Woops – blink and you miss an opportunity in this market (see David Fry's chart).

Woops – blink and you miss an opportunity in this market (see David Fry's chart).

This is where we (fundamental analysts) have a great advantage over the TA crowd. We don't need to wait for "confirmation" of some pattern to tell us when to buy. I tell members that waiting for TA signals is like going to a store and seeing your favorite jeans on sale for 30% off but then refusing to buy until you see other people buying them – by which time you often miss your chance as they sell out.

TA people don't believe stocks have a "value" outside of what the "trend" says the value is. If I say: "Hey, you can buy C for $3.65" they don't say "How much can I buy?" they say "which way is it heading?" If I say: "BAC is down to $13.50 and you know that includes MER for FREE!" they say "yeah but they are forming a right shoulder." I'm not a contrarian – really, I'm not. I just believe things have actual long-term values.

I told Members to run out and buy Toyotas on sale (cars, not the stock) when they had the big recall because it was a known issue so the new ones wouldn't have problems and and meanwhile dealers were giving all kinds of crazy incentives. A Camry that was worth $30,000 on Monday is a good deal at $25,000 on Friday isn't it? Should you stand at the dealership and say "Well, I like the Camry but the price is forming a right shoulder pattern and I can extrapolate that the price will be $15,000 if it breaks the trend-line from 1987." If you said that, people would think you were an idiot, right? Why should a stock be different?

On Monday I detailed my 9 Favorite Dow Plays (+WFR to make 10) and not only do we look for stocks that are already "on sale" but we have a coupon, in the form of our FABULOUS Buy/Write Strategy, to give ourselves an additional 20% discount off today's low prices. How can people say no? Yet they do say no to net 50% discounts on Dow components and I do get frustrated as it's obvious to me that it's a barrage of media negativity that scares people and keeps them on the sidelines, just when a stock sale is reaching it's peak discount.

We've been very fortunate to be offered another chance to buy some of the greatest companies of the 20th century at 21st century lows – yet still there are people don't believe AA has real value at $10. Not only could we buy AA for $10.20 (now $10.50) but we were able to sell 2012 $10 puts and calls for $4.55 so our net cost of entry was $5.65, 44% off the current price. The puts we sold obligate us to buy another round of AA at $10 in 2012 (only if AA is below $10, otherwise we just keep the money) and that would put us in 2x the number of shares we started with at an average of $7.83, still a 22% discount off the current price. Alcoa was founded in 1888 and aluminum seems popular enough to be used for another couple of years so I feel good about buying them at net 1/5th of the 2008 highs – but look at the downtrend!

Anyway, so that's our strategy and we're sticking to it. This is not a strategy for short-term traders. In our short-term trades we are ALL about the trends but short-term trading is a game while long-term investing is about your future. Don't treat your future like a game! I am not generally bullish, I am rangish and currently I am bottomish as we test the lower end of the same trading range we marked out way back on May 5th. So I didn't "suddenly flip bullish" at 1,014 on the S&P – that was the point we were waiting for for 2 months! This is not complicated folks – it just happens on a time-frame that many investors just don't have the patience to wait out anymore (60 days!?!). Here's an update of our chart – notice we are right in our predicted (by Fibonacci) range:

So PREPARE for me to go "bearish" at around 1,100 on the S&P where I will probably want to use our "5 Plays that Make 500% if the Market Falls" to lock in our profits but then I will go "bullish" again if we get over that 1,121 line and hold it for a couple of days (note false move around New Year's that didn't fool us at the time). Meanwhile, call me a fool but I think the 200 WEEK moving average and the 50 WEEK moving average trumps the 200 day and 50 day moving averages that have formed a dreaded short-term "death cross" that I strongly feel was manipulated specifically to get all the TA sheeple to dump out of the markets ahead of what may be a very good earnings quarter.

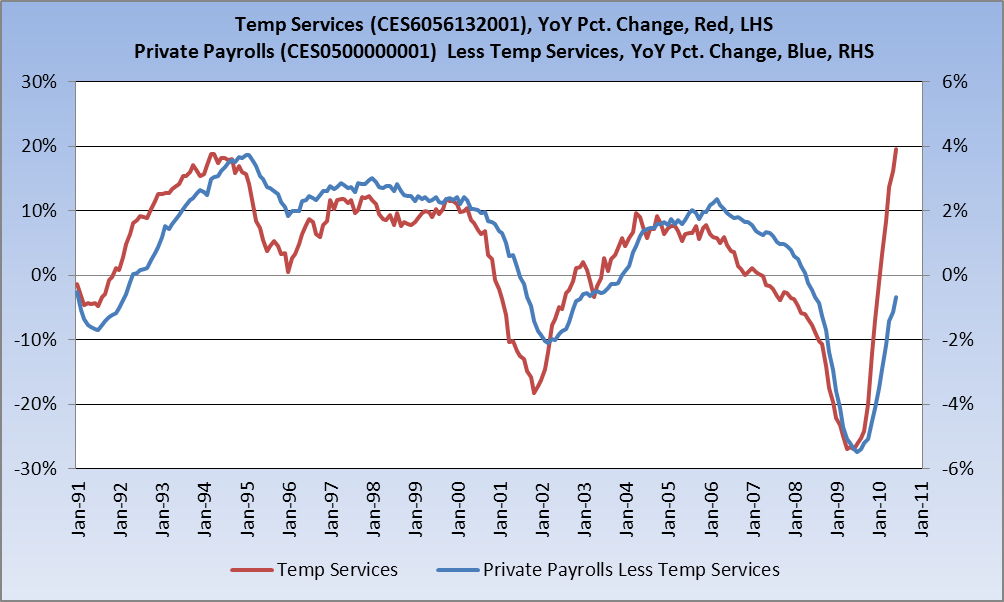

Meanwhile, let's look at some fundamentals! Another 454,000 people lost thier jobs this week but today that's good news because people are back to not caring so up we go in the futures. Continuing claims dropped 224,000 and that is good news as it's the lowest level since November and the most interesting thing to me is this chart showing the massive surge in Temp workers, which is usually a pretty good leading indicator for real job activity.

That's a lot of temps! In fact, that's 19.6% more temp jobs than last June and that is the biggest year over year increase EVER (since 1990, when they began tracking it). What happens to corportations who are getting busy and need help but the MSM convinces them that the improvements in the economy are only temporary? They hire temps! It's very possible that the irrational levels of MSM negativity are causing this very unusual gap between temps and hires. Corporate America is still scared to pull the trigger on jobs but if earnings come in strong and Q3 growth is projected – look out above!

Even the Capitalist tools at Forbes are now saying "the pouting pundits of pessimism are misreading and overreacting to economic data" and I see Retail Sales growing 4%, which is accellerating to the fastest pace of the year according to the International Council of Shopping Centers, who say: "Sales results have been uneven, [but the underlying growth rate] suggests a relatively healthy, moderate pace of spending for the remainder of the year." This morning we see ANF sales up 9% from last year, COST up 4%, M up 6.5%, JCP up 4.5% and JWN up 14.1% as the top 10% continue to party on, even while others hunkered down during a miserable June.

Both PNC and Raymond James have now come around to our point of view and are telling their clients that pessimism may have peaked and the Hamburg port in Germany (40% bigger than LA) reports a 16% increase in shipments over last year and Russian oil exports are up over 30% from last year as that country begins to become a real threat to OPEC's price stability – so more supply AND low prices on oil – that would be a great combination!

Apartment vacancies fell in Q2 and rents went up 0.7%, which is the biggest quarterly gain in 2 years so good news for the CRE sector. Rents fell in just 10 of 82 markets tracked as the lack of new construction is now pressuring availability, which drives rents up and begins to make housing an attractive alternative again. That's why they call them economic CYCLES folks. That lack of new supply is "allowing the apartment sector to do a lot better, faster than anyone in the industry anticipated," says Alex Goldfarb of Sandler O'Neill.

Of course we are all still wondering what will happen with the EU bank stress tests but it doesn't seem to be bothering the EU markets as they are up ANOTHER 2% this morning so I think we'll be seeing how all the global markets handle the 5% rule for the week and what a short squeeze we will get if we pop through those levels. The BOE and the ECB held their rates steady and our own rates are finally heading a bit higher (go TBT!) but let's not get over-confident. We have our bounce and now we need to see what sticks so let's keep an eye on our bounce levels and continue to be careful out there.