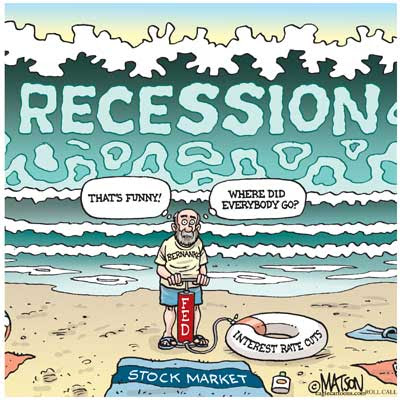

Uncle Ben says the recession is "very likely over" yesterday:

Uncle Ben says the recession is "very likely over" yesterday:

Even though from a technical perspective the recession is very likely over at this point, it is still going to feel like a very weak economy for some time as many people still find their job security and their employment status is not what they wish it was.

Yeah, it sounds better in the headlines than when you quote the whole sentence and watching the video gives you even less confidence. Speaking of confidence – I reminded members yesterday that there is no economic forecaster we should have less confidence in that Ben Bernanke:

- July 2005: "There was no housing bubble and housing prices are supported by the strength of the economy."

- Nov 2006: "The motor vehicle sector is already showing signs of strengthening" and "The rate of decline in new home construction should slow as inventory is worked off."

- Feb 2007: "We expect moderate growth going forward. There is not much indication that sub-prime mortgage issues have spread into the broader mortgage market."

- July 2007: "Home sales should ultimately be supported by growth in income and employment… The global economy continues to be strong. Overall the US economy is likely to expand at a moderate pace over the second half of 2007, with growth strengthening a bit in 2008."

$9,000,000,000,0000 in bailout spending later, Mr. Bernanke is now telling us the recession is LIKELY over and that's good enough for our man Cramer to tell his sheeple: "Sentiment is so negative right now it’s out of synch with reality.” This clip is worth watching just to hear the way Cramer sneers the phrase "Nobel Prize-winning economist" as if that title, by itself, means you should dismiss Joseph Stiglitz out of hand as he warns that current bank problems are bigger than pre-Lehman. Cramer calls Stiglitz's article: "So stupid, wrong and anti-empirical that it's just downright silly that it doesn't even dignify the use of video-tape or digital or whatever they do now." I know this sentence makes no sense but it is an exact quote.

$9,000,000,000,0000 in bailout spending later, Mr. Bernanke is now telling us the recession is LIKELY over and that's good enough for our man Cramer to tell his sheeple: "Sentiment is so negative right now it’s out of synch with reality.” This clip is worth watching just to hear the way Cramer sneers the phrase "Nobel Prize-winning economist" as if that title, by itself, means you should dismiss Joseph Stiglitz out of hand as he warns that current bank problems are bigger than pre-Lehman. Cramer calls Stiglitz's article: "So stupid, wrong and anti-empirical that it's just downright silly that it doesn't even dignify the use of video-tape or digital or whatever they do now." I know this sentence makes no sense but it is an exact quote.

Jim does manage to plug his new book during this tirade against the man who has been working with the EU and other top economists to change the way GDP is measured to focus on actual improvements in the lives of the citizenry rather than just the corporations. GDP has long been an inaccurate measure of a country's economic prosperity: It can make countries like Malaysia, who are tearing through their natural resources, look wealthy when, in fact, they're enjoying a short-lived bubble and making no real progress. Stiglitz says:

In the years preceding the crisis, many in Europe, focusing on America's higher rates of GDP growth, were drawn to the US model. Had they focused on metrics such as median income – providing a better picture of what is happening to most Americans – or made corrections for the increased indebtedness of households and the country as a whole, their enthusiasm might have been far more muted.

Stiglitz's proposed model takes into account factors like income disparity, health care, happiness ratings, environment, leisure time – many things that make capitalists cringe so it's no wonder that Cramer is spearheading the character assassination team because, if you think health care is being fought by corporate interests and the MSM, wait 'till you see the backlash against measuring GDP as if the health and happiness of the workers mattered! "That's why," Cramer says, his new book has a "Rule #17: Just because somebody has a Nobel doesn't mean they know anything about investing – or even the economy." John Stewart and Don Harrold have already said plenty about Cramer's own Economic forecasting ability so I'll just leave his wisdom at that for now.

Asia jumped on the headline "Recession is over" data and the Hang Seng rose so fast that the graph couldn’t keep up with the buybots on that index. They stopped at the 2.5% rule with a 536-point gain on the day that took the Hang Seng back to the levels of August 2008. Exporters led the rally on "strong" US Retail Sales numbers but the Shanghai dropped 1.1% as government data showed investors opened fewer trading accounts in August (no money coming off the sidelines). Keep in mind that the Shanghai is not open to foreign IBanks so the Gang of 12 has to concentrate on the Hang Seng to stir the pot in China. The Nikkei had a wild day as the dollar was jammed back up to 91 Yen just in time for the Nikkei’s open (9pm) and that gapped them up 100 points, but almost all of the gain was erased in a massive afternoon sell-off as the dollar failed to hold 91 Yen into the close.

UK unemployment hit a 14-year high this morning but that's not bothering Europe, who are up about 1.5% ahead of the US open. The OECD is predicting unemployment to hit 10% across the developed nations, the highest level since WWII with 57M people out of work by next year, double where it was in mid-2007, when Bernanke and Cramer were last telling us to BUYBUYBUY. The OECD is counting on the US to be above the average while the euro zone's labor market will suffer greater damage, it said. In Germany, France and Italy, the euro area's three largest economies, unemployment is likely to reach 11.8%, 11.3% and 10.5% by the end of 2010, respectively.

Our CPI came in blazing hot, up 0.4% but all the money went to commodity pushers so it doesn't count and Core CPI, which reflects what prices producers are able to pass through, fell to 0.1% depsite the move up in production costs. I'm no Nobel Prize-winner yet but that seems to me like there may be some margin pressure in August…. Despite the "surge" in demand from cash for clunkers – dealers still dropped their pants and new car prices fell 1.3%. Housing, which accounts for 40% of the CPI, was up 0.1% in our amazing recoveryless recovery.

I'm sorry to say I'm still urging caution. We won't be too impressed until we see 1,056 hit and held on the S&P and 6,959 on the NYSE – those are our last two 33% off the top levels we need to cross. We should open right there this morning and it's a good place to take some speculative shorts like the DIA $97 puts for .60 as they would be a great ride down on a pullback.