The market is facing a pretty significant lower opening today prior to the all important jobless claims and durable goods orders reports. Investors are not expecting bright numbers in the durable goods and unemployment sector, and there is very little news out there to give much boost to the market. Our two open positions that we were looking to close today might have to wait. Lennar (LEN) reported fantastic earnings, hitting an EPS of 0.21 vs. the expected 0.00. Yet, the stock is not getting any boost due to the fact that the company saw orders decline 10% after the tax credit expired. The stock is down just slightly in pre-market. I think we should wait and see what happens with Lennar. Discover released some  great earnings, as well. The company made a 200% surprise profit beat per share, hitting 0.33 vs. the expected 0.11. The company had record cards sales volume for a Q2 ever, saw its write-offs and delinquencies down, and had a significant income improvement. The stock is moving upwards over 4% in pre-market on top of gains we made yesterday. I am looking to sell out of the open.

great earnings, as well. The company made a 200% surprise profit beat per share, hitting 0.33 vs. the expected 0.11. The company had record cards sales volume for a Q2 ever, saw its write-offs and delinquencies down, and had a significant income improvement. The stock is moving upwards over 4% in pre-market on top of gains we made yesterday. I am looking to sell out of the open.

Let’s get into some picks for today…

Buy Pick of the Day: J. Crew Group Inc. (JCG)

Analysis: A lower than expected job loss report and better than expected losses on durable goods orders has given a rise in the loss to futures we were seeing this morning, moving from down to over 70 points to in the low 40s now. That upward trend is giving me hope for today’s market. Another great sign is that I am seeing an almost 5:1 ratio on upgrades to downgrades this morning. The release of the data gave a great spike to the European markets that is holding. Also, great earnings from Discover, Lennar, and McCormick are good signs as well.

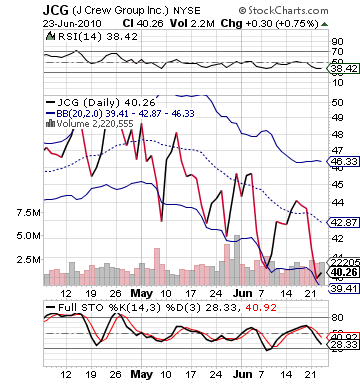

One such company that is in a very weird position this morning is J. Crew (JCG). The specialty retailer known for their preppy lines has been one of the best successes over the past few years, but it has been hit as of late. The stock has fallen 15% over the past month and a half, and the company is actually down more in pre-market trading, nearly 3%. Yet, there is really no news out there to spark such selling. The company is simply in a downward trend that should start to see a reversal for sure. The first reason is that JCG got an upgrade from Oppenheimer today from "Perform" to "Outperform." The financial firm has a target price now set at $50 for JCG, while the stock is trading below $40. One would think this would help JCG move upwards from its doldrums.

news out there to spark such selling. The company is simply in a downward trend that should start to see a reversal for sure. The first reason is that JCG got an upgrade from Oppenheimer today from "Perform" to "Outperform." The financial firm has a target price now set at $50 for JCG, while the stock is trading below $40. One would think this would help JCG move upwards from its doldrums.

Further, the market is looking like it will move upwards from a lower open after better than expected economic data. While I think the data is not great, it is better than expected, and now CNBC and all the other bears out there cannot just sit around chanting double-dip until it happens. Futures are up to -30 for the Dow last I checked, a nearly 100% increase from just before the reports came available.

JCG is also techincally at its lower bollinger band with its pre-market movement downwards. The stock is oversold and undervalued in the short term. This company is at a great position to buy, and it should get a solid bounce off of this upgrade and renewed hope for the markets. I would look to buy early before it makes much of a move. JCG has pretty volatile beta nearly 1.5, so it will move swiftly.

Entry: We are looking to enter JCG at 39.50 – 39.80.

Exit: We are looking to exit for a 2-3% gain.

Stop Loss: 3% on top.

Short Sale of the Day: Direxion Daily Energy Bear ETF (ERY)

Analysis: Per this morning’s better than expected economic data, the oil market has pared its losses as the dollar has weakened after the morning news. The crude futures have started to rise, as they gained nearly 40 cents just after the .png) data was released, breaking $76. It has stayed above $76, and I think it will continue to rise. A lot of stocks have seen selling among fears to start this week, and there is some nice bargains out there once again. I think the three-day pullback was healthy, and I think a bullish market should be restored. Double- dip recession is just not really anything about which we should worry.

data was released, breaking $76. It has stayed above $76, and I think it will continue to rise. A lot of stocks have seen selling among fears to start this week, and there is some nice bargains out there once again. I think the three-day pullback was healthy, and I think a bullish market should be restored. Double- dip recession is just not really anything about which we should worry.

Oil has dropped from nearly $80 to start this week all the way down to below $76. This quick movement down has been brought about by supply increases and weak economic data. Yet, today, we got the opposite of weak data. I think the quick movement down should be corrected today with the news.

Further, we got news this morning that Britain will go ahead with deep-sea exploration, and they believe that it is necessary to continue to drill offshore to meet oil demands. This is definitely not the best news from a safety standpoint, but it does show that demand is out there. The reduction in jobless claims shows that demand will start to increase, as well.

I think ERY is going to fall throughout today as the market starts to pick up, and oil falls in line. ERY has seen some great gains over the past few days and has actually risen very close to its upper band. It was actually trading above it in pre-market, so a pullback, technically, is in order as well.

Entry: We are looking to short from 10.90 – 11.00.

Exit: We are looking to exit for a 2-3% gain.

Stop Buy: 3% on top of entry.

Good Investing,

David Ristau