Hey all. I hope everyone is having a lovely Friday. I apologize for not posting an article this morning. I had to visit the doctor for some back pains after back-to-back (no pun intended) 35 mile bike rides the last two afternoons. So, I was out of commission. What I want to post today is a preview of something that I would want to do every Friday, and I would love to get your feedback. The post is about long term positions more than just a couple weeks or a month. It is analysis of long term investments through balance sheets, financial statements, and cash flow statements. I posted this a couple months ago, but now that I am full time I would like to do one of these every Friday afternoon. Let me know what you think.

As for positions, our final open position of the week Aeropostale Inc. (ARO) has worked out to be a dandy. We were looking for 4-6% returns off of a 28.00 entry. I got out this morning after some stellar earnings from the company and a market bounce at 29.26 for a 4.5% return. It is amazing this one was resilient enough to work out through the whole week.

Long Term Investment: Big Lots Inc.

Profile: As of the beginning of 2009, the company operated 1,339 stores in 47 states. The company operates as the largest broadline closeout retailer in the USA. Big Lots offers products in the food, health and beauty, plastics, paper, chemical, pet supplies, home decorative, furniture, electronic, tools, home maintenance, seasonal, toys, infant accessories, and apparel lines. The company is headquartered in Columbus, Ohio.

Thesis

With the economic downturn and new management in 2005, Big Lots over the past several years has begun to gain some market share and carve out its own niche in the discount store market. The shopping center has seen an influx in its income and free cash flows, which has begun to attract investors to the company. The company has seen consistency in its revenues since Steven S. Fishman took over as CEO and President in 2005. The company has redefined its business, focusing on developing new markets – higher-income residents, increasing its brand name, and focusing on long term growth.

The company, though, does face rather rigorous competition from three sides. It loses market share from the smaller, dollar-store competition, seen in Family Dollar, Dollar Tree, and Dollar General. It also faces competition from wholesalers that offer discounted groceries and other goods in Costco and BJ’s Wholesale. Finally, the mega-stores of Wal-Mart and Target steal consumers. Yet, Big Lots has been able to maintain a small niche in this market because it does not fit into any of these categories. It is larger in size than the small, convenience store style of the dollar stores. It is not as large or offering groceries like the wholesalers, and Big Lots is much smaller than the overwhelming Target and Wal-Mart. The economic moat is very small, but it does appear that Big Lots has somewhat of a niche in the market as a senior dollar store but a junior Wal-Mart.

The company, though, does face rather rigorous competition from three sides. It loses market share from the smaller, dollar-store competition, seen in Family Dollar, Dollar Tree, and Dollar General. It also faces competition from wholesalers that offer discounted groceries and other goods in Costco and BJ’s Wholesale. Finally, the mega-stores of Wal-Mart and Target steal consumers. Yet, Big Lots has been able to maintain a small niche in this market because it does not fit into any of these categories. It is larger in size than the small, convenience store style of the dollar stores. It is not as large or offering groceries like the wholesalers, and Big Lots is much smaller than the overwhelming Target and Wal-Mart. The economic moat is very small, but it does appear that Big Lots has somewhat of a niche in the market as a senior dollar store but a junior Wal-Mart.

Big Lots because of the economic crisis has been able to grow a consumer base and is rising given the popularity and necessiry of budget-conscious consumers. The chain’s main positioning mechanism during this time has been widespread expansion, development of a smaller store, and its move into higher-income markets. The company, in 2009, for the first time opened more stores than it closed. The company opened 52 new stores in ’09 and is planning to open 80 new stores in 2010 and 100 in 2011 and 2012. The company has been reinvesting its influx in free cash flow into this expansion. Additionally, in 2009, Big Lots entered “A” rating locations, which refers to high-income retail areas. Inexpensive commercial real estate allowed the discount store to open eight new stores in the “A” rated areas, and they plan to continue that development with 24 more in 2010.

The company, additionally, has been redefining their business structure in order to increase their operating margins. On a ten-year average, the company had margins of 3.16% and ROA of 2.14%. In looking at just the past five years, the company has turned their margins into 3.24% and return on assets into 5.74%. The company, which buys inventory from retailers at discount rates that is excess, has been able to decrease expenses as companies have continued to have excess inventory and lower prices. The company has continued to keep expenses low to help increase these margins and ROA while the company has not seen large growth in revenue. The company stresses it has remained profitable with tight inventory management and offering assortments of goods that consumers want. The company’s efficiency results reflect such claims as the company has improved its inventory turnover significantly. The ten-year average is 3.03 times per year versus a five-year average of 3.44.

Competition, however, still remains very tight in the industry. The company will have to continue to improve inventory management, understand trends in what consumers want to buy, offer the right assortment of goods, and continue to improve its efficiency. Discount retailers, however, all have their sights set on expansion in the economy, and they will continue to crowd the market. While Big Lots has taken many of the right steps to begin to carve out a small niche and expand into new markets that will benefit the company significantly, the improvement of the economy and competition present significant challenges. The size and diversity of goods, however, will continue to set it apart from other discount retaliers. As the company enters new markets, they are gaining brand name in these areas that will help to continue their successes post-recession. The continued psyche of wanting to buy discounted goods should continue even after more stabilization of unemployment rates and economic hardships.

Valuation

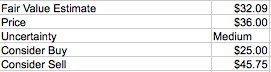

My fair value estimate for Big Lots is $32 per share based on the attached discounted cash-flow analysis. The company has seen incredilbe growth in its operating income in the past five years, averaging over 96% year-over-year. While these growth rates cannot be maintained long term, the company should be able to see continued growth on its opearating income of 8% over the next five years. Given the development of new stores and new markets, the continuation of the economic downturn, and continued growth of same-store sales that was 0.7% in 2009, the company is continuing to offer growth in its income. The company is estimating operating cash flows of nearly $200 million in 2010. I have started my estimated avaiable cash flows lower at $160 million to help remain cautious in an emerging company that may be setting the bar too high on too few consistent years. The company, however, should continue to grow those numbers with an increasing number of new stores. With questions on competition, however, and a post-recession economy, 8% is a modest assessment that is including a significant amount of caution considering the bear case. Operating margins should continue to be in the low-single digit range over the next five years. The company continues to increase its efficiency but continued competition and upturn of the economy will keep these in check.

Risk

Risk is high with Big Lots. The company, in the last five years, has started to truly redevelop and reinvent itself. New CEO Fishman has kept the company moving in the right direction with a long-term growth development plan, but competition remains very high. Additionally, low-income consumers have less consistency in purhases than high-income consumers. The movement into new, “A” grade markets does help hedge some of this risk, but the company still has the majority of its operations with low-income families. Upturn in the economy, decline in unemployment, and continued price slashing at other retailers will continue to threaten Big Lots’ recent success.

Management & Stewardship

CEO Steve Fishman has done some very admirable work with this company. A retail industry veteran, who has thirty years experience as former CEO of three companies, Rhodes Furniture, Frank’s Nursery & Crafts and Pamida, that he successfully restructured and helped bring into profitability. His experience in restructuring has helped Big Lots thus far. One issue, though, with management is that with the recent success the company has experienced, Fishman and other executives has seen significant increases in pay. Executive compensation grew from $8.74 million to $15.71 million from 2006 to 2008. The pay is in line with competitors, but the growth is still something to keep in mind. Further, Fishman has seen a tripling of his compensation package since 2006. Additionally, it would be better if their was a split of the chairman and CEO position that Fishman currently holds. The board is independent.

Overview

.png) Growth: The company has averaged 90% increases in its operating income in the past five years and over 40% in the past ten years. These results, however, have been very erratic. The company should settle into a high-single digit operating income growth rate as it continues to grow revenue and decrease expenses.

Growth: The company has averaged 90% increases in its operating income in the past five years and over 40% in the past ten years. These results, however, have been very erratic. The company should settle into a high-single digit operating income growth rate as it continues to grow revenue and decrease expenses.

Profitability: The company should continue to maintain its operating margins in the 3-4% range. The company is facing continued competition and will see increases in commercial real estate prices. Gains made be made, though, by the introduction into higher income areas.

Financial Health: The company is in very solid financial condition. The company has increased free cash flows, no long-term debt, and a solid current ratio. The company does have some worry that its quick ratio is averaged at 0.25 over the past five years. The company has a very solid interest coverage ratio with EBIT 50 times interest expense in 2009.

Good Investing,

David Ristau

Please leave some feedback on if you like this idea.