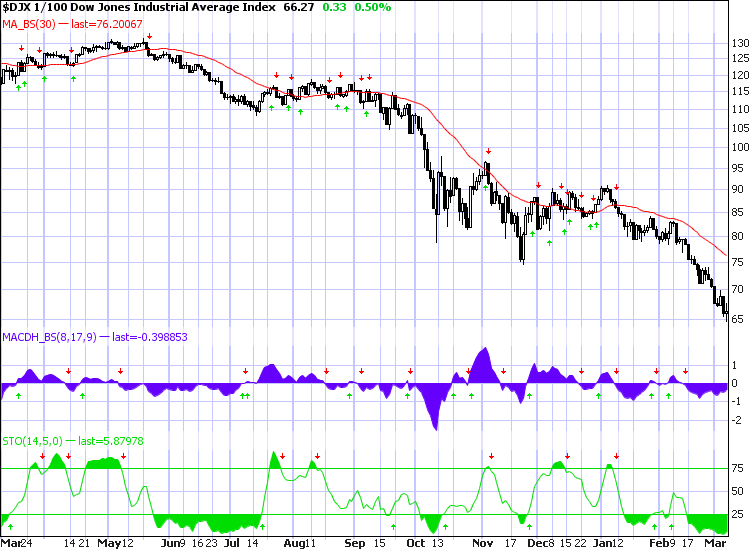

8,285 on February 9th to 6,485 at 3pm on March 6th.

That's 1,800 points down in 19 market sessions, a 22% drop with a "stick save" at the end that took us back to 6,626 – almost exactly, to the point, 20% below where we started! These are not coincidences, we just discussed the 5% rule in detail during member chat the other day and, sadly, finishing right at the 20% line on a 4-week dip is not really encouraging. As I mentioned during the video-cast on Friday, we went into the weekend 55% bearish – a decision I had to make before I left for the day at 10:30.

We did not buy into the "rally" in the morning, other than our usual stab at FAS and SKF puts, neither of which went well on the day but, as I said during the live show, we aren't really too worried until Wednesday when we'll have to roll the SKF puts to April or possibly a hedged July/April spread (we'll decided next week). As I said to members at 9:45: "This is why we need to take those bullish chances on the bad days, things get away from you fast once they get moving." We do not buy into sudden market moves at PSW, we were buying on Thursday, when everyone thought the world was ending and, had I been around Friday afternoon, we would have been buying there too!

A good example of how we offset our exuberance is my 9:17 comment to members as the futures began running up ahead of the open: "Watch 1.25% and 2.5% levels to decide when/if to stop out at least 1/2 of the covers. I would certainly roll up long puts into this rally (.50 or less per $1 higher strike)." So, what are we doing when the market is flying up nearly 200 points in the first 15 minutes – WE ARE IMPROVING OUR DOWNSIDE COVERAGE! We already have longs, those we can let run but we have an opportunity to move our long index puts up to higher strikes, which: 1) Gives us better leverage on the way down, 2) Improves our net delta to any puts we have sold as a hedge and 3) Puts us in a position to sell hedged puts at higher strikes without compromising our position advantage.

A good example of how we offset our exuberance is my 9:17 comment to members as the futures began running up ahead of the open: "Watch 1.25% and 2.5% levels to decide when/if to stop out at least 1/2 of the covers. I would certainly roll up long puts into this rally (.50 or less per $1 higher strike)." So, what are we doing when the market is flying up nearly 200 points in the first 15 minutes – WE ARE IMPROVING OUR DOWNSIDE COVERAGE! We already have longs, those we can let run but we have an opportunity to move our long index puts up to higher strikes, which: 1) Gives us better leverage on the way down, 2) Improves our net delta to any puts we have sold as a hedge and 3) Puts us in a position to sell hedged puts at higher strikes without compromising our position advantage.

So the "game plan" of watching the 2.5% levels (which I laid out in the Friday Morning Big Chart Review and which were hit almost on the button across the board) did not impress us because it was the move we expected. THIS IS NOT MAGIC PEOPLE, THIS IS THE SYSTEM WE TEACH! By stopping out our March put covers on the way down (after failing to hit levels we establish before the market opens) we can flip from a bullish play off the run to an aggressively bearish cover at the top almost automatically. Going more bearish at the top of the 2.5% run lets us ride out the 5% drop without panicking out of our bullish positions and, as I mentioned during the live broadcast, gives us money to improve our bullish positions at the bottoms, just as we improve our bearish positions at the tops.

I've been fixating on the drop from February 9th, which is where we fell out of our range, which had been between 8,200 (5% below our 8,650 mid-point and 9,100 (5% over) and have never really looked back since. Here we are down 20% from there and we have to seriously consider whether or not we'll ever "come back" to the level I thought was a fair value for the current economy. We've had major drops from 13,000 to 11,000 (15%), 11,000 to 8,500 (22%) and, hopefully now done, 8,250 to 6,500 (20%).

Like any good roller coaster ride, the drops are designed to make you feel like there is no bottom but think about it from a realistic standpoint. How much money would you pay for IBM? Not the stock – the multinational coporation that employs 385,000 people around the world, collects $103Bn in revenues and makes a profit of $12.3Bn. Right now the selling price (market cap) is $115Bn. If you had the money, at what point would you step in? $100Bn? $75Bn? $50Bn? $25Bn. Even if you waited until IBM fell to $25Bn, a point at which the ROI is 50% a year – that's still higher than zero isn't it? Yet we have numerous banks and other business priced far below 25% of their prior market caps, investments which offer ROIs (averaged over 5 years) of even better than 50%.

So CitiGroup, to pick a very distasteful example, also takes in $106Bn but lost $33Bn last year. In the 4 previous years the bank made $60Bn so, even with the loss, an average annual return of better than $5Bn on your investment. But what is your investment to buy CitiGroup? Well, at the moment you can have the bank, it's 8,300 branches and its 326,000 employees for just $5.5Bn. Of course CitiGroup has debts and other scary issues – of course it does! That's WHY you CAN buy it for $5.5Bn, but in 1999, 2000, 2001 and 2002, Citigroup made more than $11Bn a year and in 2003 and 2004 they made $17Bn and in 2005 and 2006 they made over $20Bn. In your wildest dreams buying IBM, you cannot reasonably expect them to make $20Bn a year within 5 years!

So CitiGroup, to pick a very distasteful example, also takes in $106Bn but lost $33Bn last year. In the 4 previous years the bank made $60Bn so, even with the loss, an average annual return of better than $5Bn on your investment. But what is your investment to buy CitiGroup? Well, at the moment you can have the bank, it's 8,300 branches and its 326,000 employees for just $5.5Bn. Of course CitiGroup has debts and other scary issues – of course it does! That's WHY you CAN buy it for $5.5Bn, but in 1999, 2000, 2001 and 2002, Citigroup made more than $11Bn a year and in 2003 and 2004 they made $17Bn and in 2005 and 2006 they made over $20Bn. In your wildest dreams buying IBM, you cannot reasonably expect them to make $20Bn a year within 5 years!

Let's say we quantify C's losses somehow and come up with $200Bn, enough for them to book 7 more years of losses as horrific as this one. Now let's "mortgage" that loss over 30 years ($6.6Bn a year) and slap on 10% interest ($660M) to pay for it and let's assume C never earns $20Bn again and that inflation stays flat and housing stays down and their assets never improve and let's knock 20% off the $11Bn a year they made in 1999. That's $8.8Bn less $7.26Bn = $1.54Bn in net annual profits AFTER paying off a $200Bn deficit that is is purely speculative. Now, how much is that worth? $3Bn? $5Bn?

Well, $5Bn is the price right now and if the bank survives at all, theres a heck of an upside since they are very capable of earning $11Bn a year – giving you a 220% ANNUAL ROI at some point in the distant future IF the economy ever survives. While C itself may not survive, certainly some banks in the XLF will, which is why we prefer the index plays at the moment but we can also do fun spreads like buying the C 2011 $2.50 calls for .42 and selling the 2011 $7.50 calls for .21. That's net .21 for a $5 spread, a 2,500% return if C gets to $7.50 in 2 years.

Well, $5Bn is the price right now and if the bank survives at all, theres a heck of an upside since they are very capable of earning $11Bn a year – giving you a 220% ANNUAL ROI at some point in the distant future IF the economy ever survives. While C itself may not survive, certainly some banks in the XLF will, which is why we prefer the index plays at the moment but we can also do fun spreads like buying the C 2011 $2.50 calls for .42 and selling the 2011 $7.50 calls for .21. That's net .21 for a $5 spread, a 2,500% return if C gets to $7.50 in 2 years.

Again, not C in particular but if you put just 4% of your virtual portfolio into a diversified group of spreads like this (AA 2011 $12.50/$17.50 net .40, UYG 2011 $3/$8 net .32, XHB 2011 $12.50/$20 net $1, LVS 2011 $5/$10 net .25, CBS 2011 $5/10 net .50….) and the world survives and they get back just 1/3 of what they've lost, you can up your whole virtual portfolio 40% or more. Set a 50% stop loss on each position and you are risking 2% overall – a reasonable gamble on the Great Depression, Part II giving us a miss, don't you think?

Last weekend, in the Wrap-Up, I mentioned we were 60% bearish, this weekend it's 55% but you have to do SOMETHING on the bullish side. Not all plays have to be short-term as there are many long-term hedges like these that can pay off one time better than being right on 10 20% gainers, you just need a little patience. As I mentioned last week, Buffett didn't double the S&Ps returns for 40 straight years by day trading, his philosophy of buying when things are on sale is as true today as it was then but, like a dip in the roller coaster, we have many people screaming and betting there is no floor and we will all fall to our deaths – those of us who have already been on that ride are taking those bets. Frankly, if Warren and I are wrong, we're all dead anyway…

Scaling in is the key to going long in this market. Had you decided to buy $10,000 worth of DIA at $110 (Dow 11,000), you'd be down 40% on 91 shares. If, however, you had scaled in, buying $2,500 at $110 (23 shares) and another $2,500 at $85 (29 shares) and another $2,500 at $65 (38 shares), you would have just one less share but you would have an average entry of $83 and be down 21% with $2,500 cash on the side. Should we drop another 20% from here to (gulp) 5,000, you could give up and cash out with $7,000 (down 30% on a greater than 50% Dow drop) or you could deploy the final $2,500 you allocated for the position to buy 50 more shares, putting you into 140 shares at an average entry of $71, down 30% but with a better chance of recovery to Dow 7,000 than what you would have had with 90 $110s waiting for 11,000 to break even.

No matter how much you love a position, taking a portioned approach to your entries can help tremendously. In our members' Strategy Section we discuss this in more detail as it also works on the way up, If you had been bearish on the Dow and shorted at $110 with 25% (23 shares) then added 25% at $100 (25 shares) and 25% at $90 (28 shares – we do not add to a position that is already up 20%), then you would currently have 76 shorts at an average of $98 and they would be up $2,500 with $2,500 cash on the side vs. the 91 shares that would currently be up $4,095 with no cash on the side.

If you are right better than 65% of the time, you can do better with 100% entries but this is a great way to learn trading disciplines and forces you to reevaluate your position on a regular basis. When a 25% entry is down 20% do you still like it enough to buy another round or should you get out with a net 5% (of a full position) loss? When a 25% entry is up 5 or 10%, do you like it enough for another round at the higher price or is the party probably over? As I said about FAS yesterday, I don't LOVE them at $2.50 but I'll buy $2,500 here, just in case they turn and another $2,500 at $1.25 and another $2,500 .65 and another $2,500 at .30 which would give me over 15,000 shares at about the value of 2nd lowest entry (.65) and if you ask me if I would buy 15,000 shares for .65 as a long-term hold the answer is YES! So right now, I can buy that position and, if at any point it "ruins" my plan by heading higher on me – I'm not going to be upset about it.

This logic applies to options too. SKF is a good example. I would LOVE to buy $10,000 of SKF July $200 puts for $31 (the price of the April $200 puts). Unfortunately, they are now $77 and that's not going to happen this month. Looking at April, it costs me $10 to roll the $175 puts up to the $200 puts so $2 per $5 roll about 45 days out is "acceptable". So I will start with the first July calls I CANNOT roll up for $2.50 That would be the July $175s, now $37.50. My plan, which I can execute on any run up in SKF over the next 3 months, is to roll up to the next higher strike for $2 any time I can. That would put me in the July $200 puts for net $47.50.

Since I wanted to be in for $31, I could look to see if I could sell some offsetting puts, like the April $120 puts for $6.40. If I sell $6.40 worth of lower strike puts 3 times (April, May, June), I exceed my goal of being in the July $200 puts for $31. If the SKF shoots down on me, my $175 puts are still $55 ahead of my putters on a net $31 entry so nothing to cry about. Meanwhile, since my putters are paying for my first 3 rolls, my net entry of $37.50, which is about 1/2 the cost of the July $200 puts, may be all the cash I ever have to commit. I could buy twice as many or I could take half the risk and be done with it. That too is a form of scaling in with options – not so much scaling into a size as scaling into a strike that you wouldn't want to pay full price for.

Since I wanted to be in for $31, I could look to see if I could sell some offsetting puts, like the April $120 puts for $6.40. If I sell $6.40 worth of lower strike puts 3 times (April, May, June), I exceed my goal of being in the July $200 puts for $31. If the SKF shoots down on me, my $175 puts are still $55 ahead of my putters on a net $31 entry so nothing to cry about. Meanwhile, since my putters are paying for my first 3 rolls, my net entry of $37.50, which is about 1/2 the cost of the July $200 puts, may be all the cash I ever have to commit. I could buy twice as many or I could take half the risk and be done with it. That too is a form of scaling in with options – not so much scaling into a size as scaling into a strike that you wouldn't want to pay full price for.

As to wrapping up the week – It was "Monday Market Melt-Down" with a picture of sheep jumping over a cliff, on Tuesday I posted levels of DOOM, which we crossed despite the TALF, Wednesday we thought Wen Jiabao would save us but he couldn't and on Thrill-Ride Thursday we were back on our bear roller coaster but did a little bottom-fishing, leading into Friday's review, which we reviewed above. Staying generally balanced in the virtual portfolio and picking up bargains along the bottom is the way to play if you think, long-term, that we survive this crisis. If you don't think we can survive, it's the same old "Bullets, Beans and Bullion" virtual portfolio we've been looking at since the fall as we stock up the fallout shelter and wait for the looters.

We're still doomed if we can't turn it back up from here and we'll have to see if the 60% off line holds in the global markets. That's the mark we tested on Friday's lows in the US and Europe and Asia needs to gain close to 10% just to get back over the line (as 10% of 37% value left in the Shanahi is just 3.7%). That's the funny thing about the XLF too, they are down 85% from the top but to get back just halfway, to $18, they have to gain 200% – that would REALLY suck for the SKF between now and July!