Good to be back with you today after having to miss yesterday. We had an okay Monday as we went 1/2 on the day. We had been expecting the market to make a major pullback, but it instead had a nice rise on some M&As and bargain hunting. Still, our short sale of the day, LDK Solar Inc. (LDK) worked well for us. Solar has been in the pits, and we were able to buy LDK at 8.80 early on in the day and sell off at 8.63 for a sweet 2% gain. The buy pick of the day, Ultrashort Proshares Financial ETF (SKF), was not as successful. We got involved with the stock at 25.75, and we got stopped out at 25.00 for a 3% loss. It was our first miss on the buy pick of the day in a week, and it was the first 3% loss in weeks. Today, we will have to bounce back to getting both of these right.

Here we go…

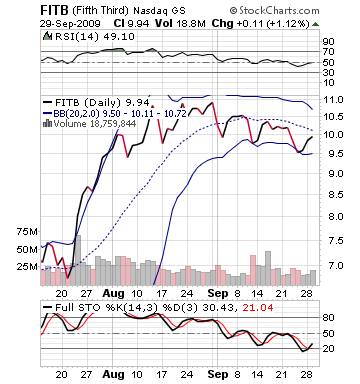

Buy Pick of the Day: Fifth Third Bancorp Inc. (FITB)

I am going to get behind a market rally coming on Wednesday, in the wake of Tuesday’s losses. There are just too many positive indicators, and while I want to be bearish (like usual), I am going to restrain myself and look at the short term fundamentals of this market. It all starts with the GDP report that came out at 8:30 AM. The GDP for Q2 was revised down by the government to a loss of only 0.7%, while the expectations were that it would be revised upwards to 1.20% from 1.00%. The suprise gain shows the economy really turned around in the latter part of Q2, and it sets up Q3 to be hopefully a growth quarter…ending the recession. Nonfarm unemployment rates were higher than expected, but the way futures are playing out, it does not really seem to matter, which will get to in a moment.

Fifth Third (FITB) is the pick of the day. This is one to get excited about if the market does rally because of its oh so sexy 2.44 beta rating, and its close connection to a company that got an upgrade today, Huntington Bancshares (HBAN), which is the best news that company has seen in a very long time. Both companies are regional banks in the midwest based in Ohio. The company’s upgrade from Duetsche Bank should give this stock that needed boost to get moving. HBAN is up over 3% in pre-market.

Futures going into the report on GDP and private sector unemployment were right at the 30 level for the Dow. As of 8:45 AM, the Dow is now up 50, which is slightly off of a high, but the market is really liking what they are seeing in that GDP report. It may lose some momentum, but that is perfectly fine because it creates a buying opportunity. Even if HBAN’s upgrade has no effect on FITB, the stock is still sexy on a rising market. The stock is oversold and down 10% in the past month. The stock, however, has really had very little movement up or down and has been trading very sideways. This is simply because investors do not know what to do with these regional banks.

Futures going into the report on GDP and private sector unemployment were right at the 30 level for the Dow. As of 8:45 AM, the Dow is now up 50, which is slightly off of a high, but the market is really liking what they are seeing in that GDP report. It may lose some momentum, but that is perfectly fine because it creates a buying opportunity. Even if HBAN’s upgrade has no effect on FITB, the stock is still sexy on a rising market. The stock is oversold and down 10% in the past month. The stock, however, has really had very little movement up or down and has been trading very sideways. This is simply because investors do not know what to do with these regional banks.

With some great reports coming out on GDP, the IMF saying that they have started to make up for losses they accrued in the financial crisis, the world markets looking good, crude prices rising (even though this should be bad for the market, crude has time and again pulled this market up), FITB looks really nice.

Technically, on its slow stochastic chart, the stock has just crossed lines towards the upside. This is a great sign of a place to buy a stock because it is a sign that buyers are entering the stock. On RSI, FITB has moved right back towards a neutral level, and it looks set for a rally, as well. FITB is only up a small 1% in pre-market, and so, we can get at a nice price that is not too much of a premium.

Entry: Looking for an entry on 9.85 – 9.95 on this one. I think we might pull back to start the morning, but its a good day.

Exit: Looking for 2-3% increase on entry price.

Stop Loss: 3% on low side

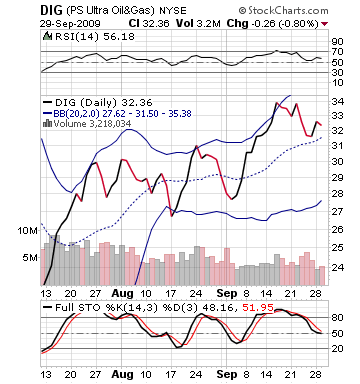

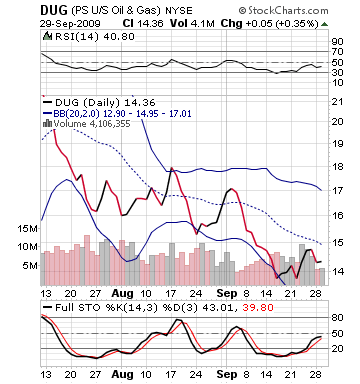

Short Sale of the Day: Ultra/Ultrashort Proshares Oil and Gas (DIG/DUG)

Short Sale of the Day: Ultra/Ultrashort Proshares Oil and Gas (DIG/DUG)

The crude oil inventories coming out today at 10:30 AM will be a great place to get a short sale in for the day. We are going to have DIG up early on in the day, but if crude inventories come out higher again this week, DIG could give up gains very quickly. However, the ETF is up only 1.5% in pre-market, so there is definitely reservation about this play.

We have to like that neutrality for the dual pick we are setting up. What we want to do is if inventories come out that they rose, immediately short sell DIG or buy DUG to short DIG. In reverse, if the crude inventories dropped (I don’t expect they did), we short DUG or buy into DIG. This will produce a short term 2-3% movement for us. This is in no way a long term play, and we want to get out as quickly as possible on this.

A great way to produce this trade is to open multiple windows for yourself and have the trade ready on multiple windows. This way when the news breaks, you can easily push what needs to be done. Both DIG and DUG are attractive technically. DIG has moved back from its highs over the past week. This gives it some definite room to make a move back to the upside. In reverse, DUG has seen some growth, but it is still very undervalued. Either appear terrific in this current situation with whatever the news tells us.

Entry: Enter short sale of DIG or DUG at 10:30 on crude report.

Exit: Looking for 2-3% before buy back.

Entry: 3% on upper side.

Good Luck and Good Investing,

David Ristau