"I don’t have to tell you things are bad. Everybody knows things are bad. It’s a depression. Everybody’s out of work or scared of losing their job. The dollar buys a nickel’s worth; banks are going bust, and there’s nobody anywhere who seems to know what to do, and there’s no end to it.

"I don’t have to tell you things are bad. Everybody knows things are bad. It’s a depression. Everybody’s out of work or scared of losing their job. The dollar buys a nickel’s worth; banks are going bust, and there’s nobody anywhere who seems to know what to do, and there’s no end to it.

We know the air is unfit to breathe and our food is unfit to eat. And we sit watching our TVs while some local newscaster tells us that today we had fifteen homicides and sixty-three violent crimes, as if that’s the way it’s supposed to be! We all know things are bad — worse than bad — they’re crazy. It’s like everything everywhere is going crazy, so we don’t go out any more. We sit in the house, and slowly the world we’re living in is getting smaller, and all we say is, "Please, at least leave us alone in our living rooms. Let me have my toaster and my TV and my steel-belted radials, and I won’t say anything. Just leave us alone."

Well, I’m not going to leave you alone. I want you to get mad! You’ve gotta say, "I’m a human being, goddammit! My life has value!"

It remains to be seen today whether or not our stocks have any value. If you click on the link above, what is scary is how little things have changed in the past 30+ years, when Network came out, around the tail end of the Watergate era. These were my formative years so you’ll have to excuse my lingering distrust of government but what else can you say about the crisis, not of finance, but of leadership that is plunging this nation into despair.

It remains to be seen today whether or not our stocks have any value. If you click on the link above, what is scary is how little things have changed in the past 30+ years, when Network came out, around the tail end of the Watergate era. These were my formative years so you’ll have to excuse my lingering distrust of government but what else can you say about the crisis, not of finance, but of leadership that is plunging this nation into despair.

About 10 years before Watergate, John F. Kennedy told us we were great, that our nation could accomplish anything – even going to the moon, if we set our minds to it – if we focused on a goal and set our minds towards accomplishing something important. Yesterday I laid out a simple and relatively cheap way to immeditely address the mortgage crisis – all it takes is the will, the way has never been a problem.

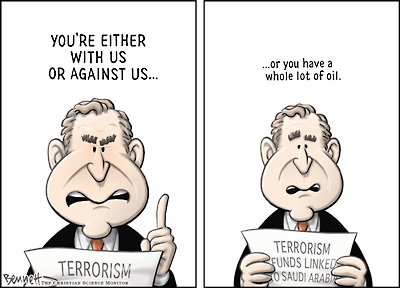

Bush, Paulson and Bernanke offered no solution last week other than more rate cuts and more tax rebates, the same thing that hasn’t worked in the past and, arguably, caused the current crisis. Giving $800 to the nation’s top 60% of all taxpayers in April is going to do very little to help 7,000 families a day who are being foreclosed, other than perhaps paying for the moving van! You don’t need congressional approval to release oil from the SPR. In winter of 2000, Bill Clinton released just 30M barrels of oil from the SPR when prices spiked to what was then considered a ridiculous $37 a barrel and he knocked to price down to $27 a barrel within two weeks. A 25% reduction in oil prices would save the average American family roughly $75 a month – that money would come NOW and would not need to be taken out of the treasury and would benefit even the poorest of us, not just the top half.

Unfortunately, the President is instead expending his energy defending his decision to ADD 1.9M barrels to the reserve in January: "I’m not sure that’s going to have much of an effect anyway when you think of the total supply of crude oil consumed on a daily basis and the rate at which the SPR is being filled up," Bush told Reuters in an interview.

Unfortunately, the President is instead expending his energy defending his decision to ADD 1.9M barrels to the reserve in January: "I’m not sure that’s going to have much of an effect anyway when you think of the total supply of crude oil consumed on a daily basis and the rate at which the SPR is being filled up," Bush told Reuters in an interview.

This will not stop until YOU get mad!

On my site this weekend someone said that the death toll of 4,000 US troops in Iraq wasn’t so bad because it’s not much worse than the murder rate in several cities. One unacceptable situation cannot excuse another! We MUST NOT accept despair as the stasus quo – not in this country, not ever!

Despair has certainly gotten it’s grip on the Asian markets with an 8.65% drop (2,061 points) in the Hang Seng last night. You need to put this in context as no single stock may drop more than 10% before trading is halted so we’re just lucky the day ended there! The market did take a 750-pont bounce after lunch, but it more than reversed into the close. The Nikkei had no such indecision and simply dropped 752 points (5.7%) with only a pre-lunch bounce before finishing at the day’s low of 12,573, down 31% from it’s July top.

![]() The Bank of China may take a $2Bn sub-prime hit, quite a bit higher than the $322M it had set aside when they announced a provision last quarter, this calls into question the reliability of Chinese banks in general, never a good thing. "We don’t have a good read on the value of mortgage holdings at Bank of China and other Chinese lenders", said Charlene Chu, a senior director at Fitch Ratings China. "The lenders have not been transparent about the ratings on the mortgage securities they own."

The Bank of China may take a $2Bn sub-prime hit, quite a bit higher than the $322M it had set aside when they announced a provision last quarter, this calls into question the reliability of Chinese banks in general, never a good thing. "We don’t have a good read on the value of mortgage holdings at Bank of China and other Chinese lenders", said Charlene Chu, a senior director at Fitch Ratings China. "The lenders have not been transparent about the ratings on the mortgage securities they own."

Europe actually is recovering slightly from its morning lows but can quickly turn back down if our opening looks scary, with scary being a relative term since the futures show the Dow down 500 points at the open, testing our 20% line already. Over the weekend we discussed the 5% rule levels we will be looking for and those are the points where I will become concerned about another leg down but, if we can’t retrace more than 20% of our opening drops today – the best defense will be a big defense or cash as it will be very likely that we drop another 5% this week.

Hank Paulson is about to address the US Chamber of Commerce (8:00) and actually has the nerve to be coming on TV to STILL say that there is no current plan but they intend to discuss it in Congress and hopefully will have "something" on the table before spring. Oh wait (8:19) FED CUT FED CUT PARTY TIME EXCELLENT – WOO HOO…. What madness, this is nice but SO WHAT! If you were freaking out about your positions – do what you wish you would have done on Friday, don’t assume this will change everything, it’s just a band aid on a severed limb. It’s a big cut and it should help but is it enough? What does it change? Nothing but it might give us a chance to reposition. Let’s remember that the Fed gave us a huge rate cut on 9/17/01 (the first day the market reopened after 9/11) and we dropped another 10% over the next 5 sessions before turning around!

Hank Paulson is about to address the US Chamber of Commerce (8:00) and actually has the nerve to be coming on TV to STILL say that there is no current plan but they intend to discuss it in Congress and hopefully will have "something" on the table before spring. Oh wait (8:19) FED CUT FED CUT PARTY TIME EXCELLENT – WOO HOO…. What madness, this is nice but SO WHAT! If you were freaking out about your positions – do what you wish you would have done on Friday, don’t assume this will change everything, it’s just a band aid on a severed limb. It’s a big cut and it should help but is it enough? What does it change? Nothing but it might give us a chance to reposition. Let’s remember that the Fed gave us a huge rate cut on 9/17/01 (the first day the market reopened after 9/11) and we dropped another 10% over the next 5 sessions before turning around!

Our priorities as far as our long calls go is to roll them longer. Yes we’d like to reposition to a lower strike but just as important, perhaps more so, is to buy ourselves more time and give the market a chance to show us a true bottom. Do not be shy about covering, if the market goes up and our callers are in the money, it is a much lesser problem (assuming we have a good time spread) than a continued downturn.

I do believe we will hold our 20% levels (see yesterday’s Big Chart) and bounce slightly off there, but less than a 20% retrace of today’s drop will be an almost certain signal of more pain to come. If I told you on Friday the Fed would cut .75 on the Funds Rate and the Discount Window, would you have guessed we’d open down 400 points? It’s very scary out there, be careful does not cover it!