By Jacob Wolinsky. Originally published at ValueWalk.

Hidden Value Stocks issue for the first quarter ended March 31, 2020, featuring interviews with Connor Haley, the Managing Partner of Alta Fox Capital Management, and with George Livadas, the Portfolio Manager of Upslope Capital. Blue Tower’s top value investment, EZCORP Inc (NASDAQ:EZPW), from their 2020 annual letter. GrizzlyRock Value Partners’ new investment idea Ciner Resources LP (NYSE:CINR), as highlighted in their 2020 annual letter.

Introduction

Welcome to the March 2021 (Q1) issue of Hidden Value Stocks.

In this issue, we have our usual two interviews and extracts from letters of funds previously profiled.

The first interview is with Connor Haley, the Managing Partner of Alta Fox Capital Management, LLC.

Alta Fox is a Fort Worth, Texas-based investment manager that primarily focuses on identifying under the radar, high-quality businesses. The Alta Fox Opportunities Fund launched in April 2018 with approximately $10 million of committed capital. Today, the fund is temporarily closed to new investors with about $210M of committed capital.

Since inception in April 2018, the fund has produced a gross return of 374% and a net return of 268% compared to the S&P 500’s return of 50%, the Russell 2000’s return of 34%, and the Russell Microcap’s return of 28%.

George Livadas, the Portfolio Manager of Upslope Capital is our second interviewee. Founded in 2017, Upslope’s objective is to deliver attractive, equity-like returns with significantly reduced market risk and low correlation versus traditional equity strategies.

Since inception, Upslope has produced a net return for investors of 63.5% with an average net long exposure of 42%, compared to a return of 17.8% for its benchmark, the HFRX Equity Hedge Index. We hope you enjoy this issue of Hidden Value Stocks, and if you have any questions or comments, please feel free to contact us at support@valuewalk.com.

Sincerely,

Rupert Hargreaves & Jacob Wolinsky.

Updates From Previous Issues: Blue Tower

Andrew Oskoui’s Blue Tower highlighted EZCORP (NASDAQ:EZPW) as one of its top value investments in the fund’s 2020 annual letter to investors:

“Normally in an economic crisis, demand for subprime credit is elevated and counter-cyclical companies such as pawn shops have their best years. As a result of the disposable income increase previously discussed, we have instead seen sharply declining demand for subprime credit. Pawn shops have seen loans repaid by customers and much of their inventory purchased, sending cash on hand to extremely high levels as pawn service charges plummet. Compounding this issue for EZCORP in particular was that the rollout of their digital Lana app saw very low adoption by customers. EZCORP has performed terribly in 2020 and the company has responded by replacing the previous CEO, Stuart Grimshaw, with a new CEO, Jason Kulas.

The company currently trades at an extremely depressed valuation. The company has a market cap of $258 million against inventory of $98 million, cash on hand of $305 million, long-term debt of $251 million and pawn loans outstanding (PLO) of $134 million. Using the multiples of inventory and PLO of recent acquisitions in the pawn shop industry, it seems likely that EZPW could command a price 2x to 4x the current share price in an acquisition scenario. We will continue to remain invested to see if the company can be turned around with its new leadership.”

Updates From Previous Issues: Grizzlyrock

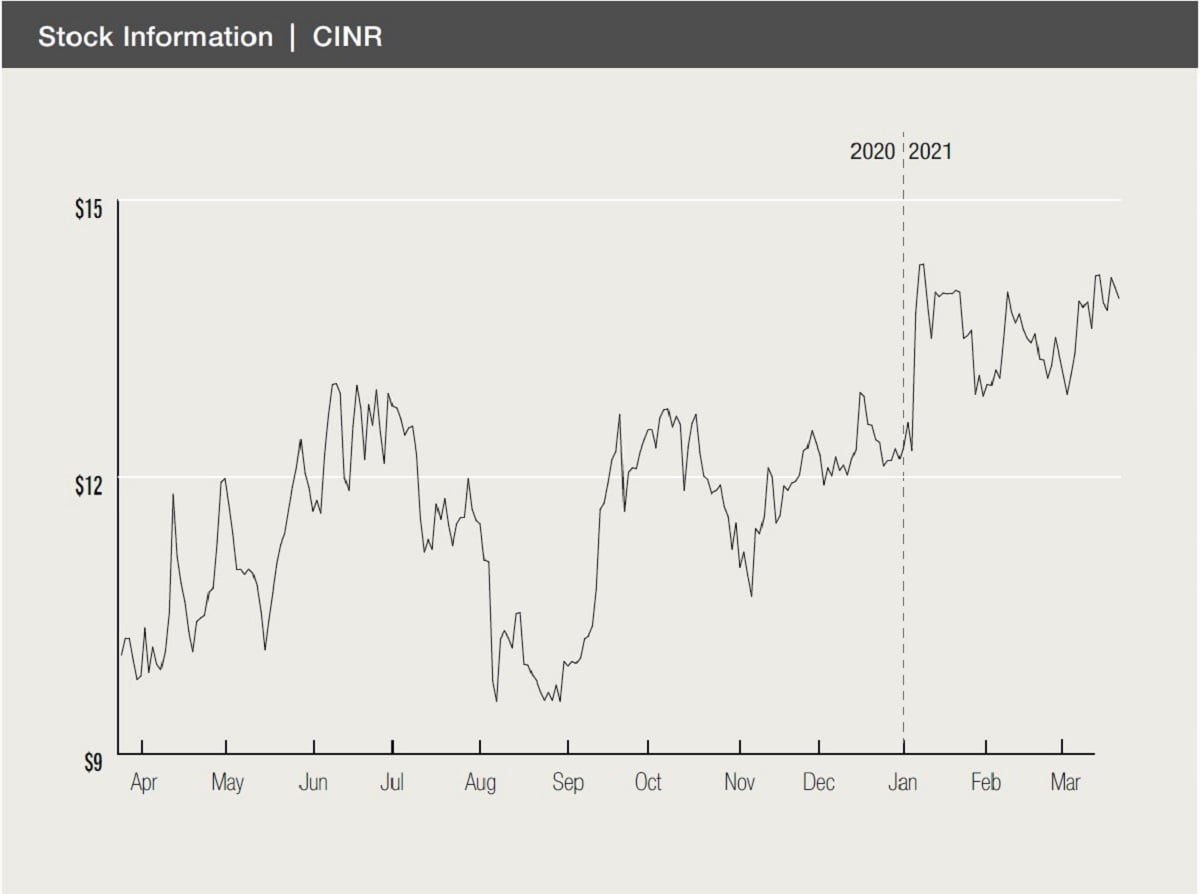

GrizzlyRock Value Partners featured in the June 2017 issue of Hidden Value Stocks. In 2020 the fund returned 7.6% net of expenses. Since inception, its geometric compounded annual growth rate is 9.24% net.

In the firm’s 2020 letter to partners, it highlighted one of its newest investment ideas, Ciner Resources LP (NYSE:CINR), a global low-cost provider of soda ash: “Ciner is a proven low-cost producer of a necessary commodity with end markets now rebounding…With production rates low, inventory levels have normalized which is pulling demand back through the supply chain. As markets return to a balanced supply/demand dynamic, both pricing and volume should recover.

…

The Company is investing ~$400 million of growth CapEx into expanding their facility by 800,000 tons of soda ash production per year. When complete (targeted for year end 2023), Ciner’s annual production capacity will increase by ~23% and should easily support a unit distribution of $2.25.

…

We anticipate a modest ($1.25 to $1.50) annual distribution being reinstated in late 2021…while we wait for the growth project to finish and the distribution to once again pay $2.25 per year. At the historic 8.9% distribution yield, this would indicate a unit price above $25 per share for a return well over 100%.”

The post HVS 1Q21: Grizzlyrock’s Investment In Ciner Resources appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.