By EXANTE. Originally published at ValueWalk.

Investors have had an interesting year, with Cryptocurrencies dominating headlines. EXANTE’s senior analyst, Victor Argonov, looks back at some of the other key moments in 2021, but also takes a look ahead and gives his views on what could be in store for 2022.

Q3 2021 hedge fund letters, conferences and more

In this report, we will delve deep into what moved the markets in 2021 and discuss what factors are going to be in focus in the early parts of 2022.

Preface

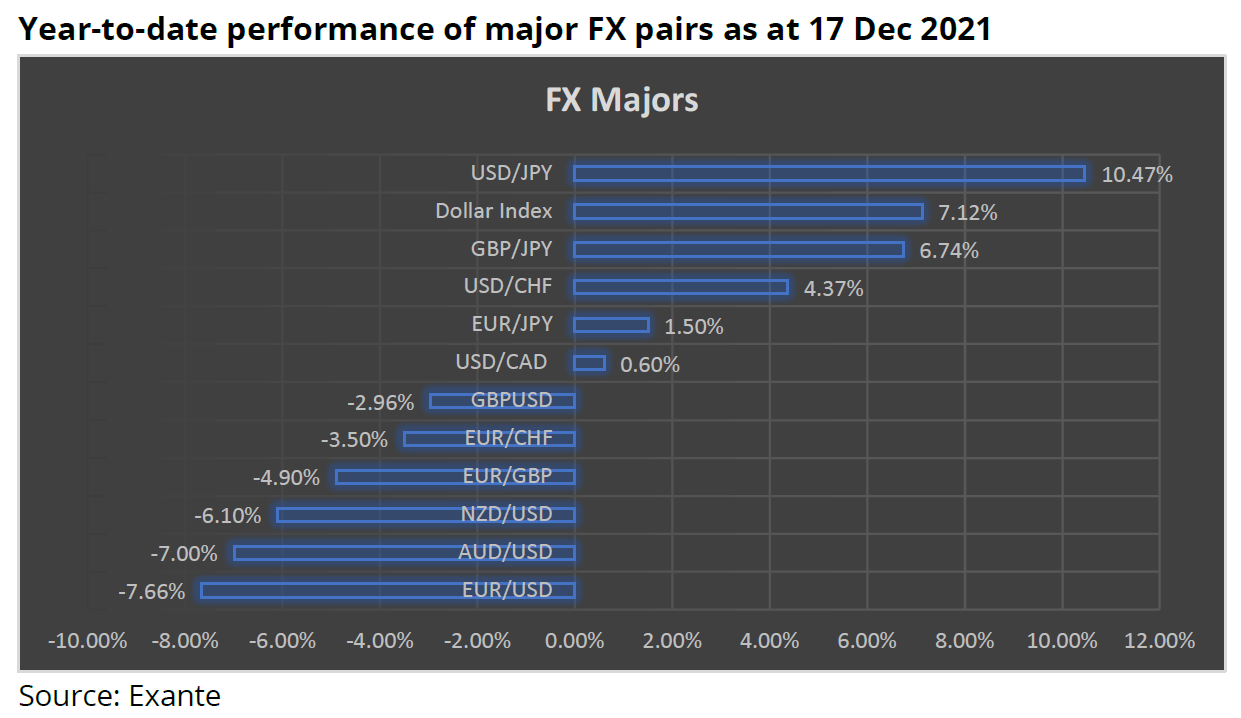

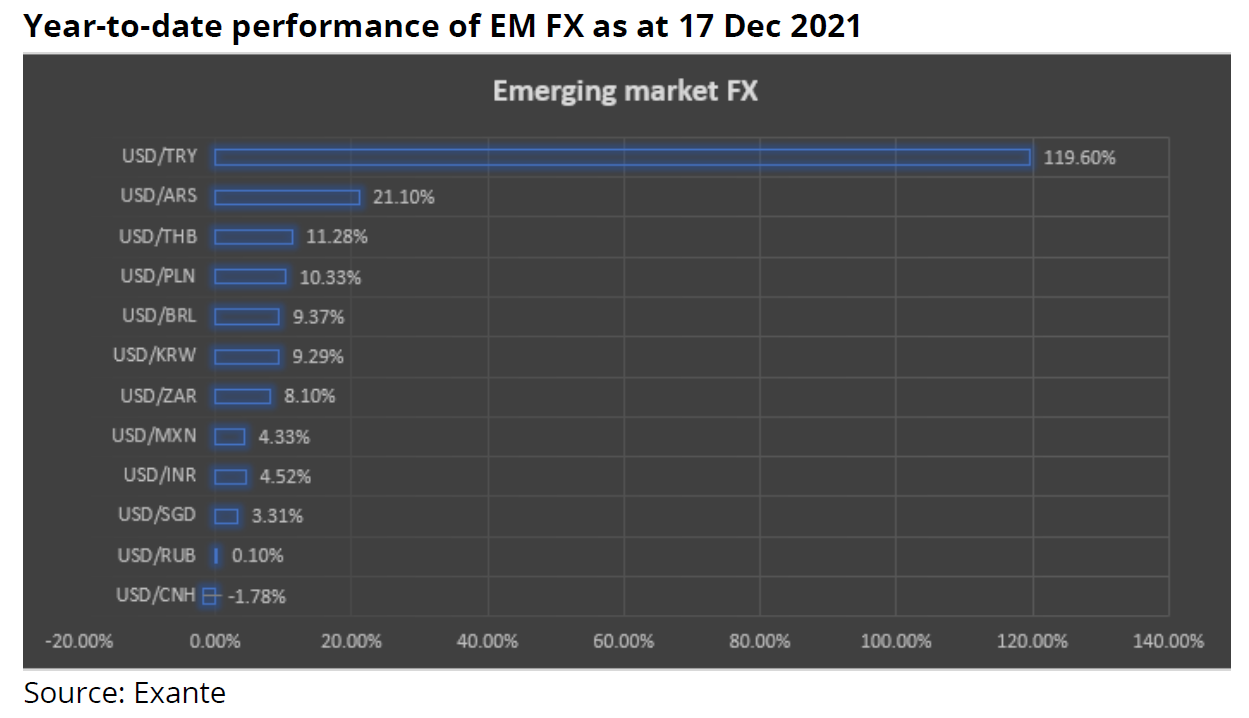

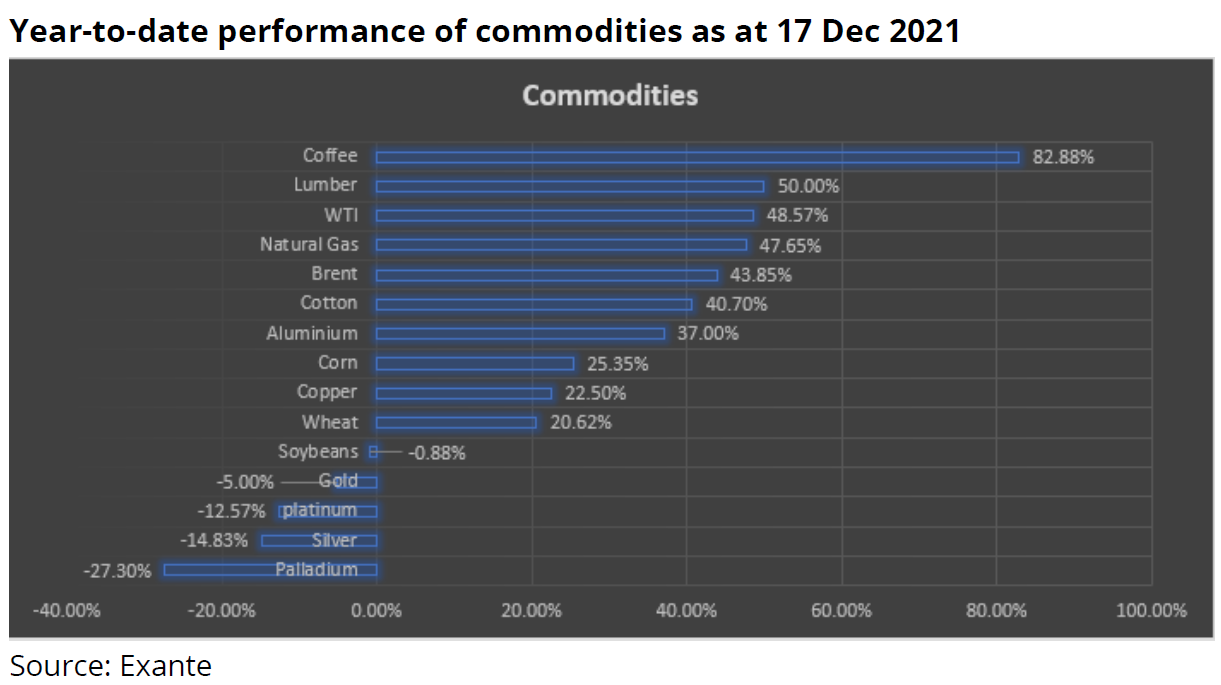

For most of 2021, risk was on the menu. Global equities continued to roar higher with US technology shares once again leading the gains. The US dollar returned to the throne as King of FX, while the yen and euro went in the opposite direction, although their losses were like a drop in the ocean when compared to the Turkish lira. Gold and silver weakened, weighed down by the dollar and rising yields, while most other commodities surged higher, including crude oil and natural gas. But it was not all plain sailing, as inflationary pressures intensified and Covid made an unwelcome return to haunt investors towards year-end. Cryptos eased back in recent months in what has otherwise been another solid year of gains.

Investors face an uncertain economic outlook given the uncertainty caused by Omicron. But we think the new Covid variant is not going to be growth-chocking. Widespread lockdowns, similar to the start of pandemic in 2020, will hopefully be avoided. The world has learned to live with the virus and a bit of restrictions here and there is not going to be a game changer. Indeed, Omicron could even speed up herd immunity given how fast it is spreading. That’s assuming it will not cause severe illness and will remain a mild variant, albeit very contagious.

Another issue that will remain a hot topic is inflation. We think that price pressures will come down, although not very quickly. This means that central banks will tighten their belts further in 2022, which could hold back growth stocks, especially during the early parts of the year.

Stocks

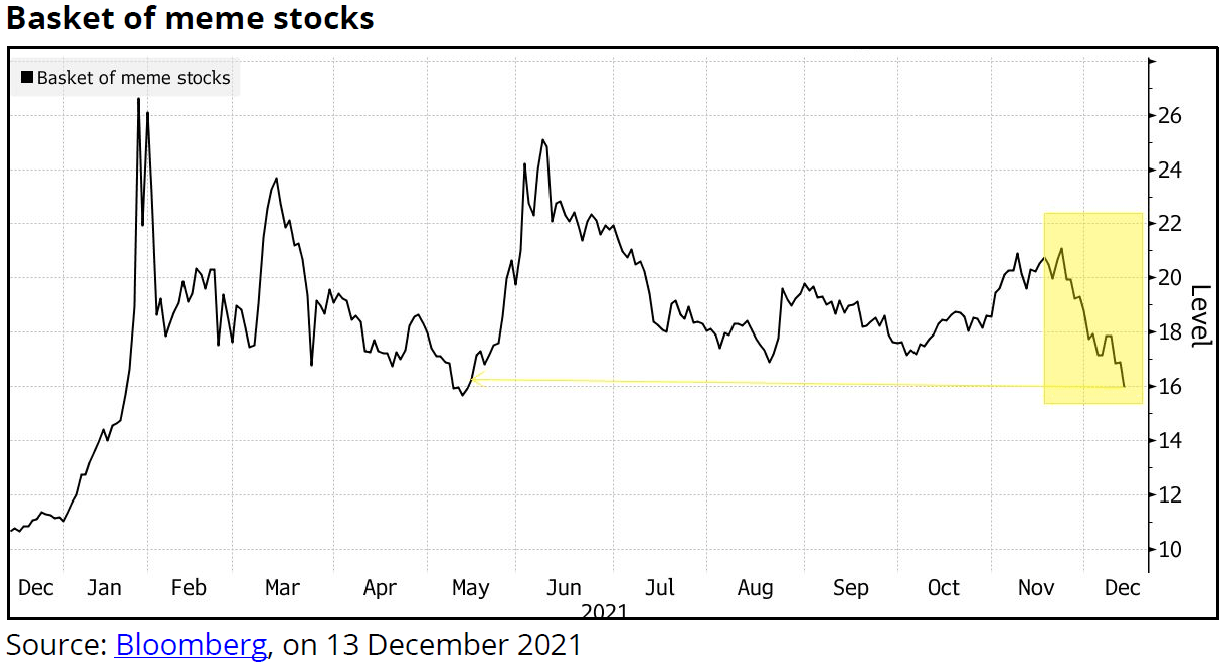

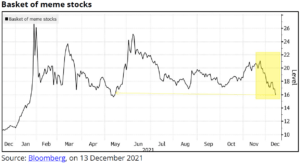

The start of 2021 was filled with optimism. There was a new president in the US and lockdowns were finally coming to an end, as vaccinations against COVID gathered pace which raised hopes that things could go back to normal soon. Investor appetite for stocks was insatiable, especially after a strong performance since after the first quarter of 2020. Not only were they buying every dip they could get their hands on in the racy tech sector but were piling in anything and everything that had momentum or Reddit crowd behind it – such as cryptos and NFTs. Meme coins and stocks surged. But the optimism and appetite for these high-risk assets faded, and towards the end of the year they came under intense pressure.

But the wider markets kept grinding higher. As optimism over a strong economic recovery gathered pace, investors started buying value stocks, as well as technology. By the middle of the year, commodities had surged sharply higher, not least crude oil and natural gas as stockpiles shrunk and demand roared higher. Later, electricity prices hit record levels in Europe. The energy crunch came as supply bottlenecks and other temporary factors all helped to send consumer and producer prices sharply higher across the world. Not to worry, because price pressures were only going to be “transitory,” reassured the Fed and other central banks. So, investors kept buying stocks, sending the US indices to new record highs.

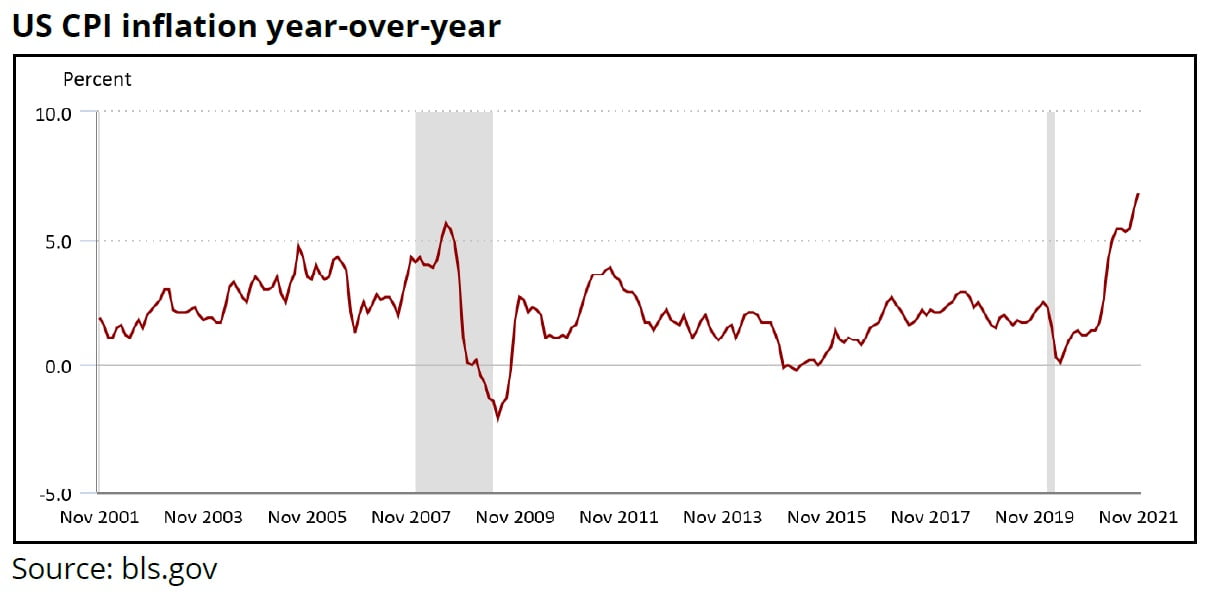

However, the Fed finally admitted it had got its inflation forecast wrong, as prices remained persistently higher than expected. In the US, consumer inflation soared to 6.8%, its highest since 1982, while CPI in the UK jumped above 5%, more than double the Bank of England’s 2% target. Similarly, inflation was overcooked in Germany and Eurozone, as well as many emerging market economies – not least Turkey.

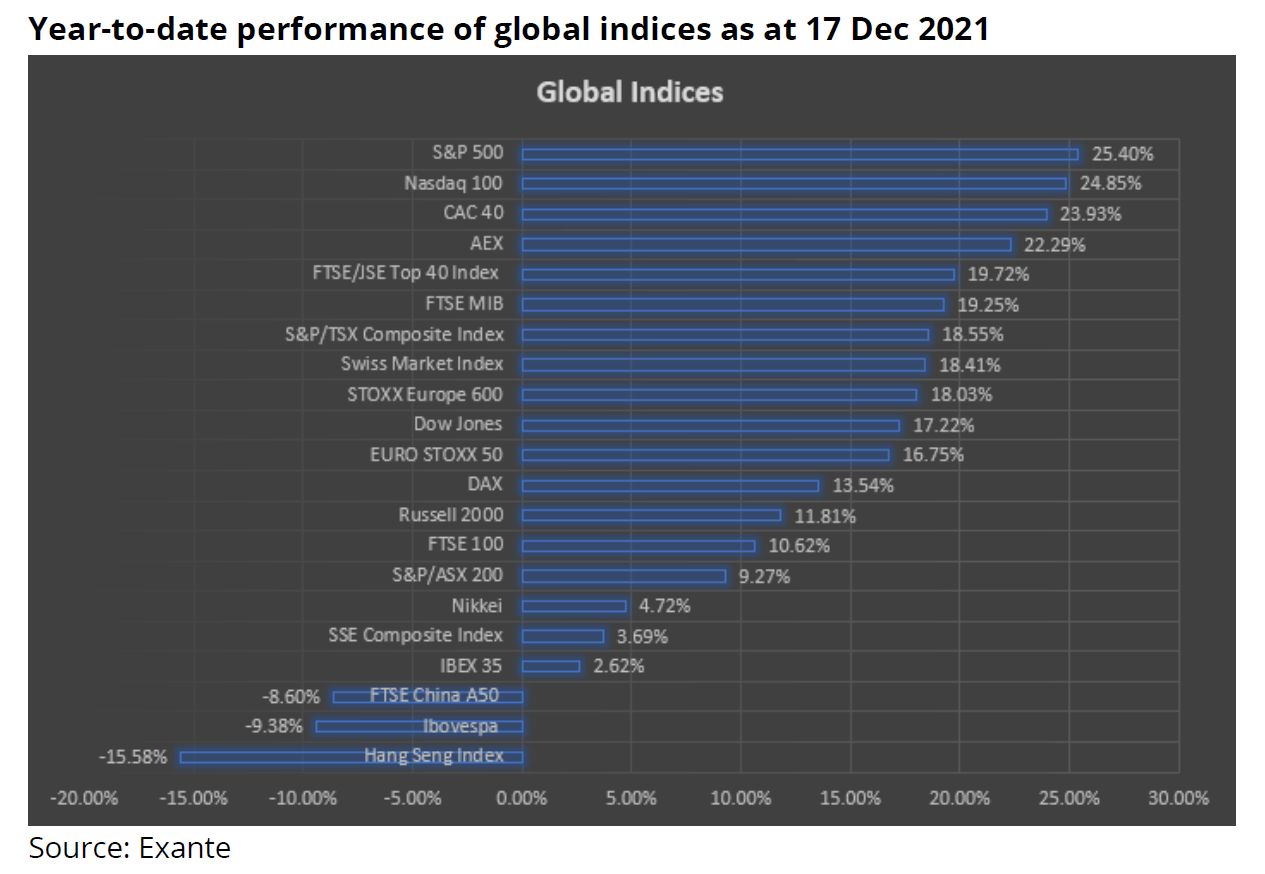

So, the Fed announced in December that it would speed up the taper and the median FOMC projections pointed to three rate increases in 2022. The Bank of England finally raised interest rates by 25 basis points, which was somewhat of a surprise move given that Omicron variant had triggered a fresh wave of restrictions in the country. The European Central Bank also turned a bit hawkish amid the sharp inflationary pressures in the eurozone and other parts of the world. As a result, global equity indices came off their best levels, especially tech-heavy indices such as the Nasdaq. But overall, most indices (excluding China and Hong Kong) remained well in the positive territory:

Looking Ahead

As we approach the end of another eventful year, coronavirus continues to dictate market direction and will likely have a big say in at least the first half of 2022. The pandemic has claimed millions of jobs and lives and was still going strong this late in 2021, even though about half the world has been fully vaccinated. Unfortunately, “fully vaccinated” is still not enough to fully protect against the new Omicron variant of Covid, which is partly why we have seen heightened volatility across risk assets in these latter parts of the year. In trying to contain the highly transmissible Omicron, several Western governments have introduced fresh restrictions and ramped up their efforts to get people a third dose of the Covid vaccine. The restrictions are likely to weigh on economic activity, especially in the services sector.

Equity investors face other challenges too. These include high levels of inflation across the world, tightening of monetary policy from the Fed and other central banks, and the potential for more turmoil in emerging market economies.

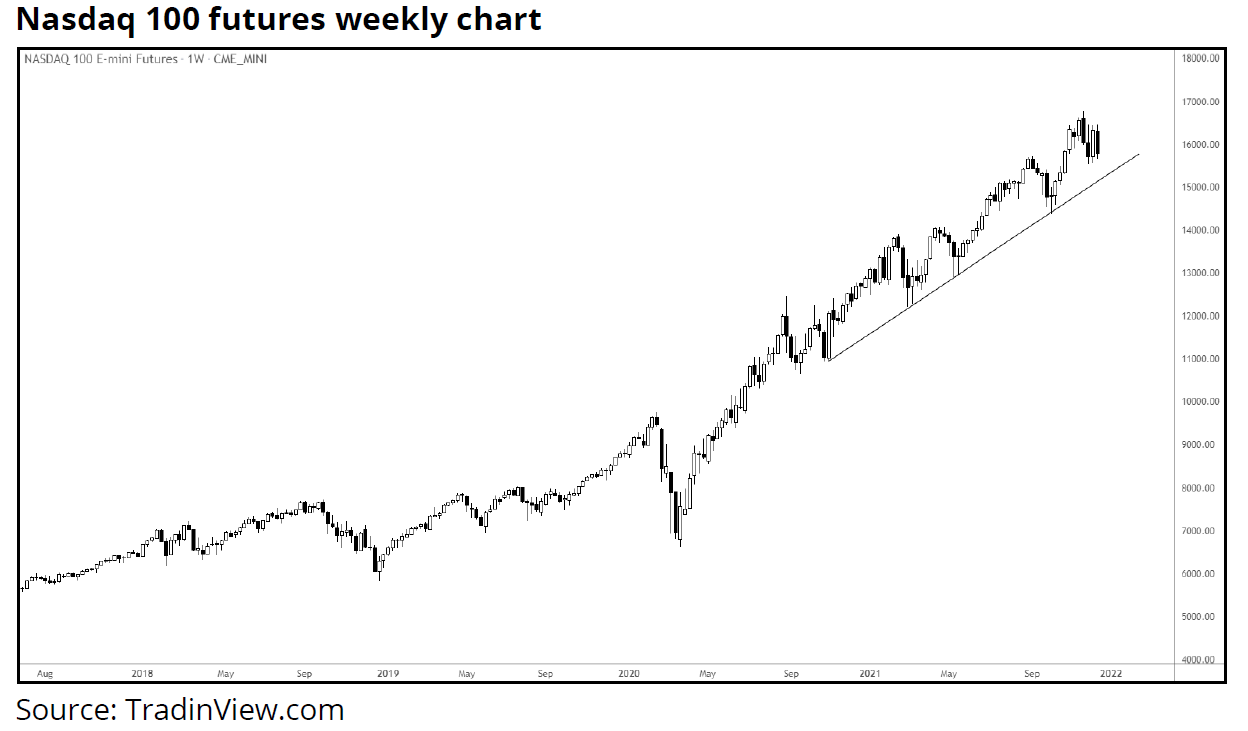

It is therefore not unreasonable to expect some weakness in the overstretched growth stocks in the US technology sector, now that the Fed has indicated it will wrap up bond purchases by March and potentially raise interest rates 3 times in 2022. Concerns over high valuations in the sector may also come to the forefront, especially as we have already seen some insider selling from the likes of Elon Musk of Tesla, Jeff Bezos of Amazon and Tim Cook of Apple.

But the outlook is not all doom and gloom for the markets. While techs may struggle, higher interest rates could help support banks and other value stocks.

Meanwhile, European mainland markets could benefit from a relatively more dovish central bank. The ECB intends to reduce the Pandemic Emergency Purchase Programme (PEPP) in Q1 before ending it by March 2022. The legacy Asset Purchase Programme (APP) will be increased from $20bn to $40bn in the second quarter, before being tapered in stages to the current $20bn in Q4 2022. So, QE will continue in the eurozone, and it is important to note that reinvestments from PEPP will continue until at least the end of 2024. Meanwhile, PEPP could be restarted if deemed necessary by the ECB, should the situation deteriorate.

FOREX

The volatility in FX remained tight on the whole throughout 2021, although there were a few exceptions – especially the Turkish lira, which slumped to repeated all-time lows. In major FX, the yen and euro have been the weakest, thanks to the significantly more dovish central banks of Japan and Eurozone. In contrast, the US Federal Reserve slowly turned hawkish, before completely dropping the “transitory” inflation rhetoric towards the end of the year. By then, the markets had already expected that the Fed would be forced to reduce QE. So, when the central bank finally upped the pace of taper, the dollar fell in immediate reaction. Among the commodity dollars, the Aussie was not helped by prolonged Covid-linked restrictions and lockdowns in Down Under. In contrast, the Canadian dollar held its own relatively well, as it was supported by a strong rebound in the North American economy and firm oil prices. The pound also did relatively well. It had a bright start to the year, as the UK raced ahead with its vaccinations programme. But it then struggled as the Bank of England delayed an expected rate hike when Covid concerns re-surfaced. However, as inflation got too hot, the BoE decided to hike rates by 25 basis points anyway in December when only 10 was expected.

The Collapse Of Turkish Lira

Emerging market currencies also weakened against the dollar, especially those of oil consumer nations or where inflation was very hot. The standout loser was the Turkish lira, which fell to repeated lows as the Turkish central bank was forced by its de-facto leader, Turkey’s President Recep Tayyip Erdogan, to slash interest rates despite runaway inflation and capital flight from the country. The bizarre policy response was met with heavy criticism from both home and abroad, but it fell to deaf ears. Traders saw opportunity – and they pounced.

Looking Ahead

FX investors will be wondering whether King Dollar will remain at the helm in the early parts of 2021, or whether foreign currencies will roar back. A lot depends on inflation and Covid.

If inflation starts to fall back quickly, and we don’t see major Covid-linked lockdowns, then the global recovery should continue. This in turn should keep risk appetite supported, causing commodity dollars to outperform.

But with the Fed ready to tighten interest rates, the downside risks to the US dollar are also limited. Even if risk appetite remains positive, the higher interest rate expectations will draw the attention of yield-seeking investors towards the dollar.

The only reason why the euro might find support is if we see eurozone inflation climb to uncomfortably high levels, causing the ECB to taper QE faster. Otherwise, we don’t expect much appreciation in the single currency.

In EM FX, things could turn from bad to ugly insofar as the lira is concerned, given the government’s attitude towards inflation and interest rates. India will be desperate to see lower oil prices, otherwise the rupee could weaken even more.

Commodities

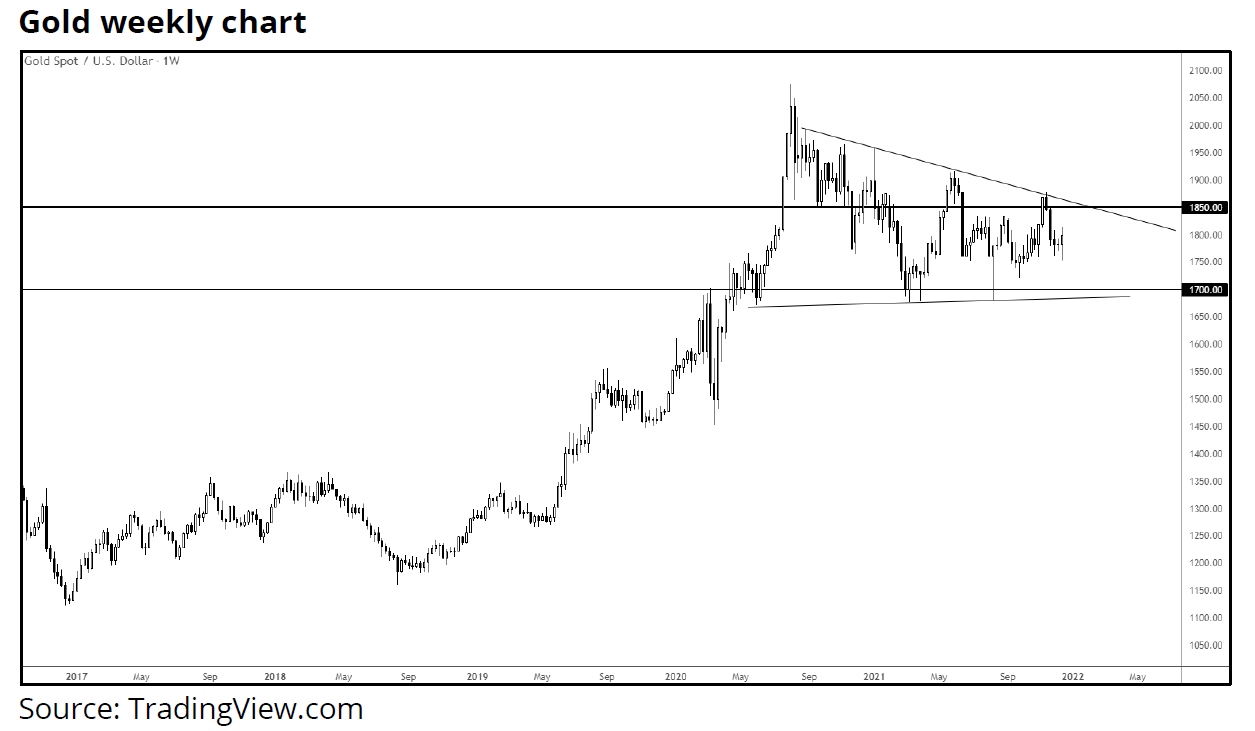

With inflation having soared across the world, you would think that gold would have flourished in 2021. After all, it is deemed by many as the ultimate inflation hedge. We think that part of the reason why it didn’t perform as well as it could have done is to do with the fact cryptos have offered a superior substitute. The other reasons are obvious: strength of the dollar and yields.

Soft commodities roared higher, due to unfavourable weather conditions, strong demand as economies re-opened and prolonged supply bottlenecks. Crude oil, natural gas and electricity prices also benefitted from similar factors. As supply disruptions eased somewhat, so commodity prices eased from their earlier highs. But most still maintained much of their gains heading into year-end.

Looking Ahead

Given how gold struggled in 2021, it is difficult to see why the early parts of 2022 would be much different for the metal. For as long as the dollar remains King of FX, the upside potential is likely to be limited. Policy tightening from major central banks are also likely to discourage gold investment. However, if inflation accelerates in Europe and cause a clear shift in monetary policy stance from the ECB, this could weigh on the dollar and boost the appetite for gold later in the year. The only other key reason why gold might find support is if we see turmoil in the stock markets, which could boost the appeal of the precious metal from a safe-haven point of view. While we certainly expect some weakness in the stock markets, that’s not to say the markets will necessarily tank. It all depends on how the pandemic will evolve.

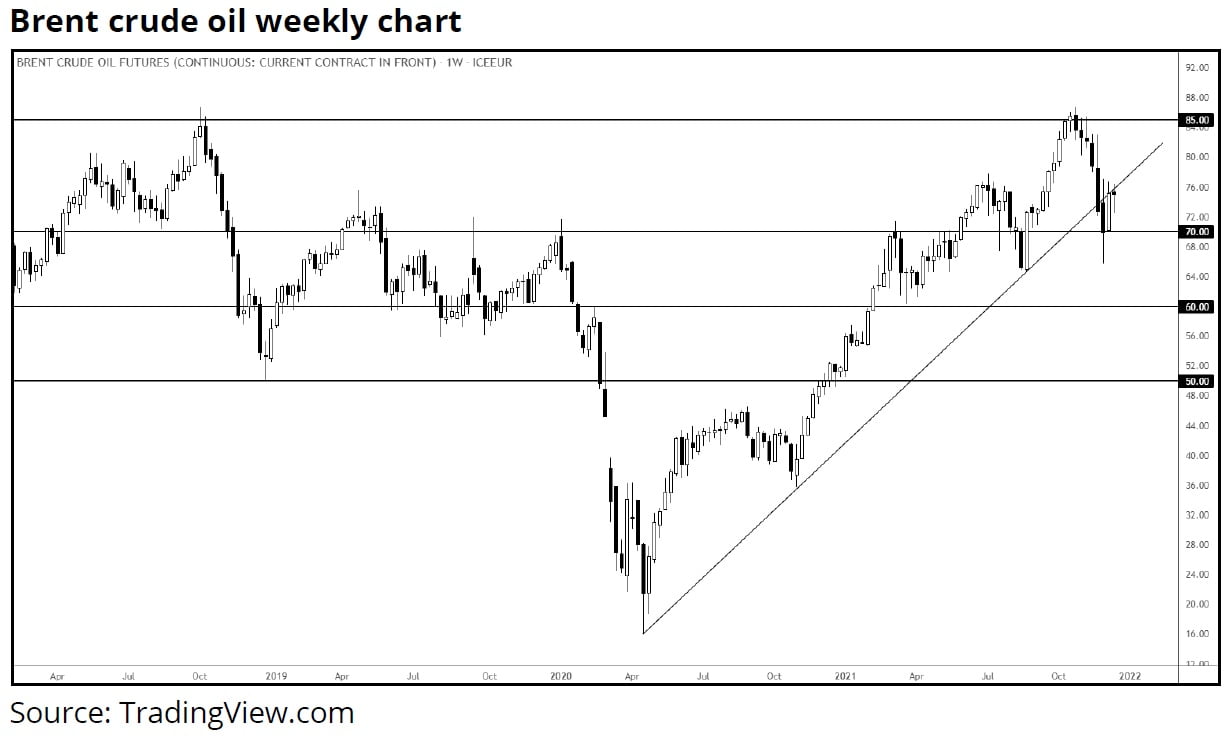

Crude oil faces key demand-side risks, due mainly to the impact of Coronavirus which has made an unwelcome return in recent months. And will gold return to winnings ways in 2022 despite the potential for rate hikes from the Fed and other major central banks?

The list of countries introducing virus-linked travel and other sorts of restrictions have been on the rise. This has the potential to weigh on the economic recovery and hurt demand for things like crude oil. Even so, the OPEC+ is expected to gradually release more oil to the market in 2022, for as long as the worst-case scenario from the pandemic does not play out. Meanwhile, US oil supply is on the rise again. The crude oil market is thus unlikely to remain tight, meaning prices could weaken somewhat.

The early parts of the year might see other growth-sensitive commodities struggle too, amid concerns about the overall macroeconomic backdrop, with Covid-related uncertainty and inflation both remaining high, and central banks being forced to tighten their belts to tackle rising prices. Inflation in the US has already risen to 6.8%, its highest level since 1982 and could remain elevated for a while yet. This is going to eat into consumers’ disposable incomes and could weigh on general risk appetite, including some commodities like copper, expensive technology stocks and cryptocurrencies.

Article By Victor Argonov, senior analyst at WealthTech EXANTE

Updated on

Sign up for ValueWalk’s free newsletter here.