By Monica Kingsley. Originally published at ValueWalk.

Broad S&P 500 rally is spilling over to precious metals and commodities – Santa Claus leaves no stone unturned, apparently. Not that yields or the dollar would move much yesterday – it‘s the omicron response relief (thus far. yet APT has risen sharply to counter the bullish and wildly profitable oil message) coupled with the yesterday mentioned market friendly Fed:

Q3 2021 hedge fund letters, conferences and more

(…) The Fed is still accomodative (just see the balance sheet expansion for Dec – this is really tapering), didn‘t get into the headlines with fresh hawkish statements, and inflation expectations keep rising from subdued levels.

Even though junk bonds retreated from intraday highs, the rally isn‘t over yet – VIX remaining around 18 is the best that the stock bulls can hope for today (i.e. a sluggish day still retaining bullish bias). Financials and industrials had a good day, but consumer discretionaries to staples ratio leaves more than a bit to be desired. The same goes for the financials to utilities ratio. Yes, the horizon is darkening, but further gains for weeks to months to come, still lie ahead. Remember, the topping process is about fewer and fewer sectors pulling their weight, about the market generals not being followed by the troops in the coming advance. We‘re not quite there yet.

The Fed didn‘t really taper much in Dec, thus the jubilant close to 2021 across the board. The compressed yield curve would eventually invert – regardless of the current levels of inflation, the GDP growth can still support higher stock prices. Precious metals and commodities would though become an increasingly appealing proposition as I‘m not looking for the Fed to be able to break inflation. The tightening risks are clearly seen in market bets via compressed yields, so they‘ll attempt to not only talk a good game – they will act, and the risks of breaking something (real economy) would grow. That‘s the message from Treasuries – hawkish monetary policy mistake is feared and increasingly expected.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

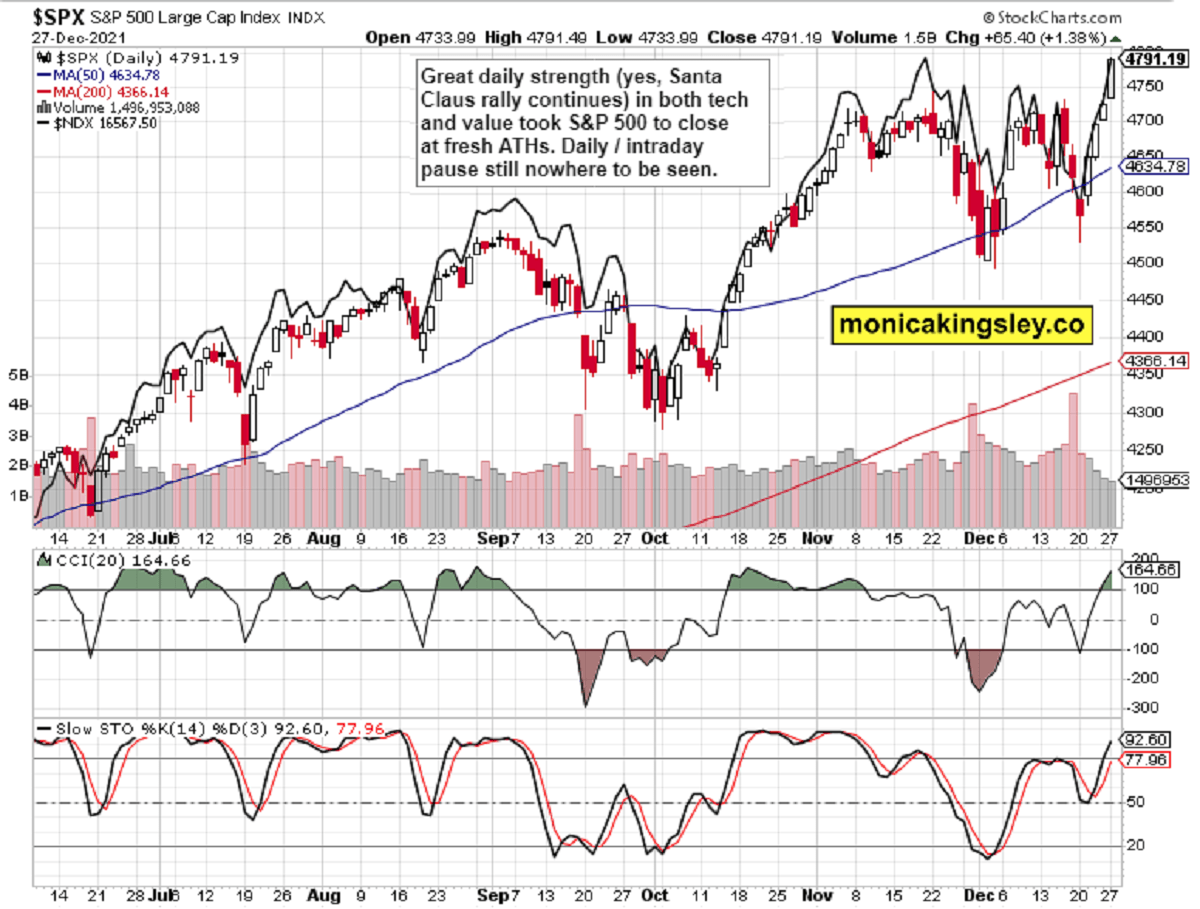

S&P 500 and Nasdaq Outlook

S&P 500 market breadth again improved – the increasing participation shows that the bull run isn‘t clearly over. And it also reveals that this isn‘t yet the time to expect a new correction.

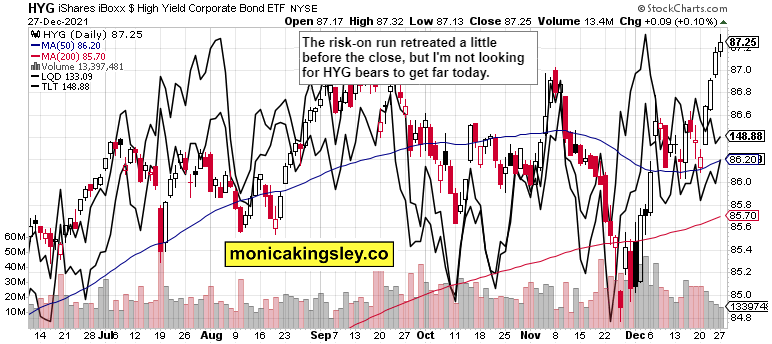

Credit Markets

HYG stalled a little, but doesn‘t look to have definitely peaked. One look at LQD reveals the nuanced risk-off turn yesterday, which might not interfere with further stock market gains today though).

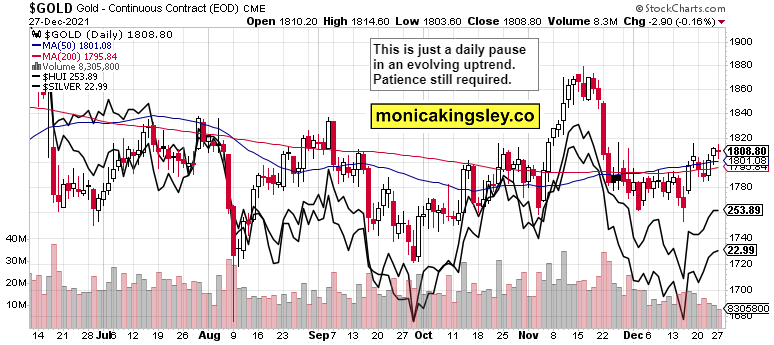

Gold, Silver and Miners

Gold and silver paused, but I‘m treating it as a daily pause in an otherwise developing uptrend. Once the inflation expectations stop being as steady as they had been yesterday, the metals will like that.

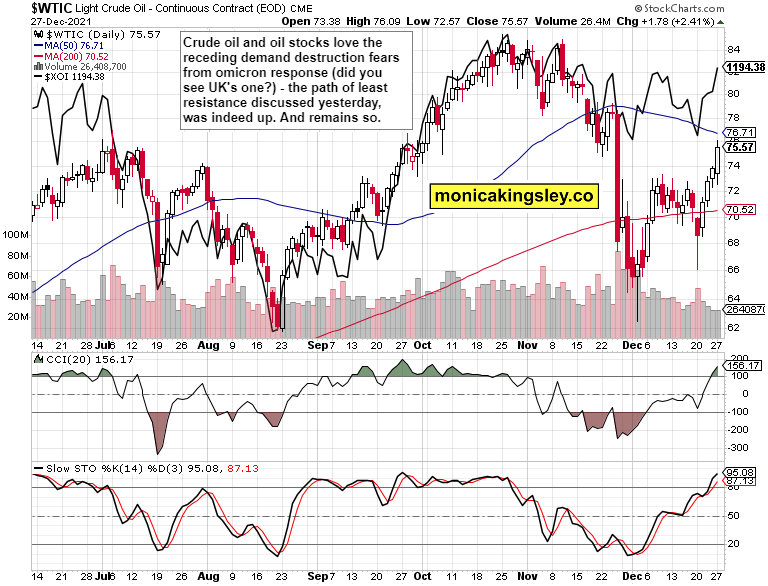

Crude Oil

Crude oil is strongly up, and oil stocks confirm. The $78 zone comes next, and could take a few days to be reached.

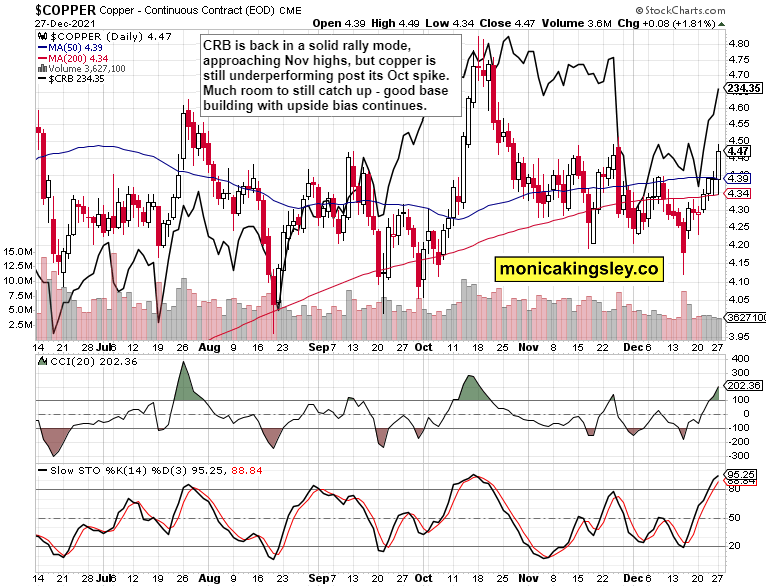

Copper

Copper still hasn‘t arrived at true fireworks – but the long consolidation is being resolved in a bullish way (of course). Broader commodities are showing that the path of least resistance is higher in the red metal as well.

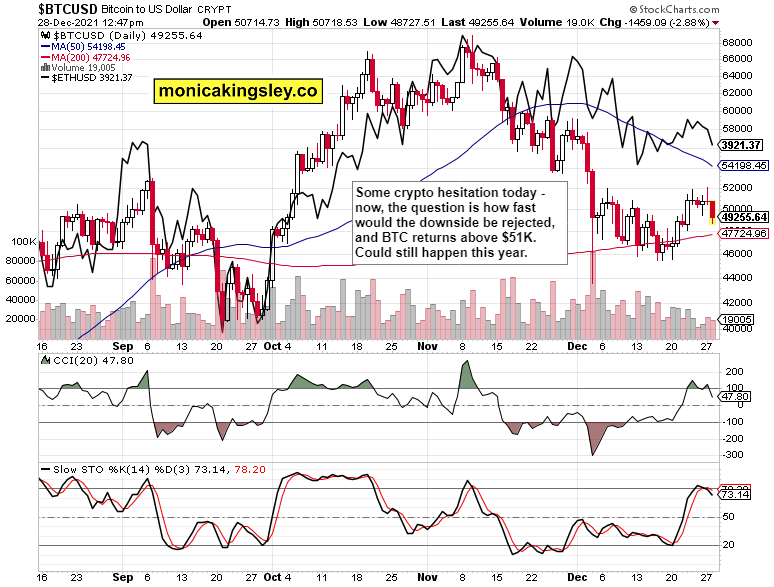

Bitcoin and Ethereum

Bitcoin and Ethereum are foretelling stiffer headwinds than had been the case recently. I don‘t think this is a start of a genuine downtrend.

Summary

Santa Claus rally naturally goes on, and yesterday‘s steep gains are likely to be followed with deceleration today – at least in stocks. Precious metals and commodities are catching up, and we‘re looking at a very positive close to 2021 across the board. The same goes for optimistic entry to 2022 in stocks, precious metals, oil, copper and cryptos alike – in Bitcoin though, I would like to see today‘s lows hold, and Ethereum to spring higher faster than Bitcoin. On a very short-term basis, S&P 500 and oil are extended today, and some trepidation shouldn‘t be surprising. The medium-term trends remain unchanged, and lead higher.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

Updated on

Sign up for ValueWalk’s free newsletter here.