By Jacob Wolinsky. Originally published at ValueWalk.

- JD Sports Fashion PLC (LON:JD) (OTCMKTS:JDSPY) will tell us whether the last few months have changed guidance

Q1 2021 hedge fund letters, conferences and more

- LVMH Moet Hennessy Louis Vuitton SA (FRA:MOHF) (OTCMKTS:LVMUY) may offer a strategic game plan for its controversial Tiffany’s acquisition

- Tesco PLC (LON:TSCO) (OTCMKTS:TSCDY) could shed some light on margin expectations

JD Sports, Full Year Results, Tuesday 13 April

William Ryder, Equity Analyst

“In a January trading statement JD Sports said full year profit before tax would be at least £400m, “significantly ahead” of prevailing market expectations of £295m. The group said demand of the Christmas trading period was “robust” and like-for-like sales for the second half were up more than 5% as customers readily switched between digital and physical sales channels. This is undeniably a good performance, but next week’s results should give us greater colour and show exactly how this was achieved. The group certainly expects the momentum to continue though, and tentatively guided for 5-10% profit growth this year. We’ll be looking to see whether the events of the last few months, including new lockdown restrictions in Europe, have affected those targets. Recently the group has raised additional funds by issuing new shares, and has announced a few acquisitions. DLTR is an American sports fashion brand and Marketing Investment Group is Polish. These will increase JD Sports’ overseas footprint, and we expect to hear more on this strategy in next week’s results.”

LVMH, First Quarter Trading Statement, Tuesday 13 April

Laura Hoy, Equity Analyst

“2020 was a trying year for LVMH. Store closures and travel restrictions dented revenue. At the peak of the crisis, organic revenue fell 38% in the second quarter. But a recovery in key markets, including the US and Asia, meant revenues were only down 3% by the final quarter. Next week we’ll find out if this positive trend has continued. But keep in mind, renewed lockdowns in Europe, and continued reduction in international travel, (LVMH relies on airport and hotel spending), means revenues are unlikely to be seeing rocket-fuelled growth. While vaccine roll outs rumble on, it’s important to look at the bigger, strategic picture for LVMH. We could hear about plans for the recently acquired Tiffany & Co. The pandemic wiped out 36% of the jewellery brand’s sales during the first six months of 2020, and LVMH tried to walk away from buying it. The balance sheet was stretched to bring the famous brand into the fold, so we’d like to understand more about how LVMH plans to polish Tiffany’s prospects.”

HL’s non-executive Chair is also a non-executive Director of Tesco plc

Tesco, Full Year Results, Wednesday 14 April

Sophie Lund-Yates Equity Analyst

“It’s been a pretty exceptional year for this supermarket giant. Navigating mammoth changes in demand patterns that come with a pandemic, hiring an army of new staff and going full throttle on online expansion, all mean profits aren’t going to be stellar for the full year. Analysts expect operating profit to fall around 37.5%. It’s important to focus on the longer-term picture. We’d like to know what expectations are for margins. As the group continues to ramp up investment, we wonder what that means for the operating margins (currently around 4.2%) Tesco worked so hard to rebuild.

One of the biggest threats for all the grocers is enormous competition. That means we’ll be looking closely for any commentary on trading in the run up to Easter. Tesco put in a very strong performance over the Christmas period, and some analysts expected consumers to pull out all the stops for Easter this year. We wonder if Tesco was able to repeat that strength in the run up to the latest round of celebrations.”

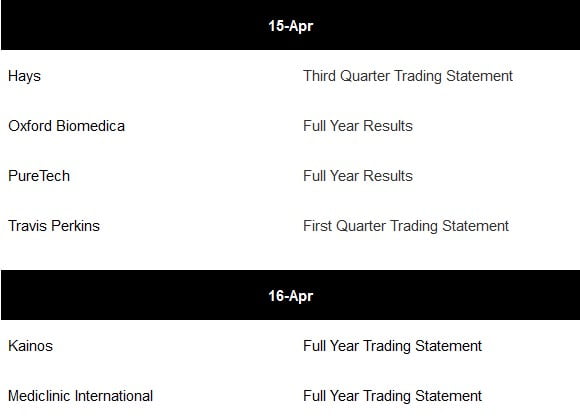

FTSE 350 Companies Reporting

*Companies on which we will be writing research

About Hargreaves Lansdown

1.5 million investors trust us with £120.6 billion (as at 31 December 2020), making us the UK’s largest direct-to-investor service.

Our purpose is to empower people to save and invest with confidence. We want to provide a lifelong, secure home for people’s savings and investments that offers great value and an incredible service, and makes their financial life easy.

Clients rate our service highly, 90% say we are good, very good or excellent.

Our expert research has been helping investors for almost 40 years through thick and thin – we’ve seen many market downturns.

We make things easy – it takes just five minutes to open or top up an ISA. More clients log into their accounts via our mobile app than through a desktop PC.

In 2018 we also launched Active Savings, an online savings marketplace that lets savers move money easily between banks, to help their money work harder without the hassle.

Our helpdesk is based in our HQ in Bristol. We have a tech hub in Warsaw Poland and around 100 financial advisers based across the UK. We are a financially secure, FTSE 100 company.

For more information: www.hl.co.uk/about-us

Press centre: https://www.hl.co.uk/about-us/press

Investor relations: www.hl.co.uk/investor-relations

The post Look Ahead To FTSE 350 Companies Reporting From 12 To 16 April appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.