What a disappointing week this has been.

What a disappointing week this has been.

Of course we suspected as much when we didn't make our very aggressive 9,100 target on Tuesday but the market drifted along Wednesday and we decided to give it a chance but we broke our must-holds from Wednesday's Big Chart and that put us a little more negative during yesterday's session. While I held out hope that an commodity-led sell-off was not a terrible thing, no other sector stepped up to the plate and lack of rotation led us to finally shift a little bearish in the afternoon and I picked the FXP Jan $25s at $9.05 at 1:47, which should get a small pop today as the Hang Seng dropped 2% this morning but we'll take the small profit and run if the US rallies back and holds our mid-points.

At 10:46 I noted gold was topping out for the week, saying to members: "We are pulling back a bit from the 200 dma on gold at $865 and it would be very easy for us to slip back to $800 next week if the Central Banks rush in to support the dollar before the end of the year but holding $800 on a pullback or anything higher will keep gold very bullish" and we'll be very pleased with our hedges today (Jan $88s at $2.50) as gold is pulling back sharply this morning. I am still hopefull that gold and treasuries are being dumped in favor of a rotation into equities but it's unlikely to play out strongly today, on a quadruple-witching Friday, when options, futures, options on futures, and single stock futures all expire. We can certainly expect a lot of volume today and a wild trading session ahead of next week's light holiday trading.

Things were so crazy yesterday that I recommended buying oil! That's right, at 3:10 on Thursday, December 18th, 2008 I selected the USO Jan $27s at $6.65 with a $1 stop loss as the frantic selling at the NYMEX seemed to be fueled by today's December contract expiration but, with oil now falling to $33.50 in pre-market trading, I'm going to call for a roll to the $25s for $1.40 or less ($8 total). We had a similar sell-off on expiration day on Nov 20th and speculators were caught yesterday holding 56M barrels that nobody wanted and were being forced to sell at any price or risk seeing their $7,750 contracts turn into $37,000 worth of oil they would have to pay for today and find storage for by the end of next month (and storage is very, very full). So when you see oil fall $3.84 in yesterday's trading, what you are actually seeing is traders taking a 50% loss on the money they already laid out to tie up January crude barrels. We could have another sharp round of selling today as many amateurs were speculating in oil this month but I think we overhshot the mark a bit at $34 a barrel and should get at least a bounce next week.

Things were so crazy yesterday that I recommended buying oil! That's right, at 3:10 on Thursday, December 18th, 2008 I selected the USO Jan $27s at $6.65 with a $1 stop loss as the frantic selling at the NYMEX seemed to be fueled by today's December contract expiration but, with oil now falling to $33.50 in pre-market trading, I'm going to call for a roll to the $25s for $1.40 or less ($8 total). We had a similar sell-off on expiration day on Nov 20th and speculators were caught yesterday holding 56M barrels that nobody wanted and were being forced to sell at any price or risk seeing their $7,750 contracts turn into $37,000 worth of oil they would have to pay for today and find storage for by the end of next month (and storage is very, very full). So when you see oil fall $3.84 in yesterday's trading, what you are actually seeing is traders taking a 50% loss on the money they already laid out to tie up January crude barrels. We could have another sharp round of selling today as many amateurs were speculating in oil this month but I think we overhshot the mark a bit at $34 a barrel and should get at least a bounce next week.

Of course the oil calls balance our energy puts as our relentless pursuit of XOM and XLE puts paid off in spades yesterday and you do need to hedge after such a significant dip. We knew XOM and CVX would drag down the Dow and yesterday those two companies accounted for 85 of the Dow's 219 points lost. We are thrilled to see money rotating out of these ridiculously overpriced companies but it's a very painful process and we have to remain cautious as they still account for 15% of the Dow's total value but a very nice change from last week, when they were a more dangerous 18%. So we discounted the drag of commodities on the markets yesterday and not only held our neutral bias but at 3:53 I put my foot down on what seemed like an oversold market drop and said: "I would be taking the opportunity to take out callers and take a chance on a bounce down here." We are, of course, going to cover into the weekend and get back to a more neutral bias but, for this morning, we are expecting as least something we can sell into.

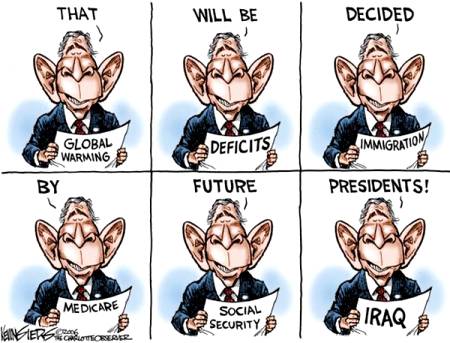

Several things led to yesterday's sell-off, most notable were rumors that GE's AAA rating may be at risk but the fatal blow delivered to the markets came courtesy of our outgoing Commander in Chief who decided to say: "I haven’t made up my mind” on an auto bailout plan during a forum at the American Enterprise Institute, a research policy organization in Washington. He said he was “worried about putting good money after bad" and “I’m worried about a disorderly bankruptcy and what it would do to the psychology of the markets,” Bush said. He also said he didn’t want to “dump a major catastrophe” on his successor. That sent GM and F tumbling 15% mid-day and the entire Auto sector joined commodities leading us down and that placed a drag on the Transports. Bush's screw-up was so monumental that White House Spokesman Dana Perino had to come out and do damage control (note her black eye from the shoe throwing incident in Baghdad). This video is just too funny re. the auto bailout.

Several things led to yesterday's sell-off, most notable were rumors that GE's AAA rating may be at risk but the fatal blow delivered to the markets came courtesy of our outgoing Commander in Chief who decided to say: "I haven’t made up my mind” on an auto bailout plan during a forum at the American Enterprise Institute, a research policy organization in Washington. He said he was “worried about putting good money after bad" and “I’m worried about a disorderly bankruptcy and what it would do to the psychology of the markets,” Bush said. He also said he didn’t want to “dump a major catastrophe” on his successor. That sent GM and F tumbling 15% mid-day and the entire Auto sector joined commodities leading us down and that placed a drag on the Transports. Bush's screw-up was so monumental that White House Spokesman Dana Perino had to come out and do damage control (note her black eye from the shoe throwing incident in Baghdad). This video is just too funny re. the auto bailout.

Bush is scheduled to speak at 9 this morning and I'm sure he'll have a script this time and I'm sure that script will be quite a bit more supportive than yesterday's pre-lunch remarks were. Hopefully that will give the markets what they need and we will continue to look for signs of rotation, hopefully with some Nasdaq leadership, which is entirely possible as Panasonic formalized their offer for Sanyo and the BOJ cut rates to 0.1% (saving that last tenth for a rainy day I guess). Although Sanyo is going for a discount, at least it puts something that looks like a floor in the market. Overall markets in Asia were weak with commodities leading the fall (copper went limit down 10%) and the Nikkei finished down a point despite the cut (TM will post their first loss in 70 years) while the Hang Seng gave up 2%. The BOJ will also be buying as much as 20 Trillion Yen (that's 2% of a Quadrillion!) of shares held by banks to boost their capital, this is part of a 75 Trillion Yen stimulus package.

Over in Europe, Russia's economy is unraveling fast as oil drops 33% for the month and the country is already seeing a rising tide of social unrest based on just this bad quarter. Europe overall is down about 2% ahead of our open with energy stocks crushing the indexes over there. The S&P was no help, cutting ratings on 11 banks, including European heavyweights CS, HBC, BCS, UBS and DB.

Over in Europe, Russia's economy is unraveling fast as oil drops 33% for the month and the country is already seeing a rising tide of social unrest based on just this bad quarter. Europe overall is down about 2% ahead of our open with energy stocks crushing the indexes over there. The S&P was no help, cutting ratings on 11 banks, including European heavyweights CS, HBC, BCS, UBS and DB.

9 am update: Who cares what Europe thinks, they just jammed a $13.4Bn IMMEDIATE relief package in for the Auto industry and boy are we going to be happy we went bullish into the close yesterday! We're still going to cover into the weekend, of course but this will give us a much better chance to see what levels we hold.

So strap in for a wild one today, we'll see how irrational our exuberance can get as there is still plenty of bad news out there and throwing a few Billion more dollars into the Big 3 sinkhole is not, by itself, going to save the market BUT – most assuredly, NOT throwing a few Billion dollars into the Big 3 would have absolutely trashed the markets and perhaps the President didn't understand that yesterday but thank goodness someone wrote it down for him to read today!

ANYTHING less than holding 8,650, 900, 1,550, 5,600 and 480 is flat out unacceptable and we are already nervous about the weekend since our conditions for a 20% drop were: GM bankruptcy (off the table until March), a major bank failing (11 credit downgrades do not help) or a minor country failing (Russia is more than minor) and those are still very much in play so let's enjoy the stimulus for as far as it can push us but we certainly want to be gripping firmly onto the handrail as we ride this coaster into the weekend.