By DIVIDEND GROWTH INVESTOR. Originally published at ValueWalk.

The Procter & Gamble Co (NYSE:PG) provides branded consumer packaged goods to consumers in North and Latin America, Europe, the Asia Pacific, Greater China, India, the Middle East, and Africa. It operates in five segments: Beauty; Grooming; Health Care; Fabric & Home Care; and Baby, Feminine & Family Care.

Q1 2021 hedge fund letters, conferences and more

Procter & Gamble Increases Quarterly Dividends

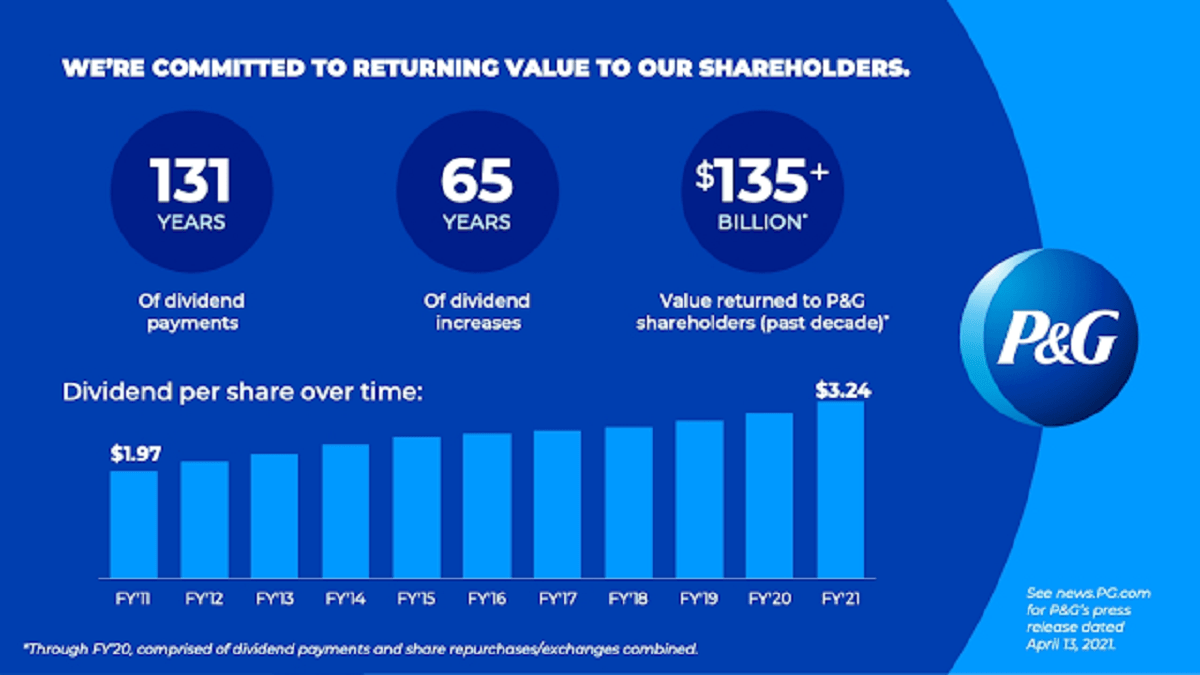

The company increased its quarterly dividend by 10% to 86.98 cents/share. This dividend increase will mark the 65th consecutive year that this dividend king has increased its dividend. The new quarterly dividend of 86.98 cents/share is almost exactly 10% higher from the prior dividend of 79.07 cents/share. Fractions make it possible to get even dividend raises on a percentage basis.

During the past decade, the company has managed to increase dividends at an annualized rate of 5.20%.

Source: Press Release

There are only 29 dividend kings in the US. Those are companies that have managed to increase their annual dividends every year for at least 50 years in a row.

This is also the 131st consecutive year that P&G has paid a dividend since its incorporation in 1890. The dividend demonstrates the company’s commitment to rewarding long-term shareholders with cash dividends. The track record is undeniably a testament to the resilience of the P&G’s business model, and the fact that it is relatively immune from recessions. Not even Covid-19 could disrupt the dividend growth for this dividend king!

Earnings Expectations

The company is expected to generate $5.70/share in earnings in 2021. That being said, the core business is very stable, which means that long-term earnings power should not be affected. Based on forward earnings, it appears that the forward dividend payout ratio is a little lower than 61%, which means that the dividend is sustainable.

I applaud this dividend hike, which is surprising in its amount.

For a long time, I did not like the fact that earnings per share did not go anywhere since hitting a high of $4.26/share in 2009. This put a limit to dividend growth. As a result, I had mostly been a holder of the stock, and haven’t added to my position since perhaps the first half of the 2010s.

However, the company earned $4.96/share in 2020, and is projected to earn $5.70/share in 2021. It looks like a turnaround is in effect indeed, and long-term patient shareholders are now getting bigger dividend paychecks.

For reference, I have never in my life gotten a 10% raise from any job. Even if I worked 60 hours/week year-round, and worked weekends.

The Company’s Performance

It is interesting to look at the company’s performance over the past decade for perspective. The stock sold for approximately $60/share a decade ago, and paid a quarterly dividend of 48 cents/share, for an annual dividend yield of 3.20%.

Fast forward to today, and the company is paying a quarterly dividend of almost 87 cents/share, for a total yield on cost of 5.80%. If we take dividend reinvestment into consideration, a $1,000 investment ten years ago would be generating $76.80 in annual dividend income today.

At the current price of $135.11/share, the stock seems overvalued at 24 times forward earnings. The stock yields 2.57%. P&G may be worth a second look on dips below $114/share.

Relevant Articles:

- Dividend Kings List for 2020

- Johnson & Johnson (JNJ) Hikes Dividends By 6.30%

- Procter & Gamble Raises Dividends for 61st Consecutive Year in a Row

- Lindsay Corporation Hikes Dividends

Article by Dividend Growth Investor

The post Procter & Gamble (PG) Increased Dividends by 10% appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.