Hello PSW and Oxen Report readers. I am back from vacation and am ready to get back to making you some money starting today. The market has been losing itself over the past three trading sessions on a number of poor economic indicators, including unemployment rates and crude oil inventories. Can the market turn itself around this Friday before Christmas week? Is Santa coming early?

Hello PSW and Oxen Report readers. I am back from vacation and am ready to get back to making you some money starting today. The market has been losing itself over the past three trading sessions on a number of poor economic indicators, including unemployment rates and crude oil inventories. Can the market turn itself around this Friday before Christmas week? Is Santa coming early?

Let’s take a look at the market and see what we got.

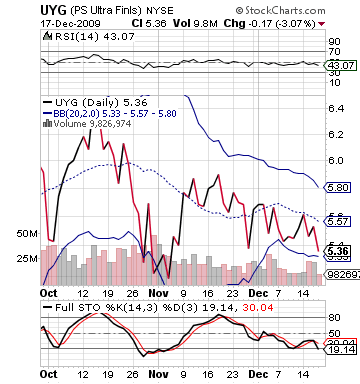

Buy Pick of the Day: Ultra Financials Proshares (UYG)

Analysis: The market’s futures are up on the morning after three down sessions, but there is not much this morning to rally behind. There is no economic data or indicators to help give the market a boost and earnings are not from any market stalwarts (Carnival and CarMax). The big news is that Barack Obama is calling more meetings on Friday for the UN Climate meetings. Additionally, Germany is boosting the European markets after the German Information Business Climate Index came out higher than expected, which is good for business sentiment in the Euro-zone. Even with Asia down across the board, the US markets are moving in accord with Europe. The largest rally point, though, is most likely the strong earnings released from Research in Motion Ltd. (RIM) with its 59% earnings increase year over year. The maker of blackberry keeps growing. Tech is looking strong. Oil is looking strong. Futures are up. Let’s turn then to a weak spot in the market to get a nice undervalued, cheap play.

This is why I am getting behind the Financial Proshares ETF (UYG) this morning because I see a good day in the market, and the financials could definitely use it. The ETF, similar to the financials, has taken a beating, losing almost 10% in the past four trading sessions. The ETF is highly undervalued, and it should definitely be looking to make its move up as the market rallies. The financial sector was pretty quiet in after hours and this morning after leading the market lower yesterday, which is one of the reasons I really like it to bounce back as the market trends higher. Earnings from CarMax Inc. (KMX) have come out stronger than expected with the company hitting an EPS of 0.33 while analysts were expecting only 0.16. This is good news for the market. Additionally, oil is rising, which interestingly seems to always help the market move higher.

Technically, you have to love UYG. The ETF is extremely undervalued, oversold, and near its lower bollinger band, almost hitting its lower band as of yesterday. That means we are looking for a pop. Yet, we only have UYG up a bit over 1%. The market could really rally today after the three days down, and buying in our range will be a great deal for an ETF that has room to grow to 5.80 or so. Get in quickly because it could be on the move.

I don’t tend to look into what market makers on CNBC or other news feed are lighting a fire under, but anytime Guy Adami and Karen Finerman, from Fast Money, get behind the financials, people buy them up. Finerman recommended Bank of America (BAC) as today’s first play of the day. Adami recommended BAC and Wells Fargo (WFC) earlier in the show. A bit of news that probably won’t lend a big hand, but it is worth mentioning.

Entry: We are looking for an entry for an entry of 5.40 – 5.50.

Exit: We are looking for a gain of 2-4%.

Stop Loss: 3% on bottom of entry.

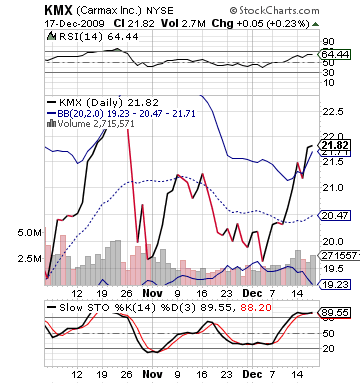

Short Sale of the Day: CarMax Inc.

Analysis: Carmax Inc. (KMX) reported some extremely solid earnings this morning for sure. The company reported for its Q3 that they saw a 19% rise in sales and an over 300% increase in profits from one year ago. The company reported an EPS of 0.33 vs. the expected 0.16. The company definitely had some very positive earnings – a lot of which was due to the Cash for Clunkers Program.

So, why would anyone want to short sell such a fantastic earnings report as this? The stock is up nearly 10% in pre-markettrading, and it may be setting up for a big sell off from the open. Going into the day, the stock had its pre-market bollinger bands set at just above 22.00. The stock was already overbought and near its bollinger band, with a gain of almost 10% over the past couple weeks. The stock was definitely pricing in gains going into earnings, so the stock is definitely highly overvalued trading near 24 dollars per share.

With the market definitely looking to open higher, the stock is going to be opening much too high and possibly moving slightly higher, but there is going to be a heavy amount of pressure for a selloff after the market opens. We don’t want to get in right away, but we will definitely like this for a short sale. KMX has already come down about thirty cents since I started writing about this, which is further signal of the trend that KMX is going to take today. Make sure to check back for the morning levels alert to see exactly where we want to get in.

Entry: We are looking for an entry of 23.80 – 23.90.

Exit: We are looking for an exit of 2-3%.

Stop Loss: 3% on top of the buy in price.

Good Luck and Good Investing,

David Ristau