What a difference a title makes!

What a difference a title makes!

Yesterday, I titled my morning post "WTF Wednesday?" and I had, at 5:36 am, already sent out a major Alert (rare thing to do) in which we discussed Raoul Pal’s statement that a major crash is coming in 2 days to 2 weeks, to which I said: "I think it’s insane not to be mainly in cash right now and hedged for at least a 40% drop. If the guy’s wrong – our buy/writes pay "just" 20% and if he’s right, then we get to DD at good prices with the profits from our Disaster Hedges!" As I’m not one to ignore a great opportunity to profit from catastrophe, we added 3 more hedges that pay 1,000% if the market does tank in the next few weeks, or days (using DIA, FAZ and TZA).

I commented that the riots in Thailand may be the first of many around the world and that "Europe is in full panic mode and is hitting the 2.5% rule at 5am, about 11 am for them – very, very bearish if they can’t hold 2.5% in a day and not very good if they finish near that line anyway. CAC must hold 3,500, DAX 6,000 and FTSE 5,175" and we all sang "Smoke on the Water" as we sat back and watched the world burning on the news at 6am. SO – when the futures were UP soundly into the market open, my article title was "WTF Wednesday?" indicating our incredulous take on the move. I noticed on Seeking Alpha, they decided to change the title to Wacky Wednesday – a very different tone and that’s a shame because I think it washed out my stern warning to revisit our disaster hedges, 16 of which I published for free this weekend to help protect the general public.

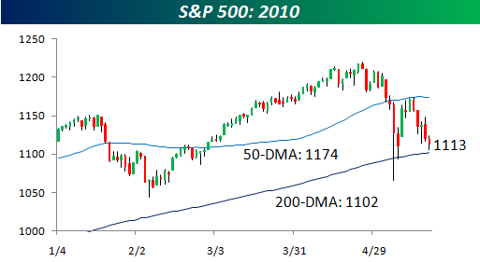

Having our bearish plays set, we attempted 3 bullish plays in our next morning Alert at 9:46 but those got quickly blown out of the water as the S&P failed our 1,115 line at 10:13. At 11:37, just before we bottomed out for the day, I said to Members: "Well, this is ugly but we couldn’t have a better set-up for a massive reversal on the Fed minutes at 2pm. Not that there’s any real reason for a turnaround on the minutes of a 2-week old meeting but it’s a great excuse to run the Bots as they will have a few pages of text to point to and say "that’s why." That helped us catch a 100 point move up that started 12 minutes later but by 2:24 we looked over the minutes and were disappointed as I said to our Members: "Well this is annoying as we had such a good run that we ran out of gas at the minutes. Since the meeting was before the EU blew up, no one is putting much stock int he Fed’s nice outlook."

- The dominoes appear to be lining up in an eerie fashion at this point in time – there are now dozens of negative catalysts in the coming 12 months (which I will detail in a soon to be released report). Although the markets are once again oversold and at risk of a bounce the fundamentals are quickly deteriorating and my expectation of a weak second half appears to be right on cue. I would continue to approach this market with a great deal of caution despite the current oversold conditions.

- What do the Germans know? This short selling ban is very desperate looking. I hate to speculate, but my gut tells me that they are beginning to realize how bad the situation is over there. They now understand that the problems in the Euro cannot be solved through intra-country debt issuance and bailouts. The short ban looks like one more act of desperation from a group of nations that have severely underestimated the problems they confront.

- Will we scare ourselves into a double dip or even a second great depression? Everyone and their mother appears to be in the same camp regarding all the very scary “money printing”. I’ve never in my life heard the drumbeat so loud for fiscal austerity. In fact, this might be the absolute scariest thing about the current predicament. Investors are now convinced that government spending has done nothing to help the economy (despite talk of a v-shaped recovery just a few weeks ago). Now everyone is convinced that we’re all bankrupt and doomed.

Josh Brown also sums it up nicely saying: "Here a Swan, there a Swan, everywhere a Black Swan… Newsletter writers, hedge fund managers, journalists, bloggers, technicians, fundamental analysts, economists and strategists are joining the crash camp left and right. Not the bear camp…the crash camp." Really! There is no happy medium with these people – it’s either all bull or all bear – that manic-depressive market we’ve been talking about all year has swing right into the depressive stage. Josh observes that on Wall Street: "Equity analysts are all pointing to year-over-year comps which will start getting harder now. They may feel OK about the "E" but they’re shaky about the "P" – will the tax hikes and regulatory headwinds we now face really allow for a high-teens multiple on whatever the earnings turn out to be."

Josh Brown also sums it up nicely saying: "Here a Swan, there a Swan, everywhere a Black Swan… Newsletter writers, hedge fund managers, journalists, bloggers, technicians, fundamental analysts, economists and strategists are joining the crash camp left and right. Not the bear camp…the crash camp." Really! There is no happy medium with these people – it’s either all bull or all bear – that manic-depressive market we’ve been talking about all year has swing right into the depressive stage. Josh observes that on Wall Street: "Equity analysts are all pointing to year-over-year comps which will start getting harder now. They may feel OK about the "E" but they’re shaky about the "P" – will the tax hikes and regulatory headwinds we now face really allow for a high-teens multiple on whatever the earnings turn out to be."

The only thing that shocks me here is how it can be possible that analysts only now realize this. When I tell people on radio or TV that I think the forward p/e’s are too high, I usually assume they are as smart as our Members and understand that it’s because, at some point in the future, we do have to balance our budget and that means taxes. You can have all the Tea Party rallies you want and the Republicans can sprinkle their supply-side fairy dust all over the country but even Ronald Reagan knew that, at some point, you have to face reality and raise some freakin’ tax money to keep the lights on.

Now while higher taxes might SUCK, they are NECESSARY in order to act like adults and balance a budget. Yes we need spending cuts too but until the Tea Party starts holding rallies to stop spending close to $1Tn a year on the military (close to 1/2 of the entire planet’s military budget and up 500% since Reagan), then we’re not seriously looking at cutting back on government waste. Not to get into a major debate here but in 2008, we spent $711Bn (not counting the off-budget wars) and Europe spent $289Bn. The ENTIRE Middle East spent $82Bn, Russia spent $70Bn and China spent $122Bn. Aside from the fact that NATO outspent all of our potential enemies 4:1 – don’t you think that they only spend what they do BECAUSE we spend what we do?

Cramer points out that it’s "just" a 10% sell-off and we should be buying to which Karl Denninger asks: "Cramer, Are You Hitting the Pipe Dude?" but I have to agree with Cramer here – not about smoking crack (although that does explain a lot of what Cramer says!), but that this "sudden realization" that the Global economy may not be this unstoppable growth engine that will go up and up and up and make everybody richer and richer and richer is not a reason to abandon the whole thing. What I’m seeing is the beginning of the new market – a market where the financials go back to making a very boring 15% profit on their banking and command p/e’s of 8-10 and commodity stocks go back to providing products to manufacturers instead of speculators and they too are lucky to scratch double-digit p/e’s and investors go back to investing in companies that produce the goods and services that people want in the most efficient possible manner and, hopefully, those companies will employ humans and capital will flow to the Capitalists, not their bankers, who once upon a time provided a peripheral service and knew their place.

That’s right, a Capitalist is "An investor of capital in business, especially one having a major financial interest in an important enterprise" – not a Speculator, who is "One that speculates regarding the future turn of events." Perhaps simply understanding the difference between these two activities would help Congress pass a better Financial Reform bill because Speculators do NOTHING to help the economy. They skim profits from the economy but that doesn’t actually help anyone except, perhaps, Chris Dodd, who was paid $3.7M this cycle by speculator types into his election fund AND HE ISN’T EVEN RUNNING!

That’s right, a Capitalist is "An investor of capital in business, especially one having a major financial interest in an important enterprise" – not a Speculator, who is "One that speculates regarding the future turn of events." Perhaps simply understanding the difference between these two activities would help Congress pass a better Financial Reform bill because Speculators do NOTHING to help the economy. They skim profits from the economy but that doesn’t actually help anyone except, perhaps, Chris Dodd, who was paid $3.7M this cycle by speculator types into his election fund AND HE ISN’T EVEN RUNNING!

I’m not joking and this isn’t funny, if you are wondering why we can’t pass decent Financial Reform, just look at this list of Dodd’s masters: Citigroup – $265,000, SAC $262,000, RBS $223,000, BSC – $190,000, Security and Investment Firms – $3.7M, Lawyers and Law Firms $1.6M, Insurance Companies (AIG) – $1.1M, Real Estate – $1M, Commercial Banks – $760,000…

Are you freakin’ kidding me? This guy is the chairman of the Senate Banking Committee. Don’t you think he should recuse himself from legislation involving people who give him this kind of money EVERY 6 YEARS? I think that’s the best way to have IMMEDIATE reform in Washington – let’s make it illegal to vote on any issue that affects someone who gave you money. Sure there would only be one or two guys eligible to vote on any issue but I’d rather have Financial Reform Bills written by and voted on by 3 guys who have no vested interest than 97 guys who are so deep in the pockets of the Banksters that they have lint in their hair…

Violence is worse in Thailand today and I made a mistake in my timing because, silly me, I forgot that Thais were Brown people. That’s why Europe was able to rally and how we effectively ignored the situation yesterday, they were Brown people and White people don’t think things that happen to Brown people matter to them. Asian people (Yellow) cared and their markets sold off another 1% today despite a strong move up in Japanese exports and Singapore’s economy grew 38.6% in Q1 – that’s pretty good! So Yellow people care about Brown people and they also care about White people and this morning, the White people in Greece (the original White people, in fact!) are rioting too – and that’s something EVERYBODY seems to care about.

Violence is worse in Thailand today and I made a mistake in my timing because, silly me, I forgot that Thais were Brown people. That’s why Europe was able to rally and how we effectively ignored the situation yesterday, they were Brown people and White people don’t think things that happen to Brown people matter to them. Asian people (Yellow) cared and their markets sold off another 1% today despite a strong move up in Japanese exports and Singapore’s economy grew 38.6% in Q1 – that’s pretty good! So Yellow people care about Brown people and they also care about White people and this morning, the White people in Greece (the original White people, in fact!) are rioting too – and that’s something EVERYBODY seems to care about.

It’s going to be a rough day for White people’s markets as European stocks have broken that 2.5% line we were watching yesterday and are down another 2% already, ahead of the US open. We talked about strikes and riots in Greece over a month ago so again, this shouldn’t be such a shock to US speculators but it does seem to be freaking people out although, as pointed out in this video, White people are prone to freaking out. Oh yeah, it also turns out they are prone to not paying their mortgage either (1 in 10 now not paying!).

I spend a lot of time teaching people of all creeds and colors NOT to freak out and this is going to be one of those days as we test those "fat finger" lows again. We are testing the lower end of the range I’ve been pointing to since we went short in early May so yay! We’ll be buying while others are panicking because we can hedge our entries and our very good timing has been a huge bonus, making us cash rich just as it all hits the fan and, as I said yesterday, we have a system for entering positions at a steep discount to the current prices so today is party time at PSW – let’s sit back and enjoy the ride.

Try to have some fun out there but do be careful!