So far, so not so bad!

That's how earnings are shaping up and we are pleased to see so many companies beating what are fairly low expectations but they are expectations that are baked into the cake nonetheless. Not only that but we're seeing something we haven't seen in a very long time – Upside Guidance! Just this morning (7:30), we have upside guidance from CHE, PBG, PFCB and PFS while last night CREE, CYMI, RCRC and WSII all raised guidance and NOT ONE company out of 41 reporting last night guided down. What kind of recession is this?

Earnings beats are outnumbering misses by 2:1 so far and some of the beats are mind-boggling, making you wonder what kind of bear poop the analysts have been smoking when ECA, for example, can make $1.26 per share when 24 professional analysts who follow the company expected earnings of just .69. AAI made .21, not the .04 expected by the people who are paid to follow them predicted and not one of the 9 analysts following IBKC were within 15 cents of their .77 earnings with consensus about 30% lower than that. Of course there are misses too but we expect misses in this environment but the hits are not justifying a sub-7,632 Dow, which is our lower-end target.

We had an extensive conversation in Member Chat last night about the true value of the market and I suppose I can sum it up with this exerpt from my morning comment to Da Bears (these things go on all night): "I don’t understand why people can’t accept the fact that companies have value, that they are able to adapt and become profitable, even in adverse environments. Perhaps they may not do as well and perhaps they will have a few bad quarters and take some losses and perhaps they will even default on some debt but that DOES NOT mean they will never recover. It does not mean they are worthless, it does not mean that you should bet against everything that dares to show signs of recovery becauase the ENTIRE course of human and market history is against your premise. The markets ALWAYS recover – Recession, Depression, War, Terrorism, Bubbles, Scandal – the markets always come back and there are winners and losers. If you are going to insist that everyone is a loser you will very likely be disappointed…."

You know I am very happy to state the bear case and point out the things that aren't working in the economy but I must defend the bull case when I see the MSM going to extremes to keep you out of stocks. Stocks are still the best asset class you can be in and we can hedge our stocks in a way that we cannot hedge our cash to make sure we have something of value at the end of the day. We don't want the market to get ahead of itself yet it amazes me how the sheeple can be stampeded in and out of positions based on whether some moron on TV hits the BUYBUYBUY or SELLSELLSELL button on a stock that day. There is no conviction at all to investors – they've even told you that buy and hold is dead yet WE HAVE A LIST OF 42 STOCKS WE'VE HELD SINCE NOVEMBER THAT ARE DOING GREAT! How – because we HEDGE our buy list! Because we mix our entries, because we take some bullish and some bearish positions and because we recognize that some companies are better than others and we're pretty good at picking the winners.

In short – we benefit from the stupidity of the markets. Unfortunately, we are not souless jackals who can stand by and laugh while retail investors get mauled on both sides of the trade on an almost daily basis, so I try to reach out and point these things out once in a while – hopefully it helps. It certainly helped the members as we jumped on yesterday's sell-off and deployed another round of buying on our $100K Hedged Virtual Portfolio, again taking positions in the $20,000 financial allocation but also executing our DBC and UNG plays. Yesterday was a fun day and we had 13 new trade ideas in yesterday's post alone with JPM and BAC puts sold (which is what I said we'd do in the morning post) already 40% winners. As I keep saying in our new Virtual Portfolio Review – Plan the Trade, Trade the Plan and that's how we're riding out this very choppy markett until we see which way this thing breaks.

We also took a chance on HCBK earnings, taking the July $12.50s naked for $1. You can tell we're getting more confident when we start doing unhedged, pre-earnings plays like this and Hudson came through with a 44% INCREASE in proifts and announced they would be increasing their dividend. For AAPL's earnings we were not as certain and we did a hedged double diagonal, much like our GOOG spread that did so well on their earnings. The VIX was nice enough to climb back to 37, which is one of the reasons we were so happy to jump on new trades – which mainly involved SELLING premium and today we are back to watching the same old levels we've been watching all week: Dow 7,900, S&P 833, Nasdaq 1,580, NYSE 5,225 and Russell 444 and we'll see if they hold up for another day, hopefully giving us some real consolidation before another attempt at 8,200 although we wouldn't mind seeing a firm test of our lower levels: Dow 7,636, S&P 805, Nas 1,525, NYSE 5,075 and Russell 420 before heading higher.

The Hang Seng continued to consolidate and we'll be glad we pressed our FXPs yesterday as they should race right back to Monday's highs this morning. Another day another 2.5% (-407 points) in a dramatic after lunch fall that doesn't give us the warm fuzzies for tomorrow's session but it is only the completion of a 20% pullback off the 5,000-point run for April so nothing to worry about unless they can't hold 14,500, another 2.5% down from here. The Nikkei flatlined at 8,727, still waiting for the Dow to catch up. The Shanghai had a down 3% day, led down by banking stocks as Monday's stimulus talk is quickly forgotten. "The market's becoming very polarized," said BBY senior trader Peter Copeland in Australia. "There are entrenched bears that think this (rally) is all just smoke and mirrors, and there are bulls who think the bears are wedded to their view in the face of recovery signs." Sounds a lot like some of our members!

Europe is wishy-washy ahead of the US open (8:30) and we really need the FTSE to take back and hold the 4,000 line if we expect the Dow to get back over 8,000 so we'll be watching the UK with great interest today. The DAX needs to hang onto 4,400 to keep a positive spin and the CAC needs to retake 3,000, which doesn't look likely. The UK Treasury will present their budget today amidst 12-year high unemployment and that will be the story of the afternoon as they take their budgets a little more seriously than we do. The UK is a microcosm of the whole EU as they stimulated early and often and there are concerns (looking at EU budget deficits) that the Union simply cannot afford any more stimulus spending because, unlike us, they have rules about spending money they don't have.

Europe is wishy-washy ahead of the US open (8:30) and we really need the FTSE to take back and hold the 4,000 line if we expect the Dow to get back over 8,000 so we'll be watching the UK with great interest today. The DAX needs to hang onto 4,400 to keep a positive spin and the CAC needs to retake 3,000, which doesn't look likely. The UK Treasury will present their budget today amidst 12-year high unemployment and that will be the story of the afternoon as they take their budgets a little more seriously than we do. The UK is a microcosm of the whole EU as they stimulated early and often and there are concerns (looking at EU budget deficits) that the Union simply cannot afford any more stimulus spending because, unlike us, they have rules about spending money they don't have.

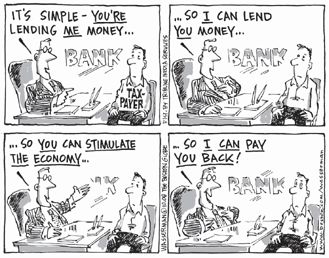

While the crisis may not be over, it certainly is as far as some banks are concerned and many are lobbying the Treasury to let them out of the TARP program only 6 months after it was imposed on them. At issue are "warrants" the government received when it bought preferred stock in roughly 500 banks over the past six months as part of TARP. The warrants allow the government to buy common stock in the banks at a later date so taxpayers can receive more of a return on their investment when the banking industry recovers.

Today, most of the warrants are essentially worthless, because their exercise price is higher than where most banks' stocks are trading. But the government believes the warrants still have value, since they give the Treasury the right to buy common stock at a set price for 10 years. Bankers say it is unfair to charge what amounts to a "prepayment penalty," which makes it additionally onerous to escape TARP. Bank representatives say the cost of buying back the warrants could be equivalent to paying 60% annual interest on short-term loans. That, they argue, would exacerbate banks' existing problems. "It is a reduction in capital, and I think it defeats the original purpose of the program," said Bob Jones, chief executive of Old National Bancorp, which has already paid back the government's $100 million investment in the company. The Evansville, Ind., firm plans to buy back the warrants if it can agree on a price with the Treasury.

![[Glimmers of Hope]](http://s.wsj.net/public/resources/images/P1-AP584B_EARNI_NS_20090421221622.gif) So banks are getting more bullish and want to get out on their own again and, as I mentioned above, 2 out of 3 companies are beating earnings expectations so far this quarter. Commentary is somewhat encouraging (see chart) and even layoffs seem to be slowing. Michael Darda, chief economist at Greenwich, Conn.-based MKM Partners, says the early indicators are "essentially pointing to a reversal in the economy sometime later this year." He cited lower interest rates for corporate bonds, a sign that companies' debt is perceived as less risky; calmer credit markets; and a rebound lately in industrial-commodity prices, reflecting an uptick in demand from manufacturers.

So banks are getting more bullish and want to get out on their own again and, as I mentioned above, 2 out of 3 companies are beating earnings expectations so far this quarter. Commentary is somewhat encouraging (see chart) and even layoffs seem to be slowing. Michael Darda, chief economist at Greenwich, Conn.-based MKM Partners, says the early indicators are "essentially pointing to a reversal in the economy sometime later this year." He cited lower interest rates for corporate bonds, a sign that companies' debt is perceived as less risky; calmer credit markets; and a rebound lately in industrial-commodity prices, reflecting an uptick in demand from manufacturers.

Keep in mind that we are not here to change sentiment, only to trade with it. We will continue to montior the signs and see which way the wind blows, investing accordingly. For over a month now, we have made good market decisions by staying unemotional and watching our levels – that will continue to be our plan until we start seeing some clear leaders breaking away from the pack – something that indicates there is a return to fundamentals but I am liking the dips more and more as a buying opportunity and our chief worry is that we WON'T get another deep bottom test, as buying stocks in early March was like shooting fish in a barrel and we'd hate to have to work hard to pick the next set of winners…