Yesterday was a pretty rough day for us. Both of our picks were pretty weak. The Buy Pick of the Day was the Direxion Oil Bear ETF (ERY). We got involved in the early going at 10.47 and saw it decline throughout the day. I said to sell at 10.22 in an alert towards the end of the day for a 2.4% loss. We could’ve held to the end of the day and only taken a small loss, but either way, it was a loser. Our Short Sale of the Day was about a 1% loser, as well. We got involved in Textron at 21.31, and we saw it bounce around all day, never making more than 1% for us. It ended the day in the green but in the red for us. We sold at 21.60 for 1.3% loss. 0/2 never makes me happy, but we have made some smart picks today that are cautious and careful. Our entry ranges are very specific, and I think we should be happy. We are dipping back into the oil market because I think it is ready to make a move. It might be the downside, however, it could be going a lot higher. Inventories will tell the tale…

Yesterday was a pretty rough day for us. Both of our picks were pretty weak. The Buy Pick of the Day was the Direxion Oil Bear ETF (ERY). We got involved in the early going at 10.47 and saw it decline throughout the day. I said to sell at 10.22 in an alert towards the end of the day for a 2.4% loss. We could’ve held to the end of the day and only taken a small loss, but either way, it was a loser. Our Short Sale of the Day was about a 1% loser, as well. We got involved in Textron at 21.31, and we saw it bounce around all day, never making more than 1% for us. It ended the day in the green but in the red for us. We sold at 21.60 for 1.3% loss. 0/2 never makes me happy, but we have made some smart picks today that are cautious and careful. Our entry ranges are very specific, and I think we should be happy. We are dipping back into the oil market because I think it is ready to make a move. It might be the downside, however, it could be going a lot higher. Inventories will tell the tale…

Let’s get into the picks…

Buy Pick of the Day: Direxion Oil and Gas Bull/Bear 3x ETF (ERX/ERY)

Analysis: We have had some trouble to start this week with our bearish positions. Yesterday, in the late afternoon, I wrote a bit of a muse talking about how we need the fundamentals to be there to make these positions come true. So, today, I am following that advice. We are going to be extra careful and picky in getting into positions. We are going to the oil market again today, but we are only going to play it if one of two things happens.

At 10:30 AM, we will get the release of the crude oil inventories. This will decide how we will approach our Buy Pick of the Day. Crude inventories came out at 4.1 million. It did not have a major effect on the oil market. Two weeks in a row, though, of big increases, especially with the market as high flying as it has been will have an effect. Therefore, if inventories are above 4.1 million, then we will want to buy ERY right away..png)

If inventories, however, are between 0 and 4.1 million, then we are going to pass on this play. It means an addition, but the movement in ERY and ERX will be short and not have a major effect on the market. We want a lot of movement and this small addition to inventories will most likely be taken with a grain of salt.

ERX is overvalued and overbought, but if the fundamentals are there for more movement to the upside on oil, then we can follow it with ERX. ETFs no know boundaries its seems. ERX, however, will only get a major boost if we actually see inventories decline by at least 1 million. Anything less than that and this play is not something we can get excited about today.

We are being picky, and the play may not work out for us. Yet, I have missed the past two days, and the market is showing no signs of going much of anywhere. I think its a day to try and be a bit more safe and wait for the fundamentals to show us the way to the promise land.

Entry: We will enter ERX or ERY based on the crude oil inventories at 10:30 AM. If inventories are above 4.1 million, then we will want to play ERY, negative ERX. In between, 0 and 4.1, then it is a no play.

Exit: We are looking for 2-3%.

Stop Loss: 3% on bottom of entry.

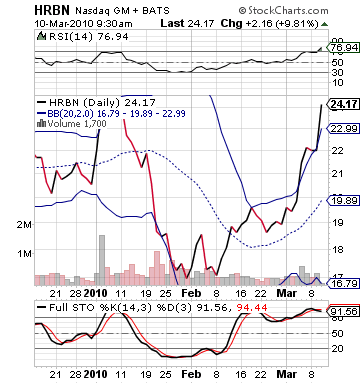

Short Sale of the Day: Harbin Electric Inc. (HRBN)

Short Sale of the Day: Harbin Electric Inc. (HRBN)

Analysis: Harbin Electric released some stellar earnings this morning that have catapulted the stock over 13% in pre-market trading. The company reported an EPS of 0.62 vs. the expected 0.47. The stock beat revenue estimates and has a strong outlook moving forward. It was all good news for HRBN, and the company will definitely finish in the green today.

So, why would we want to short sell or buy put options on this one? We can take advantage of the fact that investors are going to be taking profits on HRBN. A 13% increase means a lot of people that were buyers suddenly become sellers. The stock has low volume, so it will mean that it will probably jump up a bit more before settling down and seeing some declines on gains. 13% is quite a hefty gain, especially on a stock that has already moved around 20% in the past month. Earnings were not priced in over the past couple days, so the 13% is acceptable.

Yet, HRBN was already at that upper bollinger band and overbought, which explains why we are seeing 13% this morning. It also explains why the stock probably will see an influx in short and selling interest this morning. I have adjusted up our range to allow for a bit more explosion in the stock out of the gate. It is a bit higher, allowing the stock to move up to about 15% up on the day. It may be a bit too high, but with how things have been going, I would rather be a bit too high than a bit too low and flat on my face. This range is a solid one I believe.

If you can’t find shares to short look at the HTQ100320P00022500 option.

Entry: We are looking to enter at 25.45 – 25.55.

Exit: We will want to exit on 2-3%.

Stop Buy: 3% on top.

Good Investing,

David Ristau