Hope everyone had a great weekend. We are looking forward to another great week with The Oxen Report. We start off today with what should be a pretty neutral day in the markets. In pre-market, we got some good news out of the housing sector, which has not been releasing much in the way of positive data as of late. Housing starts and building permits for the month of February beat estimates; however, the market appears to be latching onto that it was the second straight month that building permits and housing starts fell. As investors await the Fed decision, the market will be bouncing along pretty flat, so we want to look for options that can move even if the market is not going to move as much.

Buy Pick of the Day: Rue21 Inc. (RUE)

Buy Pick of the Day: Rue21 Inc. (RUE)

Analysis: The market is looking to be pretty neutral for the day. The housing data beat estimates, which is good, but it was the second straight monthly decline for this data that we have seen. The market seems to be in limbo about today. Does it continue its way down? Does it move up before the Fed decision around 2:15 PM? Futures are right around 10 up for the Dow, coming off some earlier highs at 18. The decline does not make me excited for a major rally. So, I wanted to find a stock that I thought could make it on its own.

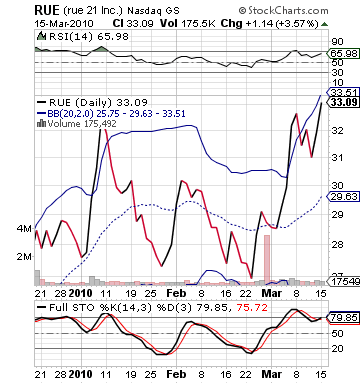

Rue21 is an up and coming retail store in the vein of Aeropostale and Hot Topic. It is cheap and teen-focused. Sounds like a winning combination. The company is set to release earnings in after hours today, and I think we may get a nice bounce and excitement going into earnings. We don’t want to hold this overnight, but we want to take advantage of a stock that has technicals showing it is moving upwards and play it on its up swing.

Last week, Aeropostale released some very enticing earnings, which is one of Rue21’s most obvious competitors and business model look alikes. The entire retail industry has been beating earnings, which is why I think investors and traders will pump into this one as they believe it will get the same kind of bounce ARO had. While the stock has become overvalued, it is carrying momentum upwards, which I like. I think it creates a nice buying opportunity today.

On the other hand, the market worries me today, and I have set my range at just 1-3%. The market looks confused, which is never a good thing. We will look to just take away small profits and not get too greedy. The technicals also send some warning. A stock that has moved almost 20% in just under a month and is near its upper bollinger band is risky. At the same time, it has buyer interest. We just hope that interest lasts one more day.

Entry: We are looking for entry in the 33.10 – 33.20 range.

Exit: We are looking to exit with a 1-3% gain.

Short Sale of the Day: Hovnanian Enterprises Inc. (HOV)

Short Sale of the Day: Hovnanian Enterprises Inc. (HOV)

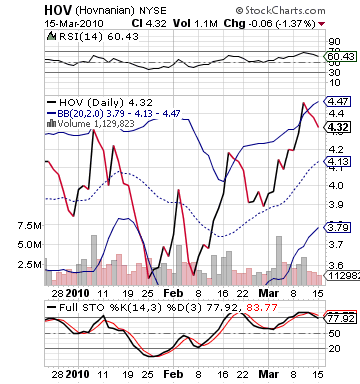

Analysis: We will want to play HOV on the fact that this stock has gotten ahead of itself in pre-market trading. HOV has moved itself up 5% in pre-market trading on really no news. The housing starts and building permits are obviously residential construction indicators, but they were really nothing special. They show further declines in the housing market, and the stock has no business jumping 5% in pre-market. In addition, it is alone in this phenomenon.

Most residential construction companies do not have pre-market trading, but the others that do were all up at most 1% in pre-market trading. What this tells me is that HOV has gone up on some false momentum, and it will be very quickly readjusting to fit with the market. Just yesterday, the builder sentiment index went down significantly. Today, we get so-so news from housing. And, HOV is up 5%?

Further, the stock is already overpriced going into today. It has gained almost 20% in one month, and it took its first big breather yesterday. It is right at the upper bollinger band. With news that should not be taken for 5%, these technicals point to a pullback, and this is where we can put together a nice short sale.

I am not being too greedy, however, with this one because the market could pull off something pretty crazy in either direction today. Get in and take some small gains to be careful. Good luck!

Entry: We are looking to enter at 4.55 – 4.65 range.

Exit: Looking to exit with a 1-3% gain.

Good Investing,

David Ristau