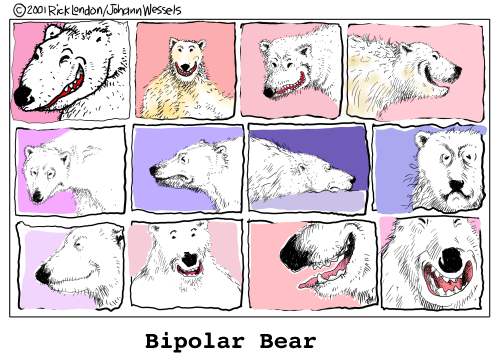

For quite some time we’ve been discussing the manic-depressive nature of the markets.

Today our futures are looking on the bright side of life depite another 1.5% drop in Asian markets, a tentative open in Europe as their financial sector comes off the worst overall quarter since 1990. Oil is persistently high, the dollar is dead and food and metals are continuing to spur inflation pressures worldwide. Wall Street’s worry, Obama, is surging in New Hampshire (many pundits said his Iowa victory was a catalyst for last week’s dip), office vacancy rates are rising rapidly, 2.8M workers have been cut from full to part-time positions and, unlike our President, who get’s on TV and lies to us, British Prime Minister Gordon Brown goes to work on a Sunday in order to warn his people that Britain’s economy faces a “dangerous” year ahead as he battles against rising energy prices and higher pay awards that he fears could undermine his pledge to “break the back of inflation”.

Brown told the BBC’s Andrew Marr: “Government ministers must have a rate of pay increase that is below 2 per cent: 1.9 per cent. At the same time, my recommendation is that that is what goes for MPs.” Although MPs vote on their own pay and many will be furious at being told to reject a proposed 10 per cent rise over three years – recommended by an independent review body – they know they will be fiercely criticized if they do not show restraint.

Brown told the BBC’s Andrew Marr: “Government ministers must have a rate of pay increase that is below 2 per cent: 1.9 per cent. At the same time, my recommendation is that that is what goes for MPs.” Although MPs vote on their own pay and many will be furious at being told to reject a proposed 10 per cent rise over three years – recommended by an independent review body – they know they will be fiercely criticized if they do not show restraint.

Restraint? Well, we all know who put the manic into this economy don’t we? Irrational feelings of superiority, unrealistic positive outlooks, grandiose delusions, irritable behavoir when your views are challenged, a distracted demeanor, a stream of half-baked ideas… These are all signs of the manic side of bi-polar disorder.

There’s a saying about what happens when the inmates run the asylum and we turned over the keys long ago and we now reap the economy we have sown. That being said though, we just need to see these depressive cycles, like last week’s, for what they are and embrace the madness of the markets as they spring back today for essentially the same reasons that they sold off last week.

As I said in this weekend’s wrap-up, the technical indicators on our market are just awful and I have little to add to what I said last Tuesday in our index round-up. We’ll be putting up Tom2oc’s Quarterly Technical Outlook later today on the member site along with my fundamental notes but the short story is we are in very dangerous waters IF we continue down from here but I’m holding out hope that our manic phase can take us back to 13,300 so we can get back to some healthy consolidation while earnings help separate the wheat from the chafe.

We stand very ready to buy and I’ll direct members to go to comments on our weekly wrap-up where Ali had two great picks we are going to turn into plays. Another play I’m looking at today is CMP, who came down nicely after running away on us last month. This is another Ag play like POT but they have the winter bonus of being a major supplier of salt used to clear roads. It’s already been a hell of a snowy winter and they pay a 3% dividend so I like the Jul $40s at $3.50, and we’ll look to sell the $45s for $1 on a good run.

For today’s action, we’re going to have to play this crazy market by ear – but that’s what famous bi-polar artist Vincent Van Gogh said he would do and look what happened to him!

For today’s action, we’re going to have to play this crazy market by ear – but that’s what famous bi-polar artist Vincent Van Gogh said he would do and look what happened to him!

We’re going to be looking for AT LEAST a 50 point gain to 12,850 for an indication that we may reverse Friday’s drop but I’m far more concerned with making up 120 points (to 12,920) that would constitute a weak bounce off last week’s losses. Anything less than this and we’ll be shorting into the "rally" and I’m not going to feel comfortable at all until we see 13,160 agian on the Dow and 1,450 on the S&P. Nasdaq leadership is a must and 2,600 needs to NOT be a barrier on the way back up.

We need oil to stay under $100 and a slow drift to the low $90s would be preferable. $10 a barrel puts over $1Bn a day back into the hands of global consumers and will make the difference between an economic slowdown and a recession. As I said over the weekend, it’s up to OPEC to save us because our own leaders don’t seem to have a clue.

Be careful out there!