Poor Bears!

Poor Bears!

They just can't seem to catch a break in this up and up market. While yesterday's housing data may have seemed good, it was up 11% from May – that didn't make it actually good as it was down 22% from last June and that was despite the average home being sold for 12% less. If I were to tell you your home is now worth 12% less than last year and next year could drop another 12%, would you be running in to buy builder stocks? Well, that was the "market" reaction yesterday to very mediocre news. In the market's defense, this move came on very low volume so it's only a few idiots running out and buying but it doesn't take many idiots to make a market – just ask Cramer, who is telling his minions to BUYBUYBUY on any pullback because we are in the middle of the next great bull market rally (seriously, that's what he said last night!).

I think Jim misinterpreted my mid-day Alert to Members yesterday where I said:

Volume on Dow at noon was anemic 70M so the wait and see crowd is in control and real men don’t come back from the Hamptons until this afternoon so tomorrow will be "Telling Tuesday" and we get some data (Consumer Confidence and Case-Shiller) to sink our teeth into. If Case-Shiller fleshes out today’s New Home Sales and looks positive, we could get enough to break higher but Shiller himself was bearish in outlook not even 10 days ago so hard to imagine major change so quickly.

A sell-off tomorrow to test our Thursday breakout levels (for the Russell 535 and NYSE 6,232) ahead of the Beige Book would be perfect if we hold it and an improved outlook could rally us from there. Thurs morning for the Dow was 8,950, Nas 1,940 (already almost tested today) and S&P 960 so those are now our "must hold" levels for the week to keep our horns on.

So Jim, that's an IF we hold our levels, not WHEN. Unless Thursday's GDP report is better than -1.5%, I don't think we can read too much into this bounce as we are still tragically shy of our 33% levels (see yesterday's Big Chart Review) and only BARELY above our 40% off levels that mark the top of our projected trading range. The only US index that has broken the 33% off line is the Nasdaq, that makes it a candidate for shorting FOR a pullback not buying into one, but we'll be very happy to sell shares to your sheeple if they insist on buying at the top of a 55% run off the March lows.

So Jim, that's an IF we hold our levels, not WHEN. Unless Thursday's GDP report is better than -1.5%, I don't think we can read too much into this bounce as we are still tragically shy of our 33% levels (see yesterday's Big Chart Review) and only BARELY above our 40% off levels that mark the top of our projected trading range. The only US index that has broken the 33% off line is the Nasdaq, that makes it a candidate for shorting FOR a pullback not buying into one, but we'll be very happy to sell shares to your sheeple if they insist on buying at the top of a 55% run off the March lows.

As Trader Mike's chart indicates, the bulls literally REFUSE to give up the trendline but you have to think it through. Will they hold it another 10 days, that would take us to 2,100 on the Nasadaq, just shy of a 66% gain off the lows (1,265) but they already blew through 33% off the top at 1,917, we can expect at least a retest there before heading off into space. Note the move we made from May 26 – June 10th, 200 points in 10 days. This rally is about the same yet Cramer says "this time it's different" and we won't be giving up half the gains but we're going to need some seriously improved data to back that up, data that clearly isn't there yet.

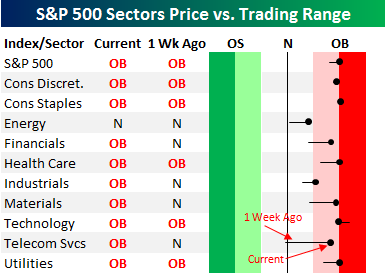

Last month, we used this very useful chart from Bespoke to illustrate that we were clearly getting oversold. Now we (those of us not wearing rose-colored glasses) can see that we are pretty clearly overbought in most sectors with tech actually already leading us lower, not higher in the past week. We'll be keeping tabs on our sectors but, after yesterday's action, we are loving our SRS play as we wait for the home builders and REIT to report their earnings (or losses, as the case may be).

Last month, we used this very useful chart from Bespoke to illustrate that we were clearly getting oversold. Now we (those of us not wearing rose-colored glasses) can see that we are pretty clearly overbought in most sectors with tech actually already leading us lower, not higher in the past week. We'll be keeping tabs on our sectors but, after yesterday's action, we are loving our SRS play as we wait for the home builders and REIT to report their earnings (or losses, as the case may be).

The heat will be on in the energy sector as well as the CTFC will be issuing a report next month suggesting speculators played a significant role in driving wild swings in oil prices — a reversal of an earlier CFTC position that augurs intensifying scrutiny on investors. The agency began shifting under Mr. Gensler, its new chairman. During his confirmation process earlier this year, Mr. Gensler said he believed speculation was partly behind the surge in commodity prices. Commissioner Chilton said the new report will contain a more-thorough analysis of the investors in contracts tied to oil and other commodities, and reveal cases in which single traders hold massive market positions. "We now have multiple sources, and confidence from different sources," he says. He said he believes the data on trading outside exchanges is also more reliable.

As we can see from the chart, we are NOT being led by the energy sector in this up leg but a combination of pending regulations and a dollar coming off the lows (now 78.64) can knock the commodity pushers off their pedestal, especially with copper looking overdone as well, in light of our report on China stockpiles this weekend. In fact, we were looking at Hugh Hendry's report from China in chat yesterday and it's a little scary to think that our global-leading economy may be the biggest house of cards ever built.

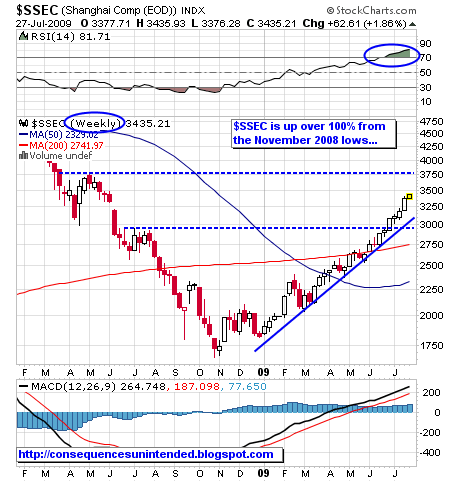

You wouldn't know it from today's trading as the Hang Seng added another 372 points (1.8%) but the Shanghai was flat, as was the Nikkei and the rest of Asia and the Baltic Dry Index popped back to 3,400 but is still looking pooped under the 50-dma. You can blame speculators for the commodity bubble but who is behind the bubble that has driven the Hang Seng over 80% off it's lows (although still 35% off the highs)? Stimulus has driven China straight up for months but some banks were lower today after China's banking regulator issued rules governing loans for infrastructure projects. That triggered concerns of a credit drain in the second half of the year, after a record 7.4 trillion yuan in loans was issued in the first half.

There are several IPOs keeping the momentum going in China but now we have a very real, psychological test as the Shanghai Composite floats up near the 3,500 mark, up 100% since the November lows. Obama is meeting with our Chinese masters this week and made a nice speech yesterday talking about how no one nation can expect to go it alone to lead the world. Sadly, Obama was not modestly saying America would willingly share it's leadership position, it was more in the line of begging China, the new global leader, to save us a place at the table when they take the big seat. "We know the talent of the Chinese people because they have helped to shape America – my own cabinet contains two Chinese Americans" Obama kowtowed..

There are several IPOs keeping the momentum going in China but now we have a very real, psychological test as the Shanghai Composite floats up near the 3,500 mark, up 100% since the November lows. Obama is meeting with our Chinese masters this week and made a nice speech yesterday talking about how no one nation can expect to go it alone to lead the world. Sadly, Obama was not modestly saying America would willingly share it's leadership position, it was more in the line of begging China, the new global leader, to save us a place at the table when they take the big seat. "We know the talent of the Chinese people because they have helped to shape America – my own cabinet contains two Chinese Americans" Obama kowtowed..

Meanwhile, over in the world's largest economy (nope, still not us), lending slowed considerably in the Euro-zone with June loan growth at a record low 1.5%, down from 1.8% in May. The data shows that banks were still lending only reluctantly at the mid-point of the year and that massive sums of state aid and liquidity provisions from the ECB haven't been fully passed on to end-users. The ECB data showed that the annual growth rate of loans to nonfinancial companies actually decreased sharply to 2.8% in June from 4.4% in May. Consumer credit growth contracted 0.7% in the year through June. "It seems that while the cost of borrowing has gone down charges to smaller companies has gone up," a government spokesman said.

EU markets are down slightly ahead of our open (8:30) but it's very unlikley that coprorate eanings can now justify what is now a 25% run since Q1 earnings came out in April. We're still getting far more earnings beats than misses this week but CW, OLN and SONO lowered guidance last night and ARLP, AME, HSC, KEI, ORB and TXT all lowered guidance this morning (but overall, their report was good for long-term investors). That's almost as many lowered guidances in one day as we had all last week. UA, VSH, ZRAN, VECO and ENOC raised but TXT is the one that should bother people as business jet sales (capital goods) are in the tanker as were industrial products and helicopters. Another miss that should concern the green shoot crowd is ODP, who missed on poor sales of office furniture (no one left to sit in the chairs!) and computers. In general, revenues for this weeks reports were down more than last week's.

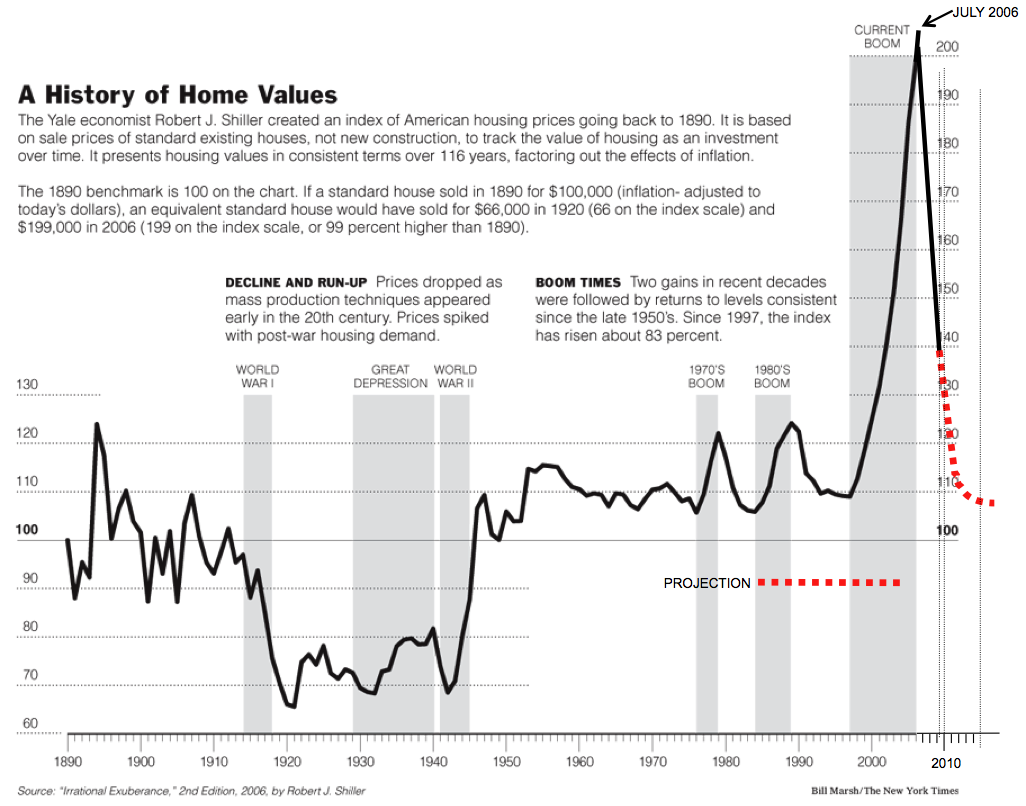

9 am update: As expected, Case-Shiller home prices came out mixed at best. US home prices were up or flat in 16 of 20 US markets but home prices are still down 17.1% in May from down 18.1% in April and that's with heavy incentives that month. Keep in mind that, no matter how the pundits try to spin this home data – THIS IS WHAT THE CHART LOOKS LIKE:

Note that prior "booms" have all corrected back to where they started, other than the post WWII boom, which was based on government stimulus on such a massive level that even Obama would choke at the inflation-adjusted numbers. So far, the administration's attempts to "modify" existing mortgages has helped just 200,000 people, or about 1/2 of the number of people who get foreclosure notices in the average month. With 6 months in office as of July, that means we have NOT helped 2.2M people under the modification program. Yes, massive numbers cut both ways!

VIA just discovered that people who lose their homes tend to not need cable and the company experienced a 14% drop in revenues that cut out 32% of their profits on lower cable subscriptions and lower advertising revenues, causing the company to burn $500M in cash during the quarter. This is becoming a theme we can play during earnings, people still may be going out for a hamburger every once in a while but they are learning to do without things like new furniture, carpets, mattresses, cable TV (at least the premium channels), high-end cards, luxury brands…. It's going to be very hard for China to lead us out of this mess if the US consumer is getting tired and nothing exhausts a consumer more than losing money on their homes. Slowing declines are not a housing victory and, according to the chart above, we may have another 20% to go before we hit a real bottom in housing.

We'll see how far down this pullback takes us but, unlike Mr. Cramer, we will not be BUYBUYBUYing until we see some stability. In early July, when Cramer told his sheeple to get out, that was a clear signal for us to get in and we kept our bearish coverage in place yesterday so we are ready to have some fun as market dips can be when you have a mattress to land on!