Hello all. It is great to be back. Monday is always the toughest day for my style of trading because the market is starting fresh, and the trends and paths do not mean as much. That is why on Mondays it is sometimes better to look towards a week long play that we think has the potential to make an extended move in the upwards direction. With earnings still roaring along, we have a lot of good catalyst for week long moves, so let us get into it.

Long Play of the Week: JC Penney Co. (JCP)

Analysis: Over the past few months, I have time and again looked at the retailers to make some great plays, and it has worked for us. Well if something isn’t broken, then don’t fix it. I am looking at JC Penney (JCP) this week for my long play of the week. JCP is the only company to report on Friday morning, but it should have a very solid week moving into those reports. The company is expected to report earnings at 0.24 EPS, but I will show you why a slew of news this week and past reports from JCP make me believe the company can have a great week and possibly exceed those earnings.

To begin, JCP is going to be benefitting from a large group of other retailers that are reporting this week. Before JCP reports, Kohl’s (KSS), Macy’s (M), Urban Outfitters (URBN), and Nordstrom’s (JWN) are all going to be reporting on Wednesday and Thursday. These companies will not only be able to attract attention to JCP, but they all should be in a position to report strong earnings. February and March were very good months of retail with most companies beating same store sales as a whole. Even a disappointing April from the retail sector, as a whole, did not seem to affect department stores too greatly, who saw increases anywhere from 1-8%. February and March showed that a strong holiday season was moving into the spring, and even with a slow down in April, I am pretty excited about the Q1 for the department stores. Department stores saw an average rise in April of 5.3%.

Often people talk about with retail a problem of market share, but the way investors work is that good news from competition and similar companies tends to drive up the price of another company not down. If KSS and M have fantastic earnings, JCP is going to decline? Absolutely not. While perhaps Friday won’t be as solid as expected if KSS and M stole their market share, it is doubtful that KSS and M’s positive earnings took all the JCP revenue and dispersed among themselves. It rather shows a trend in department stores’ ability to rebound.

Last week, JCP upped its Q1 earnings outlook after April same-store sales were released. The company estimates it will earn around 0.25 EPS, which is already better than estimates. The company said it saw its revenue, in Q1, rise 1.3% over last year in just same-store sales and revenue estimates were right in line with expectations. Further, JCP looks set to be a player over the next five years as it has lost some market share to speciality stores, a rising Kohls, and the economic hardships. The company is expecting a $5 billion increase in revenues over the next five years. I like a company that is looking to the future.

Finally, Goldman Sachs agrees with me. The company got an upgrade from GS back in April and was put on GS’ conviction buy list – a very special list of stocks that GS is pumping. The stock has decreased in price ever since, but it does not change the fact that GS sees something here too.

Goldman Sachs’ analyst Adrienne Shapira commented, "While March (sales in stores open at least one year) trends underperformed peers, momentum is building, with traffic posting a second month of gains — a sharp reversal from the second half of 2009’s declines. Today’s consumer spending recovery is lifting all department store boats; as such, we expect J.C. Penney, 2009’s laggard, to see a healthy snap back in 2010."

Goldman Sachs’ analyst Adrienne Shapira commented, "While March (sales in stores open at least one year) trends underperformed peers, momentum is building, with traffic posting a second month of gains — a sharp reversal from the second half of 2009’s declines. Today’s consumer spending recovery is lifting all department store boats; as such, we expect J.C. Penney, 2009’s laggard, to see a healthy snap back in 2010."

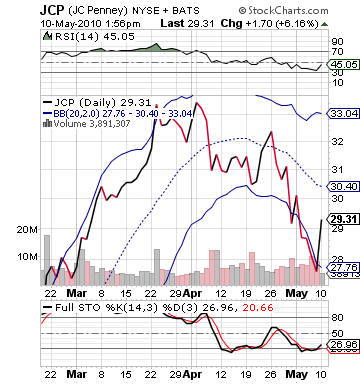

Technically, JCP is in a great position to run, as well. The stock has beaten and blundered throughout April and into early May, dropping almost 15% in the past month. The stock got a healthy boost today, but if it can keep this momentum going its gains could be astounding. The stock was below its lower bollinger band to start the day, heavily oversold, and RSI showed it at a very low strength level. That downward momentum is not sustainable and now is a great time to buy.

Get involved with JCP. We are looking for 4-6% on our entry price, which if we get we will sell then. If we have not reached it by Friday morning, then we will sell on Friday morning right at market open to get the bounce from earnings. Good luck!

Entry: We are looking to get involved at 29.10 – 29.20.

Exit: We are looking to gain 4-6% though Friday morning.

Good Investing,

David Ristau