One of my favorite chart guys, Trader Mike, does a far better job with a picture than I can with words of showing you where we are in the markets with this Nasdaq chart. This is the same kind of triangle squeeze we pointed out in weekly chart of the transports back in September just before they exploded up.

The Nasdaq weekly chart also has a bit of the same formation but, like I said on Monday: "Nasdaq 2,475 will not be that impressive but is absolutely necessary for escape velocity." You can see from the wedge above the daily how 2,450 just isn't going to do it!

The Nasdaq, like all stocks, is governed by some pretty simple physics.

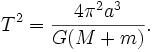

What we have in this chart, along the dotted line, is an actual picture Kepler's third law of motionin action as the Nasdaq forms an elliptical orbit as it attempts to escape. By simply applying the following formula we can see where the Nasdaq is going:

- T = time since the last crash

- a = total number of points gained

- G = bearish sentiment + bad news

- M = total value of the global market

- m= total value of the Nasdaq

In absence of new fuel (inflows), we can expect some sideways drift – something has to change in the formula (kidding about being able to predict where we are going by the way!) for us to break orbit.

Time acts as a pull, the longer it takes the more points you need to gain to make it impressive. We already know bearish sentiment is very lowso we are unlikely to make progress there and as the global markets and the Nasdaq expand (M+m) it means you need A LOT more inflow (a) just to maintain your ellipse.

To help explain this further I will liberally plagiarize Wikipedia's excellent article on Plantetary orbitsand change it to apply to an IPO:

As an illustration of the orbit around a planet (eg Earth), the much-used cannon model may prove useful (see image below). Imagine a cannon, which we will call Goldman Sachs, sitting on top of a (very) tall mountain (their money and influence), which launches an IPO. The price needs to be set (height) with enough play left in the stock to give it a strong start (trajectory) but it all comes down to how much fuel (inflows) you have as a miscalculation can cause you to crash at various levels.

While a company launch is very much under their control at the outset, once they fire, and at that point the best they can do is give it some occasional spin as it goes by.

If the IPO is launched with insufficient funding + earnings, the trajectory of the stock will curve downwards and crash(A). As the firing velocity, which, for an IPO comes in the form of more cash, better press, Cramer pumps, strong fundamentals… is increased, the stock will hit the ground farther (B) and farther (C) away from the time of the IPO, because while the ball (in the cannon example) is still falling towards the ground, the ground is curving away from it (see first point, above). Think of this as the rising tide of the market lifting all ships away from zero.

If the stock is launched with sufficient velocity, the ground (zero value) will curve away from the stock at the same rate as the positive inflows stabilize — it is now in orbit (D). The orbit may be circular like (D) or if the velocity is increased even more (through better earnings, a successful secondary offering, more spin ad pumps), the orbit may become more (E) and more (F) elliptical. At a certain even faster velocity (called the escape velocity) the motion changes from an elliptical orbit to a parabola, and will go off indefinitely and never return. At faster velocities, the orbit shape will become a hyperbola.

An example of a stock that went pretty much hyperbolic is Google as it gained 200% it's first year:

Obviously this does not happen very often and one of the reasons is that Goldman's job is to calculate the load (IPO revenues) that can be carried and try to load up as much as possible while leaving just enough room in the price to achieve a good, solid orbit.

And you thought they just make these prices up didn't you?

We can see from Google how a stock moves from one orbit to another but, if you look at the earth image you can see the danger in the higher orbits.

As you move up from one orbit to the next, you may not realize it but at some point, called the periapsis, you will get just as close to the bulk of the market (the earth) as you did when you were in a lower orbit!

We all know the axiom, the higher they climb, the farther they fall and that is very true for us as we rarely leave the earth but most stocks do achieve a fairly comfortable orbit and can remain above zero forever.

![]()

While that may seem like an obvious statement, think about how much of your thinking is clouded by the belief that things MUST come back to where they started..

When you are in D, where most stocks are, you will tend to move along with the markets (the curve of the earth) unless you are affected by an outside influence (changes in the business, sentiment on your company or sector, Cramer…). This is part of Newton's first law of physics: "A body in motion tends to stay in motion."

Positive market news, a mad money pump or (heaven forbid) actual fundamental improvements in the business can give you the fuel to get into a higher orbit while negative news, declining fundamentals, a mad money dump… can drop you into a lower orbit.

While few stocks crash and burn, the heat that is felt by the investors as the orbit takes you closer to the atmosphere of below average market performance is more than many people can stand so they bail out.

When we see people bailing out we have 3 basic choices:

- We lose faith in our ship (stock) and our captain (the CEO) or we can believe the pull of the earth (the whole market going down) has become so severe that we decide to jump with them.

- We can maintain our faith (or maybe we are just scared of not getting a refund for our aborted ride (taking a loss)) and hold on tight.

- We can trust our ship and our captain and buy the other guy's empty seat (doubling down or accumulating on the dips).

Before we decide we'd better be sure of our physics!