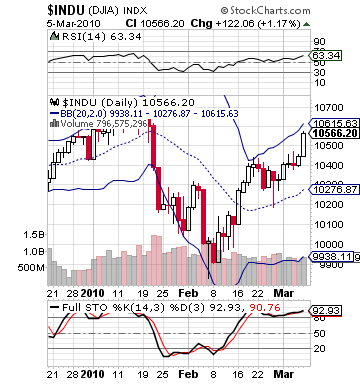

Hope everyone had a nice weekend. Today, we are starting off with a chart of the Dow Jones. This shows you that we have a market that, in the short term, is extremely overvalued. RSI is above 60, the average is moving towards the top of its bollinger bands, and it is overbought on stochastics. All this is showing to me that the market is toppy. That chart is how I want to start this week to show you that I think we are going to be looking at some short sales and inverse ETFs unless we have reason to believe the market will rally. Today, I do not see any major reason to believe that will happen. Also, be sure to check out my Weekend Wrap-Up and Virtual Portfolio Update, which shows how we have increased our Buy Pick Virtual Portfolio 129% in one year.

Hope everyone had a nice weekend. Today, we are starting off with a chart of the Dow Jones. This shows you that we have a market that, in the short term, is extremely overvalued. RSI is above 60, the average is moving towards the top of its bollinger bands, and it is overbought on stochastics. All this is showing to me that the market is toppy. That chart is how I want to start this week to show you that I think we are going to be looking at some short sales and inverse ETFs unless we have reason to believe the market will rally. Today, I do not see any major reason to believe that will happen. Also, be sure to check out my Weekend Wrap-Up and Virtual Portfolio Update, which shows how we have increased our Buy Pick Virtual Portfolio 129% in one year.

Buy Pick of the Day: Ultrashort Proshares Real Estate ETF (SRS)

Analysis: As I have been saying this morning and in my weekend post is that I think we are looking at an overvalued market that will need something to boost it to keep it going. This morning, we got some slightly bullish news in the form of an AIG sale to Metlife, but it is short lived. As of 8:00 AM, futures on the Dow were up 20. As of 8:30 AM, they were at 10. As of 8:45 AM – 2. It is a slow decline because the market is in a position to fall, and the news is not great enough to keep it moving. There is no economic data to sustain the market, and earnings were non-existent. The only even slightly important company to report was Yingli Green (YGE), who we will get to in our short sale.

For that reason, we can position ourselves well today in an inverse ETF for a buy. We want to avoid the financials and energy, however, because we had a major deal with Royal Dutch Shell and Australia Arrow Energy that could confuse the oil ETFs and oil market. AIG is in that financial sector. Therefore, I turn my attention to the under the radar Ultrashort Proshares ETF (SRS) for our Buy Pick of the Day. This one should be a bit of a slipper in the market today. It is sitting neutral in pre-market, but it is a volatile ETF that can really take off at the flip of a switch, which is what I am expecting. I rarely sell my upper sell range at 4%, and I did today..png)

There is really no news out of the ten holdings for URE, which is what SRS inverses. The holdings are a group of REITs and real estate companies, including Boston Properties, Vornado Realty, Public Storage, and Host Hotels. The lack of news and technical overvalue of the sector and market should be a reason to sell these stocks. URE is up over 7% in the past week and over 20% in the past month. It is definitely extremely overvalued. URE as an aggregate of the holdings shows the extreme overvalue of the sector.

SRS, technically, while hard to measure as an exact science like common stock is oversold, undervalued, and near its lower bollinger band. All the types of technical measures we like to see from a Buy Pick of the Day. As you can see, SRS has dropped just under 20% in the past month, following the inverse of URE. Look for a big move from SRS today and get excited for a possible 4% today.

Entry: We are looking to get involved at 6.75 – 6.85.

Exit: We are looking to exit on a 2-4% gain.

Stop Loss: 3% on bottom.

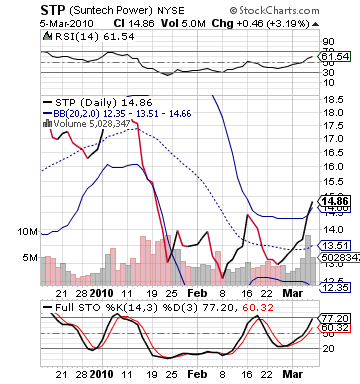

Short Sale of the Day: Suntech Power Holdings Inc. (STP)

Analysis: On the earnings front, I was so excited last week for the solar sector. I thought we had seen a lot of good beats and the sector was on fire, literally. Yet, after SOLF got me on Friday and Yingli Green (YGE) missed earnings badly this morning, reporting an EPS of 0.09 vs. the expected 0.14, I am looking to be a bit bearish on this sector. Additionally, I am not too fond of the direction of the market, as well. So, I am looking at most overvalued stocks, in the short term, as definitely all good short sales. Just something has to be a catalyst…

In the case of Suntech Power (STP), the company last week reported great earnings that really took everyone by surprise to the tune of a 100%+ beat on earnings. It took the stock up over 8% in two days, and it has taken the stock over its upper bollinger band, made it oversold on full stochastics, and increased its RSI to an alarming 60+ range. I do think STP will probably increase some more this morning just from the earnings hangover it still has, and I have adjusted my entry for that.

In the case of Suntech Power (STP), the company last week reported great earnings that really took everyone by surprise to the tune of a 100%+ beat on earnings. It took the stock up over 8% in two days, and it has taken the stock over its upper bollinger band, made it oversold on full stochastics, and increased its RSI to an alarming 60+ range. I do think STP will probably increase some more this morning just from the earnings hangover it still has, and I have adjusted my entry for that.

But, YGE really throws another wrench in the solar sector that is going to bring things down. YGE did see some rises in revenue and shipments, but the pre-market trading of this one has been all over the place. It is slightly up as of now, but it was down as far as 3% earlier this morning. Generally, I do not think it will have the momentum to hold many gains.

Across the board, the solar sector is down this morning, and STP is definitely an overvalued stock that does not have a lot more room to its upside. I think we get in after a little more rise and set ourselves up nicely for a short sale. Good luck!

Entry: We are looking to get involved at 15.05 – 15.15.

Exit: We want to cover on 2-3% decline.

Stop Buy: 3% on top.

Good Investing,

David Ristau