Yawn!

Yawn!

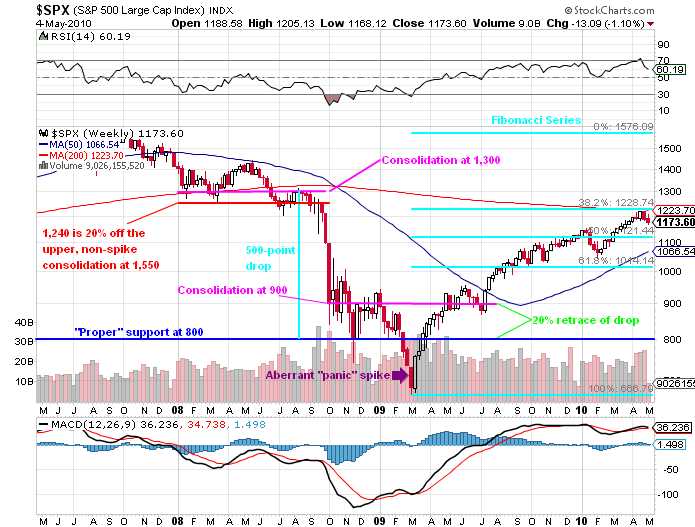

As I said in our last 5% Rule Update, way back on May 5th, I’m not a big fan of TA. We have our 5% rule and it serves us well enough but that’s a statistical analysis, not a technical one. The only TA I put a lot of stock in is Fibonacci Retracements but that, also, is really statistical science and has nothing to do with trying to predict the movement of squiggly lines on a chart.

The 5% Rule does NOT tell you which way the market is going. It does tell you where the resistance points will be. Of course, knowing that and knowing what kind of bounces to expect and knowing where a proper breakdown or break-out occurs is kind of useful and, when it coincides with the tea leaves that are read by the "real" TA guys – you can really have something good to go by!

Unfortunately, the 5% Rule is not really a RULE because it requires a cynical background in statistics, especially regarding aberrant values or "outliers" and a general understanding of market history as well as current market events because all need to be taken into account in order to give you accurate "consolidation levels" from which we base out chart movement.

The great Harry Houdini used to enjoy amazing audiences with demonstrations of the supernatural, especially when he would pull back the curtain and reveal the frauds that others were passing off as reality. That’s how I feel about TA – we can use these very simple scientific "tricks" to project the movement of the market and others can paint their charts and dress them up in whatever language they wish to make it unique but, to me, it still all boils down to the fundamentals with the underlying movement governed by normal regression patterns influenced by capital flows and sentiment.

Whatever you want to call it, here’s our chart from May 5th, where I said: "So what lies ahead? Most likely a retrace back to 1,100 (25% of our run) but if that holds and we consolidate a bit, I will be downright bullish. I will also be impressed if we hold 1,145, which was our last breakout line but, for now, we have a 3.75% drop from 1,218 but a poor bounce yesterday indicates we are likely to get down to a 5% pullback from 1,218 to 1,157 and not holding that is going to be nasty. For now, we have the rising 50 dma and the 2.5% line at 1,170 so VERY BAD if we can’t pull a bounce together here."

It’s been an interesting few months since then and here’s where we are on the same chart:

See, it’s just a range people! A very predictable, very normal trading range. The world does not end as we turn down and all of our problems are not solved when we turn up any more than a bouncing ball repeals the law of gravity on the way up and reaffirms it on the way down – that’s just the way it works and you don’t get proper perspective until you step back and take a look at the bigger picture.

It was very easy to call a top on April 28th as we "Hedged for Disaster" and it was very easy to call a bottom on July 6th as we began to feel the sell-off was overdone. The next day (July 7th) we added "9 Fabulous Dow Plays Plus A Chip Shot" to our June 26th Buy List as we considered the bonus dip to be nothing more than an additional buying opportunity that took us from a very cautious 75% cash, down to 65% cash.

So our 5% rule held for the week while the Fibonacci level (1,014) held up on the spike. That gave us reason to get bullish and, keep in mind, we were up 300% or more on our disaster hedges too so we took them off the table and readied a new batch in case we headed lower (never triggered, of course) . Notice that we spent 2 months moving from our zero line at 1,100 to our 10% line at 1,210 and then spent two months sellling off but only fell to the -5% line at 1,045. That right there should let us know that things were not as bearish as they seemed.

Now is not the time for clever predictions as we still could go either way. What we want to do is see 1,100 firm up as a better floor through earnings and after but, so far, all we have is a 33% retrace of the drop and that shouldn’t impress anybody so this is a cautious time for us with a lot of bi-directional betting in our short-term trade. Our long-term trades are committed and we do feel good about our buy-in points. If we are going to error, it will be on the side of caution as we have much to protect.