Retail, typically, is not something that I tend to suggest long term. Retailers that are creators of their own lines, especially, are subject to a lot more cyclicality than distribution-based retailers. A retailer that distributes a broad line of clothing can move better with trends and offer lines that appeal to a wide array of buyers. Luxury retail, additionally, has the ability to grow significantly coming out of the recession. Let us investigate on luxury retailer that has great potential…

Retail, typically, is not something that I tend to suggest long term. Retailers that are creators of their own lines, especially, are subject to a lot more cyclicality than distribution-based retailers. A retailer that distributes a broad line of clothing can move better with trends and offer lines that appeal to a wide array of buyers. Luxury retail, additionally, has the ability to grow significantly coming out of the recession. Let us investigate on luxury retailer that has great potential…

Long Term Investment: Nordstrom’s Inc. (JWN)

Thesis

With the economic downturn, luxury retailers and high-ticket items across the board were easily looked over. Yet, as signs of an economic recovery have continued to sprout up for the American economy, luxury retail has begun to start to get its feet underneath it. At these low valuations, Nordstrom Inc. (JWN) appears to be quite a great opportunity for long term investing. The company is the leading retailer in luxury retail with twice as many stores as competitors Saks and Neiman Marcus. The company has seen growth in its revenue operating income over the past two years, and sales are up significantly so far in 2010. Nordstrom looks to open twelve new stores in 2010, and ten already planned for 2011.

The development and success of the Nordstrom Rack is the first place of significant growth for the future of Nordstrom. The development of the Nordstrom Rack has allowed Nordstrom to tap a new market and allow for the company to develop a new market that will give the company a chance for significant future growth, since it is well developed in many luxury markets already. The Rack has been criticized for some because it is thought to take away from the image and sales of the full line. Yet, this does not seem to really make sense because it is a completely different market that will take advantage of the Rack items that would not be willing or able to buy the quantity that they could at the Rack.

already. The Rack has been criticized for some because it is thought to take away from the image and sales of the full line. Yet, this does not seem to really make sense because it is a completely different market that will take advantage of the Rack items that would not be willing or able to buy the quantity that they could at the Rack.

The criticism tends to be of cross-shopping, but the company has a history of placing Rak locations near full line locations. Only 25% of the inventory at Rack stores come from Nordstrom’s full line. So, similar goods are not available at both stores. It is more similar to the successful Gap/Old Navy difference that have mid-end to low-end differences. The company, further, swears by the two-store concept as a way to maximize their potential and has seen success with it ever since its conception.

The company has been able to give itself a small niche in the retail industry, and the ability to offer the Nordstrom name on a lower end with the Rack store series. The company faces competition from other high-end retail department stores, such as Nieman Marcus and Saks, but Nordstrom owns the market share in the industry with many more stores than both companies. They were second to Saks in the second line (Saks’ Off 5th), but they have surpassed Saks’ Off 5th fifty-plus stores with over seventy Nordstrom Racks.

The company, additionally, has broken out of the department store pack with exceptional customer service. Known as “The Nordstrom Way,” the company is continually ranked for their exceptional customer service. A late story by MSN Money about the top ten companies in the USA that treat customers right ranked Nordstrom fifth in the country for customer service. Customer service goes a long way in retail, especially on the department store front to differ a company from similar products at other companies.

With the recession coming to an end for some, 2010 has started to see recovery for Nordstrom. The company has had same-store sale increases of 3.7%, 7.5%, 16.8%, and 10.3% from May – February, respectively. Additionally, the latest results from May came while non-luxury department stores dropped nearly 1% in same-store sales. More signs that luxury is back and  Nordstrom knows something other department stores do not. The number of affluent households grew in the first five months for the first time since 2007 from 10.6 milion to 11 million. These gains will continue to grow and will directly help Nordstrom. Further, American Express Travel Insights commented that luxury spending has increased 20% this year in the first three months of 2010 while falling 20% in the entire of 2009.

Nordstrom knows something other department stores do not. The number of affluent households grew in the first five months for the first time since 2007 from 10.6 milion to 11 million. These gains will continue to grow and will directly help Nordstrom. Further, American Express Travel Insights commented that luxury spending has increased 20% this year in the first three months of 2010 while falling 20% in the entire of 2009.

Coming out of the recession, Nordstrom looks very strong with their two-pronged department store approach, growing revenue, strong free cash flow, and a P/E ratio of only 17.94. The company’s growth in the Rack stores will continue to bring potential to this company because buying mentality has shifted for discount purchases over lavishness. That mentality should maintain even after the economy recovers for some time, and Nordstrom has found a way to quench the buying thirst with their Rack stores. The recovery of luxury retail complemented with discount “masstige” at the Rack is a winning combination.

Finally, the company has seen improvements in a number of key financial ratios. Efficiency ratios are getting better. The company has improved their asset turnover ratio every year since 2008. The company has improved their inventory turnover ratio every year since 2001. The sales channel and distribution channels are getting stronger each year. One worry is the company has taken on a lot of long-term debt in 2008 to help launch a strong campaign to build more stores, but the long term debt ratio to current liabilities has reduced since 2008. Finally, the company has increased its free cash flow to sales ratio back over 10% in 2010. Free cash flow is great to see with high amounts of debt to ensure the company is very financially healthy.

back over 10% in 2010. Free cash flow is great to see with high amounts of debt to ensure the company is very financially healthy.

Valuation

My fair value estimate for Nordstrom is $52 per share based on discounted cash-flow analysis. The company has seen incredible growth in its operating income in the past two years plus the trailing term, averaging 7.5% year-over-year, which is quite large for such an established company. These growth rates may come down slightly, but on my DCF, they have declined to 5% by 2015. The company can maintain 5%+ with their approach to both luxury and “masstige.” Given the development of new stores and new markets and continued growth of same-store sales the company is continuing to offer growth in its income. The company is estimating operating cash flows of nearly $900 million in 2011. With continued competition, questions about the risk of blurring lines between full line and Rack lines, and growth of the Rack line backfiring, these growth estimates are modest at best. Operating margins should continue to be in the low-single digit range over the next five years, and the company continues to increase its efficiency each year, which should continue to help.

Risk

Risk is low with Nordstrom. The company is over 100 years old and has begun to reinvent itself for great growth coming out of the recession. Competition does remain, and there is risks coming from the increase of second tier stores. Risk of any struggle in the growth out of the recession could threaten the company. They will need consistent growth to see continual growth.

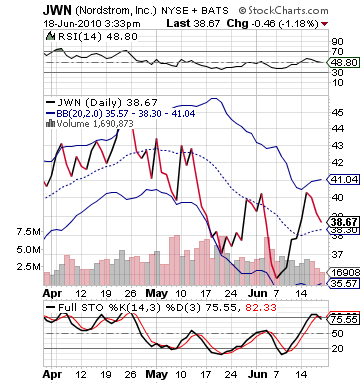

Entry: We are looking to get involved below $39.

Price Target: $52

Good Investing,

David Ristau