Isn't this fun?

Up 200, down 200, up 200, down 200 – wash out your savings, rinse and repeat! What a total sham of a market we have these days with machines running us up and down on virtually no news at all. Yesterday they would have you believe that Ben Bernanke caused a sell-off. How ridiculous is that? He didn't say one thing that he didn't already say in the Fed Minutes that were released on the 14th, which were the notes from the meeting of June 23rd so for analysts to get on TV and say "the markets were concerned by the Chairman's comments" is beyond stupid – it's criminal negligence.

That's Can Not Be Correct and other media outlets are supposed to have something that is called a Public Trust, which means that broadcast licenses are a national resource that are meant to be used responsibly. I know, that almost sounds like a joke but it's not – we used to care about these things… Now the public is treated like cattle and is simply stampeded to the slaughterhouse at the whim of the media and the Big Money that pulls their strings and our equally puppet Government spend their days fighting over who gets to wear the captian's hat on the Titanic. Maybe it is a joke – too bad it's on us!

That's why we keep things light over at PSW – we know it's a crock but, as long as it's a crock we can figure out, we're happy. I mentioned yesterday that Tuesday morning's Alert to Members had 2 long plays on the Russell that made over 40% each in a day. Well yesterday we shorted the Russell at 9:42 with TNA $32 puts $1.60 and IWM $60 puts at $1.32. It wasn't as exciting as Tuesday but the TNA puts made $2 (25%) and the IWM puts performed much better, also hitting $2 for a 50% gain on the day. We have now learned that TNA and TZA, despite looking sexy, are not as good to play for direction as the IWM puts and calls. This is due to the wide bid ask spread and low liquidity, which means the Market Maker can rob you blind by stealing nickels and dimes from you every time you buy and sell – this is something you should always be aware of when trading options on ultra-ETFs.

That's why we keep things light over at PSW – we know it's a crock but, as long as it's a crock we can figure out, we're happy. I mentioned yesterday that Tuesday morning's Alert to Members had 2 long plays on the Russell that made over 40% each in a day. Well yesterday we shorted the Russell at 9:42 with TNA $32 puts $1.60 and IWM $60 puts at $1.32. It wasn't as exciting as Tuesday but the TNA puts made $2 (25%) and the IWM puts performed much better, also hitting $2 for a 50% gain on the day. We have now learned that TNA and TZA, despite looking sexy, are not as good to play for direction as the IWM puts and calls. This is due to the wide bid ask spread and low liquidity, which means the Market Maker can rob you blind by stealing nickels and dimes from you every time you buy and sell – this is something you should always be aware of when trading options on ultra-ETFs.

We made a couple of attempts to go long, first with QQQQ and then with DIA but we got stopped out of both of those with small losses but we did get to do a little more bottom fishing – grabbing UNG (nice play for possible hurricane), STX, BAC, CCJ, GOOG and BYD. NFLX made our day with a poor report – they were our focus short for the week, as I mentioned in Tuesday morning's post and, although we were below our levels, so we couldn't get bullish, we were wise enough to take our bearish money and run on that nice sell-off – especially as copper (remember our key indicator?) was holding up nicely at $3.075, which was our predicted pullback target.

This morning it looks like the markets are primed for another major flip-flop as the futures are up a whole percent at 8am. Why? Who cares? None of it matters until we get the jobs data at 8:30 and then we have our Leading Economic Indicators at 10 (and Barry Ritholtz has a good take on this here) and those are expected to be a depressing -0.4% so a lot to slog through before we can, once again, retest our levels.

8:30 Update: 464,000 people got pink slips last week, 24,000 worse than expected (5%) and 37,000 (almost 10%) more than last week but the futures don't seem to care. Continuing claims are down sharply at at 4.49M, down 190,000 and we can thank our friends in the Republican party for that one as they once again blocked the extension of unemployment benefits yesterday (the real cause of the market sell-off) and that's how many people lose their benefits EVERY WEEK under the Republican plan (or lack thereof). Wouldn't you know it though, those sneakey Democrats finally broke the seven-week filibuster and passed the vote 59-39 last night, helping the futures to take off.

8:30 Update: 464,000 people got pink slips last week, 24,000 worse than expected (5%) and 37,000 (almost 10%) more than last week but the futures don't seem to care. Continuing claims are down sharply at at 4.49M, down 190,000 and we can thank our friends in the Republican party for that one as they once again blocked the extension of unemployment benefits yesterday (the real cause of the market sell-off) and that's how many people lose their benefits EVERY WEEK under the Republican plan (or lack thereof). Wouldn't you know it though, those sneakey Democrats finally broke the seven-week filibuster and passed the vote 59-39 last night, helping the futures to take off.

2.5M Americans will have their benefits restored and it will be fun to watch Conservative Narrators Bashing Congress do somersaults all day trying to pretend that doing the right thing and helping our fellow man can't possibly be a reason for the markets to rally. The problem for Conservatives is, if they admit that giving 2.5M people a little bit of money actually HELPS the economy – it becomes much harder to argue that giving 250M people a little bit of money is not as good of an idea as their current strategy (and our national policy) that gives 3M people a LOT of money and takes a little bit of money away from 299M people, something I explained in "The Dooh Nibor Economy – That's Robin Hood Backwards."

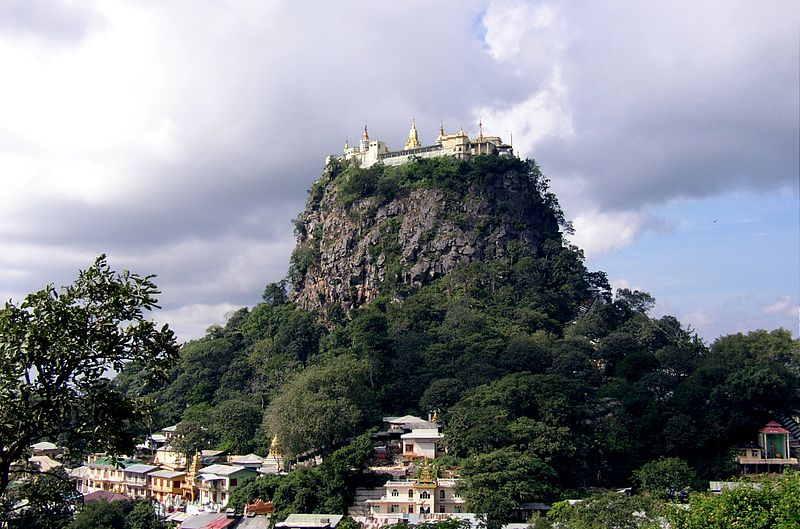

Things are now looking so bright in the markets that New York City is going to toss $7.6Bn worth of pension money into hedge funds (call me Mike!) in a plan that can't possibly go wrong, can it? In other things that can't possibly go wrong – congratulations to Myanmar (Burma), who are joining the Nuclear Weapons club. Ah there's nothing more comforting than seeing that even Military Dictatorships can make their own nuclear bombs if they keep their eyes on the prize – this should be an inspirational tale for those slackers in Iran and North Korea – who should be ashamed not to keep up with Myanmar and their $1,197 per capital GDP.

Things are now looking so bright in the markets that New York City is going to toss $7.6Bn worth of pension money into hedge funds (call me Mike!) in a plan that can't possibly go wrong, can it? In other things that can't possibly go wrong – congratulations to Myanmar (Burma), who are joining the Nuclear Weapons club. Ah there's nothing more comforting than seeing that even Military Dictatorships can make their own nuclear bombs if they keep their eyes on the prize – this should be an inspirational tale for those slackers in Iran and North Korea – who should be ashamed not to keep up with Myanmar and their $1,197 per capital GDP.

If "Buddists Building Big Bombs" doesn't shake up the global markets – what will? C lowered their 2010 China Growth Forecast by 1% to 9.5% and cut their Global Growth Forecast by 0.1% to 3.7% this year (not bad) and 3.3% in 2011. The US forecast was dropped 0.4% to 2.8% in a generally gloomy report that no one seems to care about.

Asia was up (other than the Nikkei, of course) this morning and Europe is once again off to the races with 2% gains just ahead of the US open and, once again, we take a poke at dead center of our trading range at: Dow 10,200, S&P 1,075, Nas 2,200, NYSE 6,800 and Russell 620. Keep in mind the EU is flying over their levels (FTSE 5.250, DAX 6,000 and CAC 3,500) so, if we match their pace, we should also fly through ours, which are about 1.25% up from yesterday's close. If we hit a lot of resistance there, then that's a signal to get a little shorter right away. Oil ($78) and copper ($3.16) both look very strong and Nat Gas is heading over $4.60 again (go UNG!) and gold is at $1,185 and it would be very nice to see them heading down as the markets break over our levels.

Uncle Rupert continues to fight the good fight for the bears with the current on-line headline at the WSJ saying "Stock Futures Gains Shrink" (9:20) so we'll see if that's true or if it's just the integrity of the paper that is shrinking along with the rest of the Mainstream Media.