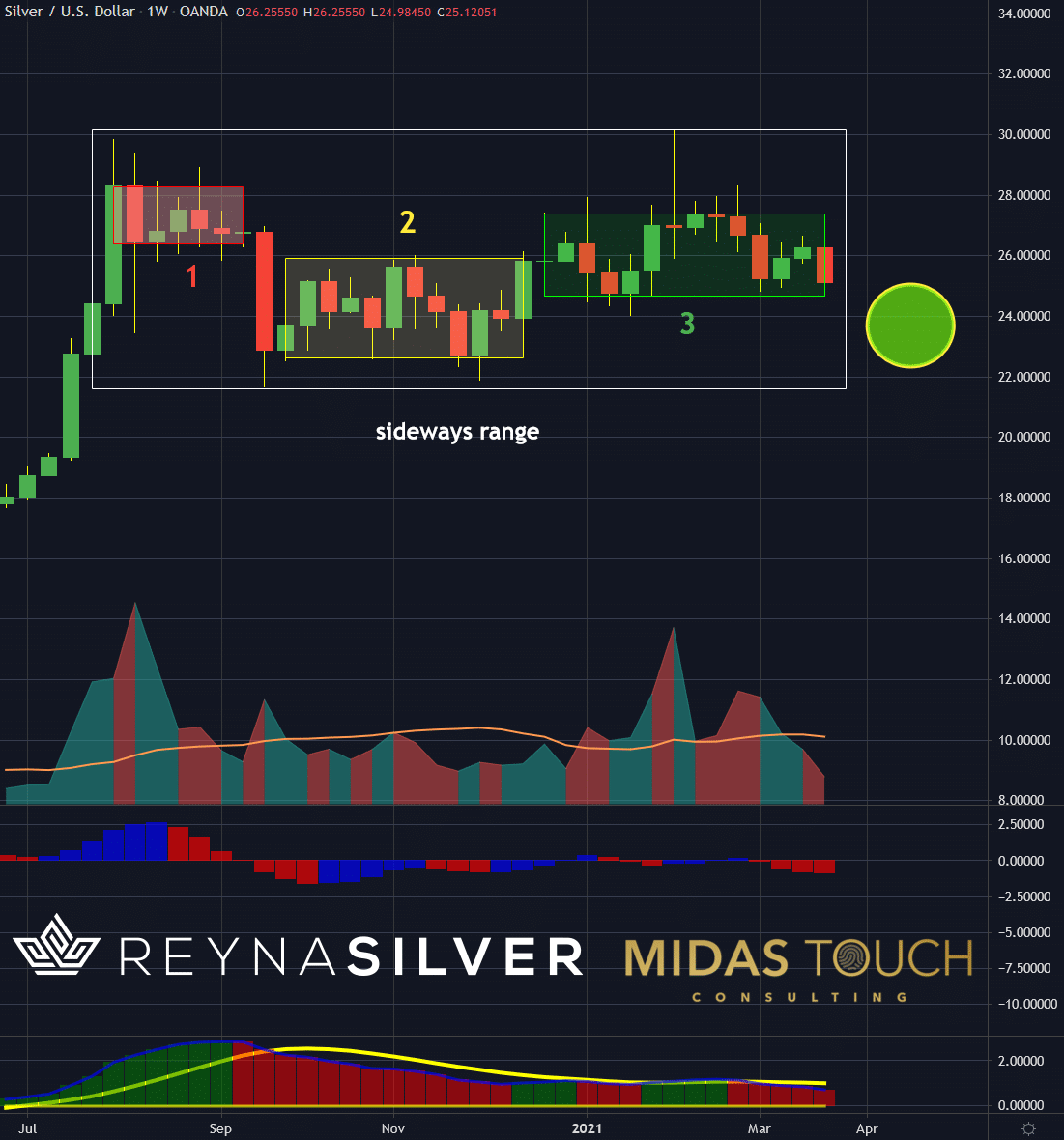

Weekly Chart, Silver in US-Dollar, Refining the plan:

Silver in US-Dollar, weekly chart as of March 24th, 2021.

The weekly chart of Silver shows in white the last eight months’ sideways range. Within that range, we had three dominant zones. Trading at the bottom of range three (green box) suggests the highest likelihood of turning point to be at trading prices right at this moment or below. (all the way down to US$22.50). Watching Gold, the sector leader for relative strength or weakness towards Silver and the individual mining stocks to pick out the highest likely turning spot and the low-risk entry point is the goal over the upcoming weeks. In short, while prices trade within the yellow circle price range, US$22.50 to US$25.05 mining chart evaluation is advised.

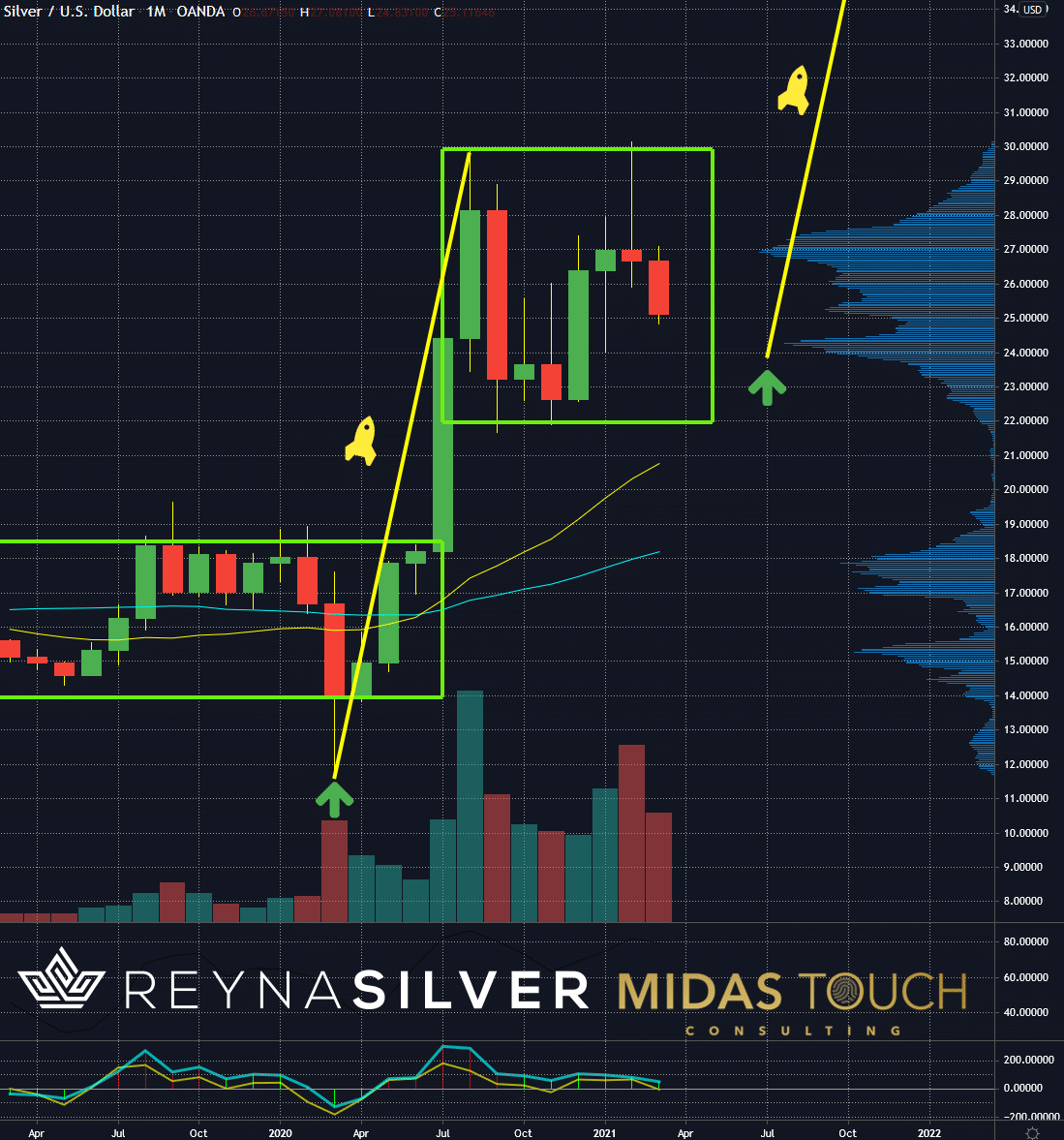

Monthly Chart, Silver in US-Dollar, Lift Off delay:

Silver in US-Dollar, monthly chart as of March 24th, 2021.

While none of these events changed the larger time frame outlook, the time component when the monthly and weekly trades will follow through to the upside has been delayed—an excellent time to plan one’s next trading instruments and entry point levels.

Silver’s situation changed, you change:

Through training, one can adapt to a more free mindset, allowing one to see clearly if plans pan out differently to formulate a different approach. This ability to rapidly change one’s opinion helps to perceive the market for what it is and not be emotionally involved if the future becomes different from anticipated. Welcoming the change, knowing it offers new opportunities, is the mental state a good speculator operates from.

Feel free to join us in our free Telegram channel for daily real time data and a great community.

If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.

About the Author: Korbinian Koller

Outstanding abstract reasoning ability and ability to think creatively and originally has led over the last 25 years to extract new principles and a unique way to view the markets resulting in a multitude of various time frame systems, generating high hit rates and outstanding risk reward ratios. Over 20 years of coaching traders with heart & passion, assessing complex situations, troubleshoot and solve problems principle based has led to experience and a professional history of success. Skilled natural teacher and exceptional developer of talent.Avid learner guided by a plan with ability to suppress ego and empower students to share ideas and best practices and to apply principle-based technical/conceptual knowledge to maximize efficiency. 25+ year execution experience (50.000+ trades executed) Trading multiple personal accounts (long and short-and combinations of the two). Amazing market feel complementing mechanical systems discipline for precise and extreme low risk entries while objectively seeing the whole picture. Ability to notice and separate emotional responses from the decision-making process and to stand outside oneself and one’s concerns about images in order to function in terms of larger objectives. Developed exit strategies that compensate both for maximizing profits and psychological ease to allow for continuous flow throughout the whole trading day. In depth knowledge of money management strategies with the experience of multiple 6 sigma events in various markets (futures, stocks, commodities, currencies, bonds) embedded in extreme low risk statistical probability models with smooth equity curves and extensive risk management as well as extensive disaster risk allow for my natural capacity for risk-taking.

The post Silver’s Situation Changed, You Change appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.