In Optrader’s swing trading virtual portfolio, we very often discuss trading the ES. For many reasons (leverage, liquidity, commissions, etc.), this is a very powerful instrument. One of the big advantages is that it is so widely followed that technical analysis works very well.

Following is a very profitable trade we made yesterday, posted live in the comments of the swing trading virtual portfolio. The goal, as with most trades, is to maximize profits VS risk. WIth ES, we follow closely pivot points as levels of support and resistance.

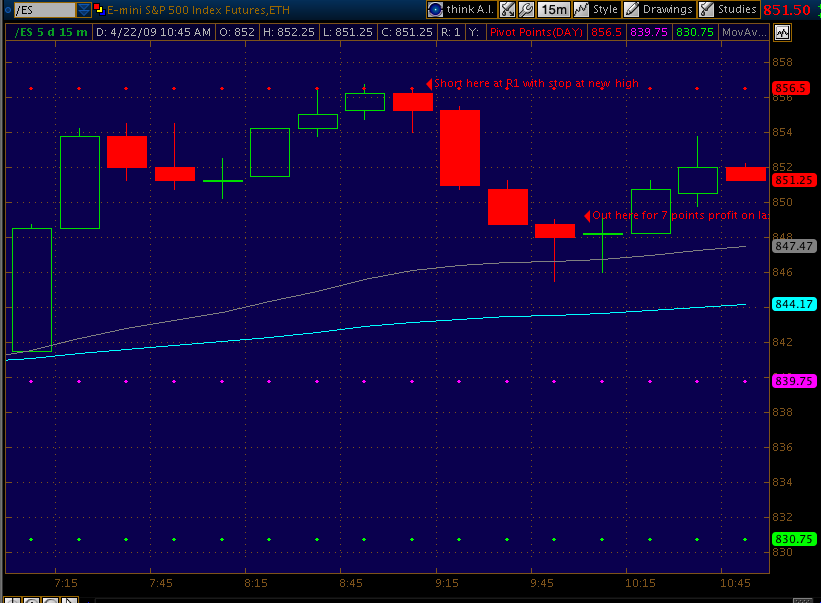

Around 9:00 am ES, on the intraday chart, tested R1, which is our level of resistance. At the same time, on the daily chart SPX was approaching a level of resistance as noted on the chart below at 860

So, as we were at resistance on both ES and SPX on different timeframes, we waited for a new high to be made on ES after it just broke R1, and we then shorted ES at 856 with a stop right above the new high at 857. That was a trade with very small risk (only one point): you know very fast if you are right or not about direction.

Then ES started dropping. We sold 1/2 for 2 points profit, 1/4 for 5 points profit, and for the last 1/4 we used a trailing stop that got us out with a 7 points profit. Here is the chart:

The trailing stop on the 15 min candle worked perfectly as ES rebounded and later went all the way back above R1. That was a trade that ended-up being very profitable, but most importantly, which had a very defined risk when we entered it. You can follow all live comments in the swing trading virtual portfolio and participate in the discussion by signing up here