Happy Friday to all. For the end of this week, we are ending a quite a bit of a pullback. That gives us some great opportunity to get involved in some new positions as stocks have come down a bit from their high valuations. Therefore, we will be getting in a typical Overnight Trade since there are a number of companies that report on Monday morning as well as getting into our Play of the Week early now.

Happy Friday to all. For the end of this week, we are ending a quite a bit of a pullback. That gives us some great opportunity to get involved in some new positions as stocks have come down a bit from their high valuations. Therefore, we will be getting in a typical Overnight Trade since there are a number of companies that report on Monday morning as well as getting into our Play of the Week early now.

Yesterday, we did not enter any new positions but we closed two very sucessful Overnight Trade from Wednesday to Thursday in Skechers Inc. (SKX) and Teradyne Inc. (TER). The trades were good for 9.5% and 10%, respectively. Both companies blew out earnings while being undervalued, which gave them lots of buying interest and sent them flying. We got into TER at 10.15 and exited at 11.15. We got into SKX at 35.50 and exited at 38.75.

Let’s hope we have similar success with today’s adventures…

Overnight Trade: Wonder Automotive Group Inc. (WATG)

Analysis: One industry that has had a great quarter along with semiconductors is the automotive industry – parts and cars alike. Thus far in the earnings season, we have had mostly just the American auto parts makers reporting earnings. In the coming week, we are also going to have some of the Chinese auto parts makers reporting as well. One of the first to hit the stage is Wonder Automotive Group on Monday. The company is an automotive electrical parts  maker that is predicted to report earnings per share at 0.19, which is a penny decline from one year ago, but I am fairly confident the company is going to have a very hefty earnings beat.

maker that is predicted to report earnings per share at 0.19, which is a penny decline from one year ago, but I am fairly confident the company is going to have a very hefty earnings beat.

What first attracted me to Wonder was the fact that auto parts makers across the board are killing earnings. The auto parts industry has seen twelve out of sixteen of its reported companies since the beginning of June hitting earnings. Many of these companies have had very strong quarterly beats above 100% and even some have had profits while losses were expected. The companies with the most exposure to China have also been among some of the best. Borg Warner and Autoliv are two that have stood out in China.

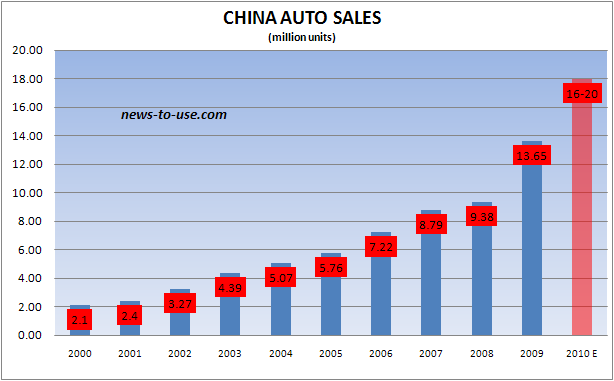

Chinese auto sales have been outpacing sales from one year ago. In April, Chinese automotive sales rose 34%. In May, they rose 28%. In June, sales rose 18%. Wonder Auto deals with a number of the top companies in China that have all seen significant increases in the past three months over one year ago. More car sales obviously also means more auto parts sales. Yet, EPS for Wonder are supposed to decline? The company had revenue of just under $50 million in 2010, and they are expected to increase that revenue to $66 million this year. I think there are strong chances that the company could significantly beat this estimate.

this year. I think there are strong chances that the company could significantly beat this estimate.

In its Q1, the company beat revenue estimates. Further, the company guided above consensus for the coming quarter. The company, recently, upped production by over 60% at various factories to meet higher demand in July. This shows that the company is at demand is so high that it is increasing production. A great sign for the company.

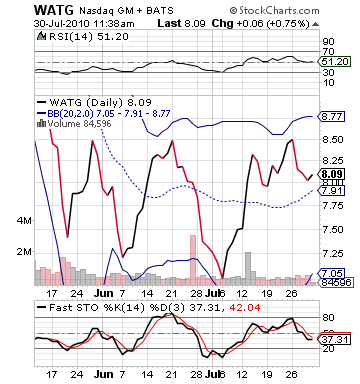

With earnings looking to be strong, the technicals are also exactly what we like to see. The company is fair valued on RSI, and it has more than 5% room to the top. Another great technical that I see is that the company’s bollinger bands are narrowing, which means that one could expect a breakout as soon as there is reason to believe there will be one. Further, fast stochastics are decreasing into oversold territory. Selling off into earnings rather than buying despite the earnings we have seen is reason to believe we are in business.

Entry: We are looking to get involved at 8.00 – 8.10.

Exit: We want to exit on Monday after earnings are reported.

Stop Loss: None.

Play of Next Week: Kulicke & Soffa Industries Inc. (KLIC)

Analysis: After a series of successful…highly successful semiconductor plays we have had, there is not too much more to say. We have found another reporting semiconductor company in a significant position to improve its earnings and yet is severely undervalued moving into earnings. This time, the company is Kulicke & Soffa Industries (KLIC). They are in the highly successful semiconductor equipment industry from which our Overnight Trade from Wednesday in  Teradyne came. KLIC’s specific expendable equipment and tools that are used to build semiconductors. The company operates in the USA and Asia supplying subcontractors that do electrical and automotive semiconductors.

Teradyne came. KLIC’s specific expendable equipment and tools that are used to build semiconductors. The company operates in the USA and Asia supplying subcontractors that do electrical and automotive semiconductors.

We have been over the great story we have in semiconductors again and again. So, if you had missed it check out the Teradyne story, this one, or this one. Here is a statistic on semiconductor equipment companies: 17/19 of the companies that have reported since the beginning of June have reported surprise profits. It has been a solid season, and it will continue for Kulicke.

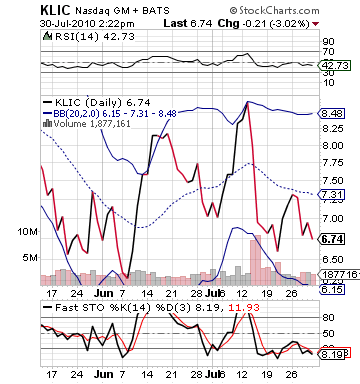

The company is projected to hit an EPS of 0.51 vs. a loss one year ago of over 0.20. The improvement will be over 300% for profits. This is going to definitely pump the stock going into earnings, especially since KLIC is very undervalued moving into earnings.The stock dropped almost 4% today, which has brought its RSI down significantly farther below 50. The stock’s fast stochastics as well are moving into oversold territory.

This company is going to most likely beat earnings, and even if it does not, I am confident that it will get solid buyer interest moving into earnings.

Get in today.

Entry: We are looking to enter at 6.55 – 6.65.

Exit: We are looking to exit after a 4-6% gain or after earnings on Thursday morning.

Stop Loss: 5% on bottom.

Good Investing,

David Ristau