By Jacob Wolinsky. Originally published at ValueWalk.

Black Bear Value Partners commentary for the first quarter ended March 31, 2021.

Q1 2021 hedge fund letters, conferences and more

“In times of joy, all of us wished we possessed a tail we could wag.” – W.H. Auden

To My Partners and Friends:

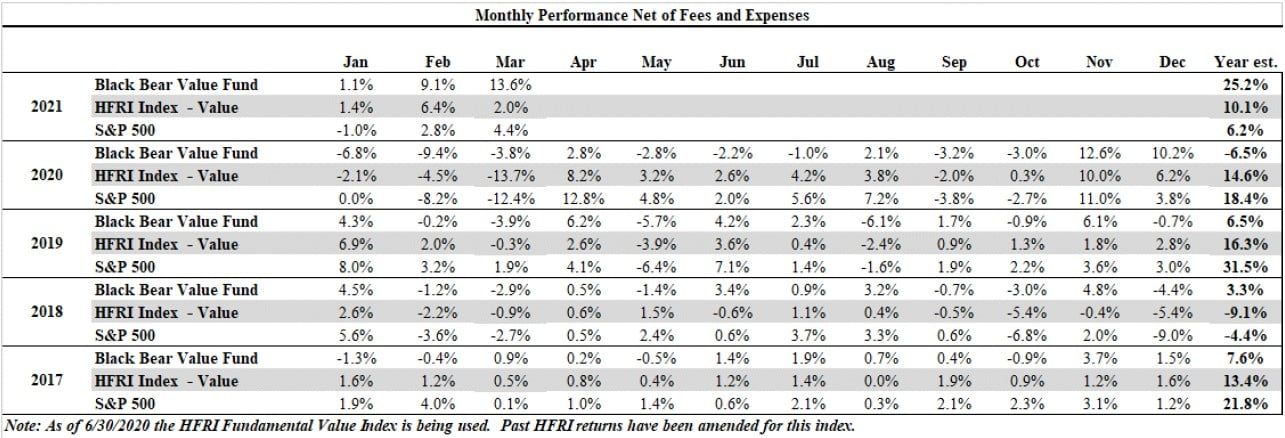

- Black Bear Value Fund, LP (the “Fund”) returned +13.6%, net, in March and is +25.2% YTD.

- The S&P 500 returned +4.4% in March and is +6.2% YTD.

- The HFRI index returned +2.0% in March and is +10.1% YTD.

- We do not seek to mimic the returns of the S&P 500 and there will be variances in our performance.

Amidst the turbulence of the financial crisis in 2008 I met my wife Lauren and her sweet little Puggle (that’s a dog) named Sami. The beauty of our relationship with Sami was a magnificent unconditional love. She could soothe on a tough day and taught us how to live in the moment and be happy with what’s in front of us. During some tough moments at Black Bear, I would joke with some of our LP’s that Sami was not doing good analysis. I am not sure if our LP’s found it funny, but I sure did. Sadly, Sami died peacefully in our arms in early March at the age of 15. All my letters and communications have been written with her by my side and her absence is notable while I am writing this one. I wanted to dedicate this letter to my beloved Sami, the chicken soup for my soul, a great buddy and a creature who taught me so much without needing to use words. I wish all of you the opportunity to have as special a friend as we had in our Samster.

March was our best performing month in the Fund’s history, but I want to caution you. Please do not extrapolate these unusual results. It will be highly unlikely that we see a month or quarter like this, and we need to temper our expectations. That said, our portfolio remains similar to the start of the year as we continue to see a lot of value in the businesses we own and extreme mispricing in the names we are short (this includes our credit short). Compared to indices, we own much higher quality businesses, with better growth prospects and at cheaper valuations. As stated in prior communications, there is a long way to go for our portfolio to approach fair value.

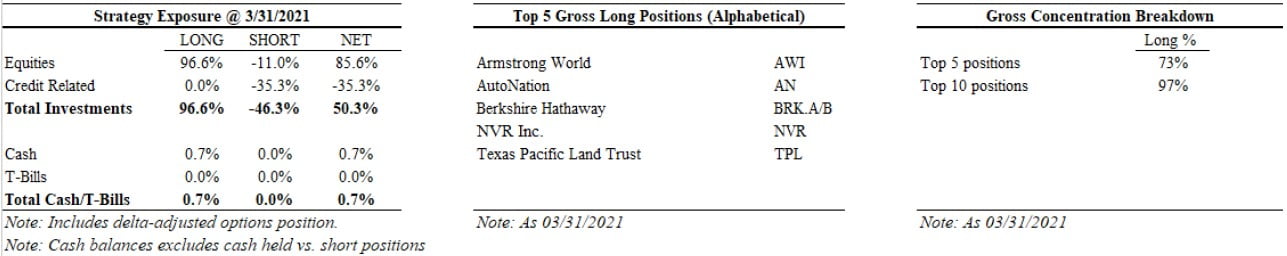

Top 5 Businesses We Own (Alphabetical)

Brief descriptions of the top 5 long positions follow as of 3/31/2021 in alphabetical order,

Armstrong World Industries

Armstrong World Industries Inc (NYSE:AWI) is a 129-year old designer and manufacturer of commercial and residential ceiling, wall, and suspension systems. 95% of their sales are for commercial use with the majority (70%) for repair and remodel (R&R). This translates to less sensitivity to new construction as R&R is a more stable revenue stream.

The US ceiling industry is consolidated with the top 3 companies controlling 98% of the market. AWI is the market leader with 65% market share.

Despite COVID related shutdowns AWI managed to generate ~$250MM in FCF which at today’s price equates to ~6% FCF yield. They have experienced sequential improvement in their end markets and should see more improvement as the world reopens.

AWI should be able to generate $4-$5 in annual free cash flow which implies a current yield of 5-6% that should be able to grow 5-7% per year over the long-run. This is an excellent business at a cheap price.

AutoNation

AutoNation, Inc. (NYSE:AN) has been a long-term holding for us dating back to the first year of the Fund. Management continues to make prudent decisions both investing in growth and shrinking the share count at cheap prices.

Most would not expect a global pandemic to benefit AutoNation, but the industry experienced a record year. Dealers have been able to increase profit margins due to a variable cost operating model and lower inventories. AutoNation has been able to materially reduce their operating expenses over the last year which will continue to benefit the business going forward.

Management will invest an incremental $200MM in used car supercenters (AutoNation USA) over the coming 3 years. Their ability to self-fund growth without a need for dilutive equity raises and/or debt raises is an enormous competitive advantage that is still not recognized appropriately by the market.

My estimates for FCF have increased as I have more confidence in their ability to permanently cut operating expenses out of the business. AutoNation can generate a range of $6-$8 in free cash flow per year. This implies a 7-9% yield to us presuming limited growth. Additionally, if AutoNation achieves modest levels of success with AutoNation USA it could add another $5-$10 of per share value to the business. Note that at current prices, very little in the way of AutoNation USA success is priced in.

Berkshire Hathaway

Below is an updated snapshot of our “Berkshire on a Napkin” valuation. This is by no means perfect but provides a very rough idea of how things look at a 10,000-foot view.

While Berkshire Hathaway Inc. (NYSE:BRK.A)’s operating businesses saw their profits decline by ~10% in 2020, their long-term positioning at the cross-section of American business remains intact if not stronger.

Berkshire bought back $9B of stock in the 4th quarter and $25BB during 2020 shrinking the sharecount and increasing our ownership by 5%.

- Cash of ~$104,000 per class A Share

- Down/Base/Up marks cash at book value to a 10% premium

- Investments of based on December prices ~$194,000 per class A share

- Presume a range of stock prices that result in:

- Down = $116,000 per class A share (-40%)

- Base = $165,000 per class A share (-15% – assumes portfolio is overpriced)

- Up = $223,000 per class A share (+15%)

- Presume a range of stock prices that result in:

- Operating businesses that should generate ~$15,000 of pre-tax income per Class A share per year

- Down = 9x = $135,000 per share – equates to ~8% FCF yield

- Base = 12x = $180,000 – equates to ~6% FCF yield

- Up = 12x = $180,000 – equates to ~6% FCF yield

- Overall

- Down = $355,000

- Base = $454,000

- Up = $465,000

Berkshire is very cheap for owning such high-quality businesses and will continue to grind higher and compound value for us.

NVR Inc.

NVR, Inc. (NYSE:NVR) is one of the highest-quality and largest homebuilders in the United States. While they focus on homebuilding, they also have a mortgage and title insurance business that has been contributing cashflow during this low-rate environment.

NVR has had a “land-light” strategy which means they don’t own much land. Instead they option land and when the land has been entitled and prepared for development they purchase and build the home. The typical homebuilder will buy and own land for many years during the entitlement process, tying up valuable capital in the meantime. Additionally, if the homebuilding economics get stretched, the land can plummet in value impairing one’s balance sheet. NVR does not have this problem as they are effectively a Just-In-Time developer. While the unit level economics are not too different among homebuilders, their land-light strategy results in returns on capital that are many multiples greater than their competition.

I have been attracted to businesses that appear as one thing but are really another. In this case, while NVR is a homebuilder it operates more like a capital-light distributor of homes with more focus on rapid inventory turns and associated high returns on capital…not the capital intensive/land-intensive homebuilders of the past (and somewhat of the present).

One of the less-desirable outcomes from the 2008 financial crisis has been a lack of homebuilding relative to historical levels. As millennials age, create families and desire more space, the lack of housing inventory will likely become even more pronounced providing tailwinds for the industry and specifically the best operators.

We own a best-in-class business at a 6-7% FCF yield with interesting upside optionality if the housing economy rebalances.

Texas Pacific Land Trust

We continue to own Texas Pacific Land Corp (NYSE:TPL) despite the stock rising 200+%. While it doesn’t scream cheap it still looks very reasonable to me with very asymmetric upside if energy inflation takes hold.

Some people have asked why own this if the Biden administration is making it more cumbersome for energy companies and making a push towards renewables? Please note we are very supportive of a renewable future and a lower associated carbon footprint. As we have discussed before, to get to a renewable future we need hydrocarbons to bridge the gap. This is many decades in the making. Additionally, as permits on federal lands are reduced, the demand remains and will migrate to the areas where it’s still possible to operate (the Permian).

As a reminder TPL is a royalty company with 100% of their acreage located in the Texas Permian Basin. In a nutshell they make money when drilling activity occurs but DO NOT have the capital needs as they simply provide access to land.

The incremental amount of work on TPL’s part is minimal as the extraction and movement of the oil/natural gas is undertaken by others. They are merely a toll collector with Returns on Capital of 80+%.

In an inflationary environment, businesses that have lower capital intensity both in capital assets and people stand to benefit. In other words, if oil goes up a lot, the incremental cost to TPL is close to 0 so it’s all incremental profit. This is a business that should benefit in a massive way if we have energy inflation. In the meantime, we likely own it at a 3-4% free cash flow yield with massive upside.

Recent Performance And Expectations

Q4 2020 and Q1 2021 have been helpful to our bottom line. Please remember focus on the long-term business prospects of our investments and do not focus on random stock price movements. We own businesses and the stock prices are the instruments that afford us ownership. The movements of a stock price can inform how people feel about the business or the industry NOW, not where it’s going. We are focused on where the business can be years from now, so we are playing a different game. It is easier to ignore the noise of the crowd when you don’t rely on its agreement or disagreement with you. The stock market is such a crowd and in any short period of time prices can swing dramatically while the underlying business value changes very little. In short, when Black Bear is doing well, I’m not as smart as I look nor am I as dumb as when we underperform though the latter can be debated by many.

Simply put our recent returns are unusual. Over the long haul our prospects look promising and we will continue to remain patient, rational, and disciplined with a focus on the underlying fundamentals of our businesses.

General Partnership Business

K-1’s were sent out at the end of March. If you have not received them, please reach out.

We have welcomed in new quality LP’s in 2021 as well as some add-on investments from our existing high-quality LP base. I am hopeful that once COVID passes we can have an investor get-together in Q1 2022.

Thank you for your trust and support.

Black Bear Value Partners, LP

Adam@BlackBearFund.Com

The post Black Bear Value Partners 1Q21 Commentary appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.