Where is the market headed? That is a really great question. We are very range bound it appears for the near term of the next couple weeks with the market taking profits and investors reinvesting into stocks that have moved down slightly off highs that were seen over the last two weeks. Playing the intraday investments will be tough as we try to gauge where the market will head on a day to day basis.

Where is the market headed? That is a really great question. We are very range bound it appears for the near term of the next couple weeks with the market taking profits and investors reinvesting into stocks that have moved down slightly off highs that were seen over the last two weeks. Playing the intraday investments will be tough as we try to gauge where the market will head on a day to day basis.

Some of the bearish indicators I see for today are that futures are still down slightly going into the morning. The Dow is down 13 points, and the NASDAQ has shaved off seven points in pre-market trading. The market is going to be moving on a lot of general market sentiment of whether investors want to take profits because they think the market has gotten too high or want to continue to add liquidity to the market. Investors will be eying the labor productivity, retail company results, and Fed Reserve meetings for some market direction, but there is no pertinent economic data being released today.

The only major earnings we saw were from Dish Network (DISH) and Dynegy (DYN). DISH had mixed results. While the  company missed estimates very badly, hitting 0.14 EPS with estimates at 0.67, the company added new subscribers and kept their revenue in line with one year ago. Investors were reacting well to certain aspects of the report, sending the stock up over 8% so far this morning. Dynegy Corp., on the other hand, missed estimates again as the company’s losses continue to grow. They lost $345 million in the quarter or -0.41 EPS. Analysts had been expecting an EPS of -0.04. Here again investors have only dropped the stock 1.5% in pre-market trading.

company missed estimates very badly, hitting 0.14 EPS with estimates at 0.67, the company added new subscribers and kept their revenue in line with one year ago. Investors were reacting well to certain aspects of the report, sending the stock up over 8% so far this morning. Dynegy Corp., on the other hand, missed estimates again as the company’s losses continue to grow. They lost $345 million in the quarter or -0.41 EPS. Analysts had been expecting an EPS of -0.04. Here again investors have only dropped the stock 1.5% in pre-market trading.

I know Phil is sort of bearish, but I think that the market has some run left in it off that news data, hopes for more solid economic data/earnings, and decent earnings.

Asia was up huge with Japan increasing 1% and China seeing its Hang Seng gain over 2.7%. Europe, however, was slightly down as investors took a breather with little news coming out from the continent. The dollar continues to show strength, which is lending to weaker oil prices.

My guess is that we bounce off a lower start to green, but it will not be able to be sustained over the day, but neither highs nor lows of the day will be significant.

Buy Pick of the Day: Comcast Corp. (CMCSA)

I like Comcast, today, because of two major reasons. One is that Dish Network’s earnings are being taken very well by investors. This should bring some positives to the whole sector. While the company did add subscribers, I think it can be looked at as a bullish sign that people are jumping back into buying some nicer things like cable and satellite television once again. The earnings reiterated some really positive earnings we saw from Comcast.

I like Comcast, today, because of two major reasons. One is that Dish Network’s earnings are being taken very well by investors. This should bring some positives to the whole sector. While the company did add subscribers, I think it can be looked at as a bullish sign that people are jumping back into buying some nicer things like cable and satellite television once again. The earnings reiterated some really positive earnings we saw from Comcast.

The second reason I like Comcast are those positive earnings. The company beat expectations on Thursday morning, and it had an earnings increase of 53%. The company jumped up significantly and then sold off Friday on the positive day. The stock, today, will have investors getting back into it as CMCSA is definitely a fundamentally solid company moving forward. This is a trend I have seen with playing stocks on earnings. The company beats and gaps up and trades sideways, gets sold off those highs the next day, and then, investors reenter the stock off those profits.

CMCSA does have a lower than market beta at 0.81, which means it is less volatile. This is another reason why I am good with this stock. With the market showing little sign of direction, it is better to be in something that is more "for sure," in case the market really heads south and follows Europe. However, the stock is not trading up much in pre-market. I think off of these morning levels we can take a 1-2% profit, and even more if the market really revs up.

The stock has room left for more upward momentum to its upper bollinger band.

Entry: I would get involved at the 14.95 – 15.00 prices, which will probably right around where the stock opens.

Exit: Taking 1-2%, puts us around 15.10 – 15.20, maybe even 15.25. I wouldn’t expect to get much more than that on this stock unless the market really rallies. If that is occurring, put a stop loss on 15.20 and look for something around 15.40 for an exit.

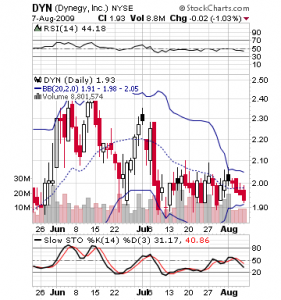

Short Sell of the Day: Dynegy Corp.

This stock is a definite short sale for today. The stock is basically a penny stock, so there is a lot of risk here, but I think the risk is really a lot smaller than with others. The company has high beta for a utility but nothing close to some other penny stocks. The earnings for Dynegy were just not good, and things just appear to be getting worse and worse for this company. The company reported that loss of $354 million, which is much worse than its break even one year ago. Further, the company had only a negative EPS of -0.04 last quarter. The company’s forecasting was also worse than expected. Investors have not been pleased and sold it off 3% in pre-market trading.

risk is really a lot smaller than with others. The company has high beta for a utility but nothing close to some other penny stocks. The earnings for Dynegy were just not good, and things just appear to be getting worse and worse for this company. The company reported that loss of $354 million, which is much worse than its break even one year ago. Further, the company had only a negative EPS of -0.04 last quarter. The company’s forecasting was also worse than expected. Investors have not been pleased and sold it off 3% in pre-market trading.

I think, however, that with this being a penny stock that downward momentum will plummet the stock early in the trading day and then trade it pretty much sideways for the rest of the day, so we want to get in on that downward movement. Buying right into the open will be the best way to play this stock as penny stocks tend to have most of their major movement on developments right away.

The stock is in a perfect position to trend lower, with slow stochastics just breaking out of that 50 range, which signals neither buying nor selling. It is just starting to trend lower, which means the stock has mounting selling pressure. This is the same with RSI. The company’s lower bollinger band is coming in pretty close to where the stock is trading, which is why for the single day I am not sure it will be able to plummet much after an early morning sell off.

Entry: Short sale should be taken right at the beginning of the morning, looking for an entry around 1.86 – 1.88.

Exit: Cover yourself on a nice 2-3% gain at 1.81 – 1.84.

Good Investing,

David Ristau