Wow what a rally!

Wow what a rally!

No, not yesterday but, once people stop trading, then – Wow! The Hang Seng gapped up 200 points at their open and then flew up another 100 points in the last 20 minutes of trading to make 297 points for the day. The Shanghai, of course, followed suit and the Nikkei was stubborn, opening up 75 but then giving it all back but then bouncing and rallying 100 after lunch for a 1.4% gain to 11,244. This was such exciting news to the FTSE that they gapped up as well and they are up 0.75% at lunch while the DAX popped up for a .75% gap open too and are at 0.84% into their lunch. Isn’t this exciting?

Clearly we are in a manic phase for the global markets and the mood swings in our local markets are getting wilder every day. Check out yesterday’s action on the Russell, Nasdaq and Dow futures all the way up to 7am this morning:

Wheee – that’s some wild stuff isn’t it? The Dow is our headliner so the pump monkeys like to make sure it’s as high as possible so they can get the suckers into the tent. As I often remark to Members, the chart action looks a lot like a hospital patient who is flatlining and occasionally gets another shot to get the heart going again but, as soon as the stimulus is removed, they go back to fading out.

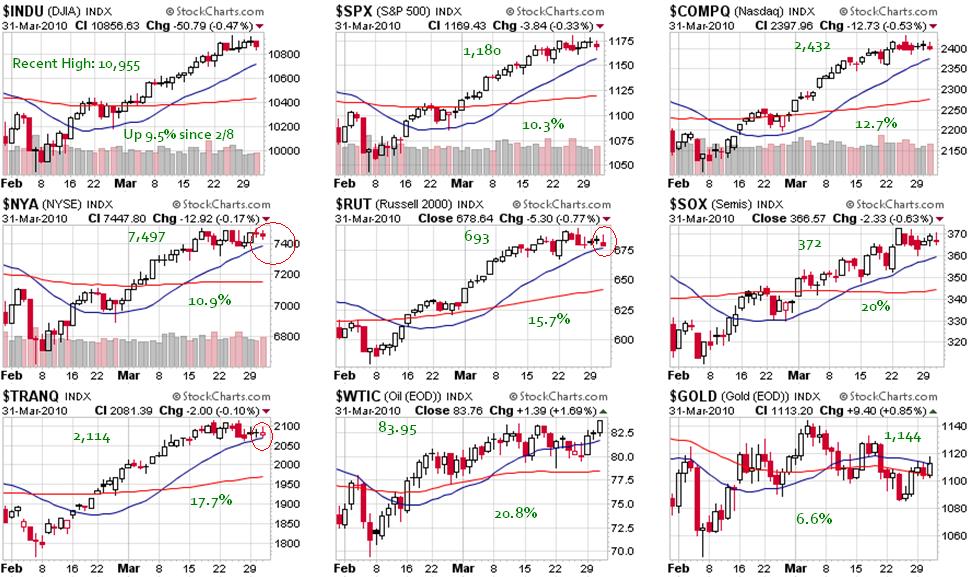

Today we only care about one thing – Can we make new highs? On Monday I said it was going to be "11,000 or Bust" and anything less than that is going to be a huge disappointment going into the weekend. Let’s take a quick look at our major indicators and see what our goals are going to be:

Other than gold – that is a very impressive group! Since we cashed out at the highs, I’m not regretting moving to the sidelines just yet but they sure are trying to pull us back in with this week’s rally. We’re not too convinced with the low volumes and all but, if we do make our breakouts, then we set a new set of breakdown levels at: Dow 11,000, S&P 1,200, Nas 2,500, NYSE 7,500 and Russell 700 – above which we will be able to switch off our brains and run with the bulls.

Meanwhile, we’ll be keeping a close eye on our weakening indicators (see circles) as we worry over the 20 dmas holding on the NYSE, Russell and Transports. It is truly amazing to see the transports climbing right along with oil – as if oil isn’t a major cost for the Transports. Maybe they are using gold to fuel their vehicles now, as that has stayed relatively low, losing considerable ground to other investments even as the gold bugs tell us over and over again how great it is. More likely, the gold that is fueling this entire rally is Goldman Sachs, who still make up 50% of the NYSE’s trading volume so, whatever Goldman wants, Goldman gets.

Meanwhile, we’ll be keeping a close eye on our weakening indicators (see circles) as we worry over the 20 dmas holding on the NYSE, Russell and Transports. It is truly amazing to see the transports climbing right along with oil – as if oil isn’t a major cost for the Transports. Maybe they are using gold to fuel their vehicles now, as that has stayed relatively low, losing considerable ground to other investments even as the gold bugs tell us over and over again how great it is. More likely, the gold that is fueling this entire rally is Goldman Sachs, who still make up 50% of the NYSE’s trading volume so, whatever Goldman wants, Goldman gets.

The bull premise is very simple, the Feb 8th lows were caused by panic over credit problems in Greece and Dubai and earnings that were improved but not in a very exciting way and, of course, the total lack of jobs in the United States oh, and the foreclosure thing and the credit card defaults and the mortgage resets and the war and the bloated Fed balance sheet and our $120Bn per month government deficit and maybe declining home prices and perhaps some nonsense about bank failures and empty retail spaces, declining wages, lost benefits, bankrupt states and local governments.

Now where was I? Oh yes, so the very simple bull premise is – That’s all just stuff! Stuff is just stuff. We’re 20% away from getting back to our all-time highs and that, in itself, proves that stuff doesn’t matter or we wouldn’t be doing so well, right? After all, stuff didn’t matter when we first rallied to our all-time highs so why should it matter now – it’s mostly the same stuff anyway. So let’s accentuate the positive and eliminate the negative, latch on to the affirmative – yadda, yadda…

.jpg) So we’re going to ignore the 439,000 people who lost their jobs last week and focus on the fact that it’s 6,000 people LESS than the 445,000 people who lost their jobs last week. Last week they said it was because of the weather so thank goodness that storm has passed! We’ll also ignore the Challenger Job-Cut Report, which shows 67,611 planned layoffs, up 59% from last month’s 42,090 but hey – that’s NOT 60%! We will (my MSM bretheren and I) focus on the March Monster Employment Index, which came in at 125, up a whopping 1 point from last month and up 6% from last year when things were totally collapsing and the S&P was racing to 666.

So we’re going to ignore the 439,000 people who lost their jobs last week and focus on the fact that it’s 6,000 people LESS than the 445,000 people who lost their jobs last week. Last week they said it was because of the weather so thank goodness that storm has passed! We’ll also ignore the Challenger Job-Cut Report, which shows 67,611 planned layoffs, up 59% from last month’s 42,090 but hey – that’s NOT 60%! We will (my MSM bretheren and I) focus on the March Monster Employment Index, which came in at 125, up a whopping 1 point from last month and up 6% from last year when things were totally collapsing and the S&P was racing to 666.

I don’t know about you but when I see a move like this, with the year-over-year growth in on-line job postings going from -30% to 6% higher than that -30%, I just have to ask myself – how can the Dow ONLY be up 4,500 points? What is it going to take to get us back to 14,000 if 24% less job listings than we had in March of 2008 can’t do it? You just can’t please some people I suppose – these damn bears are a menace.., Don’t worry though, I can pretty much guarantee you that the pom-poms will be out on CNBC and other MSM outlets telling you how amazing the growth of on-line job listings is and how this proves things are getting better.

Speaking of MSM pom-poms, the Wall Stret Journal has the iPad on the top of page one this morning and the online article (also page one) says "Laptop Killer? The iPad Comes Close," saying: "Apple’s new touch-screen device has the potential to change portable computing profoundly and to challenge the primacy of the laptop, says Walt Mossberg." They’ve got a promotional video and everything as the push is on to get AAPL over $240 as it’s 15% of the Nasdaq’s weighting and they really need it to get to that magic 2,5400 mark, almost 50% back to their all-time highs in just 10 short years!

Speaking of MSM pom-poms, the Wall Stret Journal has the iPad on the top of page one this morning and the online article (also page one) says "Laptop Killer? The iPad Comes Close," saying: "Apple’s new touch-screen device has the potential to change portable computing profoundly and to challenge the primacy of the laptop, says Walt Mossberg." They’ve got a promotional video and everything as the push is on to get AAPL over $240 as it’s 15% of the Nasdaq’s weighting and they really need it to get to that magic 2,5400 mark, almost 50% back to their all-time highs in just 10 short years!

Don’t get me wrong, I love AAPL and I love the IPad and we’re long on AAPL but this mania is getting a little overdone and APPL’s 25% run from the Feb 8th low of $190 accounts for 3.75% of the Nasdaq’s total 12.7% gain and the SOX, which are up based on projected chip demand from building iPads) are up 20% so the rest of the Nasdaq is not doing all that well by comparison. While the iPad may be a game-changer in electronics – what if it simply cannibalizes laptop sales for the rest of 2010? What if HPQ, SNE, DELL and others simply tank as consumers opt to replace laptops with iPads?

This is not idle supposition, that’s pretty much what RIMM said happened to them last quarter as volume was strong but consumers opted for the lower-priced Curve units and skipped on the upgrades. Goldman downgraded RIMM today so I wouldn’t jump right in but they are a great buying opportunity down here and we will be selling naked puts to establish a new position, probably the May $70 puts which will hopefully get to $5+.

Speaking of Goldman – the company just (9am) lowered their Non-Farm payroll forecast to +200,000 from +275,000 but that’s not bothering the futures. 75,000 census workers will be included in that count according to GS and 100,000 will be a rebound from February’s poor weather so that’s a whopping 25,000 actual jobs added in March if they are right. We don’t get that data until tomorrow, when we are closed, so it will be an interesting long weekend into which we still plan to stay bearish. We have ISM Manufacturing and Construction Spending at 10 am and at 10:30 we’ll get the Natural Gas Inventories. Oil inventories had another build yesterday but that didn’t stop oil from spiking to our short target at $85 in this morning’s futures and we’ll be re-loading our USO short plays that did very well yesterday morning. We’ll also be getting Auto Sales throughout the day and they should be up substantially from both last months snow-closed numbers and last year’s market crash numbers.

Once again we’re going to sit back and watch the fun but we’ll certainly be looking for shorting opportunities as we get near the highs. In fact, today’s Dow open is going to be begging to be shorted so it’s time to get over to Member chat and make some plays.

Be careful out there and have an excellent holiday weekend,

– Phil