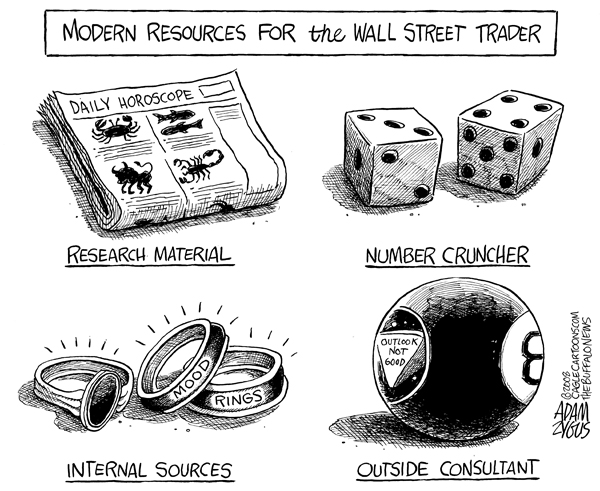

This is not too encouraging:

If we can’t break over our falling 50 Dma then it’s very likely we’re forming a lower channel that will center around our 5% line at 10,165 but we need to keep in mind that the 200 dma is WAY down at 9,552 and doesn’t even make the 3 months chart so we have to seriously consider that our 10% line at 9,650 may still be in play if the markets can’t show us the money by next week (this week is options expiration so it’s hard to believe anything we’re seeing here).

I have been contending that we are following a similar chart pattern to the one we had in 2004 this year and Barry Ritholtz has found a good comparison chart for us and so far, so good, as we expect a healthy downward consolidation as we work though our remaining issues this quarter (I’m hoping we turn around after May earnings):

Keep in mind that 10,300 on the Dow is NOT a breakout, 10,300 is the EXPECTED bounce off the 5% rule at 10,165. NOT getting a 1% bounce off a 5% drop (as we didn’t in early Feb) is a negative sign that indicates an expected further leg down. This will mark our 2nd test at this level and we see how the last one went on day’s 2 & 3 so let’s keep a close eye on today’s movement and, of course, without confirmation of our bounce levels from the S&P (1,105), Nasdaq (2,225), NYSE (7,100) AND the Russell (625) – we’re certainly not going to get excited about anything the Dow does.

We have lots of fun data today with the PPI and Jobless Claims ahead of the bell and, at 10am, we get Leading Economic Indicators and the Philly Fed (which has been AWFUL lately) followed by Natural Gas Inventories at 10:30 and Petroleum Inventories at 11. After the bell we’ll see the Fed’s Balance Sheet and the Money Supply and Fed Govs Lockhart & Bullard will give their outlooks on the US Economy.

DAI and WMT both had less than exciting earnings this morning but the news we should be paying attention to is the Pew Report estimating a $1,000,000,000,000 funding gap between the pension, health-care and other retirement benefits promised to public employees and the money set aside to pay for them.

The Pew report said its estimate of the funding gap would likely prove conservative, because it didn’t account for the massive investment losses pension funds suffered during the second half of 2008. Although there was a slight rebound last year, it wasn’t nearly enough to cover the previous losses, Pew said.

The Pew report said its estimate of the funding gap would likely prove conservative, because it didn’t account for the massive investment losses pension funds suffered during the second half of 2008. Although there was a slight rebound last year, it wasn’t nearly enough to cover the previous losses, Pew said.

This is going to be a particularly tough issue to fix as it’s coming at the same time as record numbers of people are reaching retirement age and the financial situation in the states and cities has become so dire that some are filing Chapter 9 Bankruptcy, which is a very special "F-you all" kind of bankruptcy – the kind Orange County, California declared in 1994 where you pretty much get to say to creditors and bondholders and even employees you owe money to: "I’m going to tear up all these debts as if they never existed and your choices are either resume business with me as if it never happened or go find another town to do business with but none will be better than me because I’m debt-free now. Muhahaha."

8:30 Update: I was surprised yesterday that we didn’t sell off more on the Fed minutes as it seems pretty clear to me that they will be withdrawing liquidity in 2010. Asia was mostly down this morning with the Hang Seng taking a huge hit after lunch, erasing a rally and finishing down 111 for the day and India was off 0.6% as well while the Nikkei picked up a quarter point but that was before the BOJ indicated they will NOT be making additional moves to fight deflation at this time so we’ll see what tomorrow’s reaction is to that. There are some indications that growth in China is already slowing and do make sure you check out Vitaliy Katsenelson’s slide presentation on "China – The Mother of All Black Swans," as this could become quite the topic of discussion next week, when China comes back from their holiday. Singapore also reported a slowdown in exports in January.

Europe is flat ahead of the US open and we’re watching to see if the FTSE holds 5,250 long enough for the DAX to break over 5,750 although that’s going to be a tall order with Daimler scrapping their dividend this morning. Greece is considering selling 10-year bonds and it will be very interesting to see the rates on those as now we’re talking about locking is some long-term high rates. Soc Gen fell hard on asset write-downs, the UK posted it’s first official budget deficit since 1993 and Bush’s secret girlfriend, Angela Merkel, declares it would be a “scandal” if banks helped Greece massage its budget, as European officials investigate Goldman Sachs Group Inc.’s role in Greek efforts to conceal the size of its deficit. Would be? Obviously Angela is not a PSW subscriber as we have the paper trail well marked at this point!

Europe is flat ahead of the US open and we’re watching to see if the FTSE holds 5,250 long enough for the DAX to break over 5,750 although that’s going to be a tall order with Daimler scrapping their dividend this morning. Greece is considering selling 10-year bonds and it will be very interesting to see the rates on those as now we’re talking about locking is some long-term high rates. Soc Gen fell hard on asset write-downs, the UK posted it’s first official budget deficit since 1993 and Bush’s secret girlfriend, Angela Merkel, declares it would be a “scandal” if banks helped Greece massage its budget, as European officials investigate Goldman Sachs Group Inc.’s role in Greek efforts to conceal the size of its deficit. Would be? Obviously Angela is not a PSW subscriber as we have the paper trail well marked at this point!

We have a wild couple of days ahead of us so strap in and enjoy the ride. We’re mainly in cash (all open positions well hedged) and just watching the show, waiting to see which side of the magic line the markets end up.