After what looked like a good recovery, there are signs that Northeast Manufacturing is in shap decline.

Jobless numbers are on the upswing as temporary holiday hiring is being trimmed faster than census jobs can pick up the slack. We had a big build in inventories in Q4 as clearly manufacturers were overly optimistic and a sharp rise in commodity prices during the quarter didn't help much either. We get the official report at 10am today and the most optimistic expectations have us down about 10% from last month's 20.4 reading so we can expect today's report to move the market one way or the other.

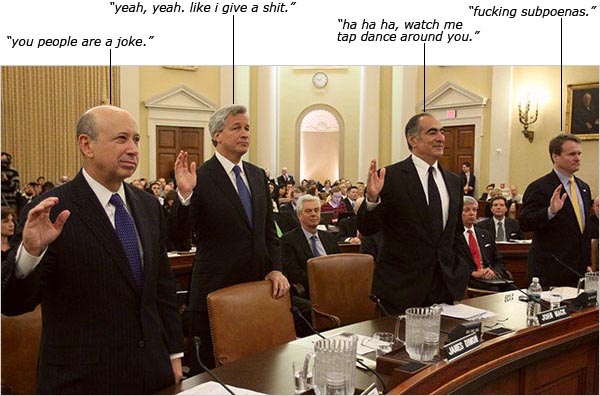

Not to worry though because, as Jonathan Weil points out in Bloomberg today, "the fix is in" on Wall Street as the 10-member Financial Crisis Inquiry Commission has been given 11 months and $8M to examine the causes of the financial crisis, including Fannie Mae’s 2008 meltdown and the near-deaths of at least 10 other major financial institutions, including Lehman Brothers Holdings Inc., American International Group Inc. and Citigroup. The statute that created the commission says its report specifically must tackle the role of regulators, monetary policy, accounting practices, tax policy, fraud, capital requirements, credit raters, executive pay, derivatives and short selling — plus a dozen other required areas of study.

Wow, that's a lot of ground to cover! To put in perspective what a joke this is, Weil points out that when Fannie Mae hired former U.S. Senator Warren Rudman in 2004 to investigate how its accounting practices had gone awry, his law firm’s final report took 17 months to complete and cost the company more than $60 Million. $60M in 2004 to investigate ONE firm over 17 months and Congress has allocated $8M over 11 months to investigate a DOZEN firms as well as get an overview of the entire financial system. What are the odds the commission can conduct all these investigations by mid-December and do a thorough job? About zero, which clearly was Congress’s intent all along. If this is a joke, it's a bad one and it's on US!

This is why we're bullish on the markets (or the market manipulators, at least) – fundamentals don't matter! The banksters have taken control of government and are flat out laughing at us, the citizens of the US (and the world) as we cry "foul" and try to reign in the madness. This is not just a US problem, it's a global problem but you can't fight "THEM" when GS is reporting $4.95Bn in QUARTERLY profits this morning (as much as XOM) on $9.62Bn in revenues (1/5 of XOMs). $4.95Bn buys you a LOT of good government, especially when you consider the ENTIRE salary of ALL of Congress, including the House, the Senate, the Executive Branch and the Supreme Court is less than $100M or 1/50th of GS's QUARTERLY PROFIT or we could say that buying out the entire US Government would consume about 1/50th of their QUARTERLY expenses.

There are, in fact, individual traders who draw a bonus that is larger than the combined salary of the entire US government. Goldman alone spent over $5M lobbying Congress in 2009, part of the $5Bn that has been spent on lobbying by the financial institutions over the past decade to "help shape our policy decisions". That's an average of 5 TIMES the ENTIRE salaries of the US government spent lobbying to them EACH year of the past decade. Check out the haul taken in by the Financial Service Committee alone! Do you think the bottom 90% are fighting a losing battle here or what? Face it, they haven't got a chance in hell of changing anything so let's line up the sheeple and get out out shears because spring is in the air and it's fleecing time!

There are, in fact, individual traders who draw a bonus that is larger than the combined salary of the entire US government. Goldman alone spent over $5M lobbying Congress in 2009, part of the $5Bn that has been spent on lobbying by the financial institutions over the past decade to "help shape our policy decisions". That's an average of 5 TIMES the ENTIRE salaries of the US government spent lobbying to them EACH year of the past decade. Check out the haul taken in by the Financial Service Committee alone! Do you think the bottom 90% are fighting a losing battle here or what? Face it, they haven't got a chance in hell of changing anything so let's line up the sheeple and get out out shears because spring is in the air and it's fleecing time!

8:30 Update: Woops, we got our jobs numbers and they were quite a bit worse than expected with 482,000 people filing claims last month and continuing claims at 4.6M – 100,000 more than estimated. Hey, what's 100,000 more or less lost jobs between friends, right? We'll be waiting for Leading Economic Indicators and the Fabulous Philly Fed report at 10, followed by crude inventories at 10:30 where the other fix is in as rumor has it that refineries cut production by ANOTHER 2.5%, down to just 77% of capacity.

A 2.5% production cut on 19Mbd of US consumption is 3.3Mb a week that the refiniry cabal (who just so happen to be the oil producing cabal who make money on shortages) is shorting the US supply chain. Combine that with record low imports and we have all the recipies for a drawdown in crude today. We knew about all this last night so we went long on oil futures at $77.50 and got a ride all the way up to $78.20 and then we stopped out and this morning in Member Chat I called the play again at $77.50 and again we got a ride up to $78.20 so VIVA LA MANIPULATORS – may you always be so obvious!

Similarly we did quite well yesterday playing for Mr. Stick to pump up the markets into the close. We are having a lot of fun now that we have decided to stop complaining (well a little complaining) and simply enjoy our status in the top 10% club and partake in the daily fleecings. I even posted a day trade up in Seeking Alpha's Stock Talk (where you can follow me live) to buy the DIA $107 calls at .95 and they hit our goal at $1.20 just into the close for a nice 26% gain on the day. This is the kind of thing we do at PSW every day and you can sign up HERE or just follow me on Seeking Alpha for the occasional freebie.

China's GDP came in at a red hot 10.7% and that spooked the Hang Seng and sent them down 423 points (2%), back below 21,000 to 20,862. The Shanghai held flat at 3,158 and India fell 2.5% but that didn't bother Japan as the Nikkei rose 1.22%, all happy that China was growing quickly (maybe they'll by more Toyotas) AND that the dollar ran all the way up to 92 Yen last night (but was rejected).

Our friend Nouriel Roubini says the global stock rally may be coming to an end but he's an NYU professor and firmly in the bottom 90% so we have to take what he says with a grain of salt. Bank bear Meredith Whitney's reputation is also taking a hit as GS knocks it out of the park however, it should be noted that most of GS's profit gains came from bonus restraint that was exercised this quarter to be politically expedient with "just" 38.5% of the firms TOTAL REVENUE going to bonuses in 2009, but that's still up 50% from last year so don't get all weepy for the poor GS employees.

Europe is up about half a point acrosss the board ahead of the US open, which is a mild retrace of yesterday's 2% sell-off but none of this matters until we get our 10 am data and that won't matter either as fundamentals are right out the window in this Meatball Market so we're just going to go with the flow and have some fun during earnings season.