Hope everyone had a great weekend. Friday was a good day for The Oxen Report. We were not able to get into SRS, our Buy Pick of the Day, because I had set the entry a bit too low. Some of you were able to play it still as the stock rose over 5% intraday. At the same time, we were able to also get a nice play out of our Short Sale of the Day, Take Two Interactive Inc. (TTWO), which fell on news that the video game industry’s sales were down. The market is a tough read this morning, however. Asian markets are flailing, while Europe is having a slight rebound today. This morning I have one short sale/put for us to think about for trading. Later in the day, I will have a new alert that I am starting called The Daily Musing as well as my Play of the Week, which will also be released as an Oxen Alert.

Hope everyone had a great weekend. Friday was a good day for The Oxen Report. We were not able to get into SRS, our Buy Pick of the Day, because I had set the entry a bit too low. Some of you were able to play it still as the stock rose over 5% intraday. At the same time, we were able to also get a nice play out of our Short Sale of the Day, Take Two Interactive Inc. (TTWO), which fell on news that the video game industry’s sales were down. The market is a tough read this morning, however. Asian markets are flailing, while Europe is having a slight rebound today. This morning I have one short sale/put for us to think about for trading. Later in the day, I will have a new alert that I am starting called The Daily Musing as well as my Play of the Week, which will also be released as an Oxen Alert.

Let’s analyze the Short Sale for today…

Short Sale of the Day: Ultrashort Proshares Euro (EUO)

Analysis: Monday is always the toughest day for me because of the lack of economic data that is released, lack of earnings reports, and lack of general consensus on where the market is going. Futures are down this morning in pre-market trading. As of 8:33 AM, the Dow was down 34 points. Some of the big news on the day is that Lowe’s beat earnings, but the company missed estimates on outlook (as I commented last week, earnings don’t seem to do it alone anymore…companies need to have outlook as well). There is some small M&A buzz around some pharmaceutical acquisitions, and the Euro hit its lowest point in four years but has rebounded since. Oil is up slightly. That is a lot of varying news without much direction. I wanted to hone on one of these stories for a play for us.

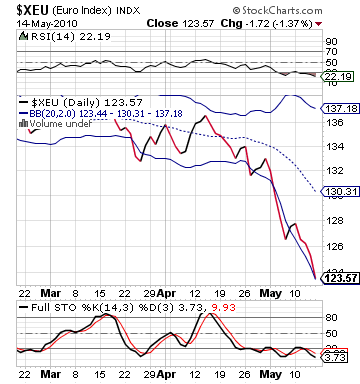

I found that the best play may actually be in the Euro. Today, the Euro hit its four year low…bad. On the flip side, the Euro has moved up from the low of $1.2337. Further, the European markets are starting to improve despite the Euro’s woes, which might be a catalyst to start getting the Euro going again. A stronger dollar is not good for oil or businesses in the USA that do any overseas exchange whatsoever. The Euro has hopefully hit a bottom, and I think that we should start to see a rebound of the Euro. Why?

I found that the best play may actually be in the Euro. Today, the Euro hit its four year low…bad. On the flip side, the Euro has moved up from the low of $1.2337. Further, the European markets are starting to improve despite the Euro’s woes, which might be a catalyst to start getting the Euro going again. A stronger dollar is not good for oil or businesses in the USA that do any overseas exchange whatsoever. The Euro has hopefully hit a bottom, and I think that we should start to see a rebound of the Euro. Why?

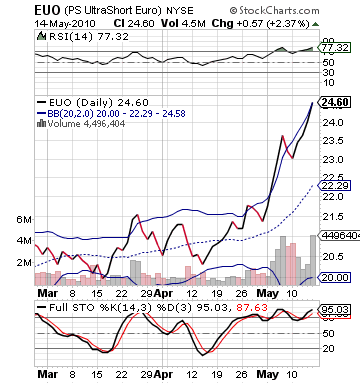

For one, the $1 trillion loan that the EU received should be the first bit of help amid the debt crisis, but further, Germany is leading the way for these nations to reform their markets under the German system of balanced budget. German Chancellor Angela Merkel believes that a balanced budget is the only way to prevent another crisis. The package should calm some fears that were out there in the short time, and it would appear help move the Euro back up. The ETF Ultrashort Proshares Euro (EUO) has benefitted from the recent 12% drop in the Euro, moving up itself nearly the same amount.

At the same time, however, the EUO signals that the 12% drop was extremely fast and probably too fast. The ETF is at its upper bollinger band, it is heavily overbought, and it is almost over 75 on the Relative Strength Index (which is a red flag for short selling).

This play may develop past this single day because I do think that while problems obviously are very severe and remain in Europe. For the next few days, fears are subsiding, and the European market may see some bounce back to stocks, which will help lead the Euro higher. As that happens, EUO will fall significantly.

We want to get ourselves positioned in it today because we can get it at such a premium for a short sale, and this movement will start today.

Entry: We are looking for entry in the 25.80 – 25.90 range.

Exit: We are looking to exit on a 2-3% gain.

Good Investing,

David Ristau