Jobs, jobs, jobs?

Jobs, jobs, jobs?

Expectations are for 350,000 jobs lost in November and a 6.8% unemployment rate, we'll find out at 8:30 how bad the damage is but the Congressional hearings did not give investors the warm fuzzies yesterday and the market already hit our mid-point levels ahead of what is widely anticipated to be one of the worst jobs numbers in US history.

Our last Non-Farm Payroll report was Nov 7th and the Dow fell from 9,650 on the 5th to 8,695 on the 6th, ahead of that number, which was a then shocking 240,000 jobs lost with unemployment moving from 6.1% to 6.5%. 10.1M Americans are considered unemployed as of that last report and, although wages were up 3.6% from last year for those lucky enough to have jobs, the CPI-U (the urban index, which is a slightly more realistic indicator) was up 5.3% meaning even the people who were working were falling behind. Economically, the 1.7% gap in wages to expenses for workers is no different than another 3M paid jobs being lost in terms of the loss of consumer spending, which makes up 70% of our GDP.

On the bright side, those numbers are reflective of October, when oil averaged $75 a barrel and began the month at $100. Gasoline has dropped 35% over the same period and our average cost of a barrel of oil in November was $58, a 23% reduction in fuel costs. This may not seem like much but the average worker earns $28,000 and drives 1,250 miles a month and buys 62 gallons of gas. Saving just $1 these is 2.6% of their total salary and about 4% of their take-home pay and over 15% of their disposable income. 200M workers getting $62 a month is $148Bn a year in economic stimulus.

This economic crisis began as runaway fuel prices took twice that much OUT of consumers hands at $4 a gallon. Then, of course, we have whatever percent of the fuel savings trickle down in heating and electricity costs as well as lower costs that are (ha ha) passed down to the consumers from manufacturers. Factor in the direct benefit of other falling commodity prices, especially food and we are talking about putting well over $30Bn a month back into the hands of consumers – that is like creating 12M $28,000 jobs!

This economic crisis began as runaway fuel prices took twice that much OUT of consumers hands at $4 a gallon. Then, of course, we have whatever percent of the fuel savings trickle down in heating and electricity costs as well as lower costs that are (ha ha) passed down to the consumers from manufacturers. Factor in the direct benefit of other falling commodity prices, especially food and we are talking about putting well over $30Bn a month back into the hands of consumers – that is like creating 12M $28,000 jobs!

Of course this is small comfort to those who do not have a job at all but it's important to realize there is a bright side to all this doom and gloom deflation talk. We are having deflation because prices had spiraled out of control, because the IDIOTS at Goldman Sachs told their clients that, not only would you continue to pay $100 a barrel for oil but that you, the consumer, were somehow magically going to come up with another $100 a barrel and start paying that (see my March article "$200 Oil – Who's Going to Pay For It?" where I predicted this house of cards would collapse). So they put buy recommendations on oil companies at the top and those companies drove up the price of rigs and rig companies bought steel and the steel companies drove up the price of shipping and the shipping companies charged more to the farmers and the farmers passed it along to you and you didn't protest because your XOM stock went from $60 to $90 and you felt rich.

Unfortunately, GS has more followers than I do and I got killed betting oil would go down from $110 in March as it instead made it halfway to Goldman's goal before people became sane so keep this in mind when I tell you that I now believe things are much better than they look from the data as spun by the MSM. Just as we had many misleading economic figures on the way up, we have many misleading signals on the way down. I have been saying for quite some time that the energy and commodity sectors are like a cancer on the markets, that has been sucking healthy investment dollars away from companies that create jobs and innovate for our future and put them into the hands of speculators, who create nothing but high prices and pain for the average global citizen.

Unfortunately, GS has more followers than I do and I got killed betting oil would go down from $110 in March as it instead made it halfway to Goldman's goal before people became sane so keep this in mind when I tell you that I now believe things are much better than they look from the data as spun by the MSM. Just as we had many misleading economic figures on the way up, we have many misleading signals on the way down. I have been saying for quite some time that the energy and commodity sectors are like a cancer on the markets, that has been sucking healthy investment dollars away from companies that create jobs and innovate for our future and put them into the hands of speculators, who create nothing but high prices and pain for the average global citizen.

There is no economic benefit derived to anybody in the bottom 99.5% of society when the cost of food and fuel for 6.6Bn people doubles. You get the same distance out of your car, the same amount of electricity, the same amount of rice – only you pay more for it. As I outlined above, the rising cost of base commodities caused cascading rising costs along the supply chain and the only person who really gets rich is the person who bet the commodities would rise – the rest of us just pay for it. It's the ultimate "trickle up" scam, just as I outlined in Real Estate when I wrote the "The Dooh Nibor Economy" way back in June of 2007. So the housing bubble is collapsing and the commodity bubble is collapsing – GOOD! Deflation is good for people who haven't had a proper raise since 2000 as their bosses keep pointing to the bogus CPI numbers and tell them they don't really need one. Next time the pundits tell you to invest in a "jobless economic boom" for the long term – keep in mind that this is the inevitable end game…

So they conned 100M American families into believing there was no inflation and that their 401Ks would fund thier retirement so they shouldn't complain about getting low wages while the wealth gap in this country reached record levels and they dangled low-interest loans and put many of these people into homes (and cars) they couldn't afford by telling them it was an "investment." That turned out to be slightly less than true and here we are bailing out the crooks who orchestrated this con rather than the victims. I sincerely believe that will change in January and, if it doesn't – I will be turning a lot more bearish but, for now, I see the makings of a recovery as we can keep people in their homes and we can create jobs IF the government has the will to do so. Combine that with 12M jobs worth of lower commodity prices and we do have what we need to put in a firm bottom here (8,200) and work towards a recovery.

Now it's 8:30 and we have a DEVASTATING 533,000 jobs lost in November and unemployment is 6.7%. October Job losses have been revised UP ANOTHER 130,000. Unemployment would have been much worse but 422,000 people "left the labor force" – in other words they have given up trying and therefore are no longer counted as unemployed. This is the worst jobs number since 1974, when another oil spike destroyed people's disposable income and caused a recession. We'll see how low the market gets pushed on these numbers and we'll be looking for 8,200 to hold on the Dow, 820 on the S&P, 1,400 on the Nasdaq, 420 on the Russell and 5,000 on the NYSE. In light of the Jobs numbers, holding these levels will only serve to firm up our view that we have finally priced in this economy and the markets are beginning to look ahead.

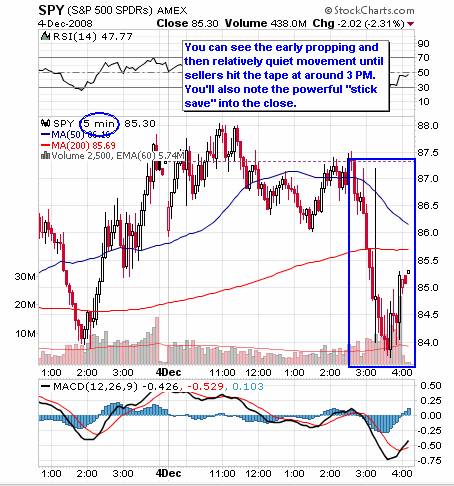

Fortunately, we were prepared for this yesterday as the market slammed right into the upper levels of our range and pulled back. We were not at all fooled by the late rally and, in fact, I said to members that David Fry would call the late rally a "stick save" and here's his S&P chart showing exactly what we were talking about.

Fortunately, we were prepared for this yesterday as the market slammed right into the upper levels of our range and pulled back. We were not at all fooled by the late rally and, in fact, I said to members that David Fry would call the late rally a "stick save" and here's his S&P chart showing exactly what we were talking about.

Our last trade of the Day, at 3:25, was the ultra-bearish FXP $50s at $7.75, "just in case" we got a bad jobs number and the world went into a tailspin. I think we may keep this one as weekend protection even though China had a good morning. I had said in the afternoon that I was not that unhappy with the sell-off as we were being led down by the commodity pushers and with oil testing $42 this morning, I'm still not too unhappy. So the pyramid scheme collapsed and the con men running it (BSC, CFC, LEH, GS, MS, ICE…) have either been shut down or are on the run and now we have to deal with the aftermath but it doesn't mean the world is going to end. PEOPLE WILL BUY SOCKS! Babies will be born, they will need diapers. Women will wash their hair with two things while men will continue to be happy with one. Razors will need to be replaced as will tires and somewhere in America, one day, a couple of kids will go to the movies – these are my bold predictions for 2009. An asteroid did not hit the earth and George Bush is no longer President so I'm not throwing in the towel just yet but, then again, I was 6 months too early on oil, which is why we are hedging!

If we do hold our levels, please refer to my Monday post: "Stocks to Buy at the Bottom," where I listed my 36 top stock picks to be entered using our hedged system that, with today's goosed VIX, should give us an additional 20% discount on our entries. We still have the Senate hearings on the Auto Industry to get through and, as I said in chat yesterday, it's a pointless circus as Congress has no choice but to bail them out or today's job losses will seem like a walk in the park compared to what will happen in Q1.

If we do hold our levels, please refer to my Monday post: "Stocks to Buy at the Bottom," where I listed my 36 top stock picks to be entered using our hedged system that, with today's goosed VIX, should give us an additional 20% discount on our entries. We still have the Senate hearings on the Auto Industry to get through and, as I said in chat yesterday, it's a pointless circus as Congress has no choice but to bail them out or today's job losses will seem like a walk in the park compared to what will happen in Q1.

As I mentioned, the Hang Seng jumped 2.5% this morning and the Shanghai added 1% while the Nikkei was flat into the weekend. The con team of oil companies and financials led the losers but food and other commodities bounced back somewhat as China has indicated they will take steps to keep 1.3Bn consumers fed and clothed. Also, Jim Rogers is running around pushing commodities to anyone who will give him some air time – expect that to continue into the weekend. Also encouraging for China is Paulson's pledge to join with China to provide $20Bn in trade financing, aiming to help ease the squeeze in credit markets that has made it harder to buy and sell goods across borders. You really should read this article as we got nothing from China, it looks like they took us to the proverbial cleaners in this week's negotiations.

According to a Chinese official who summarized his remarks for reporters, central bank governor Zhou Xiaochuan advised the U.S. to speed up adjustments to its domestic economy and raise the savings rate, in order to deal with problems of excessive consumption and debt that helped lead to the financial crisis. Chinese officials, including Mr. Wang, also pressed the U.S. to protect China's investments in the U.S., which include upwards of half a trillion dollars in Treasury bonds. And while the U.S. pushed China to continue appreciating its own currency, China argued that the industrialized nations should be stabilizing the values of major currencies like the U.S. dollar, euro and yen to reduce global financial turbulence.

EU markets pushed through the 2.5% line to the downside, doubling their losses of the morning once they heard our jobs numbers. Commodity pushers were already dragging down the markets and Brent crude is looking to test the $40 mark – certainly by next week.

We'll see if we hold our lower levels this morning, XOM and CVX are still very heavy shoes to drop on the Dow and BA is now rumored to be postponing 787 deliveries by six months so there is plenty of fuel to take us below 8,200 and holding it will actually be impressive. We'll have to play it by ear and see how real the buyers look if we get back to 8,400 and anything above that I'm pretty sure we'll be shorting into ahead of the weekend. Keep in mind that we finished December 1st at 8,149, a pullback we didn't mind after the Thanksgiving week run from 7,500. We can afford one more test but it's very important that we pass it!